Governor Hochul’s Affordability Policy Report Card

January 18, 2025 |

The governor wants to address affordability – but will cash handouts do it?

Governor Hochul’s State of the State address made clear that “affordability” is her top priority this session. As part of her agenda, Governor Hochul and her team have put forward a set of policies intended to “put money back in New Yorkers’ pockets.” The four major proposals include a tax cut, an “inflation rebate payment,” an expansion of the child tax credit, and fully funding free school lunches for all public-school students in the State.

Of these four proposals, only the child tax credit and free school lunches will significantly impact New Yorkers’ household budgets. The tax cut and inflation rebate payments create significant costs for the State, undermining the state’s ability to invest in meaningful affordability policy, without producing significant financial support for New York families.

Affordability is the right goal, and one that the governor is correct to prioritize. However, achieving affordability requires structural reforms that target root causes, not one-off spending and small tax cuts that chip away at the government’s ability to provide strong public services.

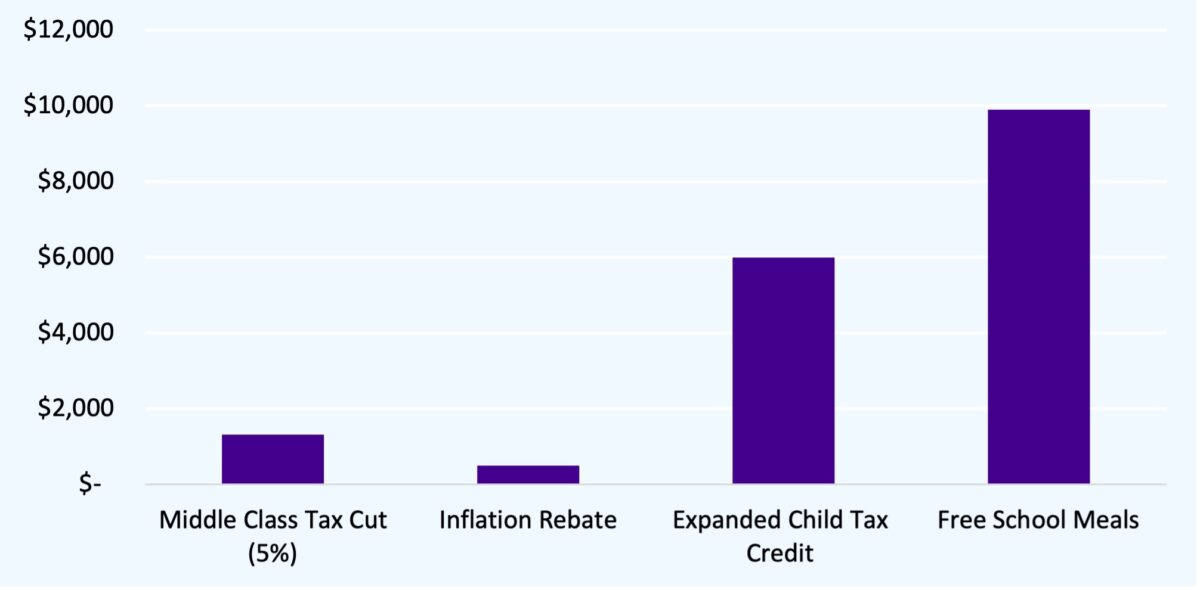

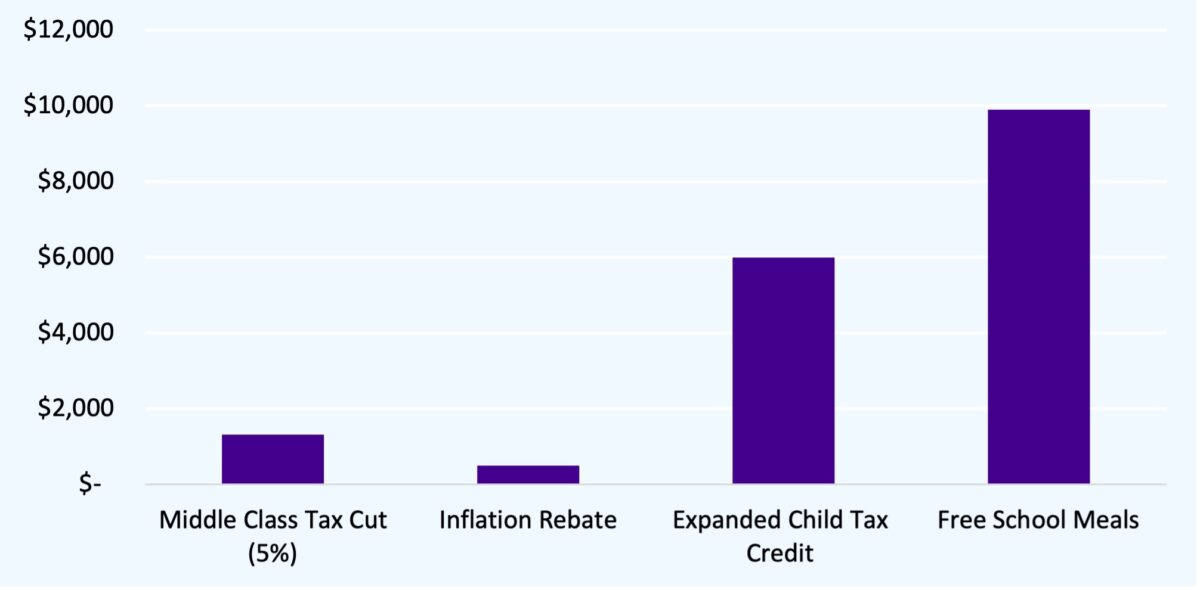

Figure 1. Accumulated 5-year benefit to married couple with two children.

Note: These estimates assume that the family earns $100,000 per year and that the children are ages 2 and 6 at the start of the 5-year period. Varying these specifications does not dramatically change the results.

