Before the State of the State: New York’s Fiscal Outlook and Millionaire Tax Breaks

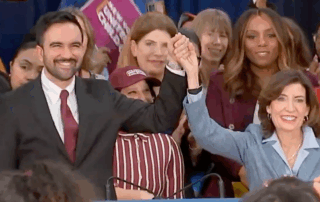

On January 13, Governor Hochul will deliver the State of the State speech, which is expected to address matters of affordability in New York and the State’s relationship with the federal government. FPI here releases summaries of two previous publications on the State’s fiscal outlook and the tax breaks that New York’s millionaire earners will receive from the federal government this year.