Who is Leaving New York State? Part I: Income Trends

December 5, 2023 |

High Earners Move Out Of New York Less Often Than Working & Middle Class And Do Not Move In Response To Tax Hikes

New analysis reveals richest New Yorkers typically leave state at 1/4 the rate of working & middle-class New Yorkers in non-Covid years.

Evidence reveals no significant change in high earner migration behavior in response to taxes

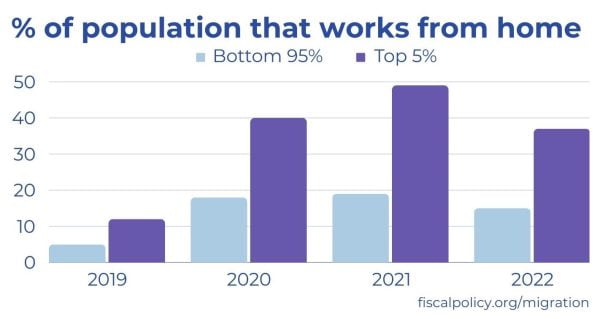

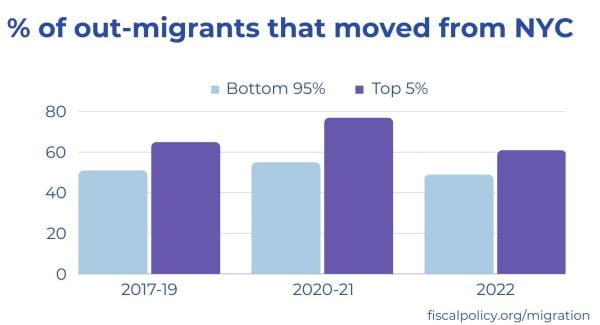

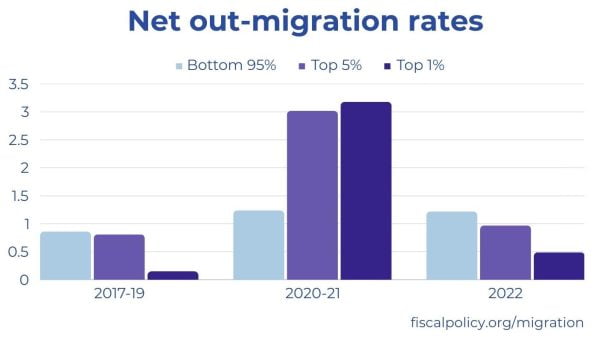

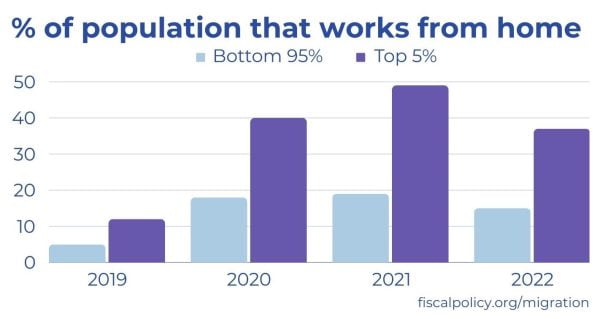

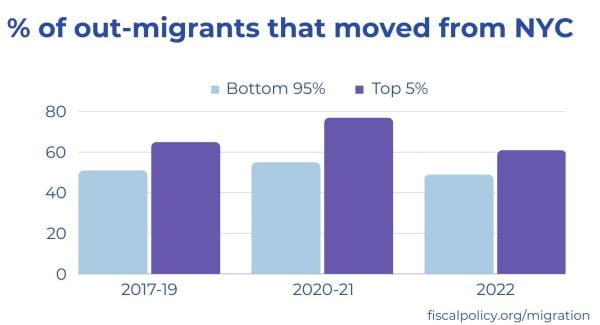

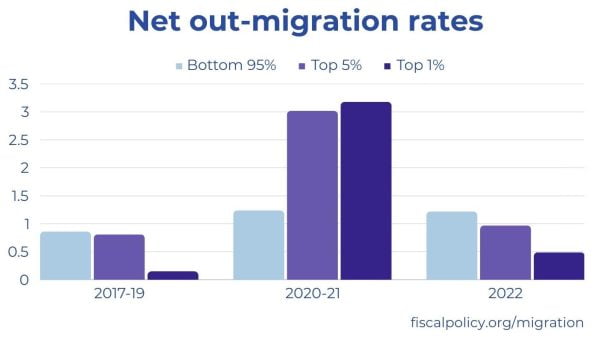

ALBANY, NY | A groundbreaking new report from the Fiscal Policy Institute, “Who Is Leaving New York State? Income Trends” reveals for the first time that the richest New Yorkers are far less likely to move out of New York than working and middle-class New Yorkers in normal, non-Covid years. While this pattern temporarily changed during Covid, when all households earning over $170,000 significantly increased their likelihood of moving out of state, migration trends reverted to normal in 2022. Moreover, this analysis finds that most high earner migration during Covid was due to flight from New York City among those who could work from home rather than tax-related reasons.

