Fiscal Year 2024 Enacted Budget Financial Plan Analysis

July 3, 2023 |

Key Findings

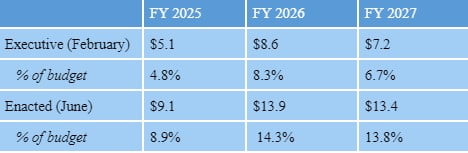

- The Enacted Budget Financial Plan projects budget gaps for future fiscal years of 8.9 to 13.8 percent of general fund revenue — reflecting more pessimistic economic projections than February’s Executive Budget Financial Plan.

- Financial plans routinely show outyear budget gaps of 4 to 7 percent of revenue — about half of the current projected gaps; these modest budget gaps generally reflect conservative budgeting practices, and tend to diminish or disappear over time.

- The gaps projected in the Enacted Budget Financial Plan likely reflect the State’s anticipation of an economic downturn from fiscal years 2024 through 2027 — not a sustained structural imbalance in the State’s finances.

- In the event of a prolonged economic downturn, it is particularly important to sustain spending on public services; the State holds a reserve fund of $19.5 billion and is well-positioned to maintain public services, rather than undertake cuts that would deepen and extend a recession.

- The most recent economic and fiscal data reflect a sustained recovery from the Covid recession, and do not indicate a recession already underway.

FPI’s Recommendations

New outyear budget gaps in the fiscal year 2024 Enacted Budget Financial Plan reflect heightened pessimism about the state’s economic trajectory by the State’s Division of Budget (DOB). While all economic projections are highly uncertain, the State is well-equipped to weather economic turbulence if these projections do materialize. Three principles should guide fiscal planning over the next year:

- Treat outyear revenue projections as uncertain: While the State’s cautious projections reflect prudent fiscal management, all multi-year economic projections reflect a high degree of uncertainty. There is not yet any evidence of a recession. The State should respond to economic conditions on a year-by-year basis as they unfold.

- Avoid cuts to public services: Stabilizing services like Medicaid, public education, and the social safety net can help avert deeper, protracted recessions. By contrast, fiscal retrenchment exacerbates recessions and slows economic recoveries.

- Use reserves in case of revenue shortfalls: New York State accumulated significant fiscal reserves totaling $19.5 billion in recent years. The purpose of reserves, as codified in State law, is to smooth spending through the economic cycle. If the State-projected recession unfolds, reserves should be used to stabilize services.

Overview

The Enacted Budget Financial Plan, published by the State on June 9, 2023, showed significant downgrades to the Division of the Budget’s (DOB) economic and fiscal outlook. Accordingly, the Financial Plan sharply revised future revenue estimates downward and projected deeper budget gaps beginning in fiscal year 2025 (while projecting a balanced budget for the current fiscal year, 2024). Pessimistic economic forecasts have been a mainstay of state budgeting during the post-Covid era. In the years since the start of the Covid-19 pandemic, the State’s economy has consistently outperformed DOB projections, with higher-than-expected revenue generating considerable surpluses and funding unprecedented fiscal reserves.

Though updated DOB projections now show larger budget gaps in future fiscal years due to national economic uncertainty, most recent economic and fiscal data show the State’s economic recovery continuing at a brisk pace. Should the State enter a recession, it would be well-advised to make use of the fiscal reserves amassed in the strong post-Covid recovery, the purpose of which is to smooth the state’s spending through the economic cycle.

Fiscal year 2024 enacted budget financial plan’s projected budget gaps in historical context

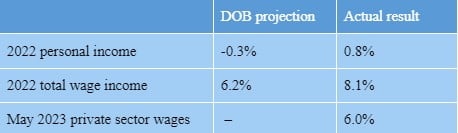

The Enacted Budget Financial Plan’s downward revisions to its economic forecast, and therefore revenue expectations, opened larger projected budget gaps in future fiscal years than prior financial plans. DOB’s revised projections are consistent with a sharp economic downturn followed by a slow recovery. Accordingly, newly-projected gaps align with the size of gaps projected in years of economic crisis. While the Executive Budget financial plan, released in February 2023, had projected modest budget gaps in future fiscal years (or “outyears”), those gaps were in line with routine fiscal shortfalls due to intentionally conservative budgeting.[1]

