New York’s minimum wage tax credit slammed as poorly designed and wasteful

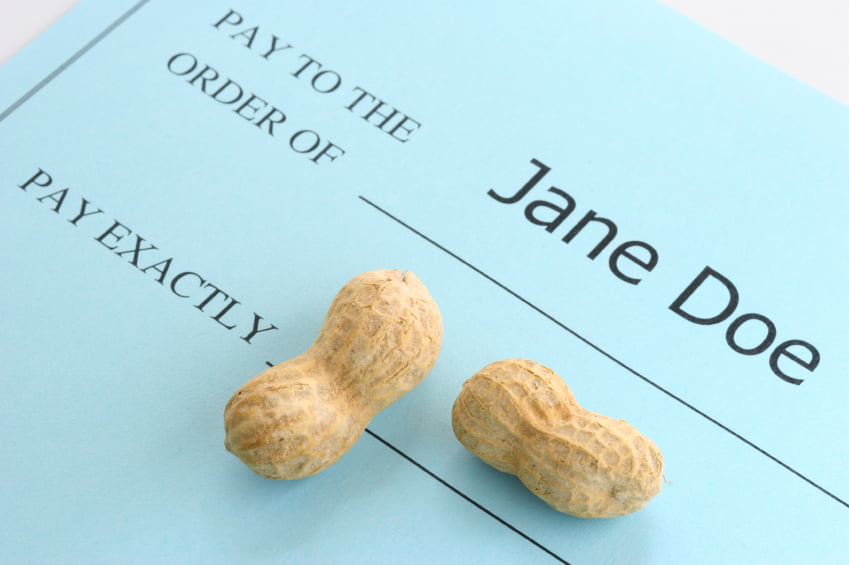

April 28, 2013. A Post-Standard story looks at New York's minimum wage tax credit and references an analysis done by FPI. “It’s utterly unprecedented in the United States,” said Paul Sonn, legal co-director of the National Employment Law Project in Washington, D.C. “We’re not aware of any state that has adopted a tax credit remotely resembling this one, which will have the taxpayer pick up the tab for the cost of the minimum wage increase for a certain category of worker.” .... Cuomo’s office estimates [...]