State Economic Update: Recession Unlikely, Tax Receipts Stable

August 11, 2023 |

By Emily Eisner, PhD, Economist

August 11, 2023

Recent revisions to economic forecasts have significantly lowered expectations of a recession. This has positive implications for the State’s fiscal outlook, as improved economic performance should translate into higher tax receipts.

A recession looks less and less likely.

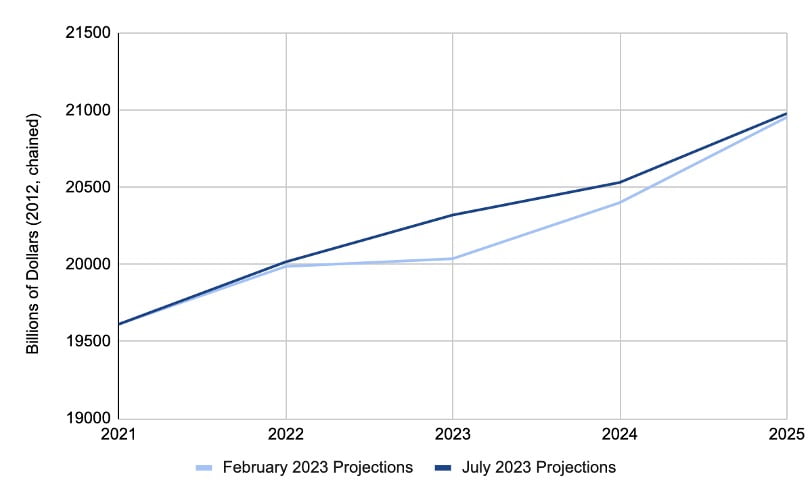

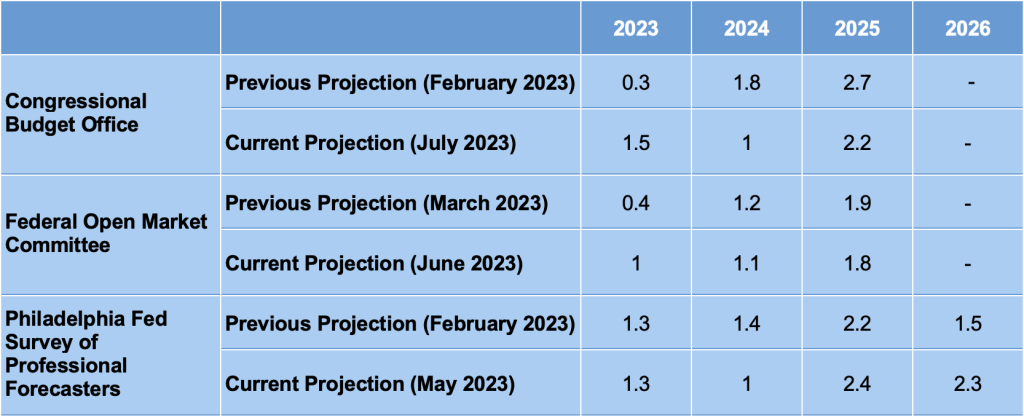

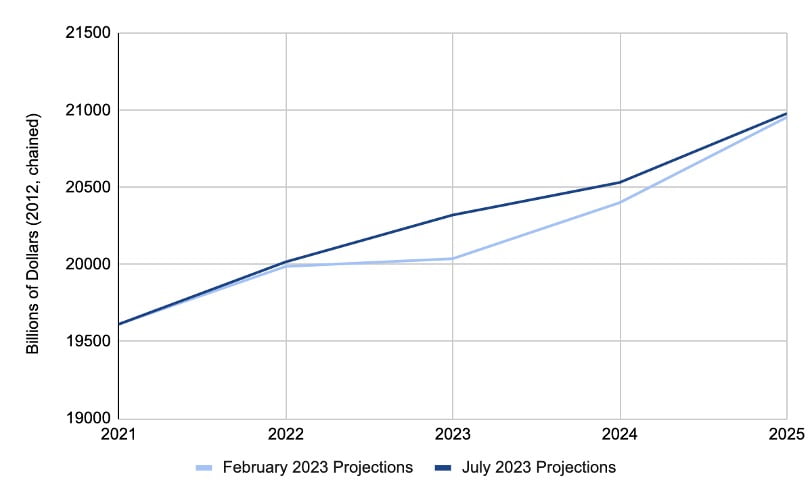

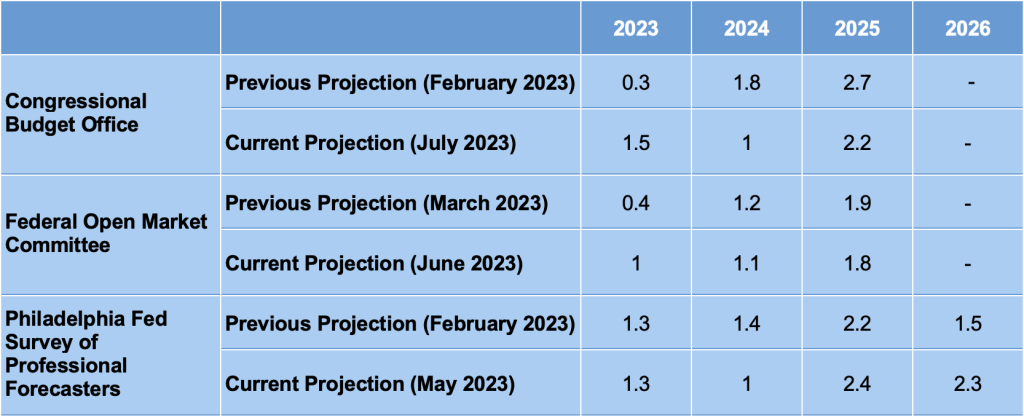

At the start of 2023, many institutional economic forecasters were predicting a high likelihood of a recession within the year, chiefly due to interest rate hikes by the Federal Reserve. In recent months, however, the major nonpartisan government institutions that forecast economic conditions have updated their predictions to reflect a lower probability of an impending recession (Table 1). On July 26, Federal Reserve Chair Jerome Powell announced that the Federal Reserve staff no longer predict a recession on the horizon.[1] The Congressional Budget Office (CBO) has also updated estimates for real GDP growth to reflect a more stable upward trajectory of real economic activity over the next two or three years (Figure 1).

Figure 1. Congressional Budget Office Estimates and Projections of Real GDP 2021-2025.

These updated forecasts suggest that the Federal Reserve has managed to quell inflation without causing a recession. Nonetheless, the economy has slowed relative to the rapid growth seen during the Covid-19 recovery, and there may still be a slowdown in growth and an uptick in unemployment as the impact of contractionary interest rate policy ripples through the economy.

Table 1. Projections of Real GDP Growth by Source and Month of Projection.

State tax receipts reflect an improving economic outlook.

New York’s tax revenues also show signs of resilience, consistent with these more optimistic economic forecasts. State tax revenues come from three main sources: 1) the personal income tax, 2) the corporate tax (and other taxes on businesses), and 3) sales taxes. Personal income tax receipts make up about 60 percent of the total tax revenue, business taxes make up about 23 percent of total tax revenue, and consumption taxes make up about 16 percent of total tax revenue. Each of these is important to the State’s tax base and each is impacted by the state of the New York economy.

The personal income tax, which makes up the largest component of tax revenue in the State, has two major components: wage income and non-wage income. Non-wage income includes bonuses, capital gains, and self-employment income. While wage income (mostly ordinary salaries) is closely correlated with the State’s labor market, non-wage income reflects business profits and investment gains, and therefore depends on both the state labor market as well as financial markets. Over recent years, about 30 percent of the State’s personal income tax revenue has come from non-wage income, which is attributable in large part to corporate bonuses and capital gains, and is heavily influenced by fluctuations in financial markets.

