Debunking Common Misconceptions about the Size of the State Budget

March 29, 2024 |

State spending grew during Covid and has steadily declined since, after adjusting for inflation

Claim: The One-House budgets propose unsustainable spending growth.

Fact: The legislature proposes spending growth that would return State spending to its 2014 level, before the former Governor implemented significant tax cuts and spending restraint.

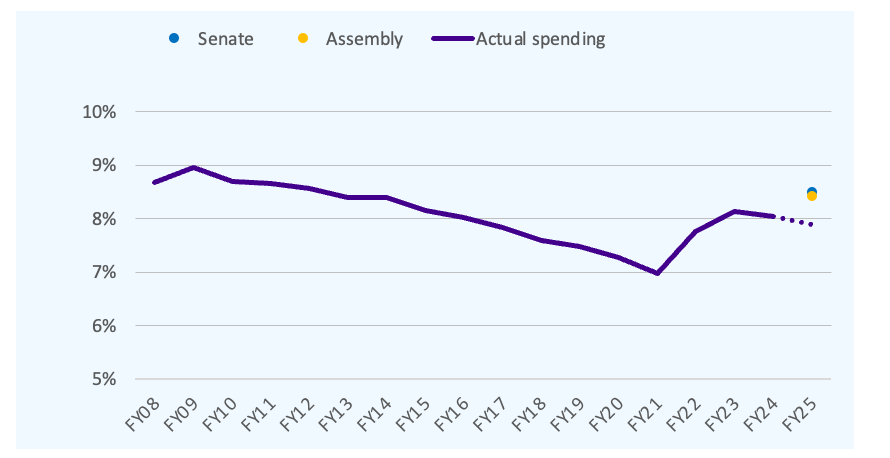

The Senate and Assembly budgets propose spending growth of 7.3% and 6.2%, respectively, after adjusting for inflation. This proposed spending is supported by expectations of slightly higher revenues than forecast by the executive budget, as well as tax increases. Under the Senate and Assembly proposals, the level of State spending on public services (measured as a share of the overall state economy) would return spending to its fiscal year 2014 level.

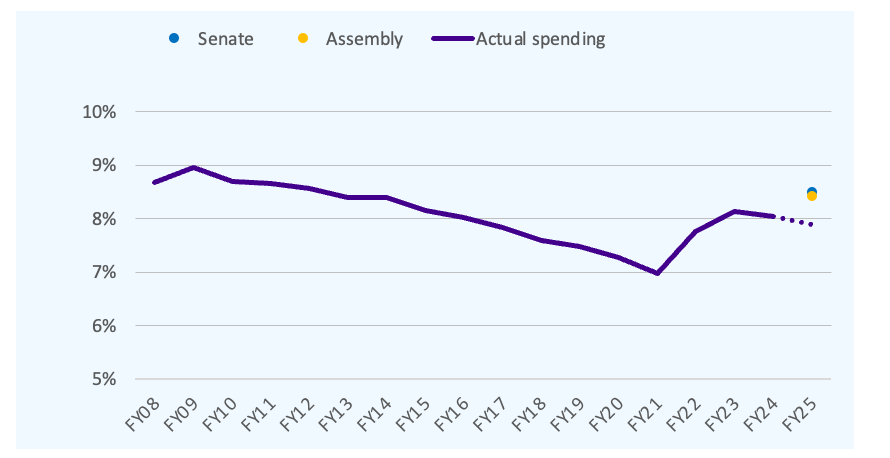

Rather than measuring the State budget only in dollar terms, the size of the budget is better understood in proportion to the state economy as a whole. The State’s ability to generate tax revenue and spend it on public services is determined by the size of the state economy, and we can measure that relationship by showing the size of the budget compared to some measure of the state economy (in the chart below we use personal income).

For context, New York’s total budget is about $130 billion (excluding federal and capital funds) and the state’s gross domestic product is over $2 trillion. By contrast, the U.S. federal budget is over $6 trillion, and U.S. gross domestic product is over $27 trillion. A state or nation’s spending can only be properly understood in relation to the economy in which the tax and spending measures take place.