Figure 1. Budget gaps projected in fiscal year 2024 Executive and Enacted Financial Plans

Dollars in billions; percent of general fund receipts

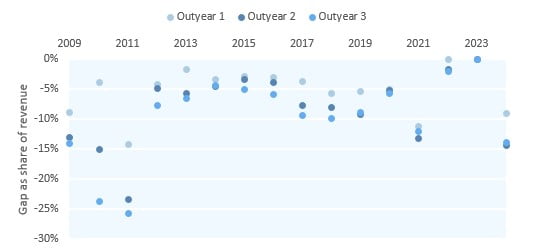

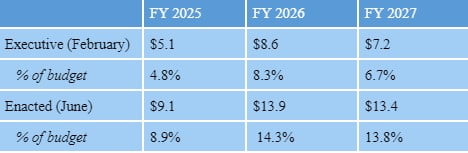

Modest outyear budget gaps are routine in New York State’s financial plans, present even in periods of lower economic uncertainty. According to an FPI analysis of enacted budget financial plans between fiscal years 2009 and 2024, all financial plans except one (fiscal year 2023) projected outyear budget gaps. Projected gaps over this period averaged 5.1 percent of expected general fund revenue in the first outyear, rising to 9.6 percent in the third outyear.[2]

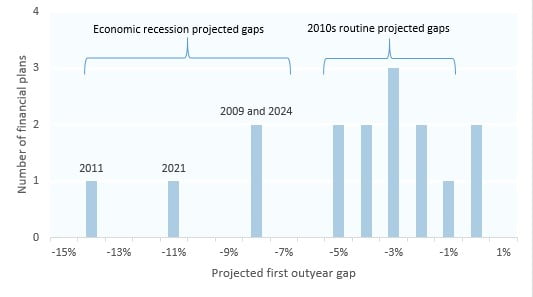

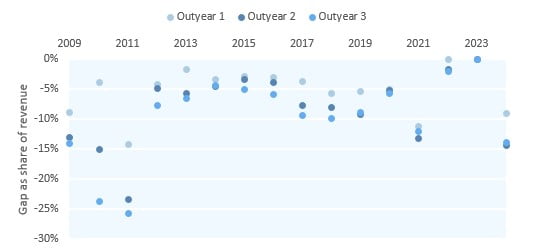

Projected outyear budget gaps are higher during economic crises. However, they are almost always present, even in fiscally-stable years. During the economic recovery from the 2008 recession — fiscal years 2012 to 2020 — financial plans projected average gaps of 3.8 percent of revenue in the first outyear and 6.9 percent in third outyear (see figure 2). Since fiscal year 2009, most financial plans have projected gaps for the first outyear between 2 and 6 percent of expected revenue (see figure 3).

Figure 2. Budget gaps projected in enacted budget financial plans as percent of projected revenue, fiscal years 2009 to 2024

Figure 3. Frequency of first outyear budget gaps projected in enacted budget financial plans, fiscal years 2009 to 2024

These routine gaps result from conservative budgeting practice. Projected budget gaps averaging 4 percent in the first outyear and 7 percent in the third outyear have generally closed as a result of revenue exceeding initial expectations and spending coming in below initial estimates. In non-crisis years, outyear forecasts underestimated revenue by an average of 3 percent and overestimated spending by average of 4 percent. Spending was significantly overestimated in the wake of the 2008 financial crisis because of dramatic cuts in fiscal years 2011-12 (see figure 4). Because projected future gaps result from sound fiscal management, they are generally considered manageable by public finance experts. For instance, credit ratings agencies upgraded New York’s credit rating in 2014 and continued to affirm the strength of the state’s fiscal position through the remainder of the decade.[3]

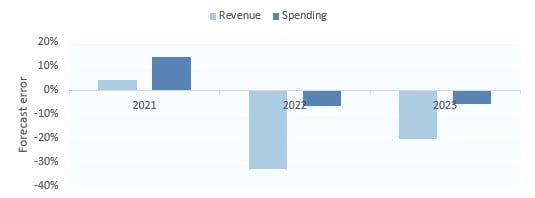

Figure 4. Revenue and spending forecast error, fiscal years 2012 to 2020

Forecast errors reflect the difference between average outyear projections and actual revenue and spending levels for each fiscal year. Positive values reflect overestimates while negative values reflect underestimates.

