Statement on 2025 State of the State

January 14, 2025 |

Governor’s policy agenda lacks strategy for structural reforms to lower the cost of living

ALBANY, NY | Fiscal Policy Institute Director Nathan Gusdorf today released the following statement on Governor Kathy Hochul’s 2025 State of the State address:

Governor Hochul’s State of the State address highlighted the many challenges facing New Yorkers, from the rising cost of living and child poverty to investing in the MTA and adapting to climate change. Unfortunately, the governor’s policy agenda lacks a strategy for structural economic reforms that would lower the cost of housing, healthcare, and childcare—instead committing billions of dollars to one-time payments and tax cuts.

The governor’s spending proposals recognize the State’s strong fiscal position—tax receipts have already exceeded October projections by $1 billion, closing next year’s budget gap, and a multi-billion dollar surplus is expected at the end of this fiscal year. Future year budget gaps could be substantially reduced by merely maintaining current tax rates on the highest earners and most profitable corporations, rather than allowing scheduled tax cuts to occur over the next two years. The State must not miss this opportunity to deploy its resources for the sake of longer-term policy changes.

Given the strength of the State’s finances, now is the time for expansive public investment to lower the cost of housing, establish universal childcare, secure the future of Medicaid, rebuild the state workforce, and adapt to the challenges of climate change. These investments—not one-off tax rebates—are what will guarantee affordability for working-class New Yorkers in the long term.

Background: Affordability

- In New York City, rents have risen by almost 18% since 2019, while renter incomes have only risen 11%. That is, housing costs have risen 55 percent faster than incomes for renters in the City.

- Statewide, rents rose by 15% in 2021 and 2022, with renter incomes only increasing by 9% over the same period. That is, rents rose 67% faster than incomes for renters in 2021 and 2022.

- Wages started to catch up in 2023 but still lag behind rental costs.

Background: Fiscal

- The State’s most recent tax receipts show $1 billion of revenue over the State’s October projections—enough to close the $1 billion budget gap projected for this upcoming fiscal year (fiscal year 2026).

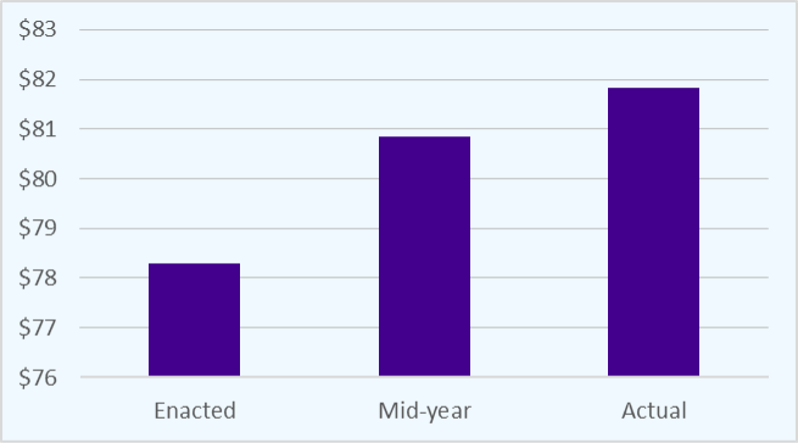

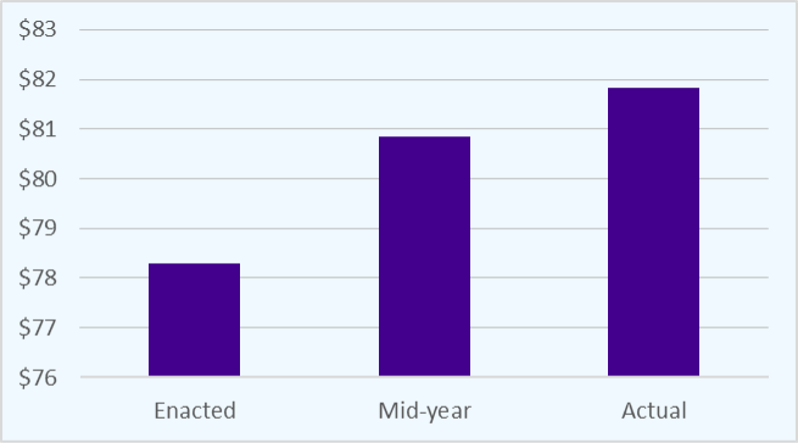

State operating funds revenue to date, actuals and financial plan projections ($ in billions)

- The State is on track to have nearly $35 billion in reserve for fiscal year 2025, the highest level in state history.