State spending as a share of total personal income, fiscal years 2008 to 2025

Dotted line represented level proposed by executive budget

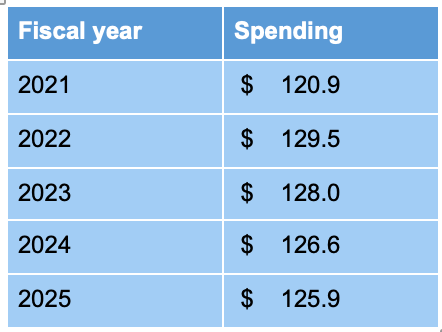

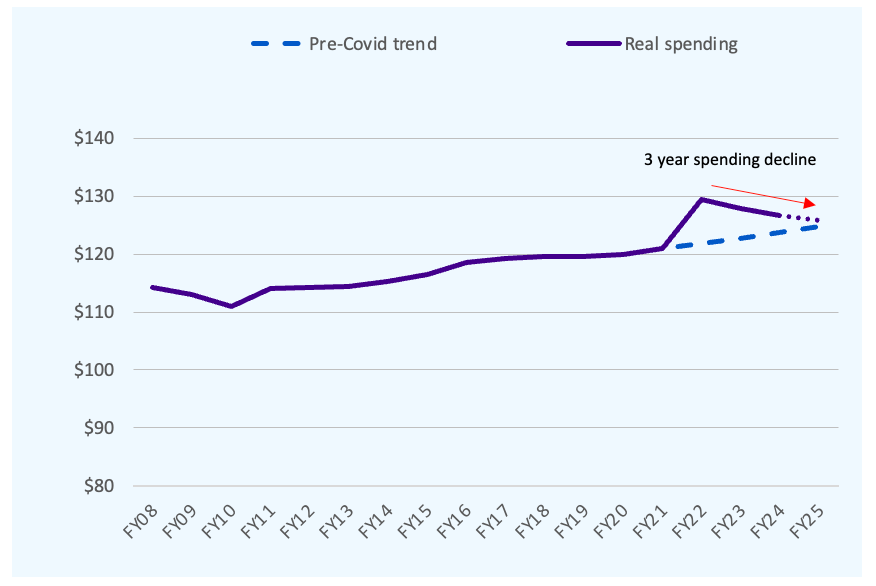

Claim: State spending has grown too fast in recent years.

Fact: Adjusting for inflation, State spending has fallen over the last two fiscal years.

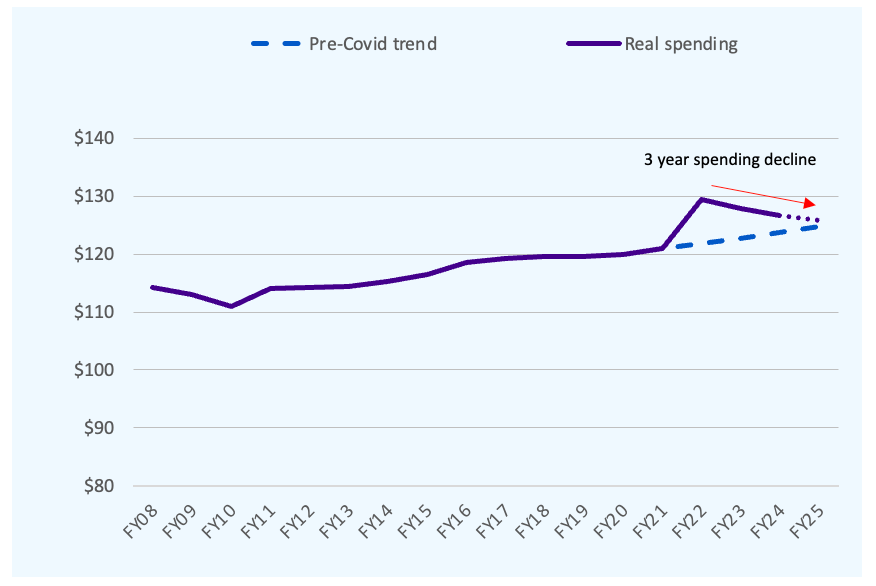

Under the fiscal year 2025 executive budget, inflation-adjusted state funding would fall for a third consecutive year. While State spending rose in response to Covid, it will return to its pre-Covid trend by fiscal year 2025.

