FPI Commends Governor Cuomo for Advancing Middle Class Circuit Breaker—Targeted Tax Relief Tied to Income Is the Most Effective Mechanism

January 14, 2015 |

January 14, 2015. Governor Cuomo just announced a $1.66 billion property tax credit program (commonly referred to as a “Circuit Breaker”) to help ease the burden on working class families who are paying too much of their income in property taxes.

The Fiscal Policy Institute (FPI), working with our partners in the Omnibus Property Tax Consortium, has been calling for a targeted circuit breaker for years. “We are pleased that the Governor announced a circuit breaker proposal that targets relief to working and middle class New Yorkers. This is a step in the right direction. We urge the Governor to make sure we pay for this tax relief by eliminating wasteful corporate tax credits that only line the pockets of the wealthiest at the expense of everyone else,” said Ron Deutsch, Executive Director of the Fiscal Policy Institute.

Deutsch added, “This targeted circuit breaker approach to providing property tax relief is far superior to the rigid property tax cap. We strongly urge that the “property tax cap-compliant” provision be dropped.”

“It is essential that the new round of property tax relief not come at the expense of restoring school aid, increasing revenue sharing to hard-pressed local governments, or restoring critical human services funding,” said James Parrott, FPI’s Deputy Director and Chief Economist.

State school aid falls $4-5 billion short of where it should be based on the 2007 school aid commitment to fund a “sound, basic education.” Revenue sharing has dropped by 75% since 1980, and the state spends far less on human services for the poor and disadvantaged in many areas than it did four years ago despite the fact that family hardships have mushroomed in the wake of the Great Recession.

To avoid crowding out critical funding needs in the state budget, FPI is urging that last year’s ill-conceived property tax freeze credit be scrapped and those resources used to help pay for a sensible circuit breaker.

For the longer term, New York State needs to restructure the state-local funding relationship. Currently, the state funds the third smallest share of combined state and local spending compared to other states, partly because New York requires localities to pay a significant portion of Medicaid costs and partly because State school aid falls short of what is needed. The State should scrap the austerity-inducing two percent spending cap, and for the State to more adequately invest in New York’s human capital and infrastructure needs, it will be important for the State to revise and make permanent the so-called “millionaire’s tax” that is now set to expire at the end of 2017.

Here’s why low- and middle-income New Yorkers need real property tax relief:

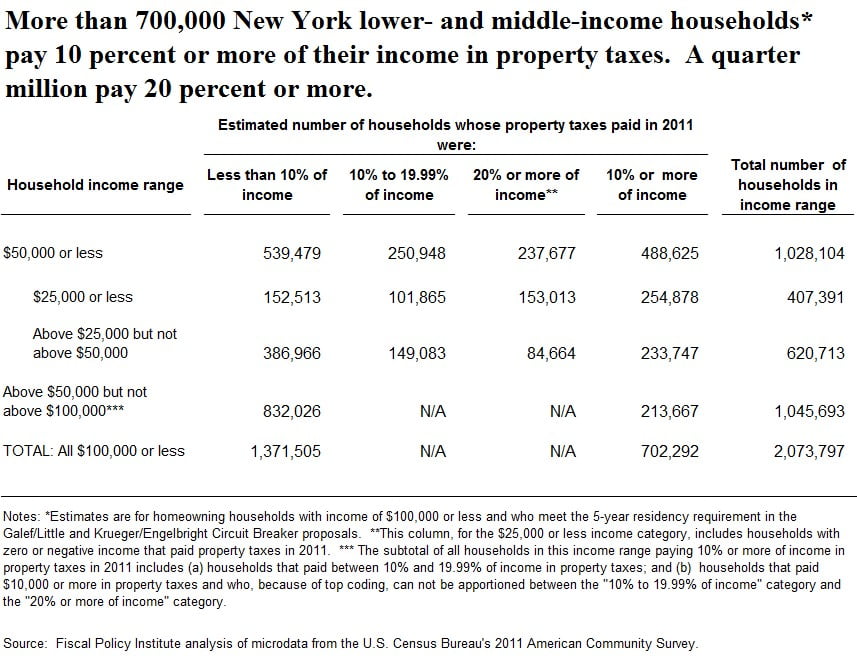

In 2011, an estimated one-third of all households in New York State with incomes of $100,000 or less paid 10% or more of their income in property taxes. About half of households with incomes of $50,000 or less had a property tax burden of 10% or more of their income.

