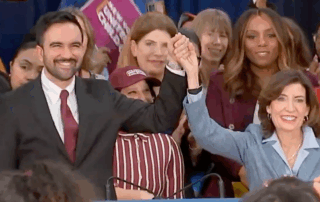

FPI Applauds Hochul-Mamdani Childcare Deal

New York's public school system, built in the nineteenth century, entitles New Yorkers aged five to twenty-one to free education. More recently, policymakers, including Governor Hochul and Mayor-elect Mamdani, have committed to finishing the project by extending universal education and care to children under the age of five.