FPI Research on Tax Migration cited on NBC, CNN, MSNBC

July 7, 2025 |

Zohran Mamdani’s recent victory in the New York City Democratic primary election has brought FPI’s past research on millionaire tax flight into the national spotlight. Mr. Mamdani himself has recently cited FPI’s research on NBC’s Meet the Press, MSNBC and CNN, accurately recounting FPI’s groundbreaking findings that the highest earning New Yorkers move out of the state at ¼ the rate of all other income groups, and that when they do move they tend to move to states with similar tax rates such as New Jersey and California. In other words, the evidence shows that the highest earners generally do not move in search of lower taxes.

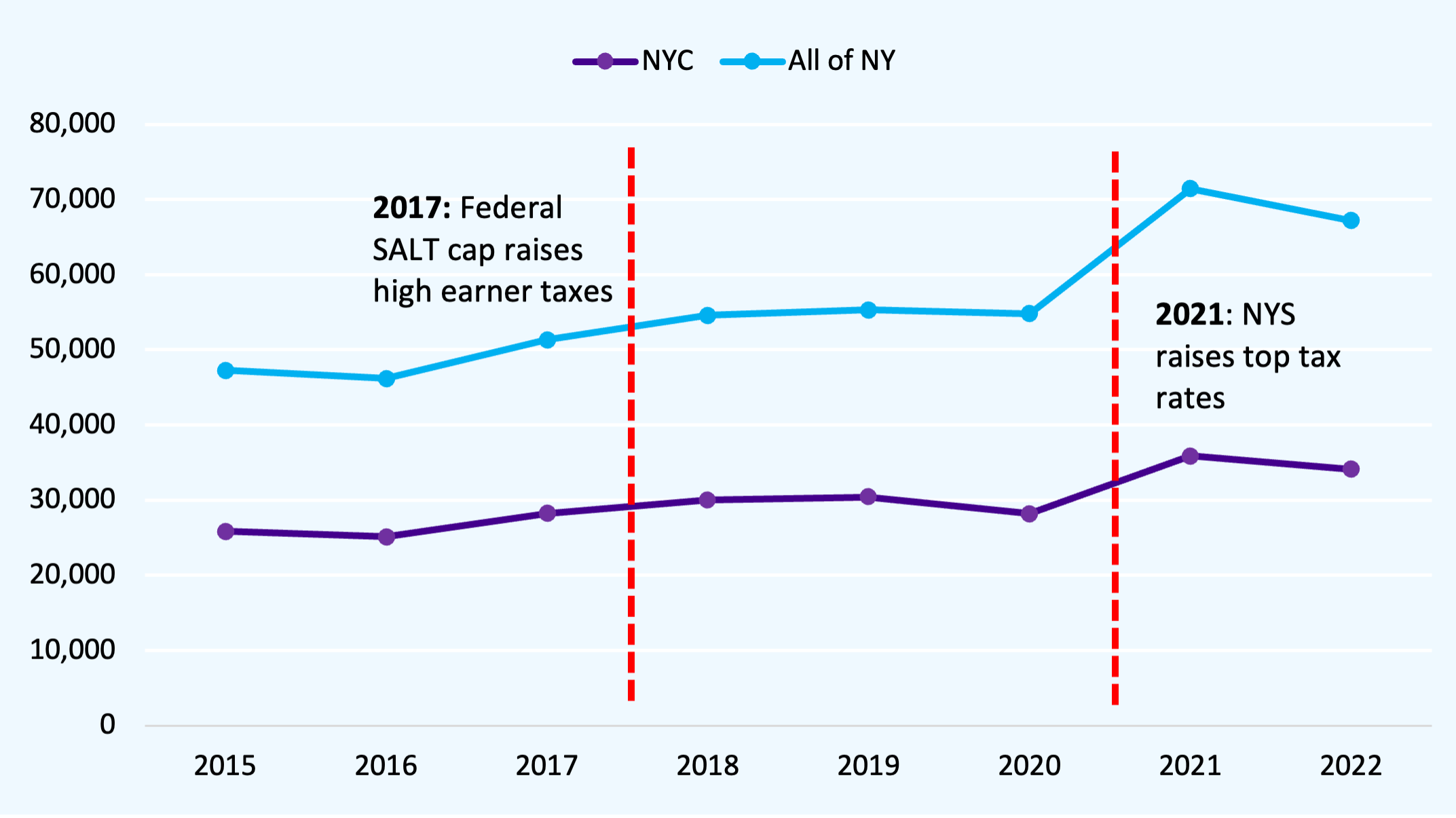

MSNBC host Catherine Rampell objected that FPI’s analysis would not hold true when taxes are increased on the top earners. But FPI’s research does, in fact, address this concern. Our study found that two previous tax rate increases on the state’s top earners – one in 2017 and another in 2021 – did not increase their migration out of the state.

The question of tax flight – i.e. whether the highest earning New Yorkers move to other states in search of lower taxes – has long been a central feature of state policy debates. The issue became particularly salient during the Covid pandemic when New Yorkers of all income groups, but especially the richest, moved away from the city. Following this unusual period, FPI undertook a study of New York State migration trends. We released our groundbreaking study on December 5, 2023 in a feature New York Times article about the affordability challenges facing working families throughout New York and the growth of the state’s millionaire-earner population.

FPI’s migration research also showed that the state’s overall population loss is concentrated in New York City where it is driven by families facing a lack of affordable housing and childcare. Households with young children are 40 percent more likely to leave the state than those without young children, and 36 percent of households report that they are moving in search of more affordable housing.

FPI issued a follow-up report earlier this year examining newly-released Census data, which confirmed the findings of our previous study. In 2023, the top 1 percent of New Yorkers were the only income group with no net migration out of the state. Among all other income groups, migration trends returned to normal levels, and 1/3 of the state’s Covid population loss was regained due to international immigration into New York City.

These studies focused on New York State – but new research by FPI shows that these findings hold true for New York City as well:

