Testimony on Mayor’s November Financial Plan

December 11, 2023 |

December 11, 2023

Submitted to the New York City Council Committee on Finance

Good morning — I am Andrew Perry, Senior Policy Analyst at the Fiscal Policy Institute, a nonpartisan research organization committed to improving public policy to better the economic and social conditions of all New Yorkers.

Overview:

New York City faces real fiscal strain in the current fiscal year and next year. However, projected gaps are the result of an unexpected and temporary fiscal shock – the costs of services to asylum seekers – rather than a permanent structural imbalance. A temporary fiscal shock can be addressed through the use of non-recurring resources. Permanent cuts, which weaken public services and cause long-term economic damage, should be a last resort — rather than the first approach. As such, to manage the City’s fiscal strain:

- the City should not make additional cuts;

- the City should avoid using conservative budgeting practices as a pretext for reactive cuts to critical services; and finally,

- the City should mobilize non-recurring resources to close any remaining shortfall next year.

Given the fiscal resources available to the City, these steps can be taken while restoring $200 million of cuts that were already taken from essential services such as libraries, education, and sanitation.

FY 2024 Budget

Between New York City June 2023 adopted budget and the November 2023 financial plan, the City substantially revised its projected city funds spending on services for asylum seekers, adding $1.4 billion in the current fiscal year — fiscal year 2024 — and $4.8 billion in the next fiscal year. Over the same period, the City revised its city funds revenue estimates for the current fiscal year upward by $800 million and instituted $1.6 billion in PEG cuts and savings. These updates allow the City to carry $643 million into the next fiscal year while retaining its planned $1.2 billion general reserve spending — a fiscal cushion that will also carry forward into next year. As such, the fiscal year 2024 budget remains balanced. No additional cuts to fiscal year 2024 in the January or April 2024 financial plans are necessary.

Given the City’s sound economic footing, it is likely that revenue will continue to exceed projections, which were revised upward only modestly in the November financial plan. Above trend revenue, together with the City’s general reserve allocation for fiscal year 2024, give the City the ability to both reverse the most damaging November PEG cuts and to carry additional fiscal relief into fiscal year 2025. Conversely, cuts to libraries that reduce service hours, a Department of Education hiring freeze, cuts to early childhood education and community schools programs, and a Department of Sanitation hiring freeze will quickly deteriorate the quality of core services. Cutting these programs will damage the City’s economy and quality of life over the coming years. These cuts can be reversed by instead tapping into the fiscal year 2024’s general reserve allocation by approximately $200 million, while retaining $1 billion of that fund to prepay expenses for next year.

New York City always projects budget gaps in future fiscal years. In recent years, the budget gaps projected in November financial plans for the following fiscal year have averaged 4 percent of projected revenue. The Fiscal Policy Institute recently reviewed ten years of City budget gaps and found that these routine budget gaps are consistently closed as a result of actual revenue exceeding projected revenue. While actual spending tends to hew close to projected spending, realized revenue exceeds one-year-out projections by 4.8 percent, on average. These routine budget gaps, therefore, are the result of conservative revenue estimation. While this reflects prudent financial management and reduces the risk posed by unexpected shocks, these routine gaps should not serve as a pretext for reactive budget cuts.

FY 2025 Budget

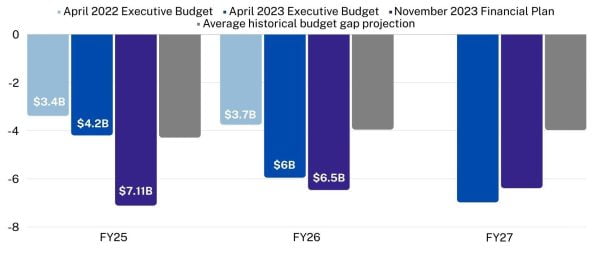

The November 2023 financial plan raised fiscal year 2025’s projected budget gap by $2 billion, bringing the projected shortfall to $7.1 billion — 6.7 percent of revenue. The fiscal year 2025 gap was driven by the City spending on services for asylum seekers, which rose $4.8 billion to $5.5 billion since the June 2023 financial plan. If not for the asylum seeker costs, the City would be on strong footing heading into fiscal year 2025, with a projected gap of $1.6 billion — or 1.5 percent of revenue — lower than the level routinely projected.

