FPI on State of the State: NY’s Long-term Economic Competitiveness Depends on Deepening Investments that Sustain Workforce

January 9, 2024 |

FOR IMMEDIATE RELEASE: January 9, 2024

Media Contact: press@fiscalpolicy.org

FPI on State of the State: NY’s Long-term Economic Competitiveness Depends on Deepening Investments that Sustain Workforce

New York’s current fiscal indicators are stable & show State could significantly increase public investment

Current $4.3 billion FY25 budget gap falls within routine range that resolve without major policy intervention

ALBANY, NY | In response to Governor Hochul’s State of the State, Fiscal Policy Institute Director Nathan Gusdorf released the following statement:

“While the Governor outlined an agenda that accurately highlights many of the challenges facing New Yorkers, she remained silent on the deep investments needed to reverse New York’s affordability crisis and ensure the state’s long-term fiscal stability. The greatest threat to New York’s economic future is the affordability crisis that is pushing working- and middle-class families out of state — a crisis that will only be solved through sustained investments in housing, education and healthcare that anchor people here.

“While a shrinking middle-class workforce poses a risk for the state’s economic future, New York’s current fiscal indicators are stable and show that the State could significantly increase public investment. Revenues have returned to normal rates after a year of Covid surpluses, the State recently cut the budget gap in half, and New York’s high earning population continues to grow — all signs of fiscal stability. While constrained spending may appear fiscally wise in the short-term, the State’s long-term economic competitiveness depends on strengthening the public programs and infrastructure that sustain New York’s workforce.

“We look forward to reviewing the Governor’s budget and financial plan for more details on the initiatives outlined today.”

Background:

Budget Gaps

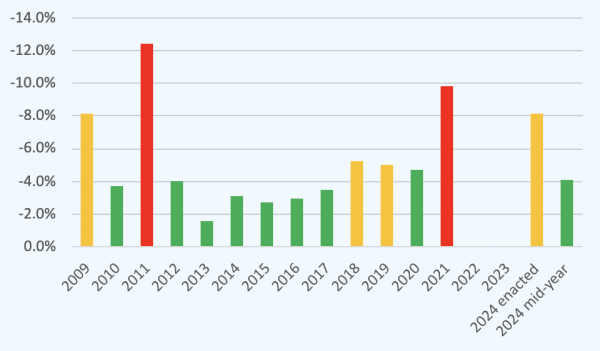

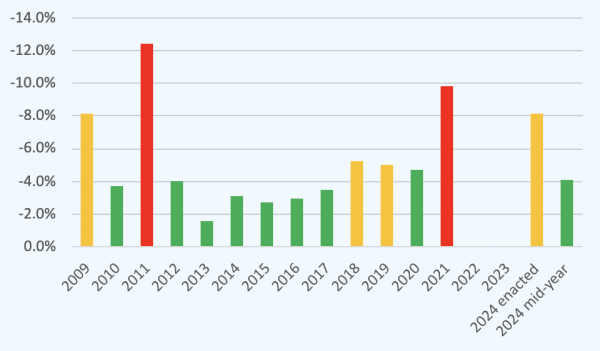

- The current $4.3 billion FY25 budget gap falls within historically routine range that resolve without major policy intervention.

- Because of conservative forecasting, outyear gaps are nearly always projected in New York State’s financial plans.

Size of First Outyear Budget Gap

As percentage of general fund spending

Population Loss

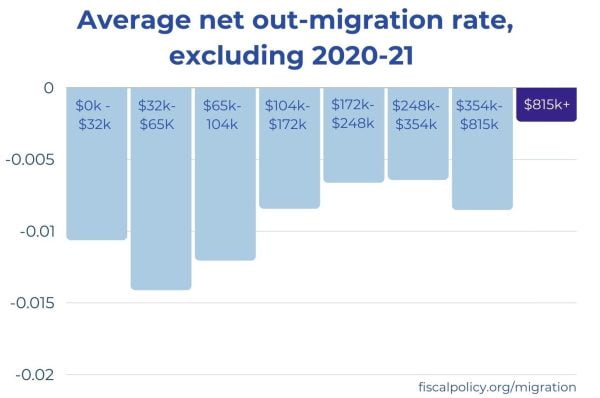

- New York’s population fell by 102,000 residents over the last year. Since 2020, the population has fallen by 533,200, or 2.7 percent.