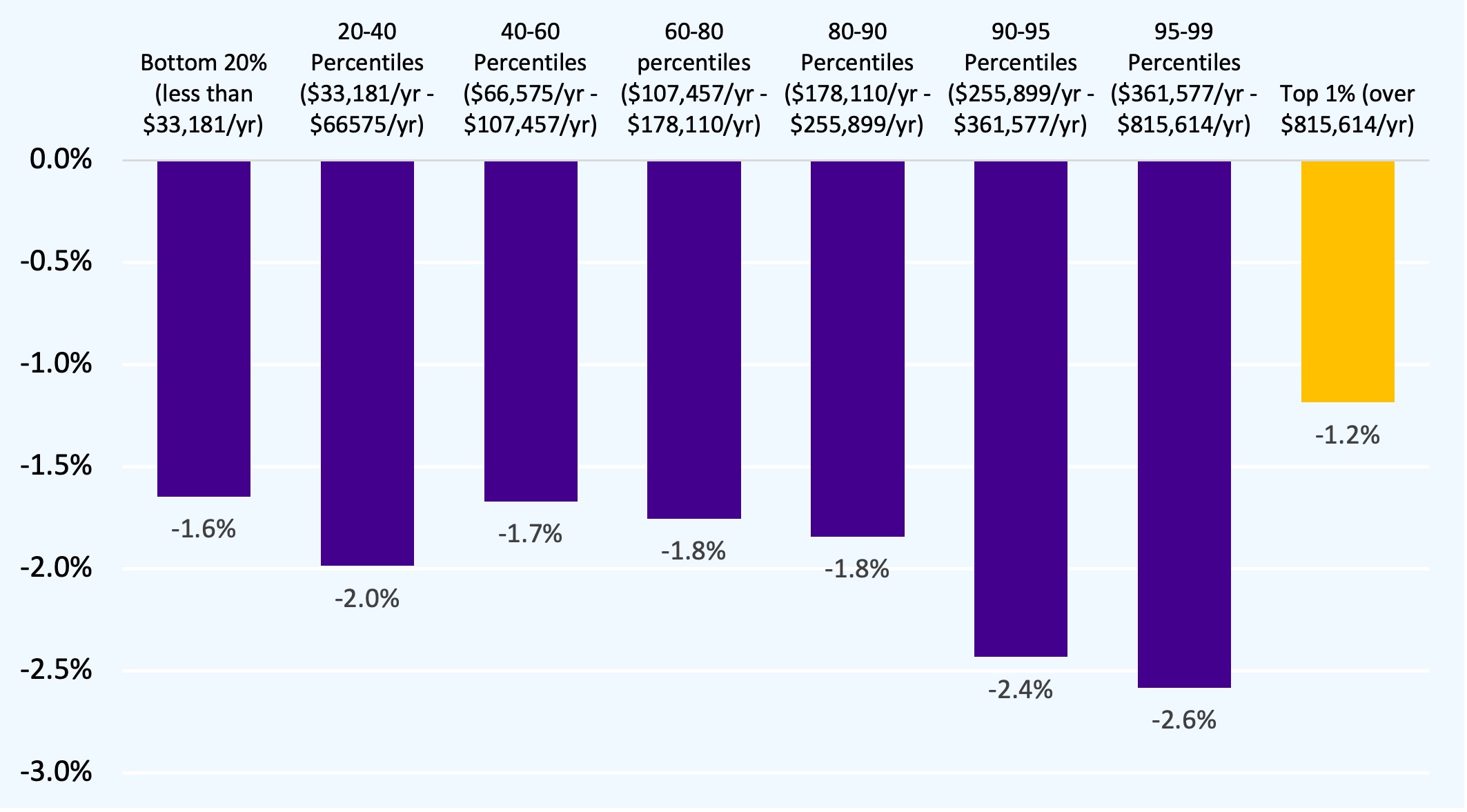

- The top 1 percent of income earners move out of New York City at about half of the rate of all other income groups.

- The city’s population of millionaire-earner households grew from 30,400 in 2019 to 34,127 in 2022. Even though the pandemic saw elevated rates of out-migration among households in the top one percent, the strength of the city economy produced new millionaire households that have sustained the tax base.

