State Corporate Tax Cut Would Cost New York $1.2 Billion in Annual Revenue

January 30, 2023 |

A return to historically low 6.5% corporate tax rate would give corporations a $1.5 billion tax cut by the end of FY 2025

Key Findings

- New York’s corporate tax rate was increased in 2021. This tax increase has raised $3.4 billion of additional revenue to date.

- Corporate tax revenue exceeded initial expectations by $750 million over FY 2022-2024.

- If New York cuts its corporate tax rate this year, returning the rate to 6.5 percent, the state will lose $1.5 billion by the end of fiscal year 2025.

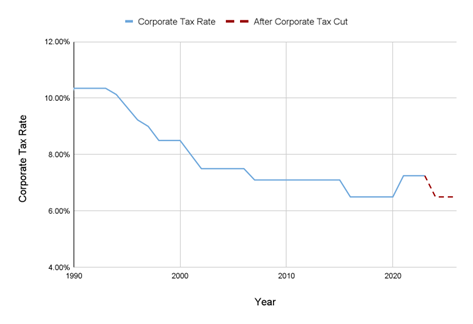

New York’s Corporate Tax: A Return to Historic Lows

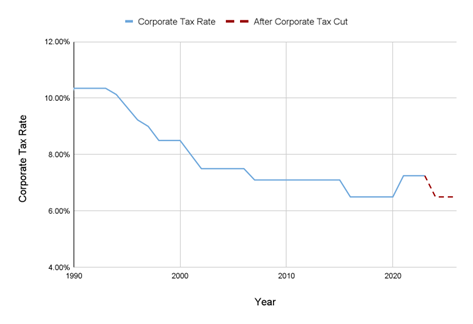

Both the U.S. federal corporate tax rate and New York State’s corporate tax rate have fallen steadily since the 1960s. The 2017 tax law known as the “Tax Cuts and Jobs Act” cut the U.S. federal corporate tax rate from 35 percent to 21 percent, bringing it to its lowest level since 1942.[1] New York State’s corporate tax rate gradually fell from 8.5 percent in 2000 to a low of 6.5 percent in 2016 (under then-Governor Andrew Cuomo) — the lowest rate since 1967. The corporate tax rate remained at its historic low of 6.5 percent until 2021, when it was increased to 7.25 percent for corporations with over $5 million in profits.[2]

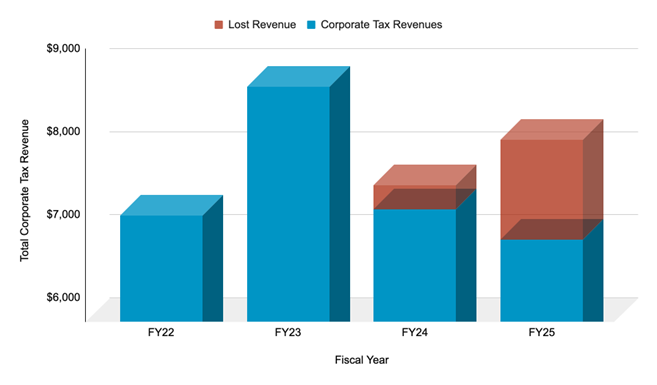

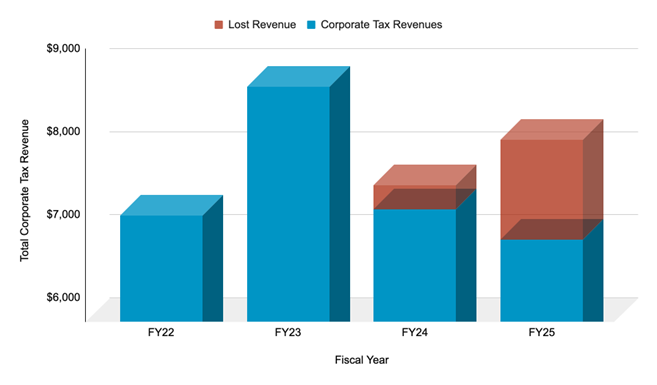

Due to the 2021 tax increase, New York’s corporate tax raised a total of nearly $9 billion in fiscal year 2023. While the state projected increased corporate tax revenue of $2.6 billion in fiscal years 2022 through 2024, the tax increase exceeded initial expectations by $750 million, bringing in a total of $3.4 billion over these three years.[3]

If New York cuts its corporate tax rate this year, returning the rate to 6.5 percent, the impact on state revenue will be significant: The state will lose $1.2 billion in fiscal year 2025. Revenue losses will begin in the last quarter of fiscal year 2024, costing the state nearly $300 million for that quarter.[4]

Fig 1. NY Corporate Tax Rate Cut: Impact on State Revenue

Dollars in millions

Fig 2. Current vs. Projected Corporate Tax Rate Revenue: Fiscal Years 2022 to 2025

