July Cash Receipts Remain Steady for Third Straight Month

August 16, 2023 |

Three months of strong tax receipts confirm State economy remains robust & align with improving economic forecasts

ALBANY, NY | August 16, 2023 — The State Comptroller released its July Cash Report today, showing that July tax receipts came in over projections and over July 2022 levels:

- July 2023 receipts: $7.75 billion

- July 2023 projections: $6.87 billion

- July 2022 receipts: $6.97 billion

Following the cash report release, Fiscal Policy Institute Executive Director Nathan Gusdorf released the following statements:

What the cash report says:

“The New York State Comptroller’s July cash basis report shows that tax receipts for the month of July continue to stabilize for the third month in a row after a shortfall in April. The July receipts confirm that New York’s tax base and economy remain strong, and that shortfalls in April reflected weaker-than-expected capital gains in tax year 2022 rather than a deterioration in current economic conditions.

“Total State funds receipts for the month of July were 12.9 percent above projections and 11.3 percent above July 2022 levels. Personal income tax receipts were 11.2 percent above projections. Business and consumption taxes both exceeded projections and 2022 receipts as well. Year-to-date receipts remain below the same months in 2022 due entirely to decreased April 2023 receipts. The month of April 2023 remains an outlier due to weak capital gains and volatility from the state’s Pass-Through Entity Tax (PTET).

What the data indicate:

“Three months of strong tax receipts confirm that the state economy remains robust, and align with improving economic forecasts. While predictions of a recession have been revised to show less risk on the horizon, there is always the possibility of unforeseen events that change the forecasted path of the economy. However, with cash reserves of $19.5 billion, the State is in a strong position to manage any future revenue shortfalls by drawing on reserves. In the event of a prolonged economic downturn, it is imperative that the State sustain its public services by drawing on these robust reserves.”

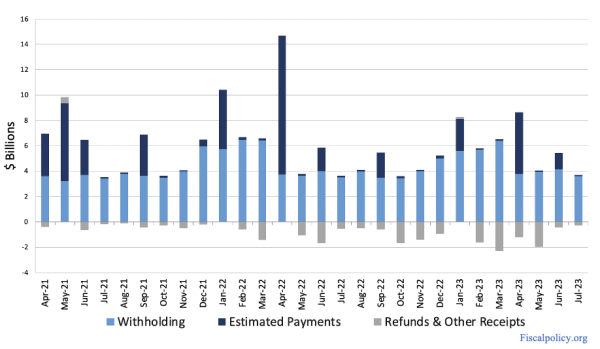

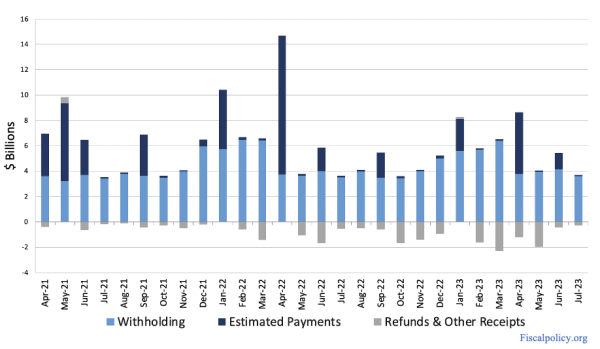

Personal income tax receipts by month and fiscal year (billions $).

Personal income tax receipts broken down by type.

The Fiscal Policy Institute is a nonpartisan, nonprofit research and education organization committed to improving public policies and private practices to better the economic and social conditions of all.

###

July Cash Receipts Remain Steady for Third Straight Month

August 16, 2023 |

Three months of strong tax receipts confirm State economy remains robust & align with improving economic forecasts

ALBANY, NY | August 16, 2023 — The State Comptroller released its July Cash Report today, showing that July tax receipts came in over projections and over July 2022 levels:

- July 2023 receipts: $7.75 billion

- July 2023 projections: $6.87 billion

- July 2022 receipts: $6.97 billion

Following the cash report release, Fiscal Policy Institute Executive Director Nathan Gusdorf released the following statements:

What the cash report says:

“The New York State Comptroller’s July cash basis report shows that tax receipts for the month of July continue to stabilize for the third month in a row after a shortfall in April. The July receipts confirm that New York’s tax base and economy remain strong, and that shortfalls in April reflected weaker-than-expected capital gains in tax year 2022 rather than a deterioration in current economic conditions.

“Total State funds receipts for the month of July were 12.9 percent above projections and 11.3 percent above July 2022 levels. Personal income tax receipts were 11.2 percent above projections. Business and consumption taxes both exceeded projections and 2022 receipts as well. Year-to-date receipts remain below the same months in 2022 due entirely to decreased April 2023 receipts. The month of April 2023 remains an outlier due to weak capital gains and volatility from the state’s Pass-Through Entity Tax (PTET).

What the data indicate:

“Three months of strong tax receipts confirm that the state economy remains robust, and align with improving economic forecasts. While predictions of a recession have been revised to show less risk on the horizon, there is always the possibility of unforeseen events that change the forecasted path of the economy. However, with cash reserves of $19.5 billion, the State is in a strong position to manage any future revenue shortfalls by drawing on reserves. In the event of a prolonged economic downturn, it is imperative that the State sustain its public services by drawing on these robust reserves.”

Personal income tax receipts by month and fiscal year (billions $).

Personal income tax receipts broken down by type.

The Fiscal Policy Institute is a nonpartisan, nonprofit research and education organization committed to improving public policies and private practices to better the economic and social conditions of all.

###