Middle Class Tax Cut

Fiscal Cost: $1 billion

FPI’s Recommendation: Reject

The governor has proposed a “middle class” income tax cut for households making up to $323,200 per year (for joint filers), at an estimated cost to the State of $1 billion. This tax cut follows a substantially larger “middle class” tax cut that was enacted in the fiscal year 2017 budget and fully phased in by fiscal year 2024. The executive branch estimated that these prior tax cuts would cost $4.2 billion by 2025; now the governor plans to increase the cumulative revenue loss from a decade of “middle class” tax cuts to over $5 billion annually. As a point of reference, the MTA is currently estimated to need about $2 billion annually in new revenue to support $33 billion of debt issuance for its capital plan. Or, $5 billion of annual revenue could cover about 1/3 of the cost of a statewide universal childcare program. Investing in transit or childcare—among other options—would be more valuable to middle class families than a few hundred dollars per year in tax cuts.

The governor’s office estimates that this tax cut will impact 8.3 million taxpayers, with a maximum tax liability decrease of 5 percent. Without more detail on the proposal, it is difficult to say exactly how much this will amount to in savings for each household. Crudely speaking, $1 billion spread across 8.3 million taxpayers implies an average tax saving of $120 per taxpayer, hardly an amount that constitutes significant savings in the face of real household budgeting concerns.