Economic and fiscal forecasts in the Covid era

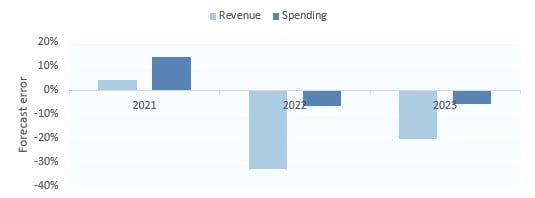

The Covid pandemic imposed enormous economic and policy uncertainty on New York State. This uncertainty has continued into the current fiscal year. The economic recovery from the Covid shock far exceeded initial expectations. As a result, financial plans preceding fiscal years 2022 and 2023 significantly underestimated those years’ actual revenue. The same projections underestimated spending to a lesser extent, leading to large fiscal surpluses amassed in the last two years (see figure 5).[4]

Recent higher-than-expected revenue was driven by uncertainty around the state’s economy and around a recent change in the state’s tax law: the pass-through entity tax (PTET). The PTET, which was enacted in fiscal year 2021, allows recipients of pass-through entity income — which includes income from partnerships, LLCs, and S-corporations — to sidestep a cap on state and local tax deductions from federal tax liabilities imposed by the 2017 Tax Cuts and Jobs Act. Taxpayers with pass-through income can opt to pay the PTET and receive an equal credit against their personal income taxes (under federal rules, state and local taxes can be deducted from business taxes, but not personal income taxes).

While PTET is revenue-neutral for New York State across the life of the program, it is not neutral in any given year: taxpayers rushed to opt in the business tax in 2022 and carried their personal income tax credits into following years. This timing misalignment has imposed volatility on the state’s finances. PTET’s fiscal impact is unbudgeted until fiscal year 2022, in which it was sharply positive, raising tax receipts by $16 billion. PTET also had a positive revenue impact the following year, fiscal year 2023, with PTET-related taxes and credits coming in $8 billion higher than initially forecast. DOB now expects PTET to be more negative than initially forecast in fiscal years 2024 through 2027. Predicting the timing of PTET’s fiscal impact, however, has proven difficult and the tax is likely to be a continued source of fiscal volatility.

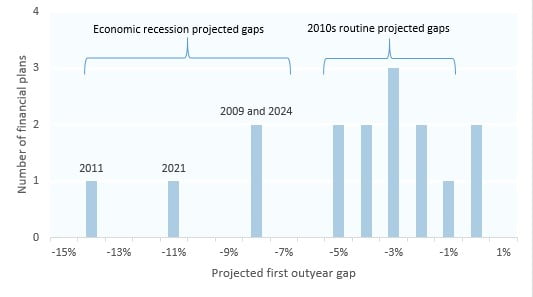

Economic uncertainty also drove substantial forecast error in recent years. In the year prior to Covid, DOB economic projections generally predicted the state’s economic trajectory well. In fiscal years 2021 and 2022, however, DOB significantly underestimated wage and personal income growth (see figure 6). While these are the most recent fiscal years for which data is fully available, the most recent economic indicators continue to show resilience.

Figure 5. Revenue and spending forecast error, fiscal years 2021 to 2023

Forecast error reflects the difference between average outyear projections and actual revenue and spending levels for each fiscal year. Positive values reflect overestimates while negative values reflect underestimates.

Figure 6. Economic projection error, fiscal years 2017 to 2022

Forecast errors reflect differences between projections made by preceding enacted budget financial plans and actual levels for each fiscal year. For instance, fiscal year 2017 values reflect the difference between fiscal year 2017 projections made in fiscal year 2016 enacted budget financial plan and actual economic indicators. Positive values reflect overestimates while negative values reflect underestimates.