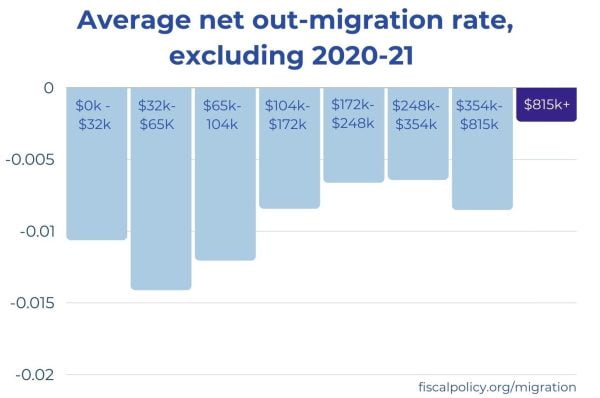

- Working and middle-class New Yorkers leave the state at four times the rate of the wealthiest New Yorkers in typical, non-Covid years.

- State Comptroller DiNapoli’s recent report revealed New York City’s population is growing wealthier as the cost of living rises.

Revenue & Expenditures

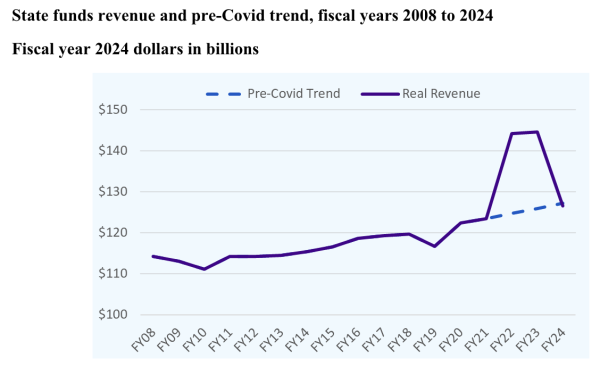

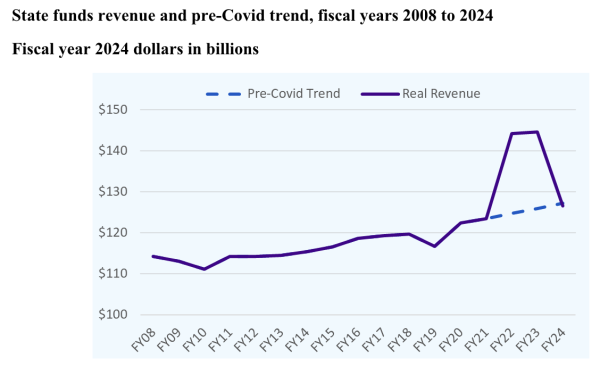

- State revenue has returned to normal rates after a year of Covid surpluses.

- While FY24 revenue will likely fall below FY23 levels, this decline does not reflect an economic downturn, but rather a step down from FY23’s capital gains-driven above-trend revenue.

