Fact Sheet: Climate Change Superfund Act

July 24, 2024 |

Climate Change Superfund Act needed to fund New York’s climate adaptation measures

Last month, both the Senate and Assembly of the New York State legislature passed the Climate Change Superfund Act (S.02129). The Act, first introduced during the FY 2022 budget cycle, would require the largest fossil fuel companies to pay a total of $75 billion — to be paid over 25 years in $3 billion annual increments — to New York State. The world’s top fossil fuel greenhouse gas emitters will be required to pay a share of the total $75 billion based on their proportional contribution to overall emissions.

The revenue received by the State will be used to pay for Climate Change adaptation measures, including measures to adapt to rising sea levels and the increasing frequency of extreme weather events — measures that wouldn’t be needed but for the high emissions caused by these companies’ business activities.

FPI strongly encourages the Governor to sign the Climate Change Superfund Act into law to mitigate the fiscal costs of climate change adaptation and build a more robust and resilient New York.

The Climate Change Superfund is a necessary source of revenue to pay for the steep costs of climate change incurred by New Yorkers.

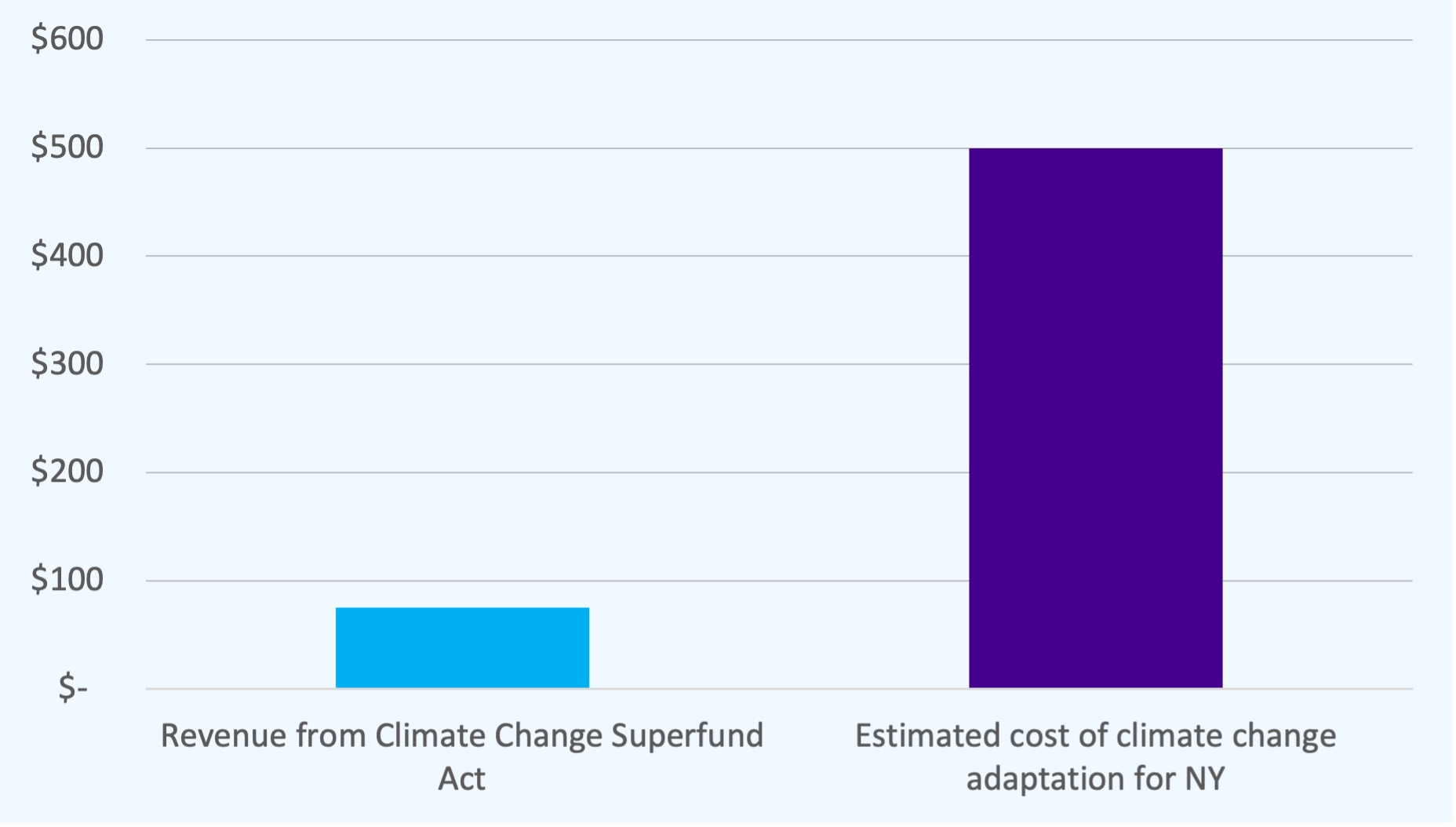

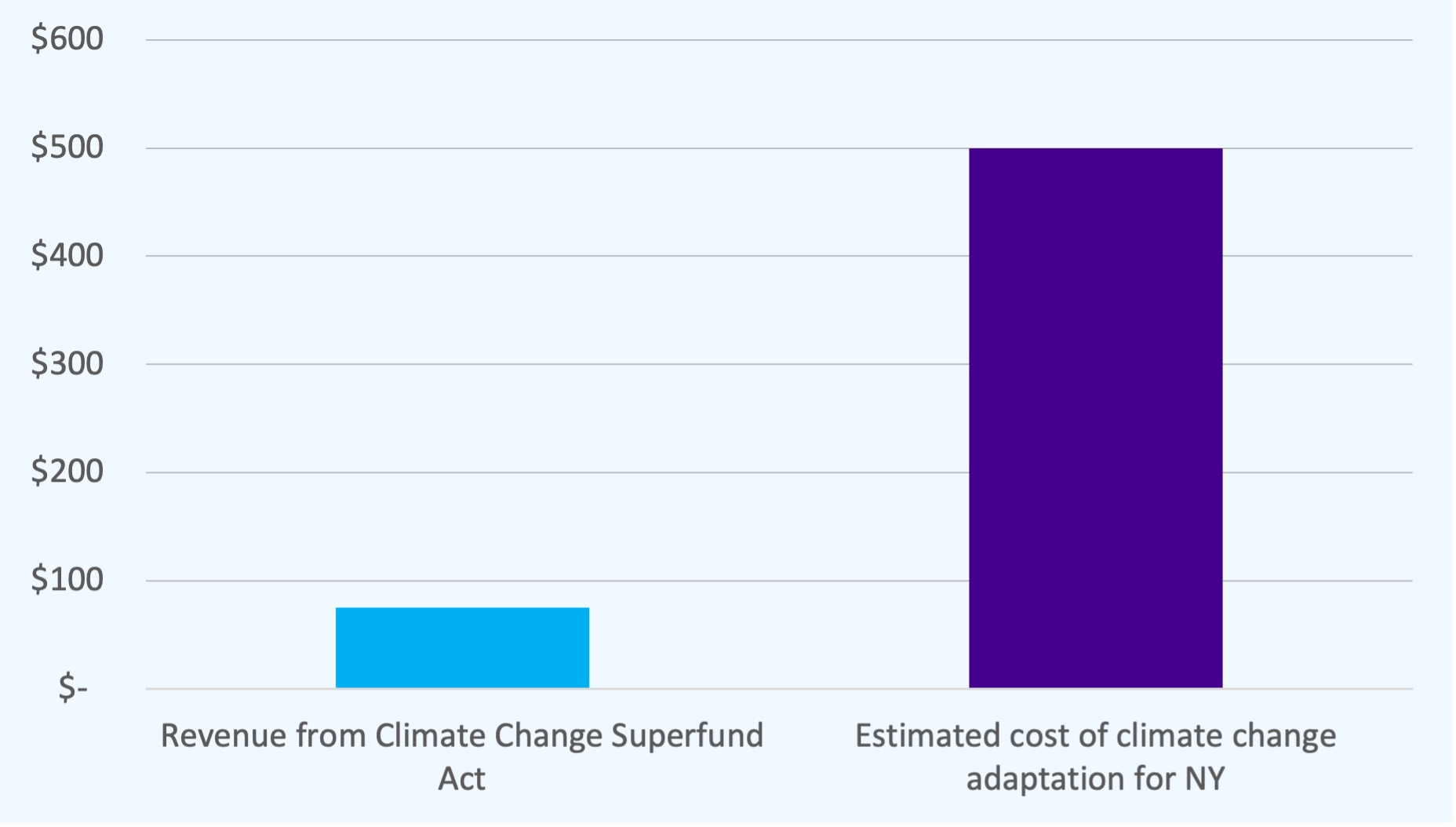

- Based on the current spending and estimates of future costs, it is safe to project that the total cost of climate change adaptation will be well over $500 billion for the State of New York.[1]

