Making Sense of Federal Funding Cuts in New York

July 25, 2025 |

A Q&A about federal funding cuts

In the wake of the “One Big Beautiful Bill Act” (OBBBA), New York State policymakers and service providers are trying to make sense of the funding cuts headed our way. FPI has put out an accounting of funding cuts that includes both the New York State budgetary impact, as well as the funding cuts that will impact New Yorkers’ ability to access healthcare systems and providers. Here are our estimates of funding cuts over the coming years and our assessment of how the State should respond:

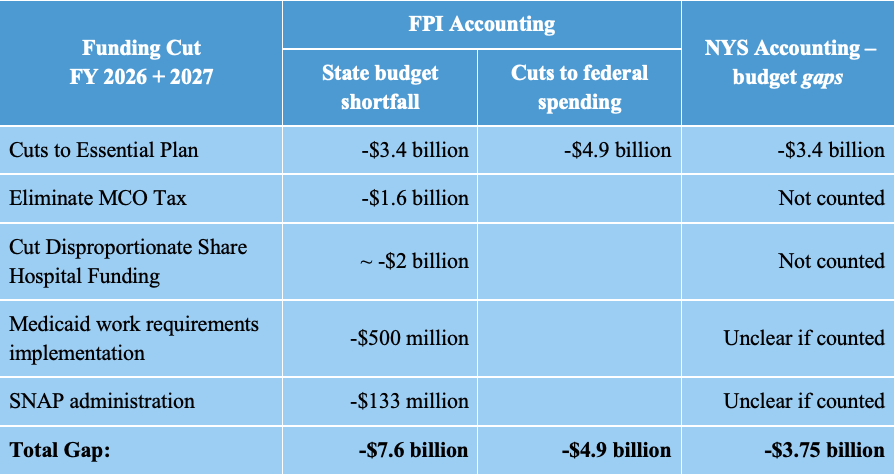

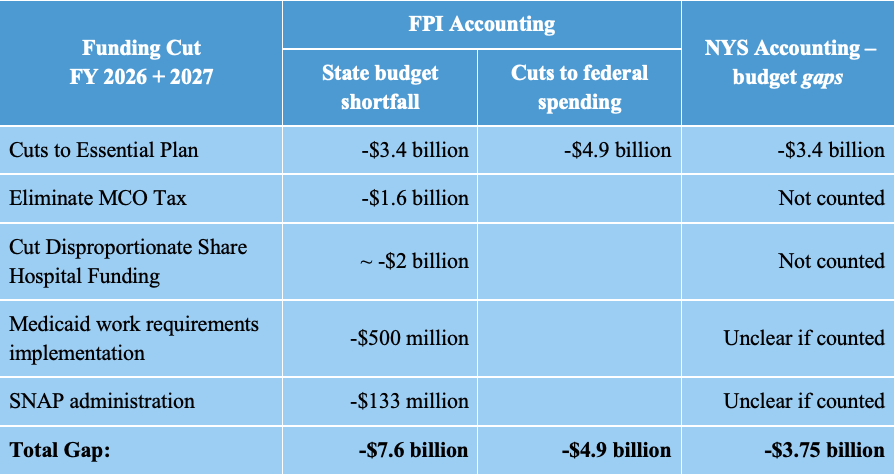

Table 1. Federal Funding Cuts to New York State, fiscal years 2026 and 2027 (combined)

Q: How much federal funding is New York losing?

FPI estimates that federal funding cuts to the state budget across fiscal years 2026 and 2027 will total $7.6 billion, plus an additional $4.9 billion in federal funding cuts to the healthcare system. Table 1 lists the sources of those funding cuts and illustrates how the estimates of budget gaps put out by the NYS Division of Budget (DOB) differ. The DOB only counts funding losses that automatically create spending obligations on the state budget. For this reason, the DOB does not count the loss of the MCO tax revenue, nor a significant proportion of Essential Plan cuts, which can be canceled without legally triggering any state obligation to make up the lost funding. Nonetheless, these cuts do constitute major losses of funding to the State’s budget and provision of healthcare services. Perhaps most importantly, the budget gap estimates from the DOB assume that the state will allow 1.5 million people to lose their health insurance with no state remedy. This would cause the uninsured rate in New York to more than double, reversing all the progress New York has made on this issue since the passage of the Affordable Care Act in 2010. For a full explanation of which funding sources are not accounted for by the DOB and why, read Michael Kinnucan’s recent piece “The State is Understating Threats to NYS Medicaid After OBBBA”.