Recession fears amid continued economic resilience

The outyear gaps contained in the fiscal year 2024 enacted budget financial plan project a sustained economic downturn. The most recent economic and fiscal data, however, does not yet indicate that such a downturn has started. Recently released data from the Bureau of Labor Statistics found that total wages paid to New York State workers rose 8.1 percent from 2021 to 2022. New York’s personal income, which includes non-wage sources of income such as capital gains, rose 0.8 percent in 2022, exceeding a DOB-projected decline amid financial sector losses and falling capital gains.[5] Finally, the most timely data, provided by the Bureau of Labor Statistics’ Current Employment Statistics (CES) shows the state’s private sector wages growing 6.0 percent between April 2022 and April 2023, maintaining the brisk pace of wage gains sustained over the past year.[6]

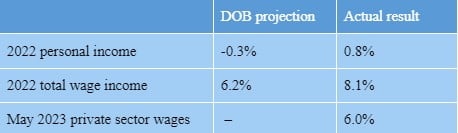

Figure 7. Current economic indicators for New York State, actual results and DOB projections

Year-over-year growth rate; May 2023 wages reflect 3-month moving average; DOB does not publish monthly economic projections

Recent fiscal data also reflect continued resilience. While April 2023 personal income tax receipts recorded a significant decline from the prior year, this decline reflected past economic conditions and policy changes. The year-over-year decline largely reflected atypically high estimated payments on personal income taxes made in April 2022, as taxpayers filed their 2021 tax returns, rather than unusually low April 2023 estimated payments. High April 2022 estimated payments were the result of both unpredictability related to the timing of PTET credits and high capital gains earnings in tax year 2021. Withholdings, the ongoing personal income tax payments made against current income by employers, were resilient in April 2023. As such, April 2023 receipts did not indicate economic weakness that will be carried into subsequent fiscal years.[7]

[1] : New York State Division of the Budget, Fiscal Year 2024 Executive Budget Financial Plan (February 2023), https://www.budget.ny.gov/pubs/archive/fy24/ex/fp/fy24fp-ex.pdf; New York State Division of the Budget, Fiscal Year 2024 Executive Budget Financial Plan (June 2023), https://www.budget.ny.gov/pubs/archive/fy24/en/fy24en-fp.pdf.

[2] FPI analysis of New York State Division of the Budget, “FY 2024 Enacted Budget Financial Plan Tables” and prior editions to fiscal year 2009 (accessed June 2023), https://openbudget.ny.gov/budgetArchives.html.

[3] S&P Global Ratings, “New York State General Obligation Debt Upgraded To ‘AA+’ From ‘AA’ On Improved Budgetary Management Framework” (July 2014), https://disclosure.spglobal.com/ratings/en/regulatory/article/-/view/type/HTML/id/1348272; Fitch Ratings, “Fitch Upgrades New York State GO and Related Bonds to ‘AA+’; Outlook Stable” (June 2014), https://www.fitchratings.com/research/us-public-finance/fitch-upgrades-new-york-state-go-related-bonds-to-aa-outlook-stable-20-06-2014.

[4] FPI analysis of New York State Division of the Budget, “FY 2024 Enacted Budget Financial Plan Tables” and prior editions to fiscal year 2009 (accessed June 2023), https://openbudget.ny.gov/budgetArchives.html.

[5] Bureau of Economic Analysis, “Personal Income by State” (accessed June 2023), https://www.bea.gov/data/income-saving/personal-income-by-state. New York State Division of Budget, “Fiscal Year 2024 Economic and Revenue Outlook” (February 2023), https://www.budget.ny.gov/pubs/archive/fy24/ex/ero/fy24ero.pdf.

[6] New York State Department of Labor, “Current Employment Statistics – Not Seasonally Adjusted Employment, Hours, and Earnings for New York State, Metro Areas, and Counties” (May 2023), https://dol.ny.gov/current-employment-statistics-0.

[7] Office of the New York State Comptroller, “May 2023 Cash Basis Report” and prior editions (June 2023), https://www.osc.state.ny.us/reports/finance.