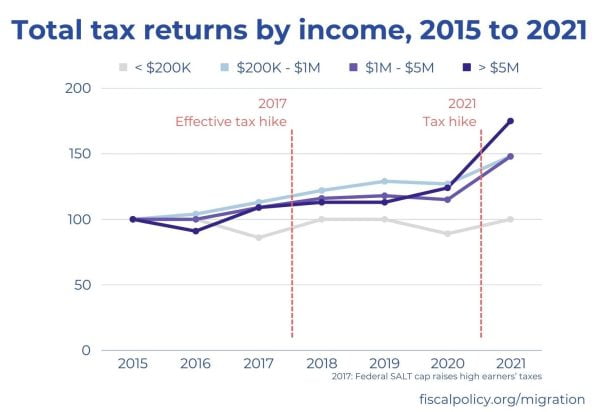

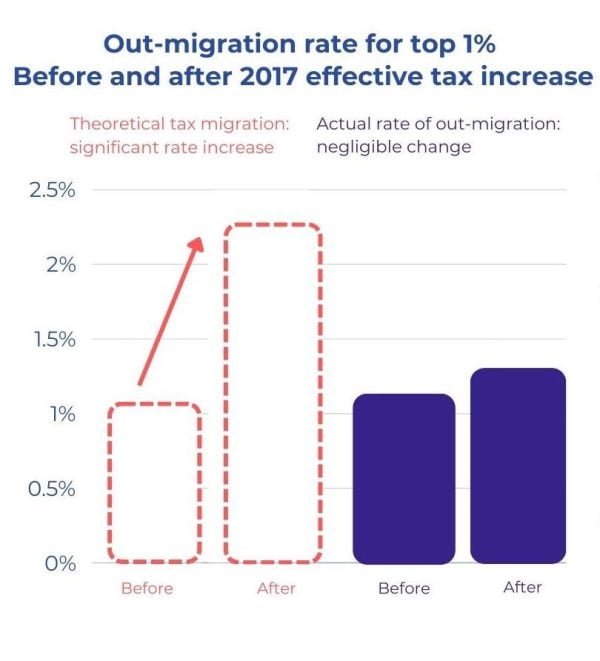

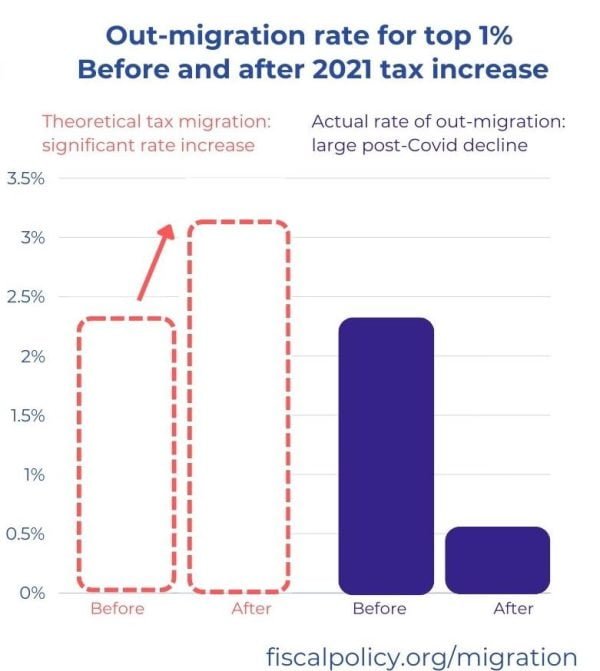

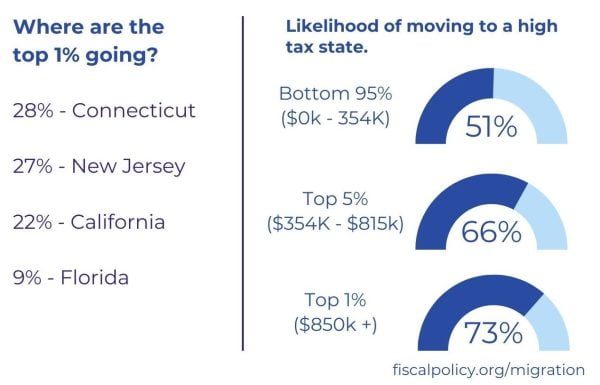

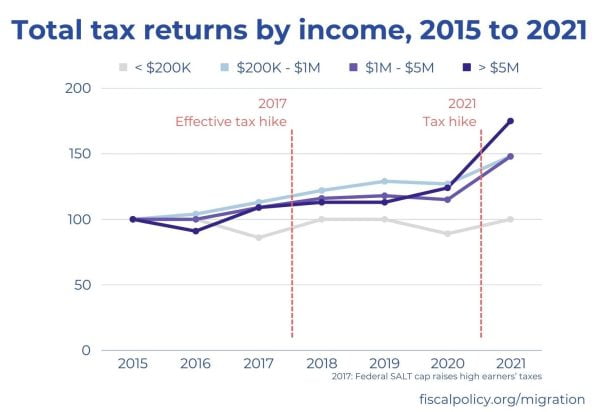

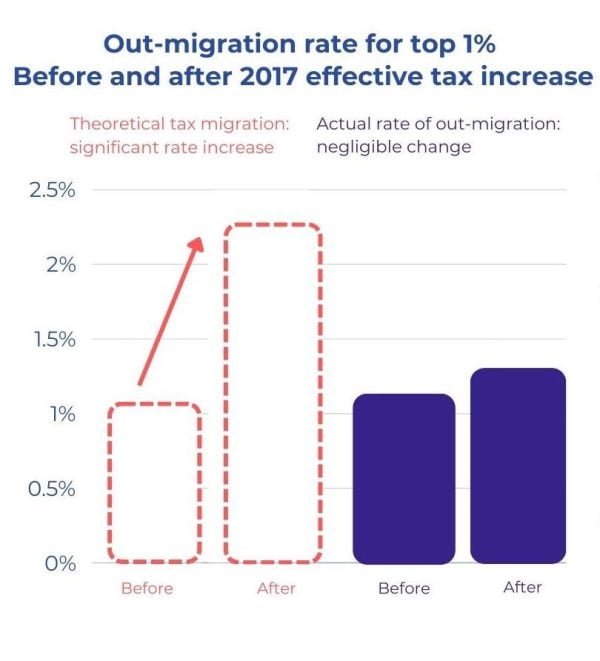

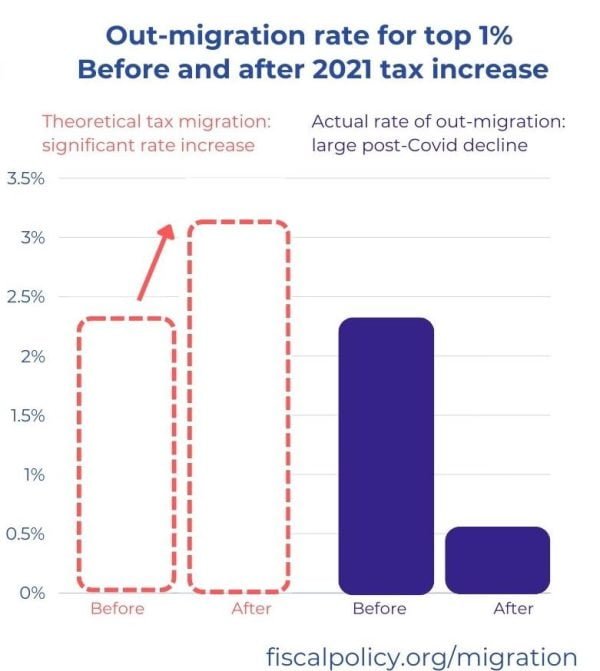

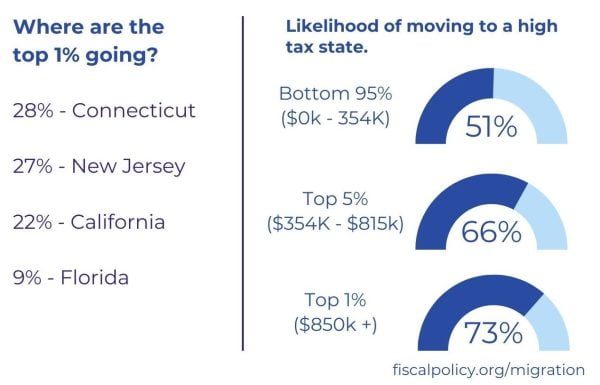

FPI’s report includes novel statistical analysis of the two most recent effective tax increases on high-earning New Yorkers (in 2017 and 2021) and reveals that high