Halfway Into Fiscal Year, Tax Receipts Remain Stable — Budget Gaps Likely to Shrink

October 17, 2023 |

FOR IMMEDIATE RELEASE: October 17, 2023

Media Contact: press@fiscalpolicy.org

Halfway Into Fiscal Year, Tax Receipts Remain Stable — Budget Gaps Likely to Shrink

If revenue remains on current trend, New York State on track to see next year’s budget gaps shrink by roughly 50 percent

ALBANY, NY | October 17, 2023 — The State Comptroller released its September Cash Report today, showing that year to date cash receipts came in over projections but under 2022 levels.

- Year to Date Actual: $63.79 billion

- Year to Date Projection: $61.25 billion

- Year to Date 2022: $68.99 billion

Following the cash report release, FPI Executive Director Nathan Gusdorf released the following statement:

“Six months into the fiscal year, State receipts remain below last year’s receipts by 7.5 percent. However, compared to the Division of the Budget’s latest projections, receipts are up by 4.2 percent. If revenue remains on the trend we’ve seen since April, New York is on track to see next year’s budget gaps shrink by roughly 50 percent. These cash receipts indicate that the State’s forecasted budget gaps may be significantly smaller than originally projected, likely less than $5 billion. With robust cash reserves of $19.5 billion, the State is in a strong position to manage any future revenue shortfalls through a combination of drawing on reserves and revenue increases. Conversely, reducing or freezing State spending would undermine the State’s ongoing economic recovery.”

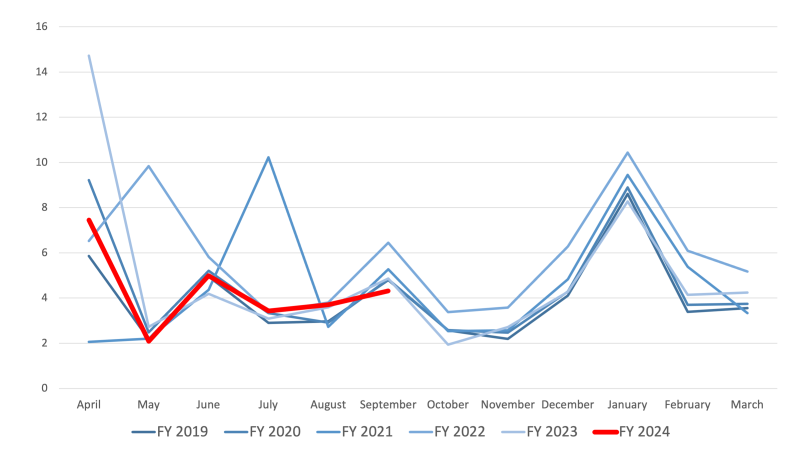

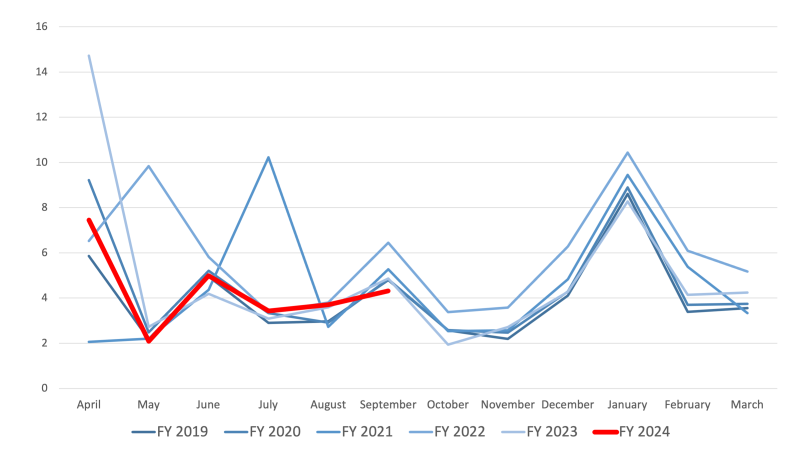

Personal income tax receipts by month and fiscal year (billions $).