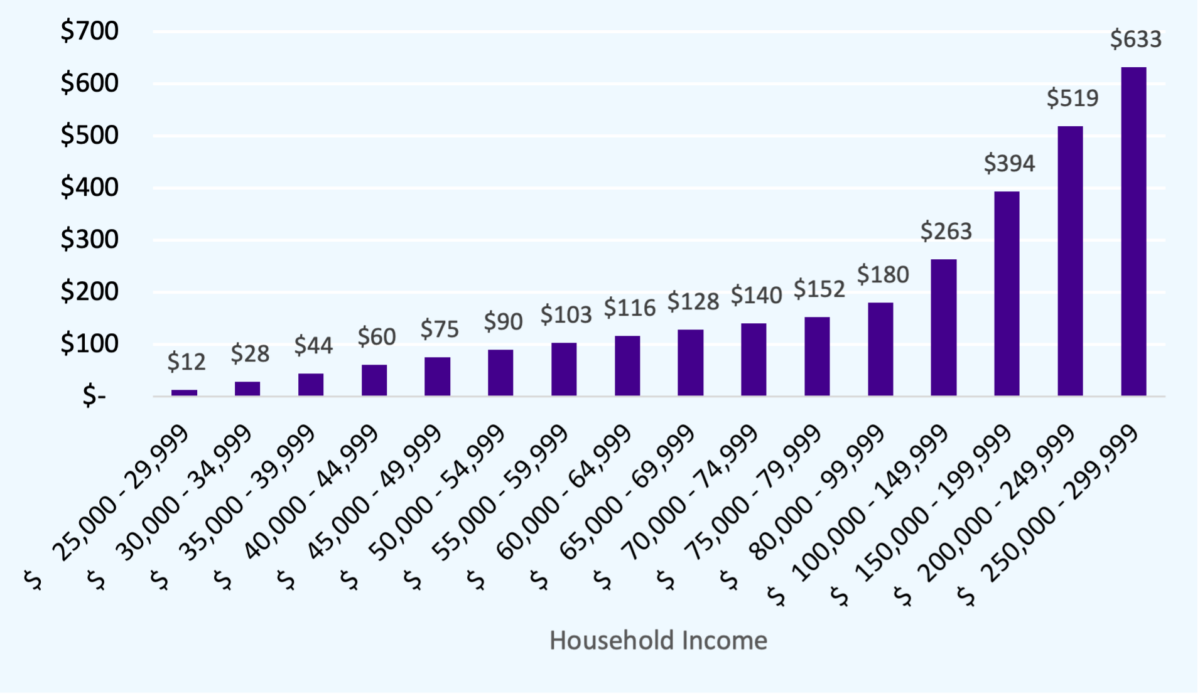

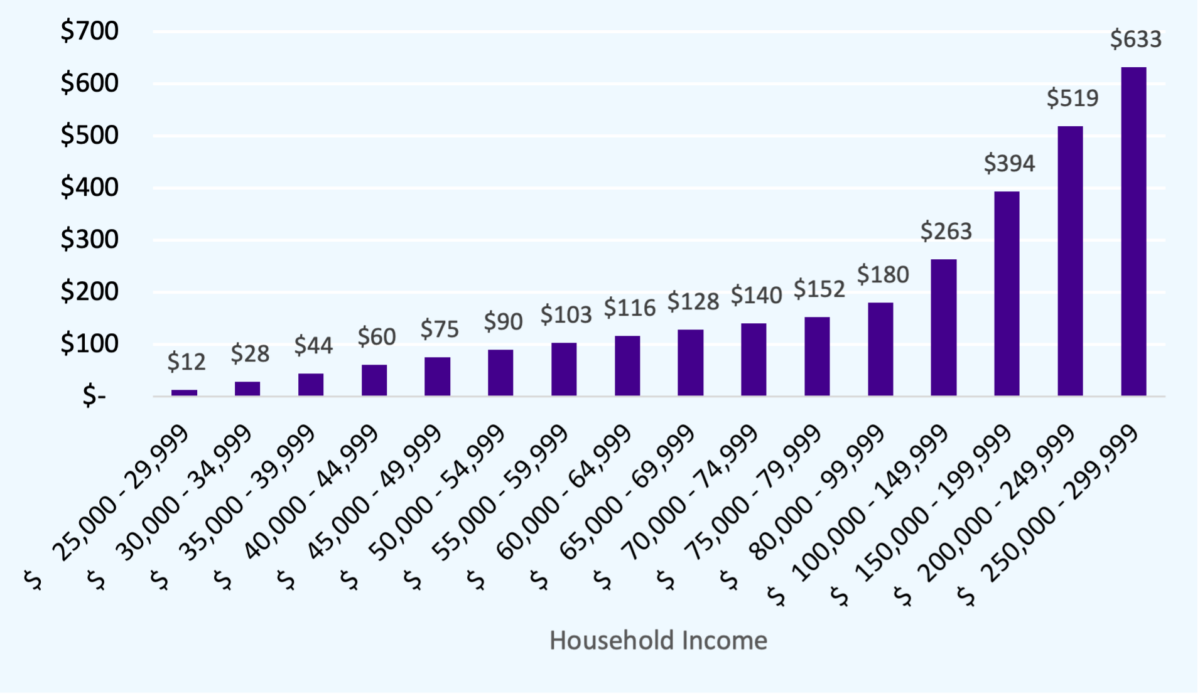

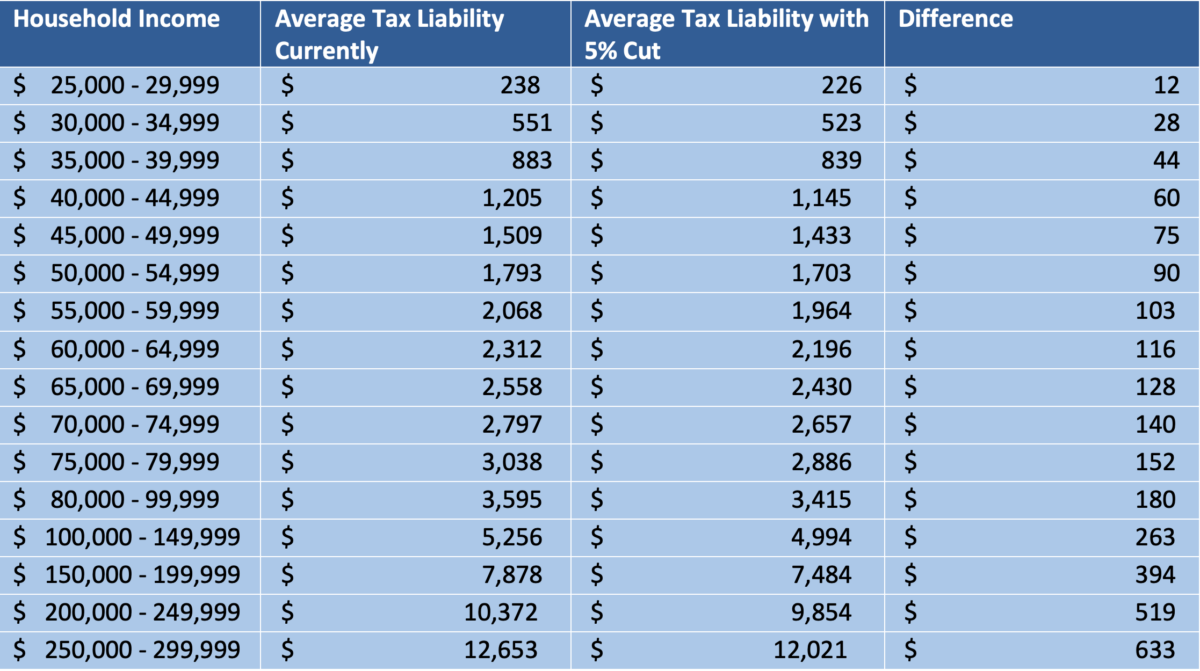

If applied progressively, the policy may deliver more savings to those with lower incomes, but even then, the tax cut isn’t poised to deliver more than a few hundred dollars of relief to families—anything more would necessarily cost the state more than $1 billion. If a tax liability decrease of 5 percent is applied to all taxpayers up to the income eligibility threshold, the total cost to the state would be about $1.2 billion. The average tax liability decrease by income group is shown in the chart below. As you can see, the maximum tax cut would be $633 for those earning up to $300,000. For those earning less, the tax cut is far less significant; for those earning less than $100,000 per year, a 5 percent tax decrease would be less than $200.

Figure 2. Estimated tax liability decrease for 5 percent tax cut.