earners do not significantly change their migration behavior in response to tax increases. The report also finds that when high earners do move out of New York State, they are more likely to move to other relatively high tax states than to move to low tax states.

Key Findings

Covid, not taxes, explain high-earner migration out of New York in 2020 and 2021:

- High earner migration out of New York during Covid was temporary, and primarily driven by work-from-home and flight from New York City.

- In 2022 — after two years of elevated, pandemic-induced out-migration — high earners’ migration rates returned to pre-Covid levels.

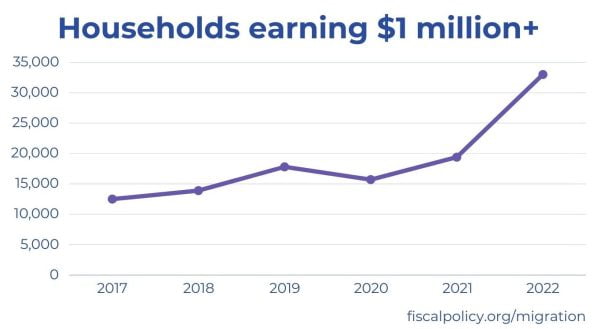

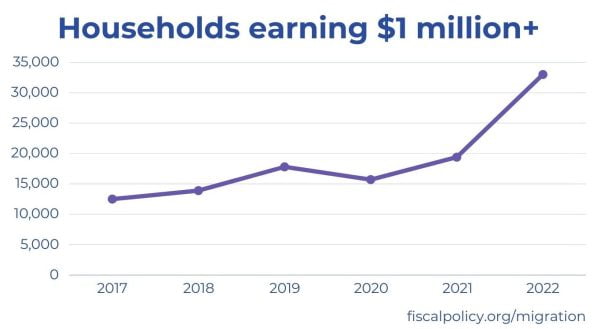

- While New York lost 2,400 millionaire households over the past three years (2020- 2022), New York gained 17,500 millionaire households in the same period due to a strong economy and rising wages.

There is no statistically significant evidence of tax migration out of New York:

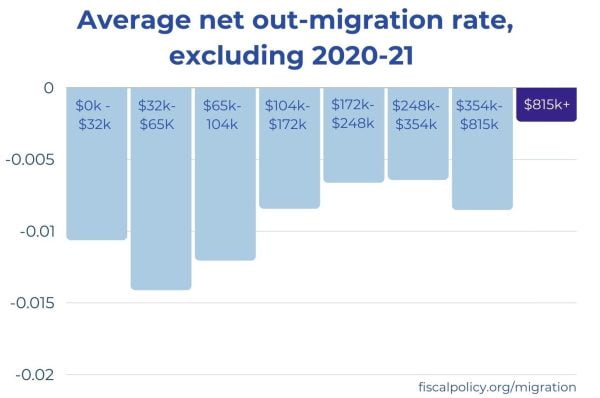

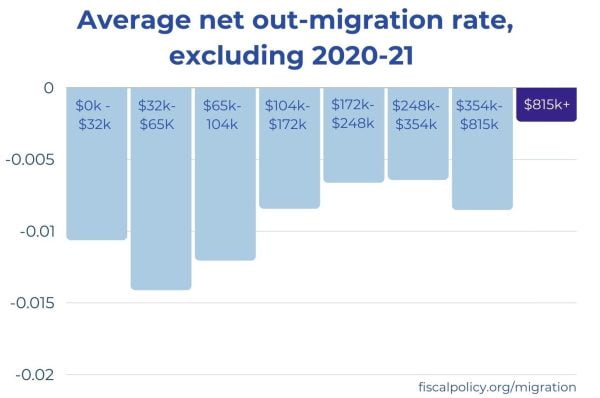

- High earning New Yorkers move out of New York State at one-quarter the rate of the rest of the population during typical, non-Covid years.

- Out-migration for those most impacted by recent effective tax increases (in 2017 and 2021) did not increase significantly in response to the tax increases.

- When New York’s high earners move, they are more likely to move to other relatively high tax states.

High earners are defined as the top 1% of New Yorkers — those earning +$815,000 per year.

“In order to address New York’s recent population loss, we must first understand who is leaving — and what is pushing them out the door. Contrary to conventional wisdom, the richest do not leave the state more frequently than other New Yorkers; rather, they typically leave at one quarter the rate of the general population in normal, non-Covid years,” said FPI Director Nathan Gusdorf. “Additionally, the evidence dispels the myth that the rich are moving away in search of lower taxes. This analysis finds that tax hikes do not provoke any significant increase in high earner migration out of the state — and when high earners do leave, they are more likely to move to other relatively high tax states than to a low tax state.”

Gusdorf continued, “New York is not struggling to retain the most affluent — New York is losing working and middle-class families. In the face of projected budget gaps, the City and State should avoid cuts to essential public services — which will only make life more costly for the working and middle-class New Yorkers who are already leaving the State at elevated rates.”

To understand migration patterns across the income distribution, FPI conducted a statistical analysis of eight years of data from the U.S. Census Bureau’s American Community Survey (ACS), tax data from the IRS, and New York State tax data. Drawing on these sources, FPI conducted the first study of its kind to analyze in and out migration in New York State, determine underlying demographics, and identify income and out-migration rates.

Covid, not taxes, explains high-earner migration out of New York in 2020 and 2021.

1. High-earner migration out of New York during Covid was temporary, and primarily driven by work-from-home and flight from New York City.

2. In 2022, after two years of elevated, pandemic-induced out-migration, high earners’ migration rates returned to pre-Covid levels.

Prior to Covid, working and middle-class New Yorkers were leaving at 4x the rate of wealthy New Yorkers.

Now, working and middle- class New Yorkers are once again leaving at higher rates than the wealthy

3. Despite some millionaires leaving during Covid, New York’s millionaire population grew significantly.

While New York lost 2,400 millionaire households over the past three years (2020 – 2022), New York gained 17,500 millionaire households in the same period due to a strong economy and rising wages.

There is no statistically significant evidence of tax migration out of New York.

1. The wealthiest New Yorkers typically move at lower rates than the rest of New Yorkers in non-Covid years.

The top 1% of New Yorkers — those earning over $815,000 — move out of New York State at one-quarter the rate of the rest of the population during typical, non- Covid years.

2. Raising taxes on the wealthy does not increase their rate of leaving New York.

3. When high earners do move out of New York, they are more likely to move to other relatively high tax states.

4. New York’s population of wealthy New Yorkers rose after the two most recent effective income tax hikes.

Who is Leaving New York State? Part I: Income Trends

December 5, 2023 |

High Earners Move Out Of New York Less Often Than Working & Middle Class And Do Not Move In Response To Tax Hikes

New analysis reveals richest New Yorkers typically leave state at 1/4 the rate of working & middle-class New Yorkers in non-Covid years.