Fiscal Year 2024 Enacted Budget Financial Plan Analysis

July 3, 2023 |

Key Findings

- The Enacted Budget Financial Plan projects budget gaps for future fiscal years of 8.9 to 13.8 percent of general fund revenue — reflecting more pessimistic economic projections than February’s Executive Budget Financial Plan.

- Financial plans routinely show outyear budget gaps of 4 to 7 percent of revenue — about half of the current projected gaps; these modest budget gaps generally reflect conservative budgeting practices, and tend to diminish or disappear over time.

- The gaps projected in the Enacted Budget Financial Plan likely reflect the State’s anticipation of an economic downturn from fiscal years 2024 through 2027 — not a sustained structural imbalance in the State’s finances.

- In the event of a prolonged economic downturn, it is particularly important to sustain spending on public services; the State holds a reserve fund of $19.5 billion and is well-positioned to maintain public services, rather than undertake cuts that would deepen and extend a recession.

- The most recent economic and fiscal data reflect a sustained recovery from the Covid recession, and do not indicate a recession already underway.

FPI’s Recommendations

New outyear budget gaps in the fiscal year 2024 Enacted Budget Financial Plan reflect heightened pessimism about the state’s economic trajectory by the State’s Division of Budget (DOB). While all economic projections are highly uncertain, the State is well-equipped to weather economic turbulence if these projections do materialize. Three principles should guide fiscal planning over the next year:

- Treat outyear revenue projections as uncertain: While the State’s cautious projections reflect prudent fiscal management, all multi-year economic projections reflect a high degree of uncertainty. There is not yet any evidence of a recession. The State should respond to economic conditions on a year-by-year basis as they unfold.

- Avoid cuts to public services: Stabilizing services like Medicaid, public education, and the social safety net can help avert deeper, protracted recessions. By contrast, fiscal retrenchment exacerbates recessions and slows economic recoveries.

- Use reserves in case of revenue shortfalls: New York State accumulated significant fiscal reserves totaling $19.5 billion in recent years. The purpose of reserves, as codified in State law, is to smooth spending through the economic cycle. If the State-projected recession unfolds, reserves should be used to stabilize services.

Overview

The Enacted Budget Financial Plan, published by the State on June 9, 2023, showed significant downgrades to the Division of the Budget’s (DOB) economic and fiscal outlook. Accordingly, the Financial Plan sharply revised future revenue estimates downward and projected deeper budget gaps beginning in fiscal year 2025 (while projecting a balanced budget for the current fiscal year, 2024). Pessimistic economic forecasts have been a mainstay of state budgeting during the post-Covid era. In the years since the start of the Covid-19 pandemic, the State’s economy has consistently outperformed DOB projections, with higher-than-expected revenue generating considerable surpluses and funding unprecedented fiscal reserves.

Though updated DOB projections now show larger budget gaps in future fiscal years due to national economic uncertainty, most recent economic and fiscal data show the State’s economic recovery continuing at a brisk pace. Should the State enter a recession, it would be well-advised to make use of the fiscal reserves amassed in the strong post-Covid recovery, the purpose of which is to smooth the state’s spending through the economic cycle.

Fiscal year 2024 enacted budget financial plan’s projected budget gaps in historical context

The Enacted Budget Financial Plan’s downward revisions to its economic forecast, and therefore revenue expectations, opened larger projected budget gaps in future fiscal years than prior financial plans. DOB’s revised projections are consistent with a sharp economic downturn followed by a slow recovery. Accordingly, newly-projected gaps align with the size of gaps projected in years of economic crisis. While the Executive Budget financial plan, released in February 2023, had projected modest budget gaps in future fiscal years (or “outyears”), those gaps were in line with routine fiscal shortfalls due to intentionally conservative budgeting.[1]

Figure 1. Budget gaps projected in fiscal year 2024 Executive and Enacted Financial Plans

Dollars in billions; percent of general fund receipts

Modest outyear budget gaps are routine in New York State’s financial plans, present even in periods of lower economic uncertainty. According to an FPI analysis of enacted budget financial plans between fiscal years 2009 and 2024, all financial plans except one (fiscal year 2023) projected outyear budget gaps. Projected gaps over this period averaged 5.1 percent of expected general fund revenue in the first outyear, rising to 9.6 percent in the third outyear.[2]

Projected outyear budget gaps are higher during economic crises. However, they are almost always present, even in fiscally-stable years. During the economic recovery from the 2008 recession — fiscal years 2012 to 2020 — financial plans projected average gaps of 3.8 percent of revenue in the first outyear and 6.9 percent in third outyear (see figure 2). Since fiscal year 2009, most financial plans have projected gaps for the first outyear between 2 and 6 percent of expected revenue (see figure 3).