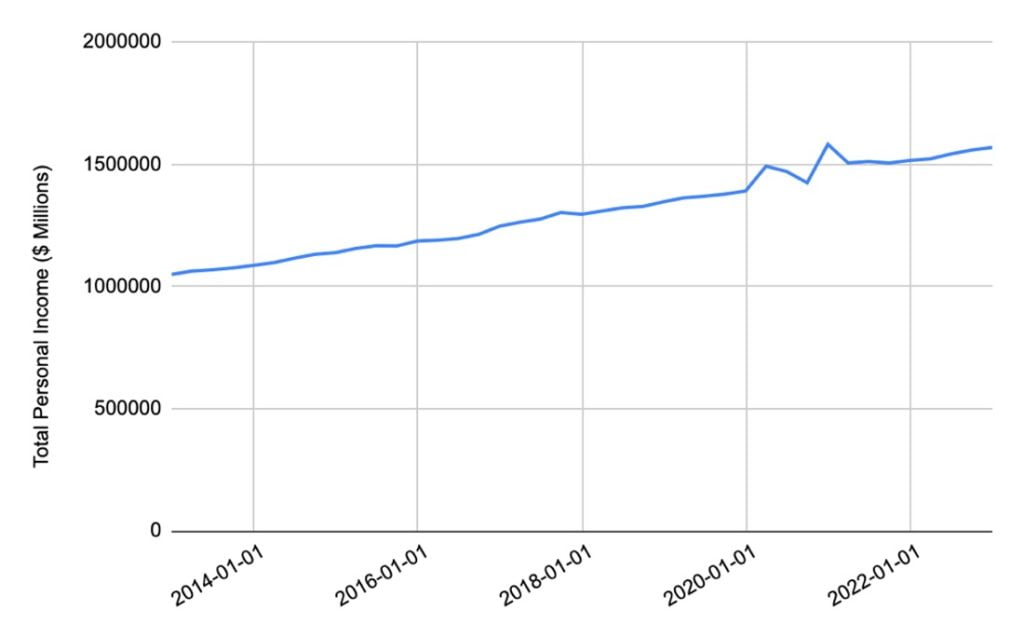

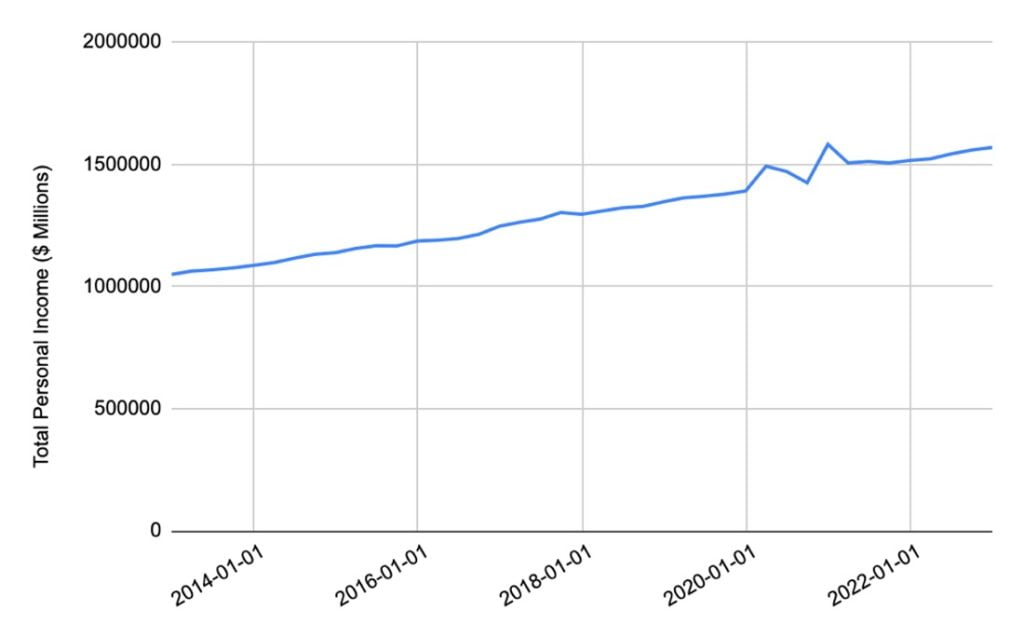

While 2020 saw an unprecedented decline in employment, the state’s labor market has largely recovered and has seen stable growth in total personal income. Total personal income offers a good approximation of the state’s tax base. Thus, from a fiscal perspective, the State’s tax base has maintained stable growth. Figure 1 below shows that personal income has grown consistently over the past 10 years and continues to grow in the post-Covid period.

Figure 2. Bureau of Economic Analysis’s Data on Total Personal Income in NY.