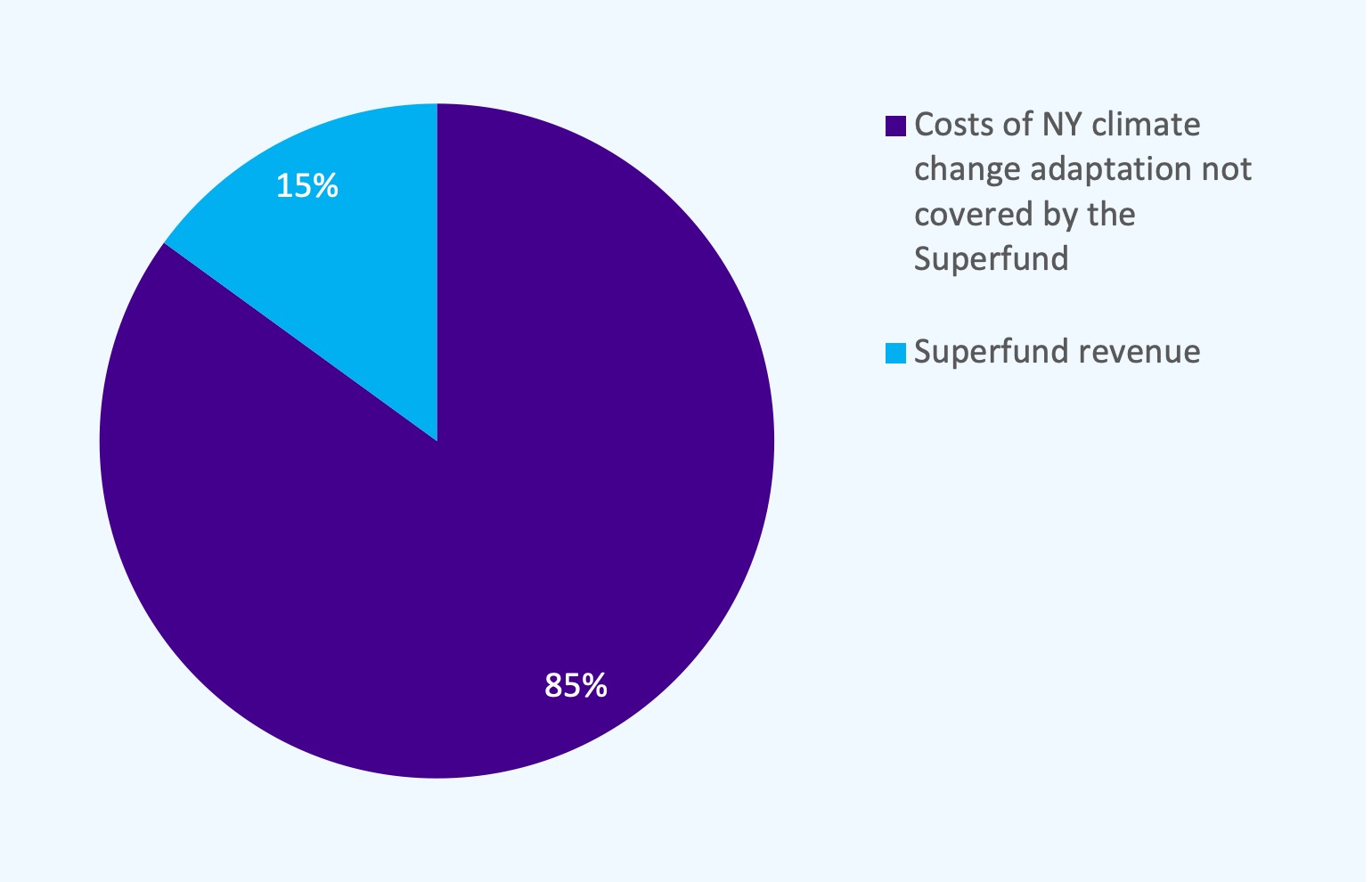

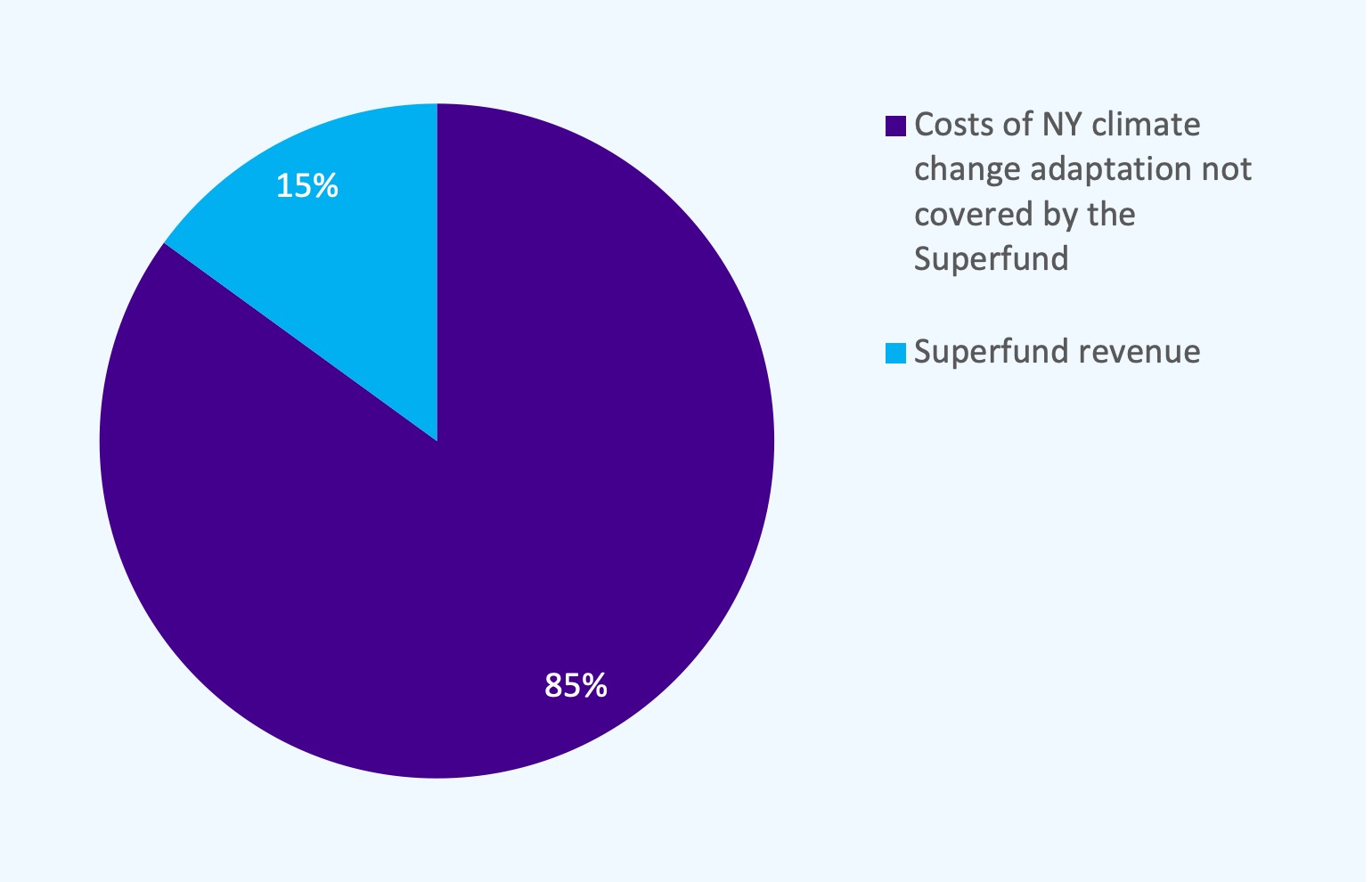

- The total revenue from the Climate Change Superfund Act will cover less than 15 percent of estimated NY climate change adaptation costs.

- In the absence of the Climate Change Superfund, New Yorkers will face increased costs of about $4,000 per person over the next 25 years.

Figure 1. Revenue from the Climate Change Superfund Act compared to estimated climate adaptation costs for NY.

Billions of US Dollars ($)

Figure 2. Revenue from the Climate Change Superfund Act as a proportion of estimated climate adaptation costs for New York State.

The Climate Change Superfund Act will raise significant revenue for the State without having a significant impact on the fossil fuel industry.