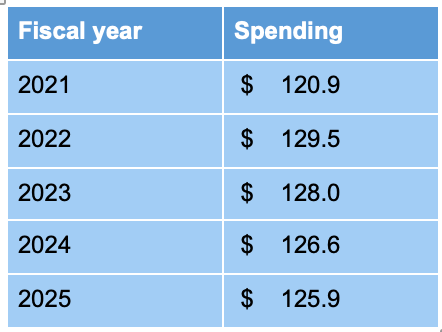

State operating funds spending, fiscal years 2021 to 2025

Billions of dollars; adjusted to fiscal year 2025 dollars

State operating funds spending, fiscal years 2008 to 2025

Billions of dollars; adjusted to fiscal year 2025 dollars; Dotted line represented level proposed by executive budget

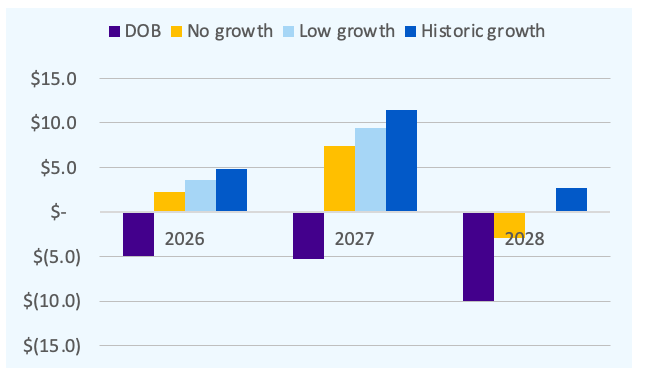

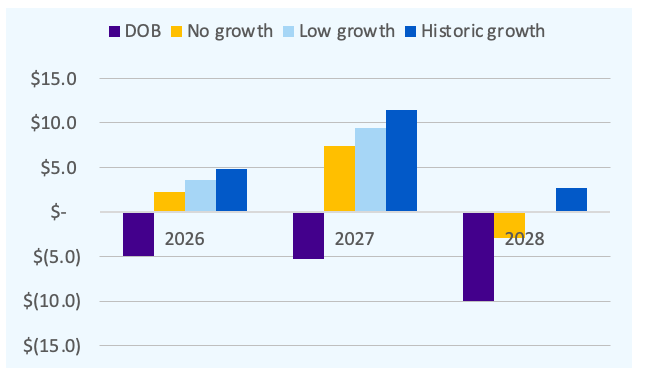

Claim: The State faces significant future budget gaps, where revenue will not be able to keep pace with spending growth.

Fact: The State’s forecasted budget gaps are based on extremely low projections compared to both state revenue trends and recent national economic forecasts.

The State’s forecasted budget gaps (which reach $10 billion in fiscal year 2028) are based on expectations of negative real revenue growth. This projected revenue growth is low compared both to the past decade of State revenue trends, as well as most US economic forecasts. FPI estimates that if state revenue growth over the next three years is about half of its ten-year average, or about half of the growth rate expected for the national economy by institutional forecasters, then State spending will be generally balanced in the future years of the financial plan, and some years will have a surplus.

Projected budget surplus/(gap), fiscal years 2026 to 2028

Chart shows projections by 2025 executive budget as well as three different growth scenarios; billions of dollars