The asylum seeker costs represent a temporary shock to the City’s budget. however, some have voiced concern that there may be more permanent structural gaps in the City’s budget. For example, some argue that the costs of recent collective bargaining agreements drive recent gaps. However, the estimated costs of labor contracts – and total expenditures other than for asylum seekers – have not increased since the April 2023 executive budget, which projected outyear budget gaps in line with routine levels. Further, recently ratified bargaining patterns keep workers’ wages in line with recent and projected inflation over the contract period. As the City struggles with excess vacancies across the public workforce, keeping workers’ wages on pace with the cost of living will be essential for attracting and retaining workers. More broadly, reviewing the size of the City’s budget over the last decade reveals that the budget has grown in direct lockstep with growth in total private wages in the City — a key measure of the City’s tax base. Thus, FPI sees no cause for concern that the City budget has grown beyond its means.

Balancing the FY 2025 Budget

The projected budget gap for fiscal year 2025 of $7.1 billion exceeds the levels routinely projected for the first outyear at this stage in the budget cycle. Because this gap is the result of an unanticipated fiscal shock — the cost of services to asylum seekers — and not a structural budget imbalance, it is appropriate to use non-recurring resources to close this short-run shortfall. These resources may include:

- State aid: New York State is on solid fiscal footing and should provide one-year appropriations to support the city through this crisis. These appropriations may be financed by state revenue, or, depending on its budget at the end of its fiscal year, the State’s considerable reserve balances, which include $13 billion non-statutory reserves and $11 billion general fund balance not designated as reserves that are available for use. State aid may also take the form of repealing unfunded mandates to the city, including its liability for charter school rent.

- City revenue: Fiscal year 2024 revenue is likely to continue to exceed projections in the remainder of the fiscal year. This above-expectations revenue, together with the remaining general reserve allocation, will allow the City to prepay fiscal year 2025 expenses, lowering the projected gap. Further, because the City’s underestimation of outyear revenue is highly consistent, it is likely that actual revenue will exceed the City’s conservative projections next year. In the event that these pessimistic expectations become reality, withdrawals from the City’s $2 billion revenue stabilization fund would be appropriate.

- City expenditures: The city allocates $1.2 billion as a general reserve each fiscal year. This allocation serves as a fiscal cushion to guard against unanticipated fiscal strain. Given next year’s unprecedented challenges, this allocation should be drawn down by $900 million. This would leave the general reserve for fiscal year 2025 at $300 million — the same level allocated during the Bloomberg administration.

Further, estimates of asylum seekers spending assume each asylum seeker household will cost the city $383 per night in both fiscal year 2024 and 2025. That is, in the November Financial Plan, the City’s cost estimates assume that there will not be any cost efficiencies over the next two years. As the arrival of asylum seekers moves from an abrupt emergency to a multi-year reality, the City should invest in the creation of supportive housing, rather than continuing reliance on market rate hotels rooms. Additionally, the cost estimates included in November 2023 were formed in August 2023. These estimates, therefore, do not account for the October 2023 redesignation of Temporary Protected Status for Venezuelan asylum seekers, which will expand access to work permits for recent arrivals and likely reduce demand for City-funded shelters.

Finally, savings associated with PEG expense re-estimates tend to be substantially underestimated in outyears. That is, it is likely that the City will continue to find substantial savings in lower-than-expected program costs that do not affect the scope or quality of existing services.

Taken together, there are numerous resources and efficiencies available that are less damaging and disruptive than the recent and potential future cuts to services. These resources and efficiencies can support a balanced fiscal year 2025 budget while restoring counterproductive cuts to the Department of Education, Sanitation, and libraries. Moreover, additional PEGs for fiscal year 2025 are unnecessary. Preemptively planning for deeper cuts will further disrupt agencies’ ability to deliver core services.