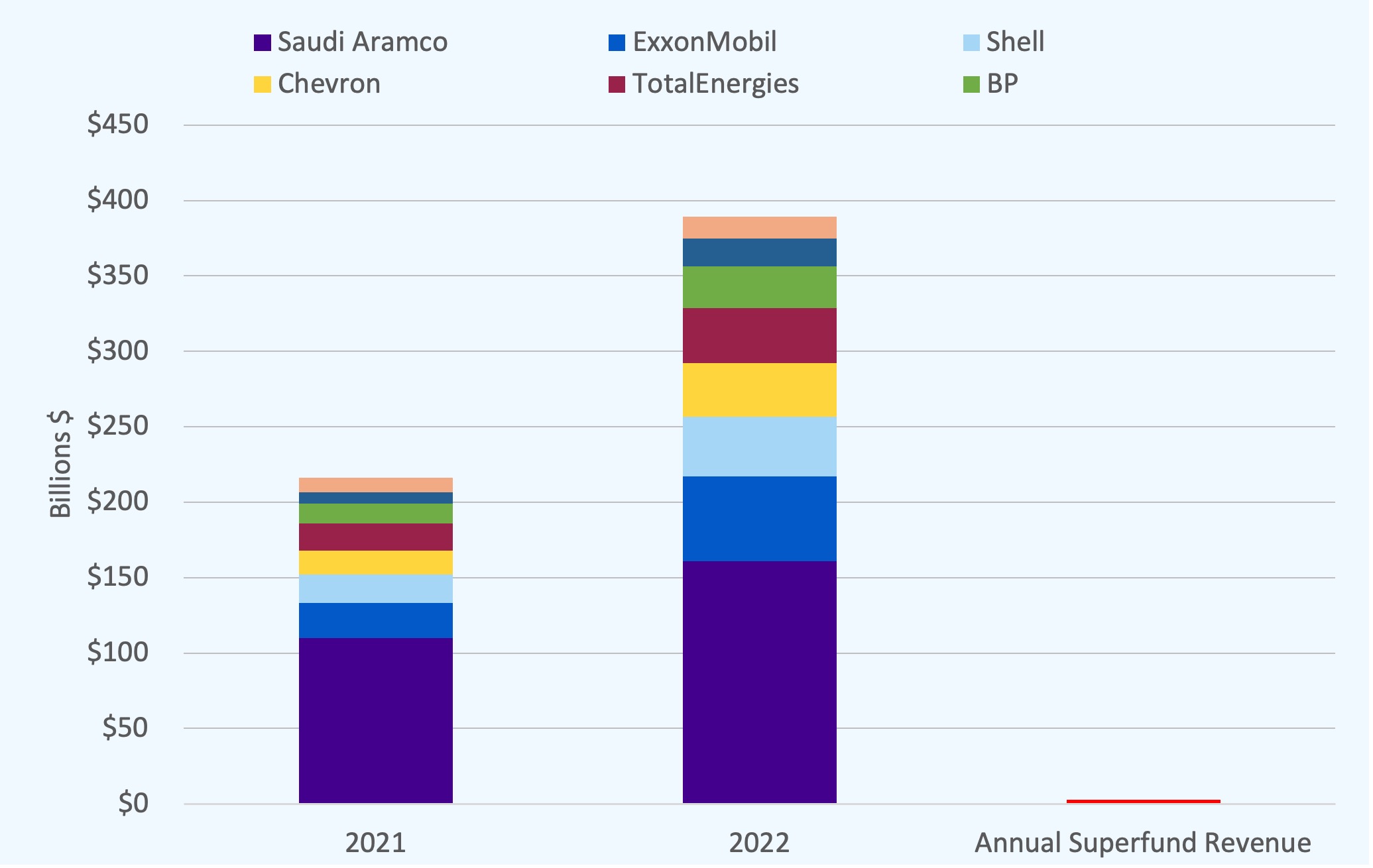

- The Superfund bill only applies to companies that emitted over 1 billion metric tons of CO2 between 2000 and 2018; this includes only 30 to 40 firms, such as US companies ExxonMobil and Chevron and foreign companies including Saudi Aramco, Shell, and BP.[2]