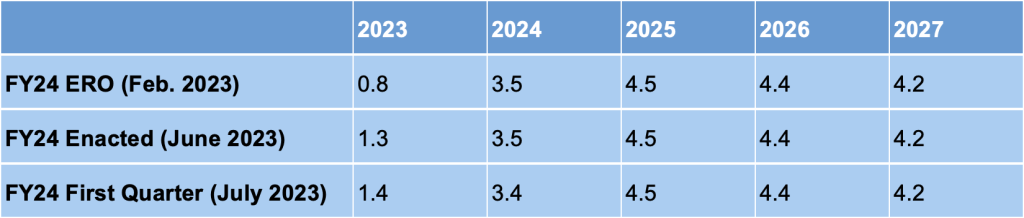

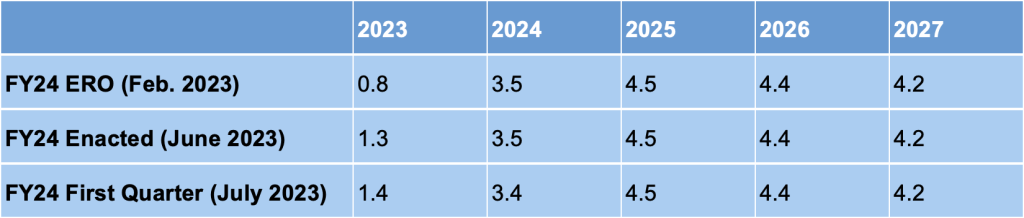

Over the last year, total personal income has grown by 3.2 percent — the best overall indicator of the health of the State’s tax base. There has also been a 2 percent increase in wages and a 2.3 percent increase in employment. The DOB produces predictions of personal income growth which are shown in Table 2. In their Fiscal Year 2024 financial plan updates, they have increased their estimates for 2023 personal income growth and have maintained an optimistic view of personal income growth over the next 4 years. These predictions are subject to change and contain substantial uncertainty as the economic situation unfolds. However, the current projections reflect a notably positive outlook for New York’s income tax base.

Table 2: New York Division on Budget Estimates for Personal Income Growth.

Volatility and uncertainty remain high.

While forecasts of a recession have been revised to show less risk on the horizon, there is always the possibility of new information and new shocks that change the forecasted path of the economy. As the economy undergoes fluctuations, so will tax revenues. Over the past three years, since the onset of the Covid-19 pandemic, tax revenues have been very hard to predict because the economy has seen such turmoil in both labor markets and in capital markets. Most recently, a decline in the stock market over the course of 2022 impacted tax receipts in April 2023, as taxpayers settled their taxes for the 2022 tax year. Low April 2023 tax receipts reflected the volatility that can occur due to fluctuations in capital markets. Since the start of 2023, the stock market has regained over 80 percent of its 2022 losses, so tax receipts driven by capital markets performance should rebound accordingly. However, the high levels of uncertainty in this market and in the economy more generally warrant vigilance and transparent communication of the degree of uncertainty.

The State should publish uncertainty measures in its fiscal forecasts.

At this time, the State does not publish measures of uncertainty with their forecasts. Without measures of uncertainty, it is difficult to know how concerned we should be about impending budget gaps. FPI recommends that DOB forecasts include uncertainty measures to give a sense of the span of possible outcomes on the horizon, and more accurately raise or lower concerns when appropriate. Without data on the full range of possibilities and their likelihood, the State could be at risk of needlessly cutting or restricting spending on public services, which would negatively impact the state economy and labor market.

[1] Chair Powell said, “So the staff now has a noticeable slowdown in growth starting later this year in the forecast, but given the resilience of the economy recently, they are no longer forecasting a recession.” https://www.reuters.com/markets/us/fed-staff-no-longer-forecasting-us-recession-powell-says-2023-07-26/.

State Economic Update: Recession Unlikely, Tax Receipts Stable

August 11, 2023 |

By Emily Eisner, PhD, Economist

August 11, 2023

Recent revisions to economic forecasts have significantly lowered expectations of a recession. This has positive implications for the State’s fiscal outlook, as improved economic performance should translate into higher tax receipts.

A recession looks less and less likely.

At the start of 2023, many institutional economic forecasters were predicting a high likelihood of a recession within the year, chiefly due to interest rate hikes by the Federal Reserve. In recent months, however, the major nonpartisan government institutions that forecast economic conditions have updated their predictions to reflect a lower probability of an impending recession (Table 1). On July 26, Federal Reserve Chair Jerome Powell announced that the Federal Reserve staff no longer predict a recession on the horizon.[1] The Congressional Budget Office (CBO) has also updated estimates for real GDP growth to reflect a more stable upward trajectory of real economic activity over the next two or three years (Figure 1).