Figure 2. Budget gaps projected in enacted budget financial plans as percent of projected revenue, fiscal years 2009 to 2024

Figure 3. Frequency of first outyear budget gaps projected in enacted budget financial plans, fiscal years 2009 to 2024

These routine gaps result from conservative budgeting practice. Projected budget gaps averaging 4 percent in the first outyear and 7 percent in the third outyear have generally closed as a result of revenue exceeding initial expectations and spending coming in below initial estimates. In non-crisis years, outyear forecasts underestimated revenue by an average of 3 percent and overestimated spending by average of 4 percent. Spending was significantly overestimated in the wake of the 2008 financial crisis because of dramatic cuts in fiscal years 2011-12 (see figure 4). Because projected future gaps result from sound fiscal management, they are generally considered manageable by public finance experts. For instance, credit ratings agencies upgraded New York’s credit rating in 2014 and continued to affirm the strength of the state’s fiscal position through the remainder of the decade.[3]

Figure 4. Revenue and spending forecast error, fiscal years 2012 to 2020

Forecast errors reflect the difference between average outyear projections and actual revenue and spending levels for each fiscal year. Positive values reflect overestimates while negative values reflect underestimates.

Economic and fiscal forecasts in the Covid era

The Covid pandemic imposed enormous economic and policy uncertainty on New York State. This uncertainty has continued into the current fiscal year. The economic recovery from the Covid shock far exceeded initial expectations. As a result, financial plans preceding fiscal years 2022 and 2023 significantly underestimated those years’ actual revenue. The same projections underestimated spending to a lesser extent, leading to large fiscal surpluses amassed in the last two years (see figure 5).[4]

Recent higher-than-expected revenue was driven by uncertainty around the state’s economy and around a recent change in the state’s tax law: the pass-through entity tax (PTET). The PTET, which was enacted in fiscal year 2021, allows recipients of pass-through entity income — which includes income from partnerships, LLCs, and S-corporations — to sidestep a cap on state and local tax deductions from federal tax liabilities imposed by the 2017 Tax Cuts and Jobs Act. Taxpayers with pass-through income can opt to pay the PTET and receive an equal credit against their personal income taxes (under federal rules, state and local taxes can be deducted from business taxes, but not personal income taxes).

While PTET is revenue-neutral for New York State across the life of the program, it is not neutral in any given year: taxpayers rushed to opt in the business tax in 2022 and carried their personal income tax credits into following years. This timing misalignment has imposed volatility on the state’s finances. PTET’s fiscal impact is unbudgeted until fiscal year 2022, in which it was sharply positive, raising tax receipts by $16 billion. PTET also had a positive revenue impact the following year, fiscal year 2023, with PTET-related taxes and credits coming in $8 billion higher than initially forecast. DOB now expects PTET to be more negative than initially forecast in fiscal years 2024 through 2027. Predicting the timing of PTET’s fiscal impact, however, has proven difficult and the tax is likely to be a continued source of fiscal volatility.

Economic uncertainty also drove substantial forecast error in recent years. In the year prior to Covid, DOB economic projections generally predicted the state’s economic trajectory well. In fiscal years 2021 and 2022, however, DOB significantly underestimated wage and personal income growth (see figure 6). While these are the most recent fiscal years for which data is fully available, the most recent economic indicators continue to show resilience.

Figure 5. Revenue and spending forecast error, fiscal years 2021 to 2023

Forecast error reflects the difference between average outyear projections and actual revenue and spending levels for each fiscal year. Positive values reflect overestimates while negative values reflect underestimates.