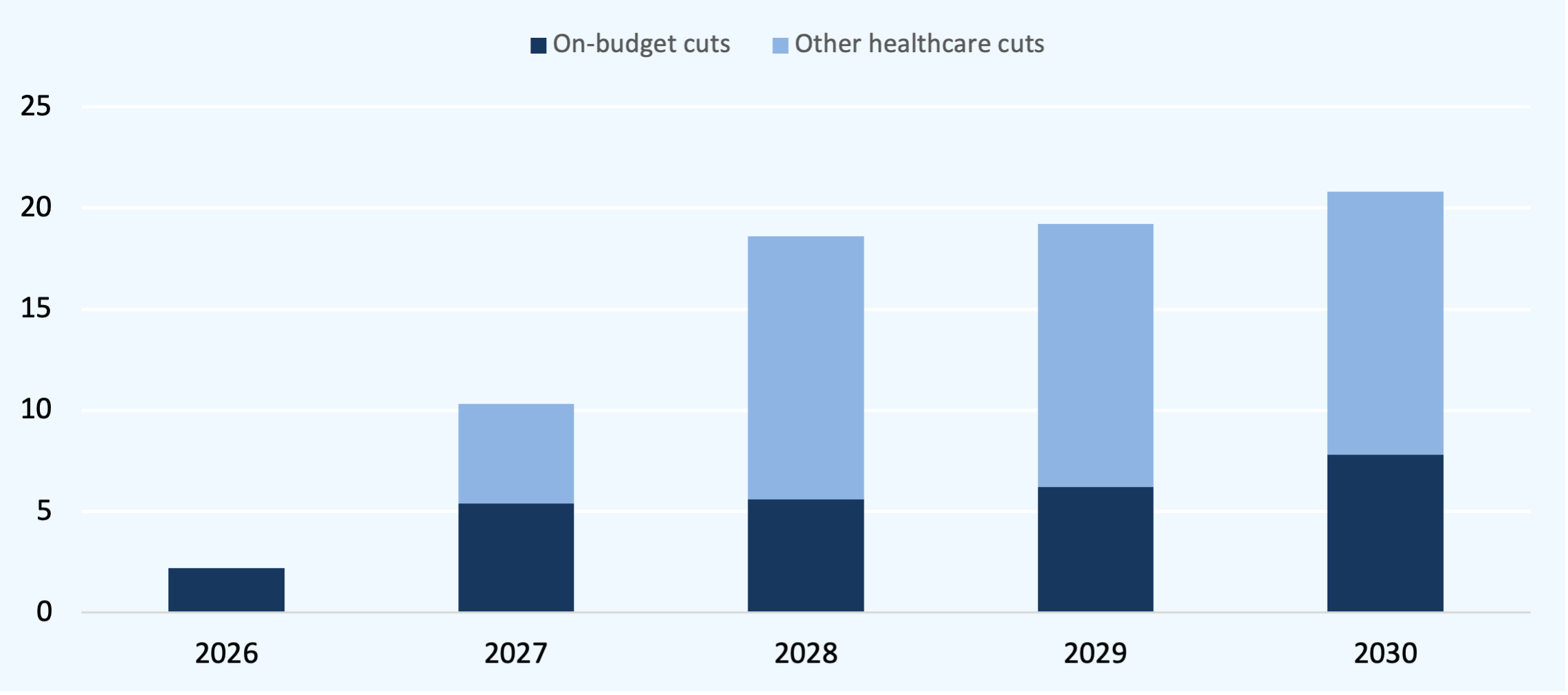

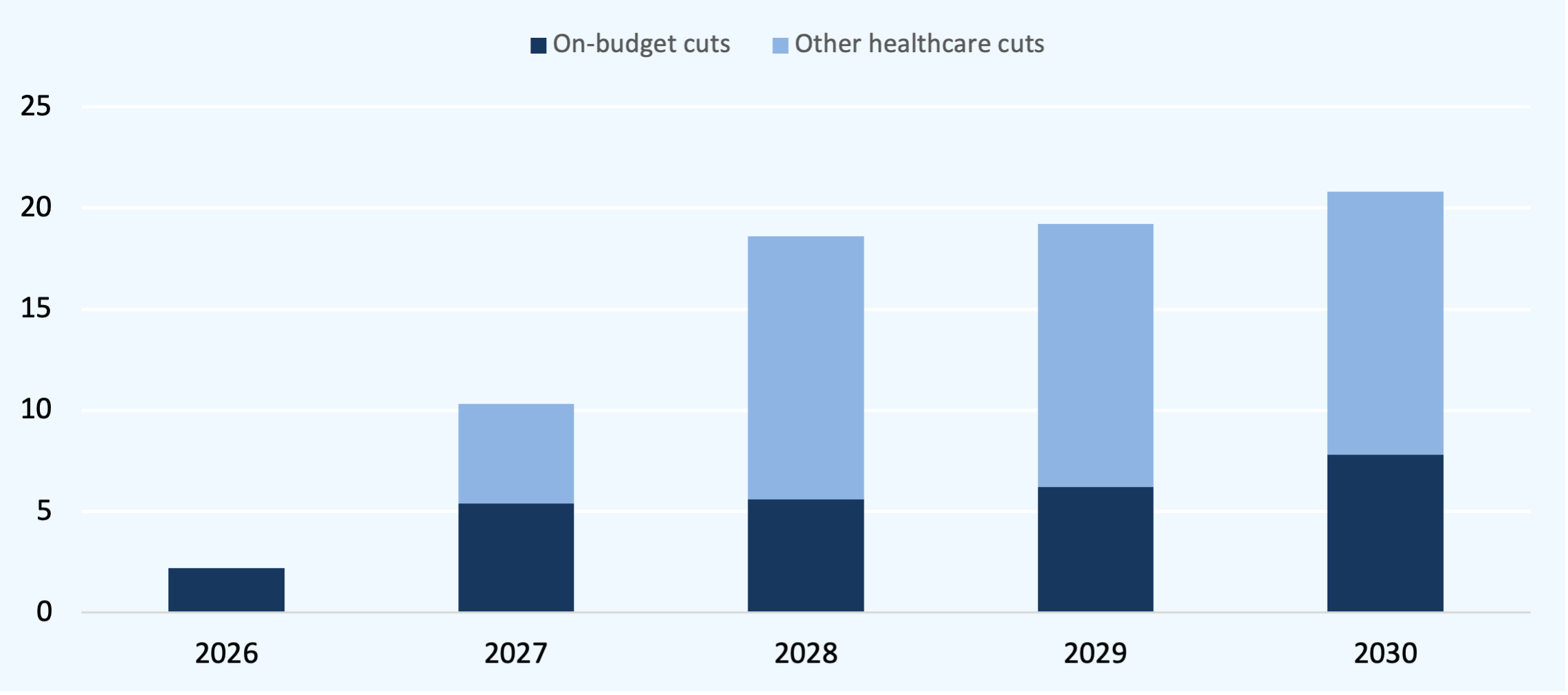

What’s more, the State’s current estimates of funding losses only reach fiscal year 2027. However, FPI’s analysis demonstrates that funding losses continue to grow until 2030, at which point the total funding cuts are over $20 billion annually. See figure 1.

Figure 1. FPI projections of funding losses to New York State based on OBBBA cuts (billions of dollars)

Q: Can the Governor fill this year’s budget gap without emergency powers?

The Governor has the power to reallocate State funds to plug relatively small, short-run budget shortfalls. FPI estimates that funding cuts to the State will exceed the amount that the Governor can reasonably rebalance mid-year. Nonetheless, understanding the mechanisms available to the Governor under “ordinary” circumstances is important. If the DOB’s estimate of the budget gap—$750 million this fiscal year—were the only fiscal concern (FPI does not hold this view), these measures may be sufficient to plug gaps.

First, to the extent that revenue within the current fiscal year exceeds budget projections, the Governor has additional, unallocated funds that can be used to cover rising spending obligations. As of June 2025, general fund revenue is exceeding projections by $744 million, giving the Governor enough extra revenue to cover at least the State’s estimate of the current-year funding shortfall. Second, the State budget includes a $2 billion Transaction Risk Reserve (TRR), which the Governor can decide to deploy as needed. Finally, the Governor can also tap fiscal reserves – which remain near record levels at $31 billion – to balance the budget. However, the Governor can only increase State spending for a program up to the maximum level appropriated by the enacted state budget. This severely restricts the Governor’s ability to make up for significant, multi-billion dollar shortfalls, as are expected under the OBBBA.

The Governor has limited ability to cut funding in the normal course of the budget. The budget is made up of appropriations, which represent legal spending requirements. Reductions to appropriations need to be approved by the legislature.

Q: Didn’t this year’s Enacted Budget give the Governor emergency powers?

The fiscal year 2026 Enacted Budget provided the Governor with extraordinary budget powers: In the event of a $2 billion fiscal imbalance (where spending obligations exceed revenue, either due to a revenue shortfall or rising spending obligations) the powers authorize the Governor to cut spending to balance the budget. Importantly, however, the powers are only triggered by a shortfall in the general fund—the portion of the State budget funded by tax revenue—and not a shortfall in federal revenue. Federal funding does not flow through the general fund, and so a major loss of federal funds will not necessarily have an impact on the general fund budgeting.

