New York’s Top 1% See All Income Gains Since Recession

January 26, 2015. The incomes of the top 1 percent in New York State were nearly 50 times more than the bottom 99 percent in 2012, according to new analysis published by the Economic Policy Institute for the Economic Analysis and Research Network (EARN). The Fiscal Policy Institute is a founding member of the EARN network. In The Increasingly Unequal States of America: Income Inequality by State, 1917 to 2012, economists Estelle Sommelier and Mark Price update their analysis of IRS tax data—using the same methodology employed by Thomas Piketty and Emmanuel Saez to generate their widely cited findings—and show inequality is rising throughout the United States.

While incomes at all levels declined as a result of the Great Recession, income growth has been lopsided since the recovery began. From 2009 to 2012 the incomes of the top 1 percent grew faster than the incomes of the bottom 99 percent in every state except West Virginia. In New York State, the incomes of the top 1 percent rose by 32 percent in the first three years of recovery from 2009 to 2012, while the average incomes of the 99 percent declined by 1.1 percent.

“Despite hollow assertions that the economy has rebounded since the Great Recession, the average New York family is still waiting to see the financial fruits of the recovery from the financial crash. This new report confirms that all of the income gains in the recovery’s early years accrued to New York’s wealthiest while everyone else has been treading water at best and many are actually worse off,” said Ron Deutsch, Executive Director of the Fiscal Policy Institute. “The Governor just unveiled his ‘Opportunity Agenda’ for New York last week and this report puts a bright spotlight on the immediate need for our Albany leaders to get serious about developing a real ‘Shared Opportunity’ agenda, not a fig leaf-version of opportunity.”

FPI’s Deputy Director and Chief Economist, James Parrott, noted: “The recovery has been uneven across New York State, not just regionally, but it has been really lopsided in concentrating all the benefits among the wealthiest. Broadly shared prosperity with wages and middle incomes rising would translate into more sustainable economic and job growth.”

According to data in the new report, average incomes of the top 1 percent are 48 times the average income of the bottom 99 percent in New York and Connecticut, more lopsided than in any other state. For the United States overall, the top-to-bottom income ratio is nearly 30. Average incomes for New York’s wealthiest 1 percent were $2.13 million in 2012, compared to $44,050 for the bottom 99 percent.

New York’s top 1 percent had nearly a third (32.8 percent) of all income in the state in 2012, slightly greater than the 32.6 percent share at the 2007 high point right before the financial crash. The all-time peak level in New York was 33.8 percent in 1929 on the eve of the stock market crash that ushered in the Great Depression.

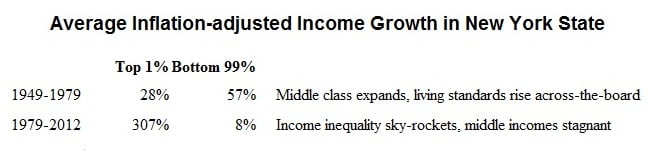

As with every state in the United States, New York’s income inequality has been on the rise since 1979 and represents a sharp reversal of the patterns of income growth that prevailed for more than three decades following World War II. During the 1949-to-1979 period, incomes rose across the board, with the middle class both expanding dramatically and experiencing fairly steady income gains. As this table shows, for the past three decades, most income gains have flowed to the very top.

According to the report, the threshold income level for New York’s top 1 percent was $506,051 in 2012. While the average income for the households in the top 1 percent was $2.13 million, incomes are highly concentrated at the very top of the income spectrum: the wealthiest 1/100th of the top 1 percent have average incomes of $69.6 million, twice the level for that group nationwide.

One of the reasons why incomes were so high for the wealthiest in 2012 was the acceleration of capital gains income that year in anticipation of higher federal income tax rates in 2013. Capital gains are highly concentrated among the very wealthy. Still, data released last week by the New York State Division of the Budget show that the top 1 percent’s share of New York personal income tax liability is expected to be nearly as high in 2015 (42.5 percent) as it was in 2012 (43.2 percent).[1] As FPI noted recently, a new report from the Institute on Taxation and Economic Policy shows that when all New York state and local taxes are factored in, the wealthiest 1 percent pay a smaller share of their income in state and local taxes than lower-income families.