Figure 6. Economic projection error, fiscal years 2017 to 2022

Forecast errors reflect differences between projections made by preceding enacted budget financial plans and actual levels for each fiscal year. For instance, fiscal year 2017 values reflect the difference between fiscal year 2017 projections made in fiscal year 2016 enacted budget financial plan and actual economic indicators. Positive values reflect overestimates while negative values reflect underestimates.

Recession fears amid continued economic resilience

The outyear gaps contained in the fiscal year 2024 enacted budget financial plan project a sustained economic downturn. The most recent economic and fiscal data, however, does not yet indicate that such a downturn has started. Recently released data from the Bureau of Labor Statistics found that total wages paid to New York State workers rose 8.1 percent from 2021 to 2022. New York’s personal income, which includes non-wage sources of income such as capital gains, rose 0.8 percent in 2022, exceeding a DOB-projected decline amid financial sector losses and falling capital gains.[5] Finally, the most timely data, provided by the Bureau of Labor Statistics’ Current Employment Statistics (CES) shows the state’s private sector wages growing 6.0 percent between April 2022 and April 2023, maintaining the brisk pace of wage gains sustained over the past year.[6]

Figure 7. Current economic indicators for New York State, actual results and DOB projections

Year-over-year growth rate; May 2023 wages reflect 3-month moving average; DOB does not publish monthly economic projections

Recent fiscal data also reflect continued resilience. While April 2023 personal income tax receipts recorded a significant decline from the prior year, this decline reflected past economic conditions and policy changes. The year-over-year decline largely reflected atypically high estimated payments on personal income taxes made in April 2022, as taxpayers filed their 2021 tax returns, rather than unusually low April 2023 estimated payments. High April 2022 estimated payments were the result of both unpredictability related to the timing of PTET credits and high capital gains earnings in tax year 2021. Withholdings, the ongoing personal income tax payments made against current income by employers, were resilient in April 2023. As such, April 2023 receipts did not indicate economic weakness that will be carried into subsequent fiscal years.[7]

[1] : New York State Division of the Budget, Fiscal Year 2024 Executive Budget Financial Plan (February 2023), https://www.budget.ny.gov/pubs/archive/fy24/ex/fp/fy24fp-ex.pdf; New York State Division of the Budget, Fiscal Year 2024 Executive Budget Financial Plan (June 2023), https://www.budget.ny.gov/pubs/archive/fy24/en/fy24en-fp.pdf.

[2] FPI analysis of New York State Division of the Budget, “FY 2024 Enacted Budget Financial Plan Tables” and prior editions to fiscal year 2009 (accessed June 2023), https://openbudget.ny.gov/budgetArchives.html.

[3] S&P Global Ratings, “New York State General Obligation Debt Upgraded To ‘AA+’ From ‘AA’ On Improved Budgetary Management Framework” (July 2014), https://disclosure.spglobal.com/ratings/en/regulatory/article/-/view/type/HTML/id/1348272; Fitch Ratings, “Fitch Upgrades New York State GO and Related Bonds to ‘AA+’; Outlook Stable” (June 2014), https://www.fitchratings.com/research/us-public-finance/fitch-upgrades-new-york-state-go-related-bonds-to-aa-outlook-stable-20-06-2014.

[4] FPI analysis of New York State Division of the Budget, “FY 2024 Enacted Budget Financial Plan Tables” and prior editions to fiscal year 2009 (accessed June 2023), https://openbudget.ny.gov/budgetArchives.html.

[5] Bureau of Economic Analysis, “Personal Income by State” (accessed June 2023), https://www.bea.gov/data/income-saving/personal-income-by-state. New York State Division of Budget, “Fiscal Year 2024 Economic and Revenue Outlook” (February 2023), https://www.budget.ny.gov/pubs/archive/fy24/ex/ero/fy24ero.pdf.

[6] New York State Department of Labor, “Current Employment Statistics – Not Seasonally Adjusted Employment, Hours, and Earnings for New York State, Metro Areas, and Counties” (May 2023), https://dol.ny.gov/current-employment-statistics-0.

[7] Office of the New York State Comptroller, “May 2023 Cash Basis Report” and prior editions (June 2023), https://www.osc.state.ny.us/reports/finance.