In April 2024, following the State budget, the City will have a clearer picture of the actual size of the fiscal year 2025 shortfall, after accounting for state aid and updated city revenue projections. At this point, the City can and should determine the non-recurring resources available to close any remaining gaps.

The City is additionally projecting budget gaps in fiscal years 2026 and 2027. Excluding asylum seeker costs, these gaps would align with historically routine gaps at this point in the budget cycle. As such, they are likely to narrow over time. Given the high level of uncertainty associated with asylum seeker costs, these projections do not provide pretext for reactive budget cuts.

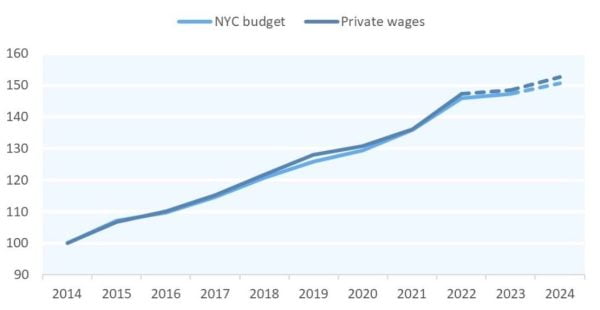

Budget Gap Growth – April to November

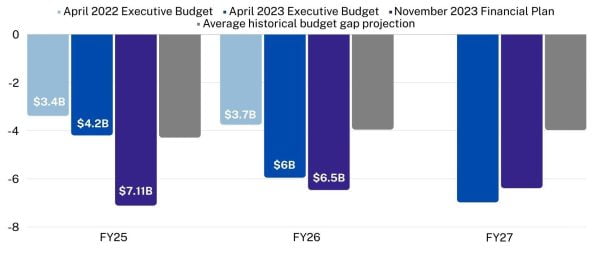

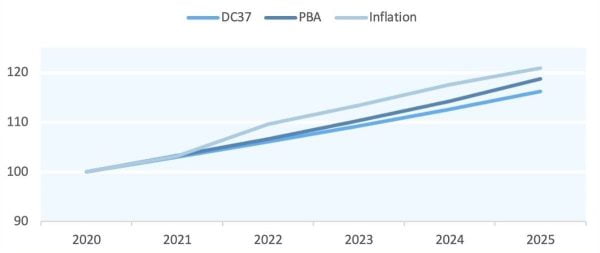

Recently ratified bargaining patterns keep workers’ wages in line

with recent and projected inflation over the contract period.

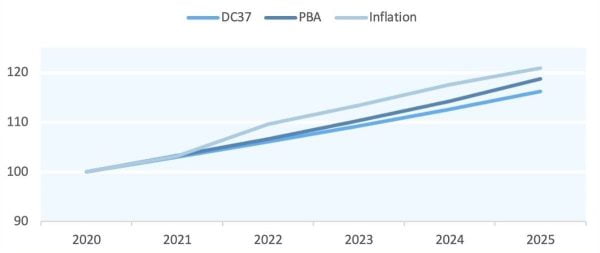

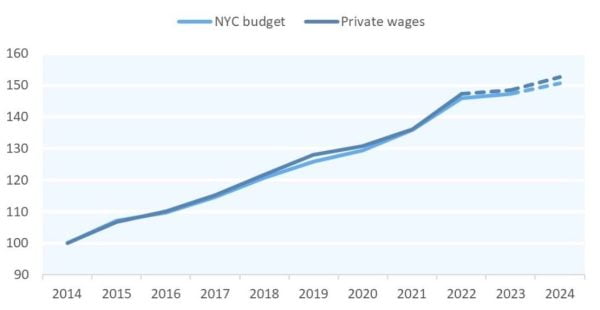

The size of New York City’s budget has closely tracked growth of private sector wages in the city;

federal Covid relief funding did not support an unsustainable increase in the city’s budget.

Testimony on Mayor’s November Financial Plan

December 11, 2023 |

December 11, 2023

Submitted to the New York City Council Committee on Finance

Good morning — I am Andrew Perry, Senior Policy Analyst at the Fiscal Policy Institute, a nonpartisan research organization committed to improving public policy to better the economic and social conditions of all New Yorkers.