How “circuit breaker” credits work and why they make sense

A property tax Circuit Breaker is a targeted form of property tax relief. The name “Circuit Breaker” is used to describe this type of tax credit since it is designed to prevent households from being overburdened by property taxes just as electrical circuit breakers interrupt the flow of electrical current when a circuit becomes overloaded.

A property tax Circuit Breaker has several key elements:

- Sets an “affordability threshold” as a percentage (such as 6%) of household income.

- Provides for the calculation of a household’s property tax “overload” as the portion of the property taxes on the household’s primary residence in excess of that “threshold” percentage of the household’s income.

- Sets a “benefit” percentage (such as 50%). A household’s Circuit Breaker credit is calculated by multiplying the household’s “overload” by the benefit percentage.

Residential property taxes are often high relative to income for low- and middle-income households. A study by the Institute on Taxation and Economic Policy finds that for this year, low-income families paid an average of 5.6% of their income in property taxes and middle-income families paid 3.6%, while the richest taxpayers paid only 0.7%.

FPI Commends Governor Cuomo for Advancing Middle Class Circuit Breaker—Targeted Tax Relief Tied to Income Is the Most Effective Mechanism

January 14, 2015 |

January 14, 2015. Governor Cuomo just announced a $1.66 billion property tax credit program (commonly referred to as a “Circuit Breaker”) to help ease the burden on working class families who are paying too much of their income in property taxes.

The Fiscal Policy Institute (FPI), working with our partners in the Omnibus Property Tax Consortium, has been calling for a targeted circuit breaker for years. “We are pleased that the Governor announced a circuit breaker proposal that targets relief to working and middle class New Yorkers. This is a step in the right direction. We urge the Governor to make sure we pay for this tax relief by eliminating wasteful corporate tax credits that only line the pockets of the wealthiest at the expense of everyone else,” said Ron Deutsch, Executive Director of the Fiscal Policy Institute.

Deutsch added, “This targeted circuit breaker approach to providing property tax relief is far superior to the rigid property tax cap. We strongly urge that the “property tax cap-compliant” provision be dropped.”

“It is essential that the new round of property tax relief not come at the expense of restoring school aid, increasing revenue sharing to hard-pressed local governments, or restoring critical human services funding,” said James Parrott, FPI’s Deputy Director and Chief Economist.

State school aid falls $4-5 billion short of where it should be based on the 2007 school aid commitment to fund a “sound, basic education.” Revenue sharing has dropped by 75% since 1980, and the state spends far less on human services for the poor and disadvantaged in many areas than it did four years ago despite the fact that family hardships have mushroomed in the wake of the Great Recession.

To avoid crowding out critical funding needs in the state budget, FPI is urging that last year’s ill-conceived property tax freeze credit be scrapped and those resources used to help pay for a sensible circuit breaker.

For the longer term, New York State needs to restructure the state-local funding relationship. Currently, the state funds the third smallest share of combined state and local spending compared to other states, partly because New York requires localities to pay a significant portion of Medicaid costs and partly because State school aid falls short of what is needed. The State should scrap the austerity-inducing two percent spending cap, and for the State to more adequately invest in New York’s human capital and infrastructure needs, it will be important for the State to revise and make permanent the so-called “millionaire’s tax” that is now set to expire at the end of 2017.

Here’s why low- and middle-income New Yorkers need real property tax relief:

In 2011, an estimated one-third of all households in New York State with incomes of $100,000 or less paid 10% or more of their income in property taxes. About half of households with incomes of $50,000 or less had a property tax burden of 10% or more of their income.

How “circuit breaker” credits work and why they make sense

A property tax Circuit Breaker is a targeted form of property tax relief. The name “Circuit Breaker” is used to describe this type of tax credit since it is designed to prevent households from being overburdened by property taxes just as electrical circuit breakers interrupt the flow of electrical current when a circuit becomes overloaded.

A property tax Circuit Breaker has several key elements:

- Sets an “affordability threshold” as a percentage (such as 6%) of household income.

- Provides for the calculation of a household’s property tax “overload” as the portion of the property taxes on the household’s primary residence in excess of that “threshold” percentage of the household’s income.

- Sets a “benefit” percentage (such as 50%). A household’s Circuit Breaker credit is calculated by multiplying the household’s “overload” by the benefit percentage.

Residential property taxes are often high relative to income for low- and middle-income households. A study by the Institute on Taxation and Economic Policy finds that for this year, low-income families paid an average of 5.6% of their income in property taxes and middle-income families paid 3.6%, while the richest taxpayers paid only 0.7%.