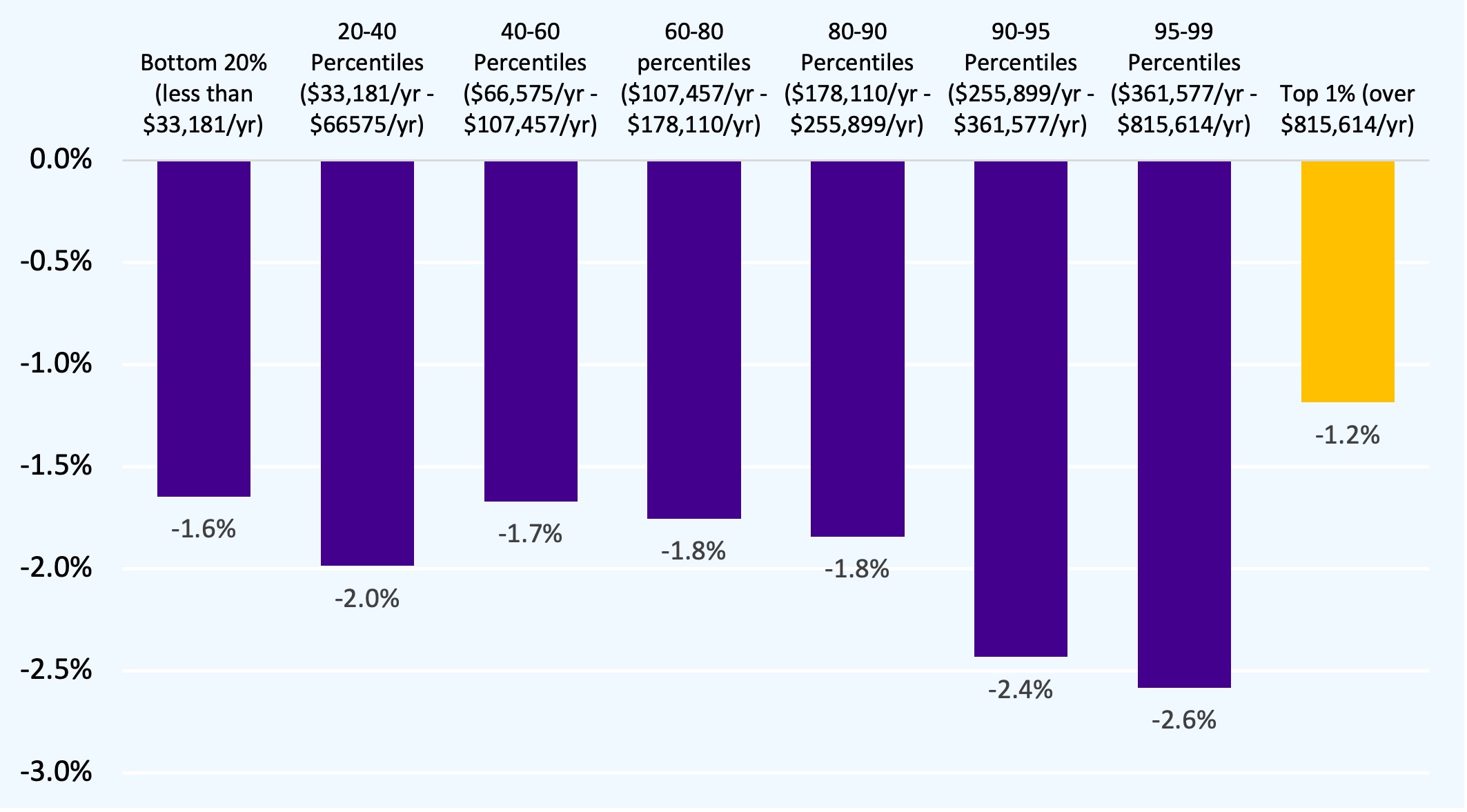

Average out-migration rate from New York City in non-Covid years

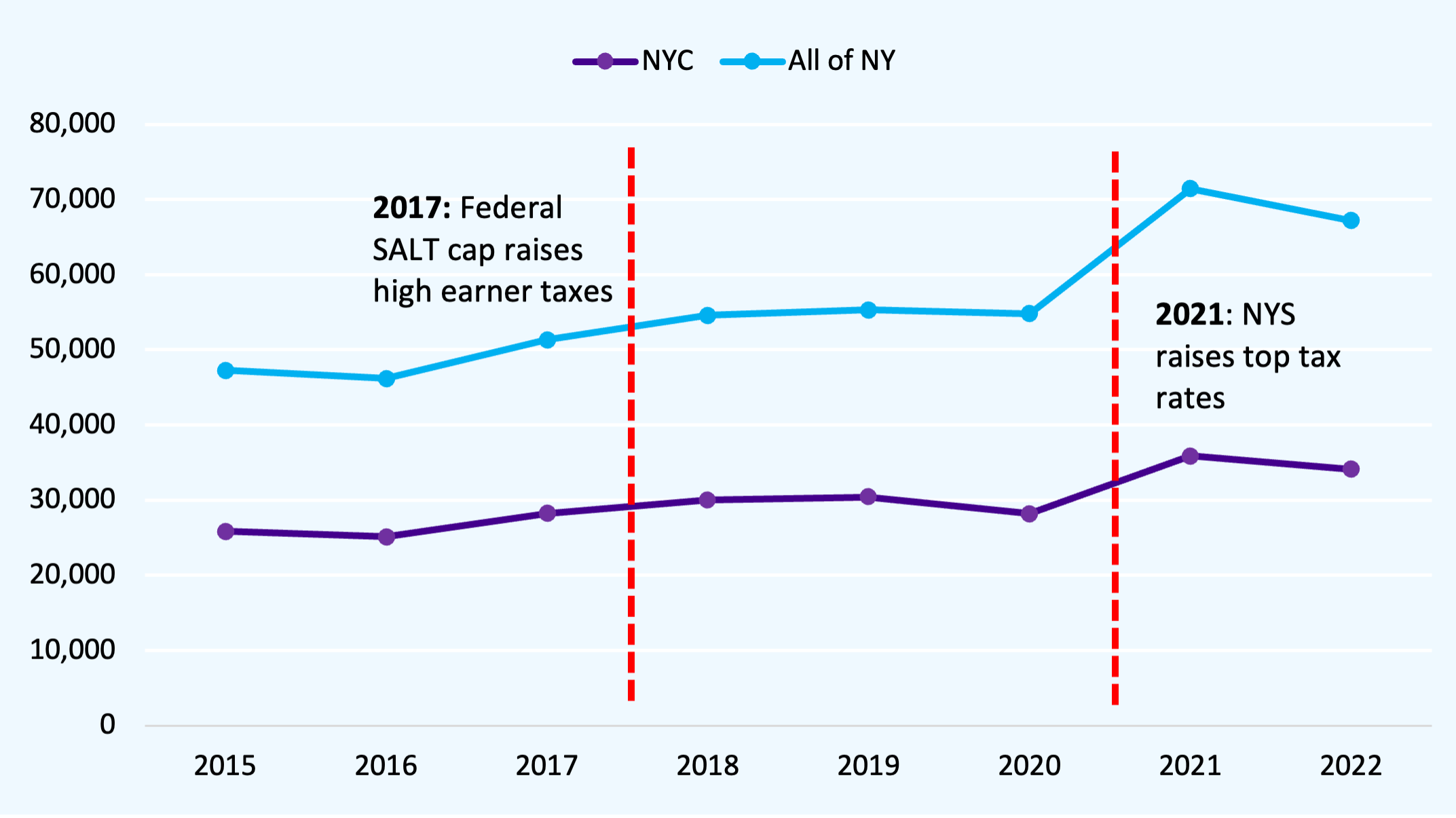

Total number of millionaire tax filers in NYS and NYC

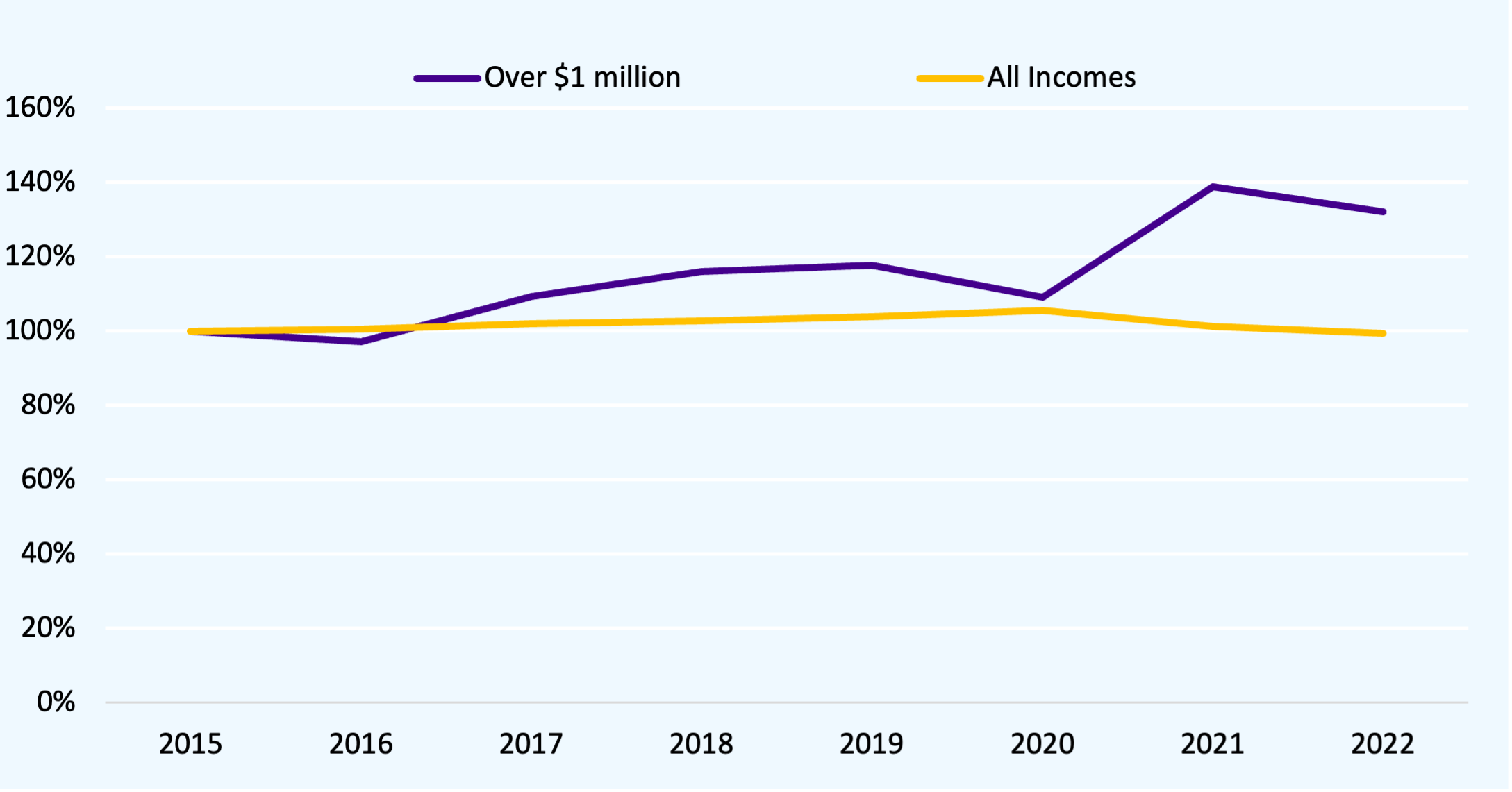

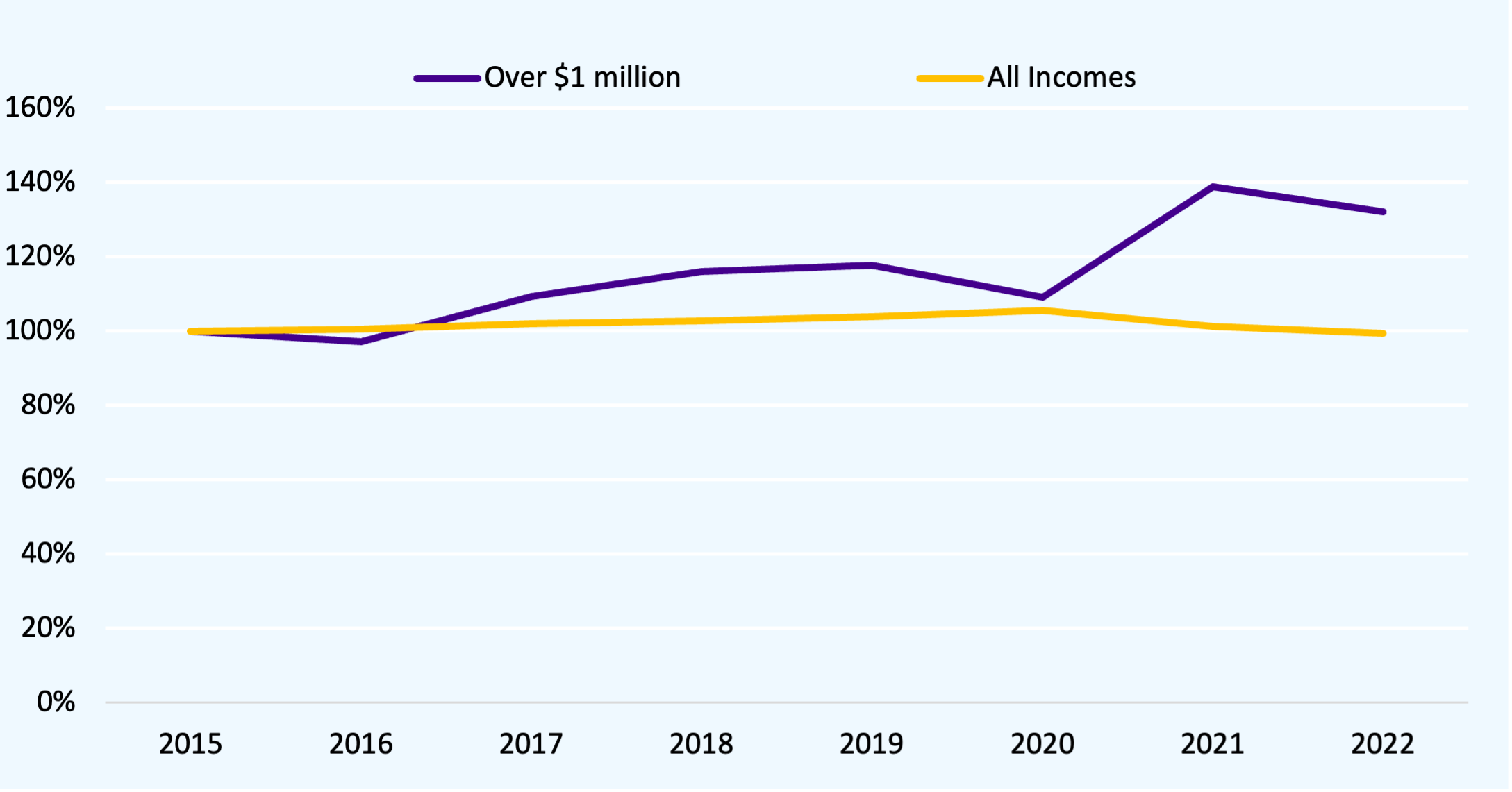

Growth of tax filers in New York City, relative to 2015 level

FPI Research on Tax Migration cited on NBC, CNN, MSNBC

July 7, 2025 |

Zohran Mamdani’s recent victory in the New York City Democratic primary election has brought FPI’s past research on millionaire tax flight into the national spotlight. Mr. Mamdani himself has recently cited FPI’s research on NBC’s Meet the Press, MSNBC and CNN, accurately recounting FPI’s groundbreaking