Overview:

New York City faces real fiscal strain in the current fiscal year and next year. However, projected gaps are the result of an unexpected and temporary fiscal shock – the costs of services to asylum seekers – rather than a permanent structural imbalance. A temporary fiscal shock can be addressed through the use of non-recurring resources. Permanent cuts, which weaken public services and cause long-term economic damage, should be a last resort — rather than the first approach. As such, to manage the City’s fiscal strain:

- the City should not make additional cuts;

- the City should avoid using conservative budgeting practices as a pretext for reactive cuts to critical services; and finally,

- the City should mobilize non-recurring resources to close any remaining shortfall next year.

Given the fiscal resources available to the City, these steps can be taken while restoring $200 million of cuts that were already taken from essential services such as libraries, education, and sanitation.

FY 2024 Budget

Between New York City June 2023 adopted budget and the November 2023 financial plan, the City substantially revised its projected city funds spending on services for asylum seekers, adding $1.4 billion in the current fiscal year — fiscal year 2024 — and $4.8 billion in the next fiscal year. Over the same period, the City revised its city funds revenue estimates for the current fiscal year upward by $800 million and instituted $1.6 billion in PEG cuts and savings. These updates allow the City to carry $643 million into the next fiscal year while retaining its planned $1.2 billion general reserve spending — a fiscal cushion that will also carry forward into next year. As such, the fiscal year 2024 budget remains balanced. No additional cuts to fiscal year 2024 in the January or April 2024 financial plans are necessary.

Given the City’s sound economic footing, it is likely that revenue will continue to exceed projections, which were revised upward only modestly in the November financial plan. Above trend revenue, together with the City’s general reserve allocation for fiscal year 2024, give the City the ability to both reverse the most damaging November PEG cuts and to carry additional fiscal relief into fiscal year 2025. Conversely, cuts to libraries that reduce service hours, a Department of Education hiring freeze, cuts to early childhood education and community schools programs, and a Department of Sanitation hiring freeze will quickly deteriorate the quality of core services. Cutting these programs will damage the City’s economy and quality of life over the coming years. These cuts can be reversed by instead tapping into the fiscal year 2024’s general reserve allocation by approximately $200 million, while retaining $1 billion of that fund to prepay expenses for next year.

New York City always projects budget gaps in future fiscal years. In recent years, the budget gaps projected in November financial plans for the following fiscal year have averaged 4 percent of projected revenue. The Fiscal Policy Institute recently reviewed ten years of City budget gaps and found that these routine budget gaps are consistently closed as a result of actual revenue exceeding projected revenue. While actual spending tends to hew close to projected spending, realized revenue exceeds one-year-out projections by 4.8 percent, on average. These routine budget gaps, therefore, are the result of conservative revenue estimation. While this reflects prudent financial management and reduces the risk posed by unexpected shocks, these routine gaps should not serve as a pretext for reactive budget cuts.

FY 2025 Budget

The November 2023 financial plan raised fiscal year 2025’s projected budget gap by $2 billion, bringing the projected shortfall to $7.1 billion — 6.7 percent of revenue. The fiscal year 2025 gap was driven by the City spending on services for asylum seekers, which rose $4.8 billion to $5.5 billion since the June 2023 financial plan. If not for the asylum seeker costs, the City would be on strong footing heading into fiscal year 2025, with a projected gap of $1.6 billion — or 1.5 percent of revenue — lower than the level routinely projected.

The asylum seeker costs represent a temporary shock to the City’s budget. however, some have voiced concern that there may be more permanent structural gaps in the City’s budget. For example, some argue that the costs of recent collective bargaining agreements drive recent gaps. However, the estimated costs of labor contracts – and total expenditures other than for asylum seekers – have not increased since the April 2023 executive budget, which projected outyear budget gaps in line with routine levels. Further, recently ratified bargaining patterns keep workers’ wages in line with recent and projected inflation over the contract period. As the City struggles with excess vacancies across the public workforce, keeping workers’ wages on pace with the cost of living will be essential for attracting and retaining workers. More broadly, reviewing the size of the City’s budget over the last decade reveals that the budget has grown in direct lockstep with growth in total private wages in the City — a key measure of the City’s tax base. Thus, FPI sees no cause for concern that the City budget has grown beyond its means.

