FPI: Modest Budget Lacks Deep Investments Needed to Reverse Affordability Crisis & Stem Population Loss

January 16, 2024 |

FOR IMMEDIATE RELEASE: January 16, 2024

Media Contact: press@fiscalpolicy.org

FPI: Modest Budget Lacks Deep Investments Needed to Reverse Affordability Crisis & Stem Population Loss

“Given recent inflation and economic growth, state spending is shrinking slightly relative to the size of the overall state economy”

ALBANY, NY | In response to the New York State Executive Budget for Fiscal Year 2025, Fiscal Policy Institute Director Nathan Gusdorf released the following statement:

“After months of overly pessimistic revenue projections, the Executive Budget recognizes the State’s improving fiscal outlook, with projected tax receipts increasing and outyear budget gaps shrinking to within the routine range that typically resolves without significant policy interventions. The more significant Fiscal Year 2028 outyear gap reflects the Personal Income Tax and Corporate Tax surcharge expirations — a clear indication that the state must make both taxes permanent to ensure long-term fiscal stability.

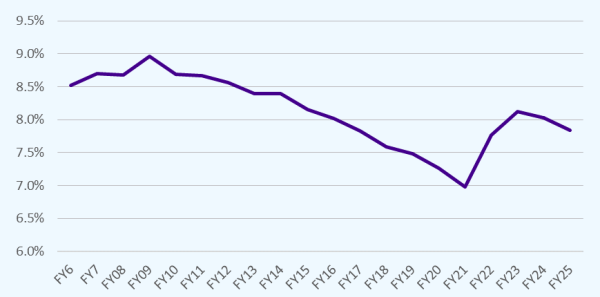

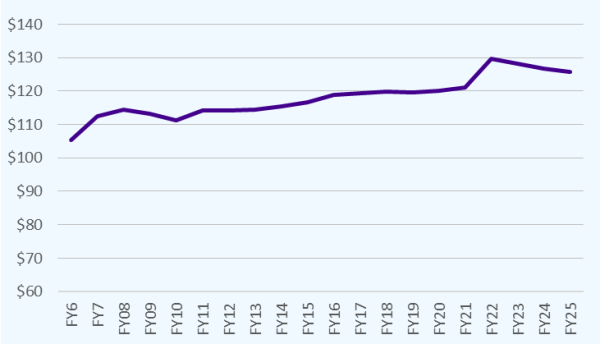

“The budget’s $129.3 billion in state operating funds for Fiscal Year 2025 reflects moderate increases in school aid and Medicaid, and declines in all other assistance and grants. Given recent inflation and economic growth, state spending is shrinking slightly relative to the size of the overall state economy.

“Despite the State’s improving economic outlook, the modest Executive Budget lacks the deep investments needed to reverse New York’s affordability crisis and stem the state’s population loss. While affordable housing is a central focus of the Executive Budget’s policy agenda, the budget relies on existing micro-grants to localities rather than new structural investments in housing construction. The legislature should build upon the Governor’s budget by deepening investments in affordable housing construction, a renewable energy transition, public funding for childcare, and the state’s public universities and community colleges. Increasing public investment will bolster New York’s long-term economic competitiveness by helping the State retain its working and middle-class population.

“Hochul’s decision to use a small portion of the State’s robust reserves for asylum seekers is a fiscally sound and responsible use of reserves to support New York City.”

State Spending as a Share of State Personal Income

State Spending, Adjusted for Inflation

The Fiscal Policy Institute is a nonpartisan, nonprofit research and education organization committed to improving public policies and private practices to better the economic and social conditions of all.

###

FPI: Modest Budget Lacks Deep Investments Needed to Reverse Affordability Crisis & Stem Population Loss

January 16, 2024 |

FOR IMMEDIATE RELEASE: January 16, 2024

Media Contact: press@fiscalpolicy.org

FPI: Modest Budget Lacks Deep Investments Needed to Reverse Affordability Crisis & Stem Population Loss

“Given recent inflation and economic growth, state spending is shrinking slightly relative to the size of the overall state economy”

ALBANY, NY | In response to the New York State Executive Budget for Fiscal Year 2025, Fiscal Policy Institute Director Nathan Gusdorf released the following statement:

“After months of overly pessimistic revenue projections, the Executive Budget recognizes the State’s improving fiscal outlook, with projected tax receipts increasing and outyear budget gaps shrinking to within the routine range that typically resolves without significant policy interventions. The more significant Fiscal Year 2028 outyear gap reflects the Personal Income Tax and Corporate Tax surcharge expirations — a clear indication that the state must make both taxes permanent to ensure long-term fiscal stability.

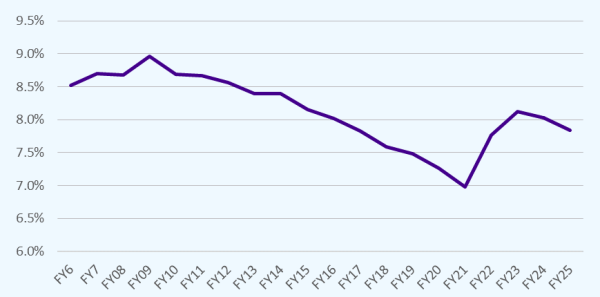

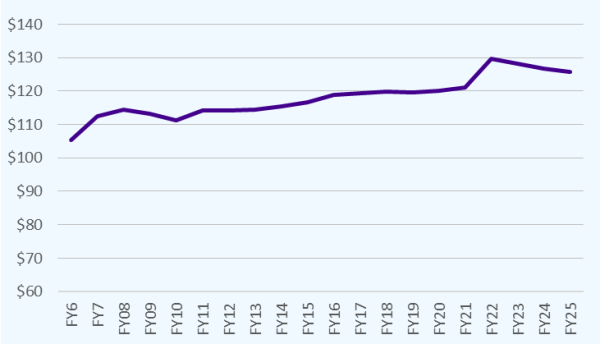

“The budget’s $129.3 billion in state operating funds for Fiscal Year 2025 reflects moderate increases in school aid and Medicaid, and declines in all other assistance and grants. Given recent inflation and economic growth, state spending is shrinking slightly relative to the size of the overall state economy.

“Despite the State’s improving economic outlook, the modest Executive Budget lacks the deep investments needed to reverse New York’s affordability crisis and stem the state’s population loss. While affordable housing is a central focus of the Executive Budget’s policy agenda, the budget relies on existing micro-grants to localities rather than new structural investments in housing construction. The legislature should build upon the Governor’s budget by deepening investments in affordable housing construction, a renewable energy transition, public funding for childcare, and the state’s public universities and community colleges. Increasing public investment will bolster New York’s long-term economic competitiveness by helping the State retain its working and middle-class population.

“Hochul’s decision to use a small portion of the State’s robust reserves for asylum seekers is a fiscally sound and responsible use of reserves to support New York City.”

State Spending as a Share of State Personal Income

State Spending, Adjusted for Inflation

The Fiscal Policy Institute is a nonpartisan, nonprofit research and education organization committed to improving public policies and private practices to better the economic and social conditions of all.

###