Evidence reveals no significant change in high earner migration behavior in response to taxes

ALBANY, NY | A groundbreaking new report from the Fiscal Policy Institute, “Who Is Leaving New York State? Income Trends” reveals for the first time that the richest New Yorkers are far less likely to move out of New York than working and middle-class New Yorkers in normal, non-Covid years. While this pattern temporarily changed during Covid, when all households earning over $170,000 significantly increased their likelihood of moving out of state, migration trends reverted to normal in 2022. Moreover, this analysis finds that most high earner migration during Covid was due to flight from New York City among those who could work from home rather than tax-related reasons.

FPI’s report includes novel statistical analysis of the two most recent effective tax increases on high-earning New Yorkers (in 2017 and 2021) and reveals that high earners do not significantly change their migration behavior in response to tax increases. The report also finds that when high earners do move out of New York State, they are more likely to move to other relatively high tax states than to move to low tax states.

Key Findings

Covid, not taxes, explain high-earner migration out of New York in 2020 and 2021:

- High earner migration out of New York during Covid was temporary, and primarily driven by work-from-home and flight from New York City.

- In 2022 — after two years of elevated, pandemic-induced out-migration — high earners’ migration rates returned to pre-Covid levels.

- While New York lost 2,400 millionaire households over the past three years (2020- 2022), New York gained 17,500 millionaire households in the same period due to a strong economy and rising wages.

There is no statistically significant evidence of tax migration out of New York:

- High earning New Yorkers move out of New York State at one-quarter the rate of the rest of the population during typical, non-Covid years.

- Out-migration for those most impacted by recent effective tax increases (in 2017 and 2021) did not increase significantly in response to the tax increases.

- When New York’s high earners move, they are more likely to move to other relatively high tax states.

High earners are defined as the top 1% of New Yorkers — those earning +$815,000 per year.

“In order to address New York’s recent population loss, we must first understand who is leaving — and what is pushing them out the door. Contrary to conventional wisdom, the richest do not leave the state more frequently than other New Yorkers; rather, they typically leave at one quarter the rate of the general population in normal, non-Covid years,” said FPI Director Nathan Gusdorf. “Additionally, the evidence dispels the myth that the rich are moving away in search of lower taxes. This analysis finds that tax hikes do not provoke any significant increase in high earner migration out of the state — and when high earners do leave, they are more likely to move to other relatively high tax states than to a low tax state.”

Gusdorf continued, “New York is not struggling to retain the most affluent — New York is losing working and middle-class families. In the face of projected budget gaps, the City and State should avoid cuts to essential public services — which will only make life more costly for the working and middle-class New Yorkers who are already leaving the State at elevated rates.”

To understand migration patterns across the income distribution, FPI conducted a statistical analysis of eight years of data from the U.S. Census Bureau’s American Community Survey (ACS), tax data from the IRS, and New York State tax data. Drawing on these sources, FPI conducted the first study of its kind to analyze in and out migration in New York State, determine underlying demographics, and identify income and out-migration rates.

Covid, not taxes, explains high-earner migration out of New York in 2020 and 2021.

1. High-earner migration out of New York during Covid was temporary, and primarily driven by work-from-home and flight from New York City.

2. In 2022, after two years of elevated, pandemic-induced out-migration, high earners’ migration rates returned to pre-Covid levels.

Prior to Covid, working and middle-class New Yorkers were leaving at 4x the rate of wealthy New Yorkers.

Now, working and middle- class New Yorkers are once again leaving at higher rates than the wealthy

3. Despite some millionaires leaving during Covid, New York’s millionaire population grew significantly.

While New York lost 2,400 millionaire households over the past three years (2020 – 2022), New York gained 17,500 millionaire households in the same period due to a strong economy and rising wages.

There is no statistically significant evidence of tax migration out of New York.

1. The wealthiest New Yorkers typically move at lower rates than the rest of New Yorkers in non-Covid years.

The top 1% of New Yorkers — those earning over $815,000 — move out of New York State at one-quarter the rate of the rest of the population during typical, non- Covid years.

2. Raising taxes on the wealthy does not increase their rate of leaving New York.

3. When high earners do move out of New York, they are more likely to move to other relatively high tax states.

4. New York’s population of wealthy New Yorkers rose after the two most recent effective income tax hikes.