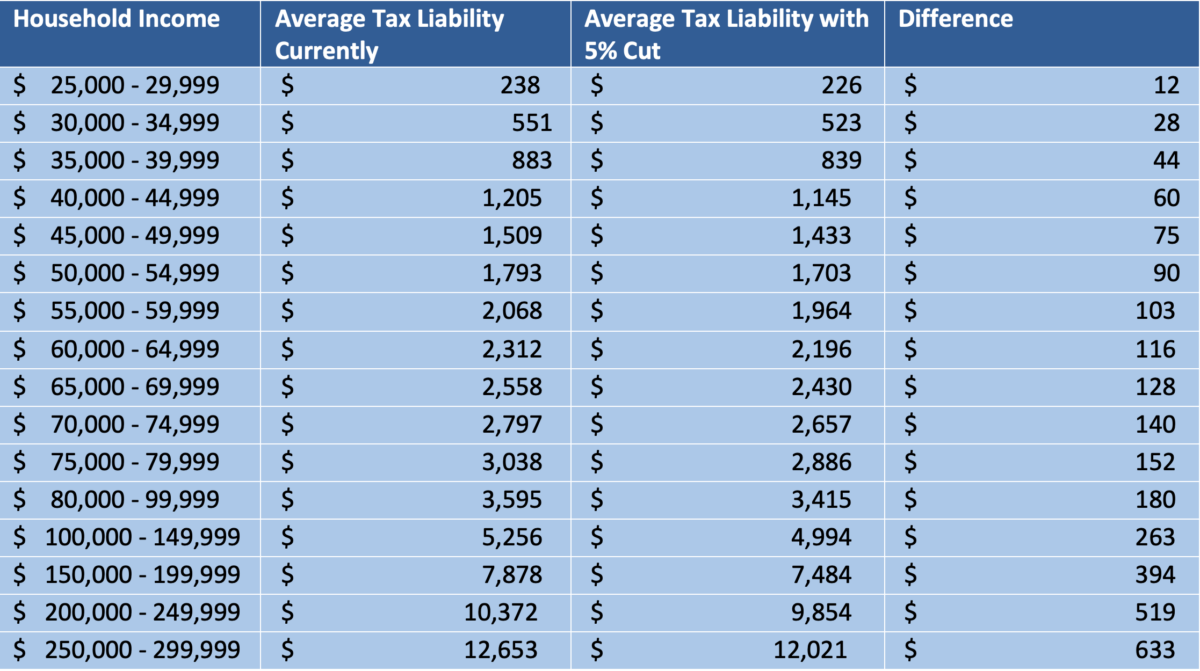

Table 1. Estimated tax liability decrease for 5 percent tax cut.

This tax cut will not provide meaningful relief to working New Yorkers, and will only further undermine the State’s ability to invest in public services and infrastructure that ease cost of living pressures. Moreover, revenue losses are particularly unwise at a time of uncertainty around federal funding. NYCHA alone could lose up to $1.3 billion from federal funding cuts under the new Trump administration, and the State must be prepared to backfill such losses.

Inflation Rebate Payments

Fiscal Cost: $3 billion

FPI’s Recommendation: Reject

Last month the governor released her first pro-affordability initiative: a one-time cash payment to New York households to offset the effects of inflation. Joint filers making up to $300,000 per year would receive a one-time payment of $500 and single filers making up to $150,000 per year would receive a one-time payment of $300. In total, the payments would go to about 8.6 million taxpayers and would cost the State $3 billion.

Theoretically, the goal of this program is to rebate sales tax receipts that rose quickly due to inflation over the last few years. However, a policy of this nature—sending modest checks to many people—could have the adverse impact of actually increasing price inflation. While the governor’s intent is to alleviate the negative impact of inflation on family budgets, her policy looks more like a stimulus policy than a measure to reduce cost pressures. If implemented, the policy could easily backfire, giving a small boost to prices rather than easing household finances.