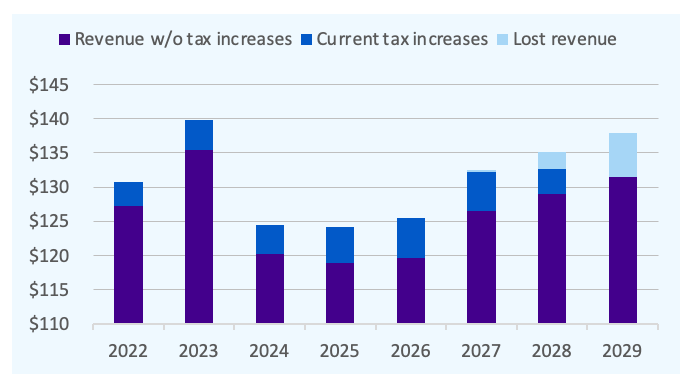

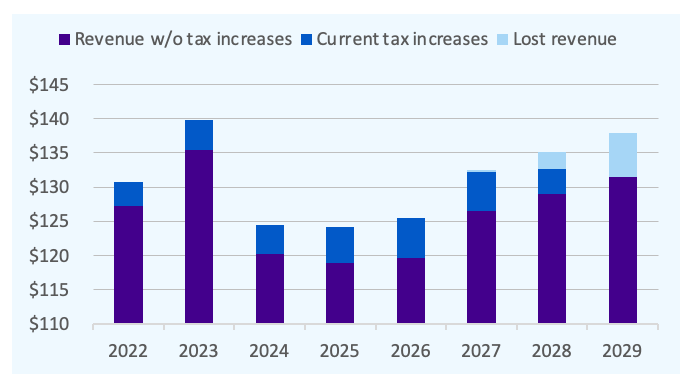

These budget gaps are also partially driven by expiring tax rates on high earners and corporations. FPI estimates that, if made permanent, these taxes would raise fiscal year 2028 revenue by $2.4 billion.

Revenue raised by 2021 surtaxes, fiscal years 2022 to 2029

Billions of dollars

Claim: The State should have maintained its policy of limiting spending growth to 2% annually over recent years.

Fact: While real spending rose in fiscal year 2022, it has since declined after adjusting for inflation. Current spending is now in line with its pre-Covid trend.

Why should spending be adjusted for inflation? Inflation affects both the state’s tax base (personal income, sales, and business revenue) and the cost of public services (mainly, public workers’ wages). Between fiscal years 2021 and 2025, inflation rose 20%. If spending had been held to 2% annual growth over this period, it would be 12% lower than pre-Covid levels in inflation adjusted terms. This would have required dramatic reductions to State services, including public education and Medicaid.

Claim: Current state spending is backed by non-recurring revenues.

Fact: Temporary tax increases on millionaires and corporations have raised about $4 billion annually, but if allowed to expire they will require significant cuts to core State programs and would negatively impact the state workforce and the healthcare workforce.

The State could easily make these tax rates permanent, avoiding unnecessary fiscal cliffs in the future.

Claim: The State does not have enough in reserve to weather an economic downturn.

Fact: The State currently has more money in its reserves than any time in its history.

The State currently has $20 billion in its formal reserves. In addition to these reserves, the State has additional unrestricted, undesignated reserves that are available to support the budget. Collectively, the State’s formal and informal reserves total $29.3 billion. This is more than sufficient to cover revenue loss in the wake of a major recession.

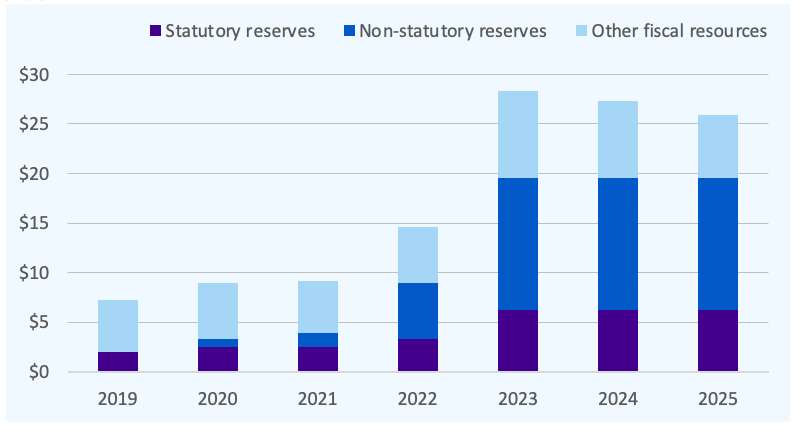

New York’s fiscal reserves, fiscal years 2019 to 2025

Billions of dollars

Debunking Common Misconceptions about the Size of the State Budget

March 29, 2024 |

State spending grew during Covid and has steadily declined since, after adjusting for inflation

Claim: The One-House budgets propose unsustainable spending growth.

Fact: The legislature proposes spending growth that would return State spending to its 2014 level, before the former Governor implemented significant tax cuts and spending restraint.

