Blame Congress, Not Immigrants, If America’s Taxes Don’t Pay for Our Expenses

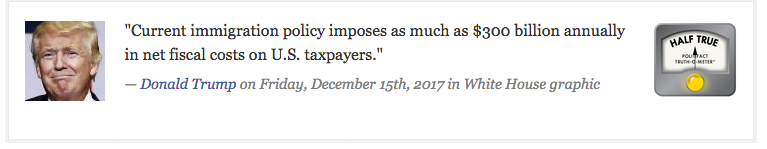

December 25, 2018. Recently, WhiteHouse.gov put up a post on its web site claiming that immigration results in “$300 billion annually in net fiscal costs on U.S. taxpayers.”

As I said in talking with PolitiFact, this is just sophistry. The United States has been running a deficit for years. So, by definition, all Americans have a bigger net cost than contribution – 1st generation immigrants, 2nd generation immigrants, and those of us who have been here for 3 or more generations. That’s a failure of tax policy, not a story about immigrants. The United States is not raising enough revenue to pay for our expenses, a situation made only worse by the new tax law.

FPI says: “Just Sophistry…”

It’s interesting to note, though, that in the analysis the president is referring to, the group that does better than all other groups, by the measure of tax contributions versus government costs, is second generation immigrants. The “costs on U.S. tax payers” actually includes immigrant taxpayers as well as everyone else. And, this analysis has nothing to do with “low-skilled” or “high-skilled,” it’s everyone.

Here’s the main story: Immigrants are in the long run helping our economy grow, and as a result helping us to pay off government debt. As was the case with retiring America’s World War II debt, the best solution is to see overall economic growth. Having a bigger and younger population in the future will make it far more manageable to pay off the debt we’re accumulating today, and to continue to sustain programs to pay for older Americans like Social Security and Medicare.

The way to get the biggest economic and fiscal contribution from immigrants is to fix our immigration system. That means creating a properly working enforcement system, fixing the vastly outdated visa process, and yes, making it possible for those who are currently undocumented to earn citizenship,

The Senate had a reasonable compromise to do just that in 2013. It was called S. 744, and it passed passed by a vote of 68-32 with broad bipartisan support. Here’s what the CBO said about that bill:

“On balance, the economic impacts not included in the cost estimate would have no significant net effect on federal budget deficits during the coming decade and would reduce deficits during the following decade. Taking into account a limited set of economic effects, the cost estimate shows that changes in direct spending and revenues under the legislation would decrease federal budget deficits by $197 billion over the 2014–2023 period and by roughly $700 billion over the 2024–2033 period.”

Even though the Senate bill seemed to have a majority of support in the House, it never came to a vote. The reason, it seems, is that while it was supported by many Republicans as well as many Democrats, it was not supported by the majority of Republicans the so-called “majority of the majority.” The majority of the majority may be the minority in the House of Representatives, but it can be enough to block a vote.

Finally, a last thought about the White House posting: It’s hard to abide any lectures about fiscal rectitude from an administration that just passed a reckless tax bill estimated to cost $1 to $1.5 trillion over the next 10 years.