Congress Must Agree on COVID Relief Package in the Next Week

September 28, 2020 |

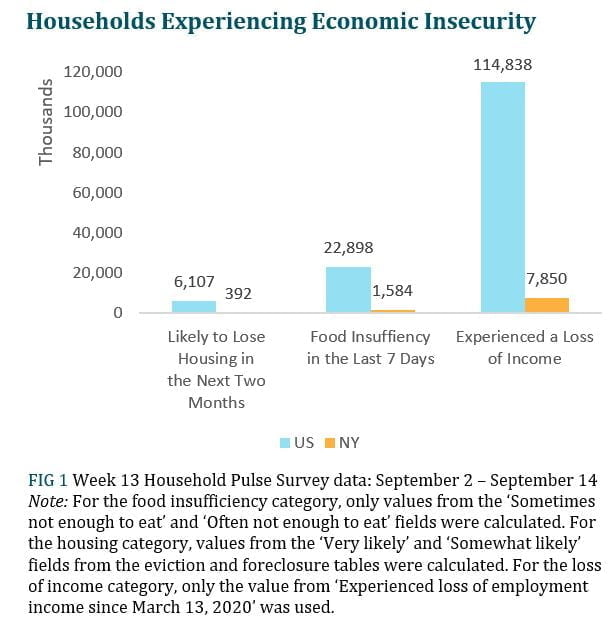

The coronavirus pandemic has hurt us all. It has harmed our physical and mental health and economic well-being. As of September 24, 2020, COVID-19 has sickened over 7.2 million Americans and killed more than 207,000. The pandemic has harmed our economy, causing large-scale business shutdowns, which were ordered to protect public health. Tens of millions of Americans lost their jobs and incomes because of the pandemic, resulting in record-high unemployment rates and a rising need for services in New York State and beyond. Initially, job losses were concentrated in the foodservice, retail, and health and social assistance industries. Still, now the public sector is also at-risk for large-scale job losses due to inaction by Congress to provide a post-CARES COVID relief package. The actual and anticipated loss of household income, combined with congressional inaction, fueled widespread concern among economists about the US job market and our long-term recovery.

In New York State, business shutdowns caused state and local tax receipts to plummet. Sales tax receipts, which typically comprise approximately 10 percent of the total revenue for counties, cities, and towns, saw precipitous declines. And while property taxes are generally used to shore up revenues, the state’s property tax cap, combined with household economic instability caused by the pandemic, means that property tax collections will most certainly not increase significantly and may even shrink. To address these revenue shortfalls, local governments have already made spending cuts, including layoffs and retirement incentives. State revenues have also declined due to pandemic-related spending and diminished sales tax, gaming, and lottery revenues. New York State has projected a revenue shortfall of $14.5 billion in FY 2021 and $16 billion in FY2022.

As a consequence of the shortfall, New York has frozen state government hiring and employee pay raises and has also suspended prompt payment of state contracts. The state is currently withholding 20 percent from payments to local governments and on contract reimbursements. These spending actions have caused financial harm to the state’s not-for-profit sector. But despite this harm, these measures may soon become permanent and will be expanded to include schools and hospitals. Congress must act urgently within the next week to pass bipartisan legislation that provides federal aid for state and local governments, increased funding for Medicaid and SNAP, enhanced unemployment benefits, rental assistance, and funding for childcare. As of September 25, the House is preparing a scaled-back $2.4 trillion COVID relief package that it could vote on early next week (The Heroes Act, passed by the House in May but not taken up by the Senate, was a $3.4 trillion package). Residents throughout New York State and every other state in the nation need federal legislators to prioritize public health and the economy and pass a robust COVID relief package before Congress goes on recess.

Congress Must Agree on COVID Relief Package in the Next Week

September 28, 2020 |

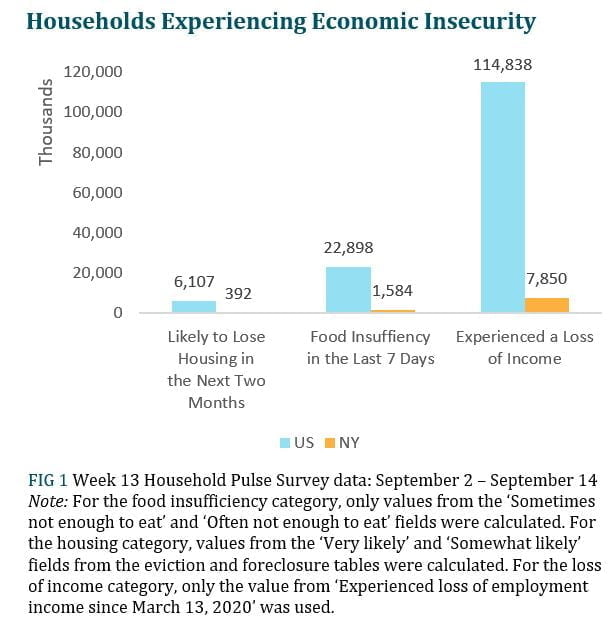

The coronavirus pandemic has hurt us all. It has harmed our physical and mental health and economic well-being. As of September 24, 2020, COVID-19 has sickened over 7.2 million Americans and killed more than 207,000. The pandemic has harmed our economy, causing large-scale business shutdowns, which were ordered to protect public health. Tens of millions of Americans lost their jobs and incomes because of the pandemic, resulting in record-high unemployment rates and a rising need for services in New York State and beyond. Initially, job losses were concentrated in the foodservice, retail, and health and social assistance industries. Still, now the public sector is also at-risk for large-scale job losses due to inaction by Congress to provide a post-CARES COVID relief package. The actual and anticipated loss of household income, combined with congressional inaction, fueled widespread concern among economists about the US job market and our long-term recovery.

In New York State, business shutdowns caused state and local tax receipts to plummet. Sales tax receipts, which typically comprise approximately 10 percent of the total revenue for counties, cities, and towns, saw precipitous declines. And while property taxes are generally used to shore up revenues, the state’s property tax cap, combined with household economic instability caused by the pandemic, means that property tax collections will most certainly not increase significantly and may even shrink. To address these revenue shortfalls, local governments have already made spending cuts, including layoffs and retirement incentives. State revenues have also declined due to pandemic-related spending and diminished sales tax, gaming, and lottery revenues. New York State has projected a revenue shortfall of $14.5 billion in FY 2021 and $16 billion in FY2022.

As a consequence of the shortfall, New York has frozen state government hiring and employee pay raises and has also suspended prompt payment of state contracts. The state is currently withholding 20 percent from payments to local governments and on contract reimbursements. These spending actions have caused financial harm to the state’s not-for-profit sector. But despite this harm, these measures may soon become permanent and will be expanded to include schools and hospitals. Congress must act urgently within the next week to pass bipartisan legislation that provides federal aid for state and local governments, increased funding for Medicaid and SNAP, enhanced unemployment benefits, rental assistance, and funding for childcare. As of September 25, the House is preparing a scaled-back $2.4 trillion COVID relief package that it could vote on early next week (The Heroes Act, passed by the House in May but not taken up by the Senate, was a $3.4 trillion package). Residents throughout New York State and every other state in the nation need federal legislators to prioritize public health and the economy and pass a robust COVID relief package before Congress goes on recess.