Dollars in millions

| Fiscal Year | Total Revenue | Revenue from 2021 Increase | Revenue After Tax Cut | Lost Revenue |

|---|---|---|---|---|

| FY 22 | $7,236 | $1,126 | ||

| FY 23 | $8,790 | $1,368 | ||

| FY 24 | $7,600 | $876 | $7,308 | -$292 |

| FY 25 | $8,154 | $0 | $6,948 | -$1,206 |

Total Loss: -$1,498

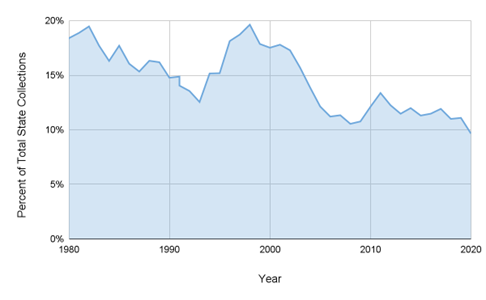

New York’s Corporate Tax in Historical Perspective

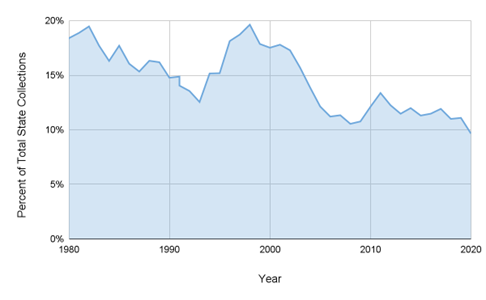

New York’s corporate tax is the state’s third largest source of tax revenue, behind the personal income tax and sales taxes. Due to the falling corporate tax rate over time, corporations now contribute a smaller percentage of the state’s total tax collections than they did in prior decades. New York’s corporate tax rate is also low by regional standards — New Jersey’s rate is 11.5 percent; Pennsylvania’s rate is 8.99 percent; and Massachusetts’ rate is 8.0 percent.

Fig 3. New York’s Falling Corporate Tax Rate: 1990 – 2024

Fig 4. New York’s Corporate Tax Revenues as Share of Total Collections: 1980-2020

Methodology

FPI based its corporate tax surcharge revenue estimates on the initial revenue estimates produced by the New York State Division of Budget in its fiscal year 2022 enacted budget financial plan and more recent financial plan data. FPI’s analysis estimates the base of taxable corporate income, and the taxes that would be raised by the former and current corporate tax rates using fiscal year 2022 estimates. The analysis then updates these estimates using corporate tax revenue projections included in the fiscal year 2023 mid-year financial plan update, the most recent financial plan data, to reflect changing economic conditions since March 2021. FPI used this updated data to estimate the revenue brought in by the new tax rate for fiscal years 2022 through 2025.

Appendix: New York State Corporate Tax Rates: 1948 – 2023

| Year | Corporate Tax Rate |

|---|---|

| 1948-1967 | 5.500% |

| 1968-70 | 7.000% |

| 1971-73 | 9.000% |

| 1974 | 9.000% |

| 1975-76 | 12.000% |

| 1977 | 10.000% |

| 1978-84 | 10.000% |

| 1985-86 | 10.000% |

| 1987-88 | 9.000% |

| 1989 | 9.000% |

| 1990-93 | 10.350% |

| 1994 | 10.125% |

| 1995 | 9.675% |

| 1996 | 9.225% |

| 1997-99 | 9.000% |

| 1999-00 | 8.500% |

| 2000-01 | 8.000% |

| 2001-05 | 7.500% |

| 2006 | 7.500% |

| 2007-2015 | 7.100% |

| 2016-2021 | 6.500% – Cuomo corporate tax cut |

| 2021-2023 | 7.250% – 2021 corporate tax increase |

[1] https://www.taxpolicycenter.org/laws-proposals/major-enacted-tax-legislation-1940-1949.

[2] The corporate tax increase was enacted only for tax years 2021 through 2023.

[3] FPI analysis of Division of Budget financial plans.

[4] The corporate tax rate would fall for tax years beginning in 2024. For the state’s fiscal year 2024 (which runs from April 2023 through March 2024) this would mean a loss of corporate tax revenue for the last three months of the fiscal year, January to March 2024.

State Corporate Tax Cut Would Cost New York $1.2 Billion in Annual Revenue

January 30, 2023 |

A return to historically low 6.5% corporate tax rate would give corporations a $1.5 billion tax cut by the end of FY 2025

Key Findings

- New York’s corporate tax rate was increased in 2021. This tax increase has raised $3.4 billion of additional revenue to date.

- Corporate tax revenue exceeded initial expectations by $750 million over FY 2022-2024.