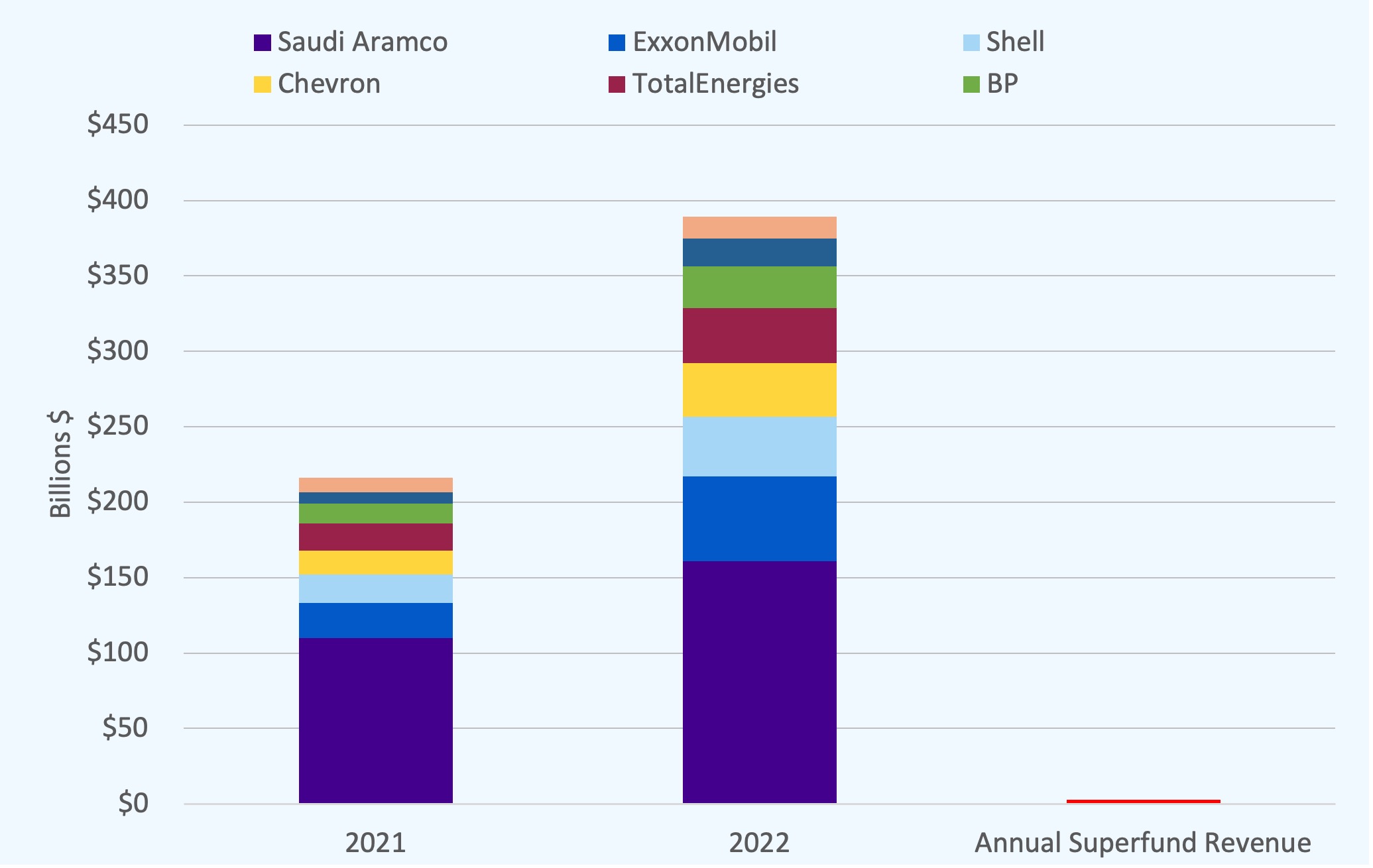

- The largest eight of these fossil fuel companies collectively earned $389 billion in profits in 2022 alone, meaning that an annualized fee of $3 billion amounts to less than 0.8 percent of industry profits in some years.[3]

Figure 3. Net profits for large fossil fuel companies that would be impacted by the Climate Change Superfund Act

Billions of US Dollars ($)

The assessed fees imposed on companies by the Climate Change Superfund Act will not be passed on to consumers and will not raise energy costs.

- The Superfund is designed to impose an assessment on the past actions of mega-emitters. Because these assessments are based on previous behavior, they do not influence current or future decisions of these companies.

- Because the assessments are designed to be a fixed cost for these companies, they will not impact the revenue-maximizing price or the quantity of fossil fuels produced. That is, companies would lose additional profit, rather than recover part of the cost of paying the Superfund assessments, if they were to adjust prices for consumers in response to the assessments created by the Superfund.

- Assessments can raise prices for consumers when they affect all market participants similarly — for instance, if all businesses paid a 10 percent tax on sales of soft drinks, every soft drink retailer might raise their prices by 10 percent. The Superfund, by contrast, affects only a small number of market participants, and each is affected differently, so companies have no means to raise prices across the board for consumers.

- Suppose that Company A pays a very large assessment to the Superfund and raises its prices to make up for the amount paid. Other companies that are paying either (i) no Superfund assessment or (ii) a lower Superfund assessment will be able to sell their products for a lower price, thereby outcompeting Company A — forcing it to lower its prices to the market rate.