findings that the highest earning New Yorkers move out of the state at ¼ the rate of all other income groups, and that when they do move they tend to move to states with similar tax rates such as New Jersey and California. In other words, the evidence shows that the highest earners generally do not move in search of lower taxes.

MSNBC host Catherine Rampell objected that FPI’s analysis would not hold true when taxes are increased on the top earners. But FPI’s research does, in fact, address this concern. Our study found that two previous tax rate increases on the state’s top earners – one in 2017 and another in 2021 – did not increase their migration out of the state.

The question of tax flight – i.e. whether the highest earning New Yorkers move to other states in search of lower taxes – has long been a central feature of state policy debates. The issue became particularly salient during the Covid pandemic when New Yorkers of all income groups, but especially the richest, moved away from the city. Following this unusual period, FPI undertook a study of New York State migration trends. We released our groundbreaking study on December 5, 2023 in a feature New York Times article about the affordability challenges facing working families throughout New York and the growth of the state’s millionaire-earner population.

FPI’s migration research also showed that the state’s overall population loss is concentrated in New York City where it is driven by families facing a lack of affordable housing and childcare. Households with young children are 40 percent more likely to leave the state than those without young children, and 36 percent of households report that they are moving in search of more affordable housing.

FPI issued a follow-up report earlier this year examining newly-released Census data, which confirmed the findings of our previous study. In 2023, the top 1 percent of New Yorkers were the only income group with no net migration out of the state. Among all other income groups, migration trends returned to normal levels, and 1/3 of the state’s Covid population loss was regained due to international immigration into New York City.

These studies focused on New York State – but new research by FPI shows that these findings hold true for New York City as well:

- The top 1 percent of income earners move out of New York City at about half of the rate of all other income groups.

- The city’s population of millionaire-earner households grew from 30,400 in 2019 to 34,127 in 2022. Even though the pandemic saw elevated rates of out-migration among households in the top one percent, the strength of the city economy produced new millionaire households that have sustained the tax base.

Average out-migration rate from New York City in non-Covid years

Total number of millionaire tax filers in NYS and NYC

Growth of tax filers in New York City, relative to 2015 level