Labor Day: Shines Light on NY Workers With Fewest Protections

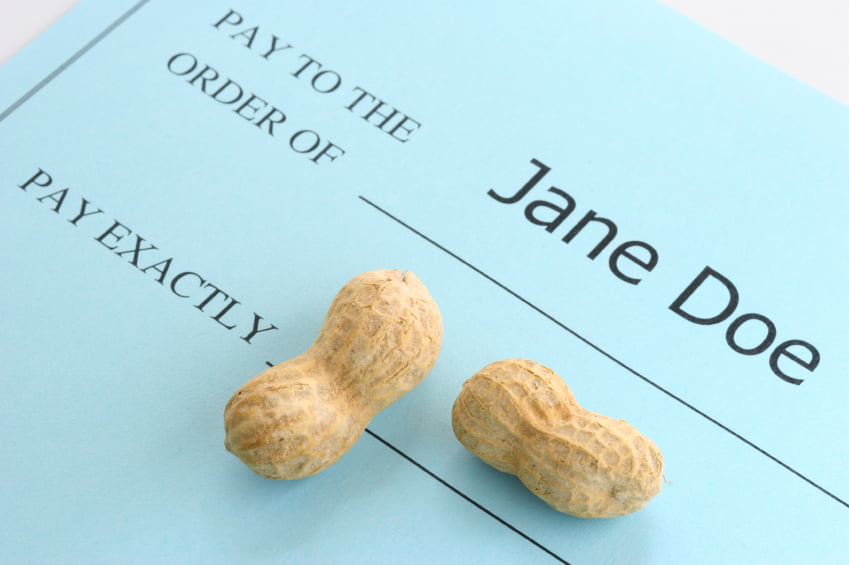

August 31, 2012. A story reported by Mike Clifford, Public News Service - NY. As New York heads into a long weekend to celebrate the contributions made by workers, local advocates say this Labor Day should shine a spotlight on local workers who have the least protections. David Dyssegard Kallick, director of the Fiscal Policy Institute's Immigration Research Initiative, says immigrant day laborers are doing tough jobs and contributing to local economic growth, despite the fact that many work "under the table" in low-paying jobs [...]