Statement on NYC’s Preliminary Budget: Progressive Taxes and Increased State Aid are Best Solutions to City Budget Challenges

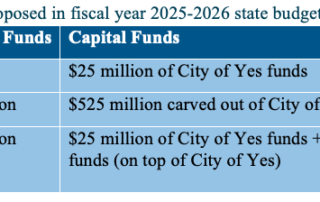

Growth in the City’s budget should be seen as a necessary expense for sustaining one of the greatest cities in the world, not as fiscal recklessness, and the State ought to do its part to help the City manage this crisis.