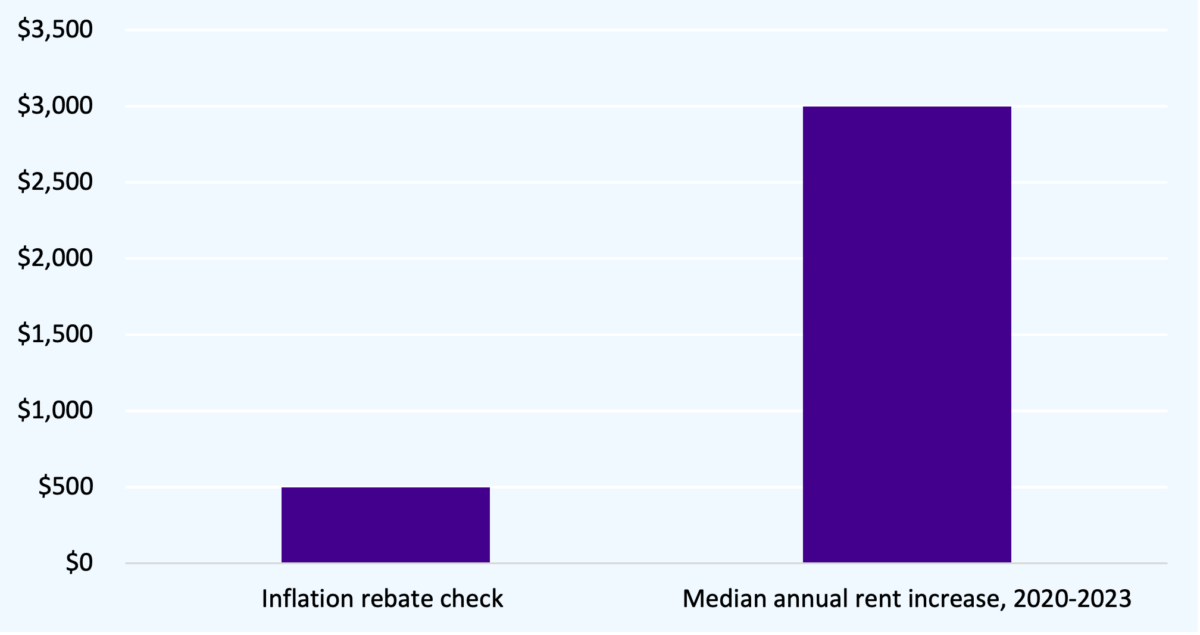

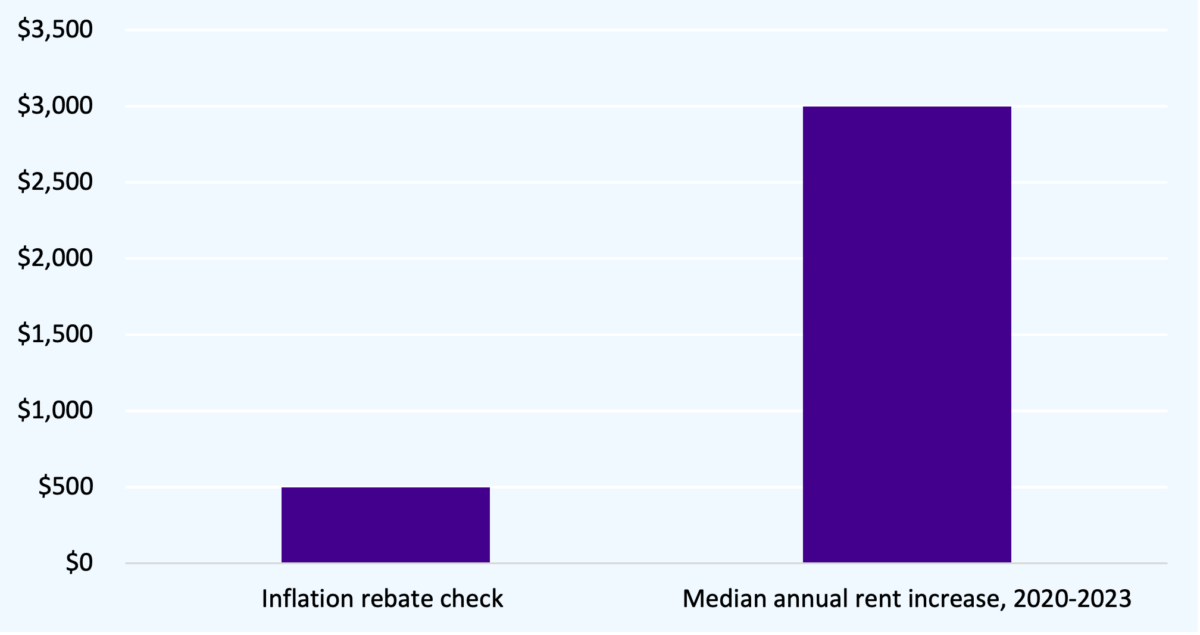

This policy will do very little to alleviate the stresses imposed by inflation and other cost-of-living increases. For example, the median renter household in New York saw an increase in rent of almost $250 per month between 2020 and 2023—meaning that the annual expense for the median renter increased by $3,000 from rent alone. A $500 check barely puts a dent in the household budgets keeping New Yorkers up at night, and it does nothing to change these cost trends.