- If New York cuts its corporate tax rate this year, returning the rate to 6.5 percent, the state will lose $1.5 billion by the end of fiscal year 2025.

New York’s Corporate Tax: A Return to Historic Lows

Both the U.S. federal corporate tax rate and New York State’s corporate tax rate have fallen steadily since the 1960s. The 2017 tax law known as the “Tax Cuts and Jobs Act” cut the U.S. federal corporate tax rate from 35 percent to 21 percent, bringing it to its lowest level since 1942.[1] New York State’s corporate tax rate gradually fell from 8.5 percent in 2000 to a low of 6.5 percent in 2016 (under then-Governor Andrew Cuomo) — the lowest rate since 1967. The corporate tax rate remained at its historic low of 6.5 percent until 2021, when it was increased to 7.25 percent for corporations with over $5 million in profits.[2]

Due to the 2021 tax increase, New York’s corporate tax raised a total of nearly $9 billion in fiscal year 2023. While the state projected increased corporate tax revenue of $2.6 billion in fiscal years 2022 through 2024, the tax increase exceeded initial expectations by $750 million, bringing in a total of $3.4 billion over these three years.[3]

If New York cuts its corporate tax rate this year, returning the rate to 6.5 percent, the impact on state revenue will be significant: The state will lose $1.2 billion in fiscal year 2025. Revenue losses will begin in the last quarter of fiscal year 2024, costing the state nearly $300 million for that quarter.[4]

Fig 1. NY Corporate Tax Rate Cut: Impact on State Revenue

Dollars in millions

Fig 2. Current vs. Projected Corporate Tax Rate Revenue: Fiscal Years 2022 to 2025

Dollars in millions

| Fiscal Year | Total Revenue | Revenue from 2021 Increase | Revenue After Tax Cut | Lost Revenue |

|---|---|---|---|---|

| FY 22 | $7,236 | $1,126 | ||

| FY 23 | $8,790 | $1,368 | ||

| FY 24 | $7,600 | $876 | $7,308 | -$292 |

| FY 25 | $8,154 | $0 | $6,948 | -$1,206 |

Total Loss: -$1,498

New York’s Corporate Tax in Historical Perspective

New York’s corporate tax is the state’s third largest source of tax revenue, behind the personal income tax and sales taxes. Due to the falling corporate tax rate over time, corporations now contribute a smaller percentage of the state’s total tax collections than they did in prior decades. New York’s corporate tax rate is also low by regional standards — New Jersey’s rate is 11.5 percent; Pennsylvania’s rate is 8.99 percent; and Massachusetts’ rate is 8.0 percent.

Fig 3. New York’s Falling Corporate Tax Rate: 1990 – 2024

Fig 4. New York’s Corporate Tax Revenues as Share of Total Collections: 1980-2020

Methodology

FPI based its corporate tax surcharge revenue estimates on the initial revenue estimates produced by the New York State Division of Budget in its fiscal year 2022 enacted budget financial plan and more recent financial plan data. FPI’s analysis estimates the base of taxable corporate income, and the taxes that would be raised by the former and current corporate tax rates using fiscal year 2022 estimates. The analysis then updates these estimates using corporate tax revenue projections included in the fiscal year 2023 mid-year financial plan update, the most recent financial plan data, to reflect changing economic conditions since March 2021. FPI used this updated data to estimate the revenue brought in by the new tax rate for fiscal years 2022 through 2025.

Appendix: New York State Corporate Tax Rates: 1948 – 2023

| Year | Corporate Tax Rate |

|---|---|

| 1948-1967 | 5.500% |

| 1968-70 | 7.000% |

| 1971-73 | 9.000% |

| 1974 | 9.000% |

| 1975-76 | 12.000% |

| 1977 | 10.000% |

| 1978-84 | 10.000% |

| 1985-86 | 10.000% |

| 1987-88 | 9.000% |

| 1989 | 9.000% |

| 1990-93 | 10.350% |

| 1994 | 10.125% |

| 1995 | 9.675% |

| 1996 | 9.225% |

| 1997-99 | 9.000% |

| 1999-00 | 8.500% |

| 2000-01 | 8.000% |

| 2001-05 | 7.500% |

| 2006 | 7.500% |

| 2007-2015 | 7.100% |

| 2016-2021 | 6.500% – Cuomo corporate tax cut |

| 2021-2023 | 7.250% – 2021 corporate tax increase |

[1] https://www.taxpolicycenter.org/laws-proposals/major-enacted-tax-legislation-1940-1949.

[2] The corporate tax increase was enacted only for tax years 2021 through 2023.

[3] FPI analysis of Division of Budget financial plans.

[4] The corporate tax rate would fall for tax years beginning in 2024. For the state’s fiscal year 2024 (which runs from April 2023 through March 2024) this would mean a loss of corporate tax revenue for the last three months of the fiscal year, January to March 2024.