Footnotes

[1] The costs of upgrading New York City’s sewer system to withstand storms and flood risk are estimated to be $100 billion (NYC, 2021); A proposal to build a sea barrier that would protect the City from flooding would cost $53 billion (USACE, 2022); The Long Island Regional Planning Council is projecting $75 to $100 billion in taxpayer funds for new roads and other infrastructure improvements required by worsening storms and sea level rise (McGowen, 2023); Other estimates contributing to the overall cost estimate come from NYPIRG (Nov. 2023) and the NY Comptroller (April 2023).

[2] NYPIRG, Nov. 2023

[3] NYPIRG, Nov. 2023

Sources

Climate Change Superfund bill text, Bill No. S02129B/A03351-B, June 2024. https://nyassembly.gov/leg/?default_fld=&leg_video=&bn=S02129&term=2023&Summary=Y&Actions=Y&Committee%26nbspVotes=Y&Floor%26nbspVotes=Y&Memo=Y&Text=Y&LFIN=Y&Chamber%26nbspVideo%2FTranscript=Y

Howard, Peter H., & Xu, Minhong. “Enacting the ‘Polluter Pays’ Principle: New York’s Climate Change Superfund Act and Its Impact on Gasoline Prices,” Institute for Policy Integrity, November 2022. https://www.nypirg.org/climatechange/files/Final_Brief_MPP_Economics.pdf

McGowen, Carl. “Rising ocean, bay tides could eventually reshape Long Island,” Newsday, April 24, 2023. https://www.newsday.com/long-island/environment/climate-change-sea-levels-bay-tides-long-island-s1hsx81r

New York City Office of the Deputy Mayor for Administration, “The New Normal: Combatting Storm-Related Extreme Weather in New York City,” 2021. https://www.nyc.gov/assets/orr/pdf/publications/WeatherReport.pdf

New York State Comptroller, “New York’s Local Governments Adapting to Climate Change: Challenges, Solutions and Costs,” April 2023. https://www.osc.ny.gov/files/local-government/publications/pdf/climate-change-2023.pdf

New York State Department of Taxation and Finance, “Personal income tax: Tabular data,” March 2024. https://www.tax.ny.gov/data/stats/taxfacts/pit-tables.htm#rfbty

Rabe, Anne. “On the Backs of New York City Taxpayers: The Extreme Costs of Climate Change,” New York Public Interest Research Group, November 2023. https://www.nypirg.org/pubs/202311/Report_and_Release_Costs_of_Climate_Change_Nov2023.pdf

US Army Corps of Engineers (USACE), “New York – New Jersey Harbor and Tributaries Study,” September 2022. https://www.nan.usace.army.mil/Portals/37/NYNJHATS%20Draft%20Integrated%20Feasibility%20Report%20Tier%201%20EIS.pdf

Fact Sheet: Climate Change Superfund Act

July 24, 2024 |

Climate Change Superfund Act needed to fund New York’s climate adaptation measures

Last month, both the Senate and Assembly of the New York State legislature passed the Climate Change Superfund Act (S.02129). The Act, first introduced during the FY 2022 budget cycle, would require the largest fossil fuel companies to pay a total of $75 billion — to be paid over 25 years in $3 billion annual increments — to New York State. The world’s top fossil fuel greenhouse gas emitters will be required to pay a share of the total $75 billion based on their proportional contribution to overall emissions.

The revenue received by the State will be used to pay for Climate Change adaptation measures, including measures to adapt to rising sea levels and the increasing frequency of extreme weather events — measures that wouldn’t be needed but for the high emissions caused by these companies’ business activities.

FPI strongly encourages the Governor to sign the Climate Change Superfund Act into law to mitigate the fiscal costs of climate change adaptation and build a more robust and resilient New York.

The Climate Change Superfund is a necessary source of revenue to pay for the steep costs of climate change incurred by New Yorkers.

- Based on the current spending and estimates of future costs, it is safe to project that the total cost of climate change adaptation will be well over $500 billion for the State of New York.[1]

- The total revenue from the Climate Change Superfund Act will cover less than 15 percent of estimated NY climate change adaptation costs.

- In the absence of the Climate Change Superfund, New Yorkers will face increased costs of about $4,000 per person over the next 25 years.

Figure 1. Revenue from the Climate Change Superfund Act compared to estimated climate adaptation costs for NY.

Billions of US Dollars ($)

Figure 2. Revenue from the Climate Change Superfund Act as a proportion of estimated climate adaptation costs for New York State.

The Climate Change Superfund Act will raise significant revenue for the State without having a significant impact on the fossil fuel industry.