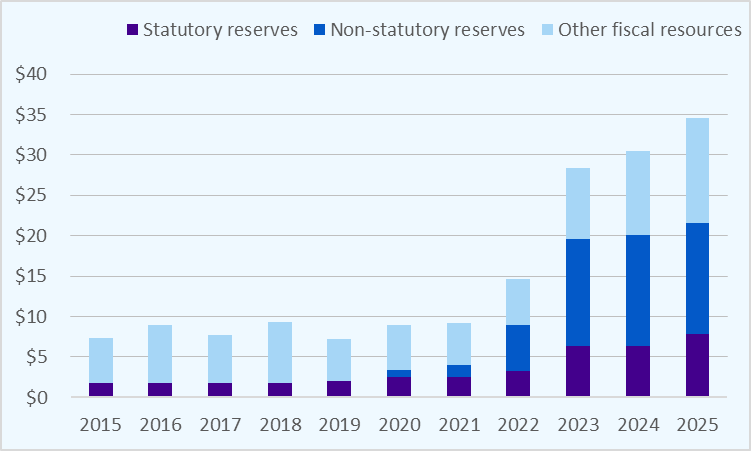

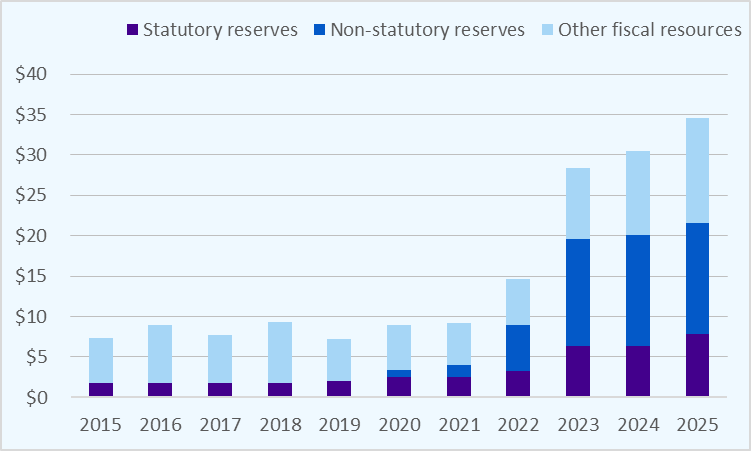

State reserve funds, fiscal years 2015-2025 ($ in billions)

Statement on 2025 State of the State

January 14, 2025 |

Governor’s policy agenda lacks strategy for structural reforms to lower the cost of living

ALBANY, NY | Fiscal Policy Institute Director Nathan Gusdorf today released the following statement on Governor Kathy Hochul’s 2025 State of the State address:

Governor Hochul’s State of the State address highlighted the many challenges facing New Yorkers, from the rising cost of living and child poverty to investing in the MTA and adapting to climate change. Unfortunately, the governor’s policy agenda lacks a strategy for structural economic reforms that would lower the cost of housing, healthcare, and childcare—instead committing billions of dollars to one-time payments and tax cuts.

The governor’s spending proposals recognize the State’s strong fiscal position—tax receipts have already exceeded October projections by $1 billion, closing next year’s budget gap, and a multi-billion dollar surplus is expected at the end of this fiscal year. Future year budget gaps could be substantially reduced by merely maintaining current tax rates on the highest earners and most profitable corporations, rather than allowing scheduled tax cuts to occur over the next two years. The State must not miss this opportunity to deploy its resources for the sake of longer-term policy changes.

Given the strength of the State’s finances, now is the time for expansive public investment to lower the cost of housing, establish universal childcare, secure the future of Medicaid, rebuild the state workforce, and adapt to the challenges of climate change. These investments—not one-off tax rebates—are what will guarantee affordability for working-class New Yorkers in the long term.

Background: Affordability

- In New York City, rents have risen by almost 18% since 2019, while renter incomes have only risen 11%. That is, housing costs have risen 55 percent faster than incomes for renters in the City.

- Statewide, rents rose by 15% in 2021 and 2022, with renter incomes only increasing by 9% over the same period. That is, rents rose 67% faster than incomes for renters in 2021 and 2022.

- Wages started to catch up in 2023 but still lag behind rental costs.

Background: Fiscal

- The State’s most recent tax receipts show $1 billion of revenue over the State’s October projections—enough to close the $1 billion budget gap projected for this upcoming fiscal year (fiscal year 2026).

State operating funds revenue to date, actuals and financial plan projections ($ in billions)

- The State is on track to have nearly $35 billion in reserve for fiscal year 2025, the highest level in state history.

State reserve funds, fiscal years 2015-2025 ($ in billions)