Nevertheless, if federal budget cuts exceed $2 billion and the State makes up the shortfall by increasing general fund spending, the State could conceivably identify a general fund imbalance of $2 billion or more. This would activate the emergency powers, thus allowing the Governor to cut spending elsewhere in the state budget.

Q: Is the Governor using emergency powers to make cuts right now?

As of now, the Governor has not invoked emergency powers. By claiming that the budget gap in fiscal year 2026 is only $750 million, the Governor and the DOB appear to be minimizing the apparent need for emergency powers or a special session. However, the budget gap estimates assume that the State will allow 1.5 million people to lose their health insurance with no state remedy. This would be an increase in the uninsured population in New York of 100 percent, or double the current uninsured rate. The estimates also ignore major funding losses that don’t technically count as “budget gaps,” such as the cancellation of the MCO tax which will likely result in a $1.6 billion funding loss alone over the next 18 months. (The State wrote into law that all spending funded by the MCO tax revenue would be cancelled if the revenue didn’t materialize. Thus, the loss of MCO tax revenue reduces both the revenue and spending sides of the budget, not resulting in any additional gap from a technical standpoint). In the absence of a special session, the Executive can make unilateral cuts to spending and will also allow many billions of dollars of healthcare spending to simply evaporate based on the OBBBA’s cuts.

Q: Does the legislature need to call a special session?

The legislature should call a special session for three specific reasons:

- To cancel the $2 billion inflation refund checks and divert the funds into a new, flexible fund to stabilize healthcare programs;

- To deliberate and enact new revenue raisers that can meet the funding needs of the State (see FPI Executive Director Nathan Gusdorf’s recent report with FPI’s recommendations); and

- To design a plan to provide public state-funded health insurance to the 1.5 million New Yorkers who will lose insurance under the OBBBA.

Q: How would a special session work?

Either the Governor or legislature (if two-thirds of members sign a proclamation) can call for a special legislative session. The proclamation that convenes a special session must identify the topics to be considered, and debate is limited to these topics. As stated above, FPI encourages the legislature to call for a special session to address major funding cuts to the state budget and to establish a healthcare plan for the 1.5 million New Yorkers who will lose care under OBBBA.

Special sessions hold far greater power to modify the budget than emergency powers or normal mid-year budget maneuvers. During a special session, lawmakers enact the budget measures as they do during a typical budget session, including modifying existing programs and revenue options. As such, special sessions are the only way to holistically confront major fiscal challenges that emerge during the fiscal year.

Making Sense of Federal Funding Cuts in New York

July 25, 2025 |

A Q&A about federal funding cuts

In the wake of the “One Big Beautiful Bill Act” (OBBBA), New York State policymakers and service providers are trying to make sense of the funding cuts headed our way. FPI has put out an accounting of funding cuts that includes both the New York State budgetary impact, as well as the funding cuts that will impact New Yorkers’ ability to access healthcare systems and providers. Here are our estimates of funding cuts over the coming years and our assessment of how the State should respond:

Table 1. Federal Funding Cuts to New York State, fiscal years 2026 and 2027 (combined)

Q: How much federal funding is New York losing?

FPI estimates that federal funding cuts to the state budget across fiscal years 2026 and 2027 will total $7.6 billion, plus an additional $4.9 billion in federal funding cuts to the healthcare system. Table 1 lists the sources of those funding cuts and illustrates how the estimates of budget gaps put out by the NYS Division of Budget (DOB) differ. The DOB only counts funding losses that automatically create spending obligations on the state budget. For this reason, the DOB does not count the loss of the MCO tax revenue, nor a significant proportion of Essential Plan cuts, which can be canceled without legally triggering any state obligation to make up the lost funding. Nonetheless, these cuts do constitute major losses of funding to the State’s budget and provision of healthcare services. Perhaps most importantly, the budget gap estimates from the DOB assume that the state will allow 1.5 million people to lose their health insurance with no state remedy. This would cause the uninsured rate in New York to more than double, reversing all the progress New York has made on this issue since the passage of the Affordable Care Act in 2010. For a full explanation of which funding sources are not accounted for by the DOB and why, read Michael Kinnucan’s recent piece “The State is Understating Threats to NYS Medicaid After OBBBA”.

What’s more, the State’s current estimates of funding losses only reach fiscal year 2027. However, FPI’s analysis demonstrates that funding losses continue to grow until 2030, at which point the total funding cuts are over $20 billion annually. See figure 1.