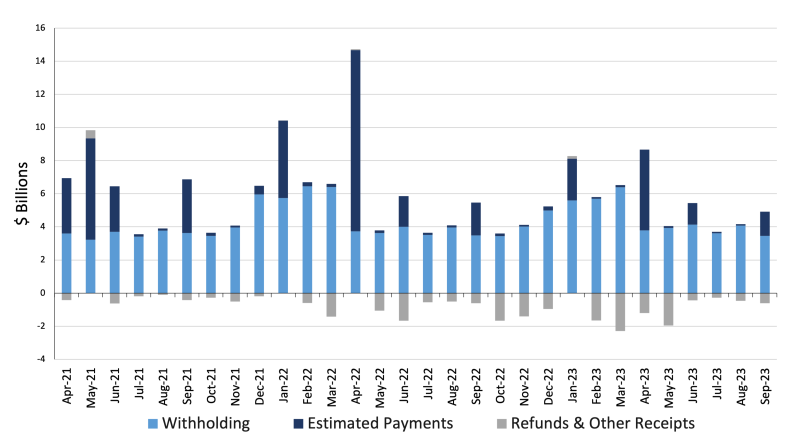

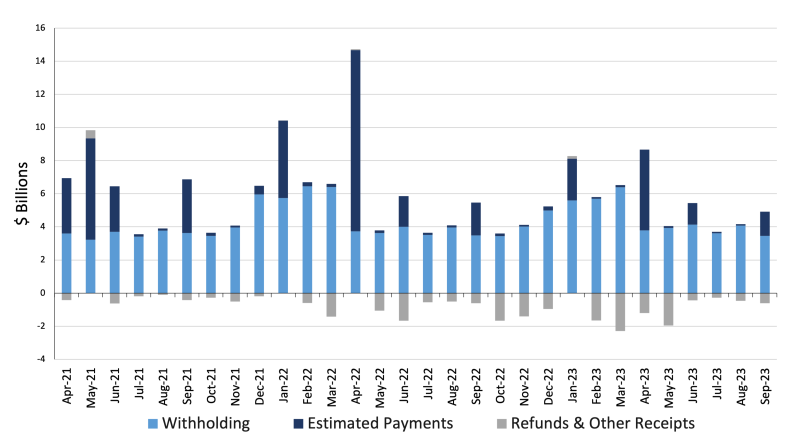

Personal income tax receipts broken down by type.

The Fiscal Policy Institute is a nonpartisan, nonprofit research and education organization committed to improving public policies and private practices to better the economic and social conditions of all.

###

Halfway Into Fiscal Year, Tax Receipts Remain Stable — Budget Gaps Likely to Shrink

October 17, 2023 |

FOR IMMEDIATE RELEASE: October 17, 2023

Media Contact: press@fiscalpolicy.org

Halfway Into Fiscal Year, Tax Receipts Remain Stable — Budget Gaps Likely to Shrink

If revenue remains on current trend, New York State on track to see next year’s budget gaps shrink by roughly 50 percent

ALBANY, NY | October 17, 2023 — The State Comptroller released its September Cash Report today, showing that year to date cash receipts came in over projections but under 2022 levels.

- Year to Date Actual: $63.79 billion

- Year to Date Projection: $61.25 billion

- Year to Date 2022: $68.99 billion

Following the cash report release, FPI Executive Director Nathan Gusdorf released the following statement:

“Six months into the fiscal year, State receipts remain below last year’s receipts by 7.5 percent. However, compared to the Division of the Budget’s latest projections, receipts are up by 4.2 percent. If revenue remains on the trend we’ve seen since April, New York is on track to see next year’s budget gaps shrink by roughly 50 percent. These cash receipts indicate that the State’s forecasted budget gaps may be significantly smaller than originally projected, likely less than $5 billion. With robust cash reserves of $19.5 billion, the State is in a strong position to manage any future revenue shortfalls through a combination of drawing on reserves and revenue increases. Conversely, reducing or freezing State spending would undermine the State’s ongoing economic recovery.”

Personal income tax receipts by month and fiscal year (billions $).

Personal income tax receipts broken down by type.

The Fiscal Policy Institute is a nonpartisan, nonprofit research and education organization committed to improving public policies and private practices to better the economic and social conditions of all.

###