Balancing the FY 2025 Budget

The projected budget gap for fiscal year 2025 of $7.1 billion exceeds the levels routinely projected for the first outyear at this stage in the budget cycle. Because this gap is the result of an unanticipated fiscal shock — the cost of services to asylum seekers — and not a structural budget imbalance, it is appropriate to use non-recurring resources to close this short-run shortfall. These resources may include:

- State aid: New York State is on solid fiscal footing and should provide one-year appropriations to support the city through this crisis. These appropriations may be financed by state revenue, or, depending on its budget at the end of its fiscal year, the State’s considerable reserve balances, which include $13 billion non-statutory reserves and $11 billion general fund balance not designated as reserves that are available for use. State aid may also take the form of repealing unfunded mandates to the city, including its liability for charter school rent.

- City revenue: Fiscal year 2024 revenue is likely to continue to exceed projections in the remainder of the fiscal year. This above-expectations revenue, together with the remaining general reserve allocation, will allow the City to prepay fiscal year 2025 expenses, lowering the projected gap. Further, because the City’s underestimation of outyear revenue is highly consistent, it is likely that actual revenue will exceed the City’s conservative projections next year. In the event that these pessimistic expectations become reality, withdrawals from the City’s $2 billion revenue stabilization fund would be appropriate.

- City expenditures: The city allocates $1.2 billion as a general reserve each fiscal year. This allocation serves as a fiscal cushion to guard against unanticipated fiscal strain. Given next year’s unprecedented challenges, this allocation should be drawn down by $900 million. This would leave the general reserve for fiscal year 2025 at $300 million — the same level allocated during the Bloomberg administration.

Further, estimates of asylum seekers spending assume each asylum seeker household will cost the city $383 per night in both fiscal year 2024 and 2025. That is, in the November Financial Plan, the City’s cost estimates assume that there will not be any cost efficiencies over the next two years. As the arrival of asylum seekers moves from an abrupt emergency to a multi-year reality, the City should invest in the creation of supportive housing, rather than continuing reliance on market rate hotels rooms. Additionally, the cost estimates included in November 2023 were formed in August 2023. These estimates, therefore, do not account for the October 2023 redesignation of Temporary Protected Status for Venezuelan asylum seekers, which will expand access to work permits for recent arrivals and likely reduce demand for City-funded shelters.

Finally, savings associated with PEG expense re-estimates tend to be substantially underestimated in outyears. That is, it is likely that the City will continue to find substantial savings in lower-than-expected program costs that do not affect the scope or quality of existing services.

Taken together, there are numerous resources and efficiencies available that are less damaging and disruptive than the recent and potential future cuts to services. These resources and efficiencies can support a balanced fiscal year 2025 budget while restoring counterproductive cuts to the Department of Education, Sanitation, and libraries. Moreover, additional PEGs for fiscal year 2025 are unnecessary. Preemptively planning for deeper cuts will further disrupt agencies’ ability to deliver core services.

In April 2024, following the State budget, the City will have a clearer picture of the actual size of the fiscal year 2025 shortfall, after accounting for state aid and updated city revenue projections. At this point, the City can and should determine the non-recurring resources available to close any remaining gaps.

The City is additionally projecting budget gaps in fiscal years 2026 and 2027. Excluding asylum seeker costs, these gaps would align with historically routine gaps at this point in the budget cycle. As such, they are likely to narrow over time. Given the high level of uncertainty associated with asylum seeker costs, these projections do not provide pretext for reactive budget cuts.

Budget Gap Growth – April to November

Recently ratified bargaining patterns keep workers’ wages in line

with recent and projected inflation over the contract period.

The size of New York City’s budget has closely tracked growth of private sector wages in the city;

federal Covid relief funding did not support an unsustainable increase in the city’s budget.