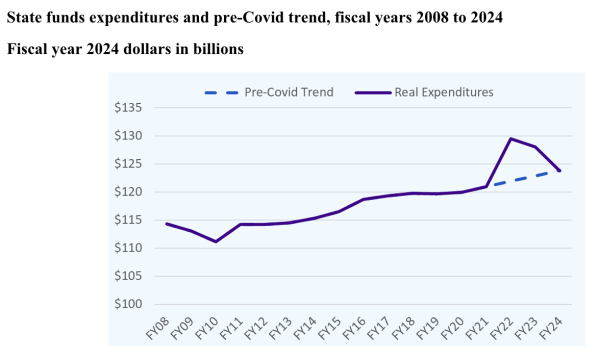

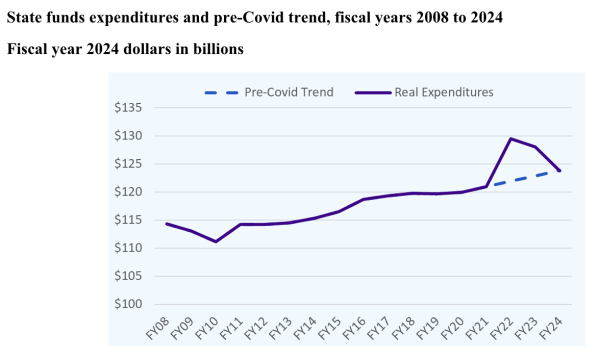

- FY24 State spending was $123.8 billion – on par with the level it would have been had Covid not occurred and the budget continued to grow at an inflation-adjusted rate of 0.8% per year.

The Fiscal Policy Institute is a nonpartisan, nonprofit research and education organization committed to improving public policies and private practices to better the economic and social conditions of all.

###

FPI on State of the State: NY’s Long-term Economic Competitiveness Depends on Deepening Investments that Sustain Workforce

January 9, 2024 |

FOR IMMEDIATE RELEASE: January 9, 2024

Media Contact: press@fiscalpolicy.org

FPI on State of the State: NY’s Long-term Economic Competitiveness Depends on Deepening Investments that Sustain Workforce

New York’s current fiscal indicators are stable & show State could significantly increase public investment

Current $4.3 billion FY25 budget gap falls within routine range that resolve without major policy intervention

ALBANY, NY | In response to Governor Hochul’s State of the State, Fiscal Policy Institute Director Nathan Gusdorf released the following statement:

“While the Governor outlined an agenda that accurately highlights many of the challenges facing New Yorkers, she remained silent on the deep investments needed to reverse New York’s affordability crisis and ensure the state’s long-term fiscal stability. The greatest threat to New York’s economic future is the affordability crisis that is pushing working- and middle-class families out of state — a crisis that will only be solved through sustained investments in housing, education and healthcare that anchor people here.

“While a shrinking middle-class workforce poses a risk for the state’s economic future, New York’s current fiscal indicators are stable and show that the State could significantly increase public investment. Revenues have returned to normal rates after a year of Covid surpluses, the State recently cut the budget gap in half, and New York’s high earning population continues to grow — all signs of fiscal stability. While constrained spending may appear fiscally wise in the short-term, the State’s long-term economic competitiveness depends on strengthening the public programs and infrastructure that sustain New York’s workforce.

“We look forward to reviewing the Governor’s budget and financial plan for more details on the initiatives outlined today.”

Background:

Budget Gaps

- The current $4.3 billion FY25 budget gap falls within historically routine range that resolve without major policy intervention.

- Because of conservative forecasting, outyear gaps are nearly always projected in New York State’s financial plans.

Size of First Outyear Budget Gap

As percentage of general fund spending

Population Loss

- New York’s population fell by 102,000 residents over the last year. Since 2020, the population has fallen by 533,200, or 2.7 percent.

- Working and middle-class New Yorkers leave the state at four times the rate of the wealthiest New Yorkers in typical, non-Covid years.

- State Comptroller DiNapoli’s recent report revealed New York City’s population is growing wealthier as the cost of living rises.

Revenue & Expenditures

- State revenue has returned to normal rates after a year of Covid surpluses.

- While FY24 revenue will likely fall below FY23 levels, this decline does not reflect an economic downturn, but rather a step down from FY23’s capital gains-driven above-trend revenue.

- FY24 State spending was $123.8 billion – on par with the level it would have been had Covid not occurred and the budget continued to grow at an inflation-adjusted rate of 0.8% per year.

The Fiscal Policy Institute is a nonpartisan, nonprofit research and education organization committed to improving public policies and private practices to better the economic and social conditions of all.

###