The Senate and Assembly budgets propose spending growth of 7.3% and 6.2%, respectively, after adjusting for inflation. This proposed spending is supported by expectations of slightly higher revenues than forecast by the executive budget, as well as tax increases. Under the Senate and Assembly proposals, the level of State spending on public services (measured as a share of the overall state economy) would return spending to its fiscal year 2014 level.

Rather than measuring the State budget only in dollar terms, the size of the budget is better understood in proportion to the state economy as a whole. The State’s ability to generate tax revenue and spend it on public services is determined by the size of the state economy, and we can measure that relationship by showing the size of the budget compared to some measure of the state economy (in the chart below we use personal income).

For context, New York’s total budget is about $130 billion (excluding federal and capital funds) and the state’s gross domestic product is over $2 trillion. By contrast, the U.S. federal budget is over $6 trillion, and U.S. gross domestic product is over $27 trillion. A state or nation’s spending can only be properly understood in relation to the economy in which the tax and spending measures take place.

State spending as a share of total personal income, fiscal years 2008 to 2025

Dotted line represented level proposed by executive budget

Claim: State spending has grown too fast in recent years.

Fact: Adjusting for inflation, State spending has fallen over the last two fiscal years.

Under the fiscal year 2025 executive budget, inflation-adjusted state funding would fall for a third consecutive year. While State spending rose in response to Covid, it will return to its pre-Covid trend by fiscal year 2025.

State operating funds spending, fiscal years 2021 to 2025

Billions of dollars; adjusted to fiscal year 2025 dollars

State operating funds spending, fiscal years 2008 to 2025

Billions of dollars; adjusted to fiscal year 2025 dollars; Dotted line represented level proposed by executive budget

Claim: The State faces significant future budget gaps, where revenue will not be able to keep pace with spending growth.

Fact: The State’s forecasted budget gaps are based on extremely low projections compared to both state revenue trends and recent national economic forecasts.

The State’s forecasted budget gaps (which reach $10 billion in fiscal year 2028) are based on expectations of negative real revenue growth. This projected revenue growth is low compared both to the past decade of State revenue trends, as well as most US economic forecasts. FPI estimates that if state revenue growth over the next three years is about half of its ten-year average, or about half of the growth rate expected for the national economy by institutional forecasters, then State spending will be generally balanced in the future years of the financial plan, and some years will have a surplus.

Projected budget surplus/(gap), fiscal years 2026 to 2028

Chart shows projections by 2025 executive budget as well as three different growth scenarios; billions of dollars

These budget gaps are also partially driven by expiring tax rates on high earners and corporations. FPI estimates that, if made permanent, these taxes would raise fiscal year 2028 revenue by $2.4 billion.

Revenue raised by 2021 surtaxes, fiscal years 2022 to 2029

Billions of dollars

Claim: The State should have maintained its policy of limiting spending growth to 2% annually over recent years.

Fact: While real spending rose in fiscal year 2022, it has since declined after adjusting for inflation. Current spending is now in line with its pre-Covid trend.

Why should spending be adjusted for inflation? Inflation affects both the state’s tax base (personal income, sales, and business revenue) and the cost of public services (mainly, public workers’ wages). Between fiscal years 2021 and 2025, inflation rose 20%. If spending had been held to 2% annual growth over this period, it would be 12% lower than pre-Covid levels in inflation adjusted terms. This would have required dramatic reductions to State services, including public education and Medicaid.

Claim: Current state spending is backed by non-recurring revenues.

Fact: Temporary tax increases on millionaires and corporations have raised about $4 billion annually, but if allowed to expire they will require significant cuts to core State programs and would negatively impact the state workforce and the healthcare workforce.

The State could easily make these tax rates permanent, avoiding unnecessary fiscal cliffs in the future.

Claim: The State does not have enough in reserve to weather an economic downturn.

Fact: The State currently has more money in its reserves than any time in its history.

The State currently has $20 billion in its formal reserves. In addition to these reserves, the State has additional unrestricted, undesignated reserves that are available to support the budget. Collectively, the State’s formal and informal reserves total $29.3 billion. This is more than sufficient to cover revenue loss in the wake of a major recession.

New York’s fiscal reserves, fiscal years 2019 to 2025

Billions of dollars