Figure 1. FPI projections of funding losses to New York State based on OBBBA cuts (billions of dollars)

Q: Can the Governor fill this year’s budget gap without emergency powers?

The Governor has the power to reallocate State funds to plug relatively small, short-run budget shortfalls. FPI estimates that funding cuts to the State will exceed the amount that the Governor can reasonably rebalance mid-year. Nonetheless, understanding the mechanisms available to the Governor under “ordinary” circumstances is important. If the DOB’s estimate of the budget gap—$750 million this fiscal year—were the only fiscal concern (FPI does not hold this view), these measures may be sufficient to plug gaps.

First, to the extent that revenue within the current fiscal year exceeds budget projections, the Governor has additional, unallocated funds that can be used to cover rising spending obligations. As of June 2025, general fund revenue is exceeding projections by $744 million, giving the Governor enough extra revenue to cover at least the State’s estimate of the current-year funding shortfall. Second, the State budget includes a $2 billion Transaction Risk Reserve (TRR), which the Governor can decide to deploy as needed. Finally, the Governor can also tap fiscal reserves – which remain near record levels at $31 billion – to balance the budget. However, the Governor can only increase State spending for a program up to the maximum level appropriated by the enacted state budget. This severely restricts the Governor’s ability to make up for significant, multi-billion dollar shortfalls, as are expected under the OBBBA.

The Governor has limited ability to cut funding in the normal course of the budget. The budget is made up of appropriations, which represent legal spending requirements. Reductions to appropriations need to be approved by the legislature.

Q: Didn’t this year’s Enacted Budget give the Governor emergency powers?

The fiscal year 2026 Enacted Budget provided the Governor with extraordinary budget powers: In the event of a $2 billion fiscal imbalance (where spending obligations exceed revenue, either due to a revenue shortfall or rising spending obligations) the powers authorize the Governor to cut spending to balance the budget. Importantly, however, the powers are only triggered by a shortfall in the general fund—the portion of the State budget funded by tax revenue—and not a shortfall in federal revenue. Federal funding does not flow through the general fund, and so a major loss of federal funds will not necessarily have an impact on the general fund budgeting.

Nevertheless, if federal budget cuts exceed $2 billion and the State makes up the shortfall by increasing general fund spending, the State could conceivably identify a general fund imbalance of $2 billion or more. This would activate the emergency powers, thus allowing the Governor to cut spending elsewhere in the state budget.

Q: Is the Governor using emergency powers to make cuts right now?

As of now, the Governor has not invoked emergency powers. By claiming that the budget gap in fiscal year 2026 is only $750 million, the Governor and the DOB appear to be minimizing the apparent need for emergency powers or a special session. However, the budget gap estimates assume that the State will allow 1.5 million people to lose their health insurance with no state remedy. This would be an increase in the uninsured population in New York of 100 percent, or double the current uninsured rate. The estimates also ignore major funding losses that don’t technically count as “budget gaps,” such as the cancellation of the MCO tax which will likely result in a $1.6 billion funding loss alone over the next 18 months. (The State wrote into law that all spending funded by the MCO tax revenue would be cancelled if the revenue didn’t materialize. Thus, the loss of MCO tax revenue reduces both the revenue and spending sides of the budget, not resulting in any additional gap from a technical standpoint). In the absence of a special session, the Executive can make unilateral cuts to spending and will also allow many billions of dollars of healthcare spending to simply evaporate based on the OBBBA’s cuts.

Q: Does the legislature need to call a special session?

The legislature should call a special session for three specific reasons:

- To cancel the $2 billion inflation refund checks and divert the funds into a new, flexible fund to stabilize healthcare programs;

- To deliberate and enact new revenue raisers that can meet the funding needs of the State (see FPI Executive Director Nathan Gusdorf’s recent report with FPI’s recommendations); and

- To design a plan to provide public state-funded health insurance to the 1.5 million New Yorkers who will lose insurance under the OBBBA.

Q: How would a special session work?

Either the Governor or legislature (if two-thirds of members sign a proclamation) can call for a special legislative session. The proclamation that convenes a special session must identify the topics to be considered, and debate is limited to these topics. As stated above, FPI encourages the legislature to call for a special session to address major funding cuts to the state budget and to establish a healthcare plan for the 1.5 million New Yorkers who will lose care under OBBBA.

Special sessions hold far greater power to modify the budget than emergency powers or normal mid-year budget maneuvers. During a special session, lawmakers enact the budget measures as they do during a typical budget session, including modifying existing programs and revenue options. As such, special sessions are the only way to holistically confront major fiscal challenges that emerge during the fiscal year.