- The Superfund bill only applies to companies that emitted over 1 billion metric tons of CO2 between 2000 and 2018; this includes only 30 to 40 firms, such as US companies ExxonMobil and Chevron and foreign companies including Saudi Aramco, Shell, and BP.[2]

- The largest eight of these fossil fuel companies collectively earned $389 billion in profits in 2022 alone, meaning that an annualized fee of $3 billion amounts to less than 0.8 percent of industry profits in some years.[3]

Figure 3. Net profits for large fossil fuel companies that would be impacted by the Climate Change Superfund Act

Billions of US Dollars ($)

The assessed fees imposed on companies by the Climate Change Superfund Act will not be passed on to consumers and will not raise energy costs.

- The Superfund is designed to impose an assessment on the past actions of mega-emitters. Because these assessments are based on previous behavior, they do not influence current or future decisions of these companies.

- Because the assessments are designed to be a fixed cost for these companies, they will not impact the revenue-maximizing price or the quantity of fossil fuels produced. That is, companies would lose additional profit, rather than recover part of the cost of paying the Superfund assessments, if they were to adjust prices for consumers in response to the assessments created by the Superfund.

- Assessments can raise prices for consumers when they affect all market participants similarly — for instance, if all businesses paid a 10 percent tax on sales of soft drinks, every soft drink retailer might raise their prices by 10 percent. The Superfund, by contrast, affects only a small number of market participants, and each is affected differently, so companies have no means to raise prices across the board for consumers.

- Suppose that Company A pays a very large assessment to the Superfund and raises its prices to make up for the amount paid. Other companies that are paying either (i) no Superfund assessment or (ii) a lower Superfund assessment will be able to sell their products for a lower price, thereby outcompeting Company A — forcing it to lower its prices to the market rate.

Footnotes

[1] The costs of upgrading New York City’s sewer system to withstand storms and flood risk are estimated to be $100 billion (NYC, 2021); A proposal to build a sea barrier that would protect the City from flooding would cost $53 billion (USACE, 2022); The Long Island Regional Planning Council is projecting $75 to $100 billion in taxpayer funds for new roads and other infrastructure improvements required by worsening storms and sea level rise (McGowen, 2023); Other estimates contributing to the overall cost estimate come from NYPIRG (Nov. 2023) and the NY Comptroller (April 2023).

[2] NYPIRG, Nov. 2023

[3] NYPIRG, Nov. 2023

Sources

Climate Change Superfund bill text, Bill No. S02129B/A03351-B, June 2024. https://nyassembly.gov/leg/?default_fld=&leg_video=&bn=S02129&term=2023&Summary=Y&Actions=Y&Committee%26nbspVotes=Y&Floor%26nbspVotes=Y&Memo=Y&Text=Y&LFIN=Y&Chamber%26nbspVideo%2FTranscript=Y

Howard, Peter H., & Xu, Minhong. “Enacting the ‘Polluter Pays’ Principle: New York’s Climate Change Superfund Act and Its Impact on Gasoline Prices,” Institute for Policy Integrity, November 2022. https://www.nypirg.org/climatechange/files/Final_Brief_MPP_Economics.pdf

McGowen, Carl. “Rising ocean, bay tides could eventually reshape Long Island,” Newsday, April 24, 2023. https://www.newsday.com/long-island/environment/climate-change-sea-levels-bay-tides-long-island-s1hsx81r

New York City Office of the Deputy Mayor for Administration, “The New Normal: Combatting Storm-Related Extreme Weather in New York City,” 2021. https://www.nyc.gov/assets/orr/pdf/publications/WeatherReport.pdf

New York State Comptroller, “New York’s Local Governments Adapting to Climate Change: Challenges, Solutions and Costs,” April 2023. https://www.osc.ny.gov/files/local-government/publications/pdf/climate-change-2023.pdf

New York State Department of Taxation and Finance, “Personal income tax: Tabular data,” March 2024. https://www.tax.ny.gov/data/stats/taxfacts/pit-tables.htm#rfbty

Rabe, Anne. “On the Backs of New York City Taxpayers: The Extreme Costs of Climate Change,” New York Public Interest Research Group, November 2023. https://www.nypirg.org/pubs/202311/Report_and_Release_Costs_of_Climate_Change_Nov2023.pdf

US Army Corps of Engineers (USACE), “New York – New Jersey Harbor and Tributaries Study,” September 2022. https://www.nan.usace.army.mil/Portals/37/NYNJHATS%20Draft%20Integrated%20Feasibility%20Report%20Tier%201%20EIS.pdf