[1] NYS Division of the Budget, FY 2016 Economic & Revenue Outlook, p. 171.

Related Posts

New York’s Top 1% See All Income Gains Since Recession

January 26, 2015. The incomes of the top 1 percent in New York State were nearly 50 times more than the bottom 99 percent in 2012, according to new analysis published by the Economic Policy Institute for the Economic Analysis and Research Network (EARN). The Fiscal Policy Institute is a founding member of the EARN network. In The Increasingly Unequal States of America: Income Inequality by State, 1917 to 2012, economists Estelle Sommelier and Mark Price update their analysis of IRS tax data—using the same methodology employed by Thomas Piketty and Emmanuel Saez to generate their widely cited findings—and show inequality is rising throughout the United States.

While incomes at all levels declined as a result of the Great Recession, income growth has been lopsided since the recovery began. From 2009 to 2012 the incomes of the top 1 percent grew faster than the incomes of the bottom 99 percent in every state except West Virginia. In New York State, the incomes of the top 1 percent rose by 32 percent in the first three years of recovery from 2009 to 2012, while the average incomes of the 99 percent declined by 1.1 percent.

“Despite hollow assertions that the economy has rebounded since the Great Recession, the average New York family is still waiting to see the financial fruits of the recovery from the financial crash. This new report confirms that all of the income gains in the recovery’s early years accrued to New York’s wealthiest while everyone else has been treading water at best and many are actually worse off,” said Ron Deutsch, Executive Director of the Fiscal Policy Institute. “The Governor just unveiled his ‘Opportunity Agenda’ for New York last week and this report puts a bright spotlight on the immediate need for our Albany leaders to get serious about developing a real ‘Shared Opportunity’ agenda, not a fig leaf-version of opportunity.”

FPI’s Deputy Director and Chief Economist, James Parrott, noted: “The recovery has been uneven across New York State, not just regionally, but it has been really lopsided in concentrating all the benefits among the wealthiest. Broadly shared prosperity with wages and middle incomes rising would translate into more sustainable economic and job growth.”

According to data in the new report, average incomes of the top 1 percent are 48 times the average income of the bottom 99 percent in New York and Connecticut, more lopsided than in any other state. For the United States overall, the top-to-bottom income ratio is nearly 30. Average incomes for New York’s wealthiest 1 percent were $2.13 million in 2012, compared to $44,050 for the bottom 99 percent.

New York’s top 1 percent had nearly a third (32.8 percent) of all income in the state in 2012, slightly greater than the 32.6 percent share at the 2007 high point right before the financial crash. The all-time peak level in New York was 33.8 percent in 1929 on the eve of the stock market crash that ushered in the Great Depression.

As with every state in the United States, New York’s income inequality has been on the rise since 1979 and represents a sharp reversal of the patterns of income growth that prevailed for more than three decades following World War II. During the 1949-to-1979 period, incomes rose across the board, with the middle class both expanding dramatically and experiencing fairly steady income gains. As this table shows, for the past three decades, most income gains have flowed to the very top.

According to the report, the threshold income level for New York’s top 1 percent was $506,051 in 2012. While the average income for the households in the top 1 percent was $2.13 million, incomes are highly concentrated at the very top of the income spectrum: the wealthiest 1/100th of the top 1 percent have average incomes of $69.6 million, twice the level for that group nationwide.

One of the reasons why incomes were so high for the wealthiest in 2012 was the acceleration of capital gains income that year in anticipation of higher federal income tax rates in 2013. Capital gains are highly concentrated among the very wealthy. Still, data released last week by the New York State Division of the Budget show that the top 1 percent’s share of New York personal income tax liability is expected to be nearly as high in 2015 (42.5 percent) as it was in 2012 (43.2 percent).[1] As FPI noted recently, a new report from the Institute on Taxation and Economic Policy shows that when all New York state and local taxes are factored in, the wealthiest 1 percent pay a smaller share of their income in state and local taxes than lower-income families.

[1] NYS Division of the Budget, FY 2016 Economic & Revenue Outlook, p. 171.