Proposal Would Worsen Affordability Crisis; Increase Out-Migration

Proposed deal does not address state’s housing problems; effectively returns state to the 2019 housing market, but with far higher rental costs

The housing deal currently under consideration in budget negotiations (as publicly reported) would create new tax incentives for affordable housing developers, weaken certain tenant protections passed in 2019, and impose a watered-down version of “Good Cause Eviction” with significant exemptions and loopholes.

Since 2019, tenants throughout the state have faced skyrocketing rents, leading many to move to other states in search of lower housing costs. Weakening tenant protections would likely accelerate the State’s affordability crisis and increase working class out-migration. The proposed “Good Cause Eviction” provisions, in light of their limited scope, expansive exemptions, and loopholes, are unlikely to meaningfully change this dynamic.

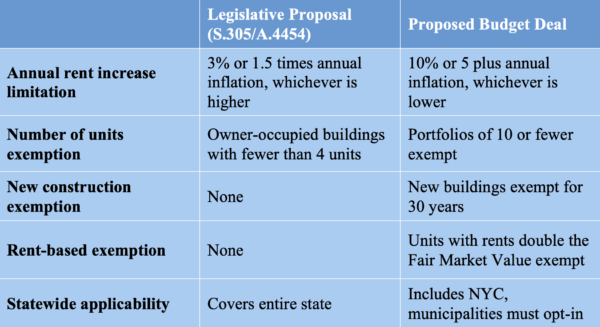

Table 1. Comparison of Good Cause Eviction proposals

- It is impossible to estimate the scope of the proposed exemption for landlords with 10-unit portfolios, as landlords are typically organized as anonymous LLCs.

- Without knowledge of the real owners of residential apartments, it may be practically impossible for tenants to enforce their rights.

- Landlords may find ways to take advantage of such exemptions by organizing their holdings into smaller, 10-unit portfolios, each under the identity of a different anonymous LLC.

- The deal would roll back certain tenant protections enacted in the 2019 Housing Stability and Tenant Protection Act (HSTPA) relating to Individual Apartment Improvements (IAIs).

- Currently, when landlords make improvements on a rental unit, up to $15,000 in expenses may be recovered from a rent-stabilized tenant through additional rent increases. The deal would double that threshold to $30,000, or $50,000 in cases of apartment vacated by long-term tenants (tenants of at least 25 years).

- This deal would change New York’s housing market to resemble the 2019 market, when rent stabilization rules were subject to numerous exceptions that allowed landlords to significantly increase rents.

Four Facts Supporting Stronger Tenant Protections

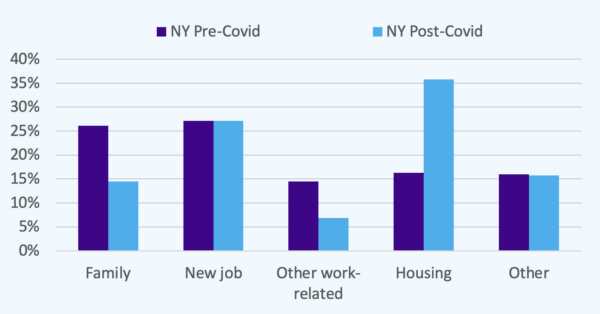

1. Housing affordability is now the leading reason why families move out of New York State, accounting for more than 1/3 of all decisions to move.

Figure 1. New York domestic migrants’ stated reasons for moving, pre- and post-Covid

Source: IPUMS CPS, University of Minnesota, www.ipums.org

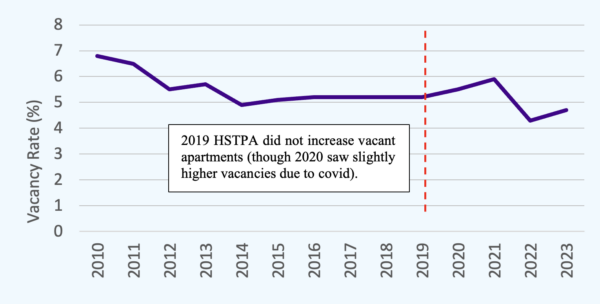

2. Critics of the 2019 housing laws argue that tenant protections undermine profitability and force landlords to keep their units vacant; however, the data do not support this claim.

- Vacancy rates of rental units have declined since the passage of the 2019 tenant protections and are now at a 20-year low.

Figure 2. Vacancy rate of all New York rental units, 2010 – 2023

Source: U.S. Census Bureau, Rental Vacancy Rate in the United States

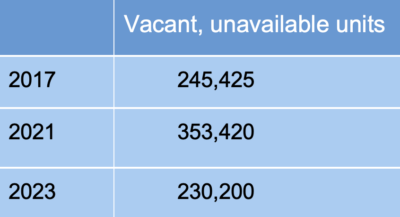

Table 2. Number of units held vacant and not available for rent or sale

Source: U.S. Census Bureau, Rental Vacancy Rate in the United States

- The vacancy rate in Table 1 does not include vacant units that are unavailable for rent. Some critics of the 2019 HSTPA argue that it led units to be taken off the market. These units would be reflected in statistics on vacant, unavailable units.

- The number of units held vacant and unavailable for rent or sale fell 35 percent between 2021 and 2023.

- Many of these units are pieds-à-terre, former short-term rentals, or undergoing renovations – however, the total number of such units has declined significantly since 2019 – as shown in table above – demonstrating that landlords are not removing rent-stabilized units from the market.

3. Landlords argue that rent stabilization decreases their earnings, which in turn causes less housing to be built. However, the data disagree — their earnings do not correspond to how much new housing is built.

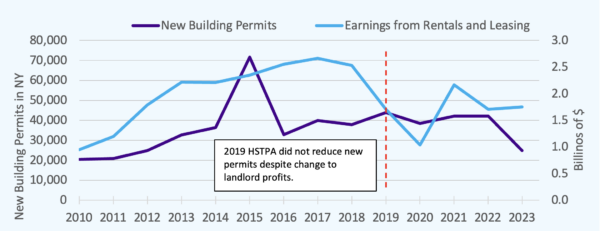

Figure 3. Declines in the earnings of landlords do not correspond to declines in new building construction.

Sources: U.S. Bureau of Economic Analysis and Federal Reserve Bank of St. Louis, Real Estate, Rental and Leasing Earnings in New York; U.S. Census Bureau, New Private Housing Units Authorized by Building Permits for New York

- This finding follows from the fact that housing construction in New York is primarily determined by strict regulations that limit new housing. Expanding tenant protections is unlikely to affect this fundamental dynamic.

- After the 2019 HSTPA was enacted, the pace of new building permits being filed did not change, whereas earnings from rentals and leasing did decline (also driven by the pandemic in 2020 and other market factors).

4. Rent stabilization laws are a matter of racial equity, and sorely needed at a time when Black and Hispanic New Yorkers are leaving the state at higher rates than the rest of the population.

- Black New Yorkers are much more exposed to fluctuations in the rental market; only 41 percent of Black New Yorkers own their homes, whereas 61 percent of all non-Black New Yorkers own their homes.[1]

- Whereas most homeowners enjoy the financial stability of a fixed-rate mortgage, making their housing costs stable and predictable, renters without rent stabilization lack predictability about where they can afford to live.

[1] Computed using 1-yr ACS files for New York state residents between 2017 and 2022.