A Tax Credit for New York State Workers Hit Hardest by the Pandemic

March 23, 2021 |

Our state’s Earned Income Tax Credit (EITC) keeps more money in workers’ pockets, helping them pay for essentials including food, transportation, housing, education, and child care, as well as cover extra expenses. This tax credit is even more beneficial during the pandemic.

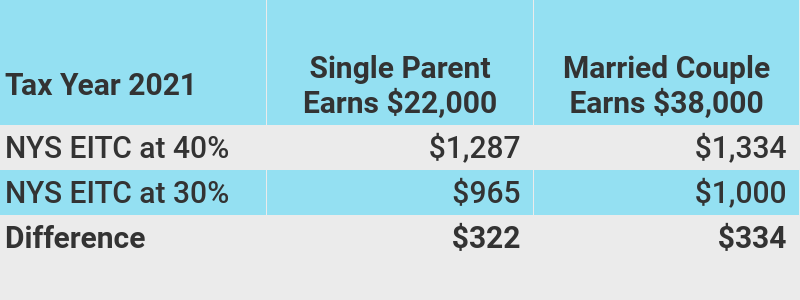

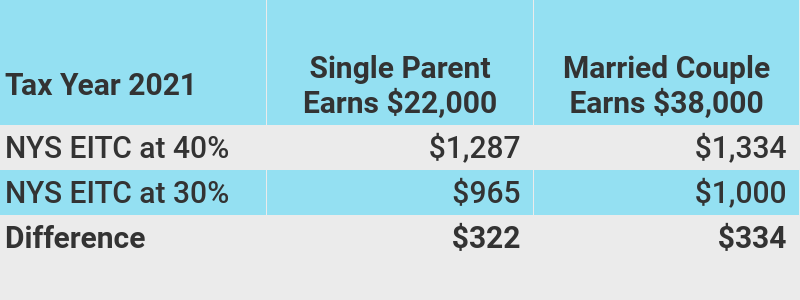

The New York State Assembly’s FY 2022 One-House Budget Proposal includes expanding the state EITC from 30 percent of the federal credit to 40 percent of the federal credit beginning in Tax Year 2021. That is a 25 percent increase to the maximum credit amounts – which means more than a million New York workers can keep even more of their earned income.

Our state’s EITC percentage has not been raised since 2000 when it was increased from 25 percent to 30 percent by Governor George Pataki. For over 20 years, the state’s EITC has stood at 30 percent of the federal, with the amount of credit claimed stagnating over the years. In 2018, the total amount of the credit claimed statewide was $987 million, roughly the same as the $967 claimed in 2009.

The Assembly’s proposal would address this stagnation and significantly boost the amount of income workers could keep by increasing the average credit of $664 to $938.1 This is real money that benefits everyday New Yorkers and supports local communities.

If enacted in the FY 2022 state budget, this expansion would coincide with the federal EITC’s changes in the American Rescue Plan (ARP). Starting in Tax Year 2021, childless workers aged 19-24, excluding those who are attending school part or full-time, will be able to claim the EITC.2 Moreover, they will receive an increased benefit, as the ARP increased the maximum federal EITC from $543 to $1,500 for workers without children.

Over 900,000 working people in New York State will benefit from the federal change to the EITC, 46 percent of whom are Black, Indigenous, and people of color.3 EITC expansions mean New Yorkers can keep more of their wages – a real boost to those earning low wages. Including the Assembly’s proposed state EITC enhancement in the final FY 2022 New York State budget would significantly assist struggling works.

1The federal EITC expansion also includes workers over the age of 64.

2Data provided by the Institute on Taxation and Economic Policy. October 2020.

3Center on Budget and Policy Priorities, “American Rescue Plan Act Includes Critical Expansions of Child Tax Credit and EITC”, March 2021.

by Cara Long Corra, Senior Policy Analyst, Fiscal Policy Institute

A Tax Credit for New York State Workers Hit Hardest by the Pandemic

March 23, 2021 |

Our state’s Earned Income Tax Credit (EITC) keeps more money in workers’ pockets, helping them pay for essentials including food, transportation, housing, education, and child care, as well as cover extra expenses. This tax credit is even more beneficial during the pandemic.

The New York State Assembly’s FY 2022 One-House Budget Proposal includes expanding the state EITC from 30 percent of the federal credit to 40 percent of the federal credit beginning in Tax Year 2021. That is a 25 percent increase to the maximum credit amounts – which means more than a million New York workers can keep even more of their earned income.

Our state’s EITC percentage has not been raised since 2000 when it was increased from 25 percent to 30 percent by Governor George Pataki. For over 20 years, the state’s EITC has stood at 30 percent of the federal, with the amount of credit claimed stagnating over the years. In 2018, the total amount of the credit claimed statewide was $987 million, roughly the same as the $967 claimed in 2009.

The Assembly’s proposal would address this stagnation and significantly boost the amount of income workers could keep by increasing the average credit of $664 to $938.1 This is real money that benefits everyday New Yorkers and supports local communities.

If enacted in the FY 2022 state budget, this expansion would coincide with the federal EITC’s changes in the American Rescue Plan (ARP). Starting in Tax Year 2021, childless workers aged 19-24, excluding those who are attending school part or full-time, will be able to claim the EITC.2 Moreover, they will receive an increased benefit, as the ARP increased the maximum federal EITC from $543 to $1,500 for workers without children.

Over 900,000 working people in New York State will benefit from the federal change to the EITC, 46 percent of whom are Black, Indigenous, and people of color.3 EITC expansions mean New Yorkers can keep more of their wages – a real boost to those earning low wages. Including the Assembly’s proposed state EITC enhancement in the final FY 2022 New York State budget would significantly assist struggling works.

1The federal EITC expansion also includes workers over the age of 64.

2Data provided by the Institute on Taxation and Economic Policy. October 2020.

3Center on Budget and Policy Priorities, “American Rescue Plan Act Includes Critical Expansions of Child Tax Credit and EITC”, March 2021.

by Cara Long Corra, Senior Policy Analyst, Fiscal Policy Institute