Factsheet: Expiration of CARES Act Unemployment Benefits Will Harm New Yorkers and the Economy

December 18, 2020 |

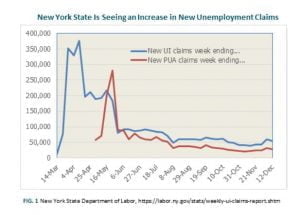

Unemployment claims for the weeks ending December 5 and 12, 2020, are 23 percent higher than claims from the two prior weeks, November 21 and 28. Unemployment in New York State remains historically high, with initial claims for the week of December 12 rising by as much as 400 and 500 percent in some counties.

- The remaining enhanced unemployment insurance (UI) programs established under the CARES Act will expire on December 26, 2020.

- Over 1 million New Yorkers will lose benefits when Pandemic Unemployment Assistance (PUA) and Pandemic Emergency Unemployment Compensation (PEUC) expire.

- These programs help workers who are either not eligible for regular UI (PUA) or workers who have lost eligibility for regular UI (PEUC).

- A recent Household Pulse survey reveals that 35 percent of New Yorkers who have experienced a decline in their incomes have used UI benefits to make ends meet, with an increasing share – 31 percent – now relying on credit cards to cover household expenses.

Since the start of the coronavirus pandemic, New York State has processed over 6 million claims for UI benefits:

4.3 million for regular UI and 1.8 million for PUA.

- To date, New York State has approved over $52 billion in unemployment compensation to workers experiencing layoffs, allowing them to care for themselves and their families and remain safely housed.

- Without federal action to provide aid and protect the unemployment expansions enacted through CARES, it is likely that the unemployment rate will remain historically high and workers and communities will suffer severe economic harm and worsen existing racial, and ethnic inequities.

by Brent Kramer, PhD, Senior Economist, and Cara Long Corra, Senior Policy Analyst

Download the factsheet pdf “Expiration of CARES Act Unemployment Benefits Will Harm New Yorkers and the Economy”

The Fiscal Policy Institute is a nonpartisan, nonprofit research and education organization committed to improving public policies and private practices to better the economic and social conditions of all.

###

Factsheet: Expiration of CARES Act Unemployment Benefits Will Harm New Yorkers and the Economy

December 18, 2020 |

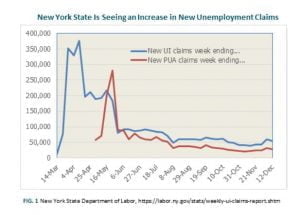

Unemployment claims for the weeks ending December 5 and 12, 2020, are 23 percent higher than claims from the two prior weeks, November 21 and 28. Unemployment in New York State remains historically high, with initial claims for the week of December 12 rising by as much as 400 and 500 percent in some counties.

- The remaining enhanced unemployment insurance (UI) programs established under the CARES Act will expire on December 26, 2020.

- Over 1 million New Yorkers will lose benefits when Pandemic Unemployment Assistance (PUA) and Pandemic Emergency Unemployment Compensation (PEUC) expire.

- These programs help workers who are either not eligible for regular UI (PUA) or workers who have lost eligibility for regular UI (PEUC).

- A recent Household Pulse survey reveals that 35 percent of New Yorkers who have experienced a decline in their incomes have used UI benefits to make ends meet, with an increasing share – 31 percent – now relying on credit cards to cover household expenses.

Since the start of the coronavirus pandemic, New York State has processed over 6 million claims for UI benefits:

4.3 million for regular UI and 1.8 million for PUA.

- To date, New York State has approved over $52 billion in unemployment compensation to workers experiencing layoffs, allowing them to care for themselves and their families and remain safely housed.

- Without federal action to provide aid and protect the unemployment expansions enacted through CARES, it is likely that the unemployment rate will remain historically high and workers and communities will suffer severe economic harm and worsen existing racial, and ethnic inequities.

by Brent Kramer, PhD, Senior Economist, and Cara Long Corra, Senior Policy Analyst

Download the factsheet pdf “Expiration of CARES Act Unemployment Benefits Will Harm New Yorkers and the Economy”

The Fiscal Policy Institute is a nonpartisan, nonprofit research and education organization committed to improving public policies and private practices to better the economic and social conditions of all.

###