Taxpayers to subsidize NY’s higher minimum wage

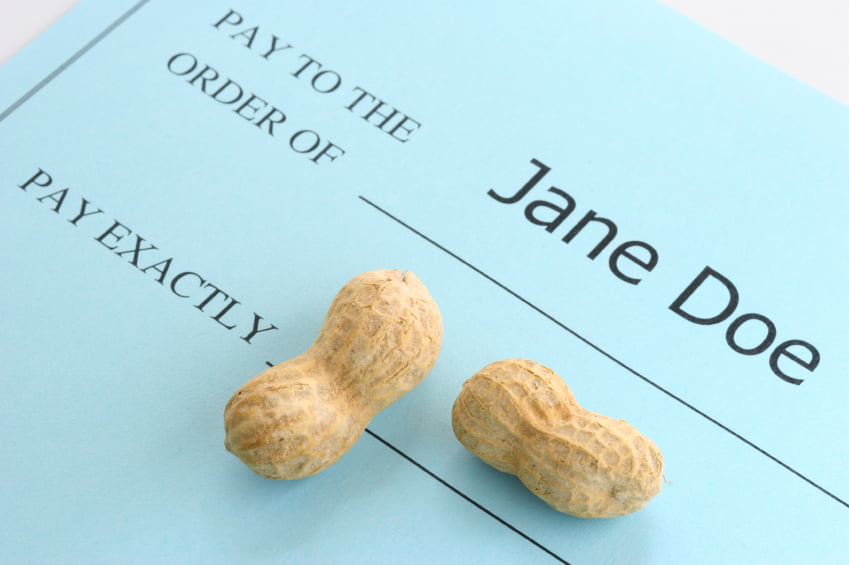

March 27, 2013. In this story, Michael Gormley points out that New York taxpayers will be paying for the new minimum wage tax credit. Advocates for the working poor fear the credit will prompt employers to replace adults with students. Mauro said Tuesday the credit also would result in the first maximum wage for many employees because employers would lose the credit if they raise wages over the minimum wage. The credit "flies in the face of sound tax policy, good labor market practice, or [...]