Figure 1. Congressional Budget Office Estimates and Projections of Real GDP 2021-2025.

These updated forecasts suggest that the Federal Reserve has managed to quell inflation without causing a recession. Nonetheless, the economy has slowed relative to the rapid growth seen during the Covid-19 recovery, and there may still be a slowdown in growth and an uptick in unemployment as the impact of contractionary interest rate policy ripples through the economy.

Table 1. Projections of Real GDP Growth by Source and Month of Projection.

State tax receipts reflect an improving economic outlook.

New York’s tax revenues also show signs of resilience, consistent with these more optimistic economic forecasts. State tax revenues come from three main sources: 1) the personal income tax, 2) the corporate tax (and other taxes on businesses), and 3) sales taxes. Personal income tax receipts make up about 60 percent of the total tax revenue, business taxes make up about 23 percent of total tax revenue, and consumption taxes make up about 16 percent of total tax revenue. Each of these is important to the State’s tax base and each is impacted by the state of the New York economy.

The personal income tax, which makes up the largest component of tax revenue in the State, has two major components: wage income and non-wage income. Non-wage income includes bonuses, capital gains, and self-employment income. While wage income (mostly ordinary salaries) is closely correlated with the State’s labor market, non-wage income reflects business profits and investment gains, and therefore depends on both the state labor market as well as financial markets. Over recent years, about 30 percent of the State’s personal income tax revenue has come from non-wage income, which is attributable in large part to corporate bonuses and capital gains, and is heavily influenced by fluctuations in financial markets.

While 2020 saw an unprecedented decline in employment, the state’s labor market has largely recovered and has seen stable growth in total personal income. Total personal income offers a good approximation of the state’s tax base. Thus, from a fiscal perspective, the State’s tax base has maintained stable growth. Figure 1 below shows that personal income has grown consistently over the past 10 years and continues to grow in the post-Covid period.

Figure 2. Bureau of Economic Analysis’s Data on Total Personal Income in NY.

Over the last year, total personal income has grown by 3.2 percent — the best overall indicator of the health of the State’s tax base. There has also been a 2 percent increase in wages and a 2.3 percent increase in employment. The DOB produces predictions of personal income growth which are shown in Table 2. In their Fiscal Year 2024 financial plan updates, they have increased their estimates for 2023 personal income growth and have maintained an optimistic view of personal income growth over the next 4 years. These predictions are subject to change and contain substantial uncertainty as the economic situation unfolds. However, the current projections reflect a notably positive outlook for New York’s income tax base.

Table 2: New York Division on Budget Estimates for Personal Income Growth.

Volatility and uncertainty remain high.

While forecasts of a recession have been revised to show less risk on the horizon, there is always the possibility of new information and new shocks that change the forecasted path of the economy. As the economy undergoes fluctuations, so will tax revenues. Over the past three years, since the onset of the Covid-19 pandemic, tax revenues have been very hard to predict because the economy has seen such turmoil in both labor markets and in capital markets. Most recently, a decline in the stock market over the course of 2022 impacted tax receipts in April 2023, as taxpayers settled their taxes for the 2022 tax year. Low April 2023 tax receipts reflected the volatility that can occur due to fluctuations in capital markets. Since the start of 2023, the stock market has regained over 80 percent of its 2022 losses, so tax receipts driven by capital markets performance should rebound accordingly. However, the high levels of uncertainty in this market and in the economy more generally warrant vigilance and transparent communication of the degree of uncertainty.

The State should publish uncertainty measures in its fiscal forecasts.

At this time, the State does not publish measures of uncertainty with their forecasts. Without measures of uncertainty, it is difficult to know how concerned we should be about impending budget gaps. FPI recommends that DOB forecasts include uncertainty measures to give a sense of the span of possible outcomes on the horizon, and more accurately raise or lower concerns when appropriate. Without data on the full range of possibilities and their likelihood, the State could be at risk of needlessly cutting or restricting spending on public services, which would negatively impact the state economy and labor market.

[1] Chair Powell said, “So the staff now has a noticeable slowdown in growth starting later this year in the forecast, but given the resilience of the economy recently, they are no longer forecasting a recession.” https://www.reuters.com/markets/us/fed-staff-no-longer-forecasting-us-recession-powell-says-2023-07-26/.