By contrast, $3 billion could be deployed to capitalize the governor’s revolving loan proposal (which she would fund with only $100 million) to build mixed-income housing. A revolving loan fund capitalized with $3 billion could feasibly be used to produce 45,000 additional units of housing every five years, putting a significant dent into the housing supply needs of the state.[1]

Figure 3. Comparing inflation rebate to increased annual housing costs for median renter

Child Tax Credit Expansion

Fiscal Cost: $1 billion

FPI’s Recommendation: Adopt

The governor proposes expanding the Empire State Child Credit (ESCC) so that income-eligible families will receive $1,000 per child ages 0-3 and $500 for children ages 4-16. Households that include married adults filing jointly receive the full benefit if their incomes are less than $110,000 per year. Single filers receive the full benefit if annual income is less than $75,000. A generous phase-out is applied so that households earning up to $200,00 still receive a partial benefit.

The ESCC expansion puts dollars where they are most effective and constitutes a recurring investment in New York families. The federal child tax credit expansion during the Covid-19 pandemic contributed to a dramatic reduction in child poverty.[i] New York has a high rate of child poverty relative to peer and neighboring states. As of 2022, the child poverty rate in New York was 18.8 percent—meaning nearly 1 in 5 children in New York live below the federal poverty line.[ii] Further, because the New York cost of living is so high relative to the federal poverty line, the poverty statistics necessarily undercount the population of children living below their needs. A report released this past December by the Child Poverty Reduction Advisory Council recommended expanding the ESCC as a primary tool for addressing child poverty in the State (notably along with a series of other policies including a statewide housing voucher program).[iii] The governor’s team estimates that her proposed expansion to the ESCC would reduce child poverty in the State by 8.2 percent. The policy would impact an estimated 1.7 million households and 3 million children.

Universal Free School Meals

Fiscal Cost: $340 million

FPI’s Recommendation: Adopt

Universal school meals have become an increasingly common tool for states to improve educational services and support the finances of low- and middle-income families. By eliminating the income test, universal school meal programs dramatically cut down on administrative burden and stigma faced by low-income families. For example, the New York Health Foundation found that before implementing universal free school lunch in the New York City public schools, only one third of eligible students participated in the means-tested program. By making the program universal, participation increases dramatically, as the stigma of receiving the benefit is removed.[iv] Universal school meal programs have also been shown to significantly cut down on the rate of child food hardship, and to boost test scores in both reading and math.[v]

In the 2022-2023 school year, New York reportedly had 1.26 million students receiving free school lunches and 708,000 receiving free school breakfasts.[vi] Based on student participation in free school meals during the Covid-19 pandemic, when the program was temporarily made universal, there are approximately 500,000 students who would be impacted by making free school lunch universal again and 200,000 students who would be impacted by making free school breakfast universal again. The governor’s office estimates that providing free school meals saves a family $165 per month per child. That saves families well over $1,500 per year in grocery costs per child—50 percent more than the value of the largest ESCC in the governor’s proposal.

Conclusion

Governor Hochul’s proposals to address affordability in New York fall short of addressing the magnitude of the cost-of-living strain faced by New Yorkers. Two of the governor’s top line proposals—the middle class tax cut and the inflation rebate—do relatively little to ease the budget crunch faced by families, while making a significant impact on the State’s resources. These proposals will cost $4 billion in the next fiscal year without meaningfully lowering the cost of living for working New Yorkers. On the other hand, two of the governor’s proposals—the expanded child tax credit and universal free school meals—will make significant progress towards supporting families with children. To fully address the affordability concerns that plague the State, the governor and legislators will need to implement structural reforms to housing policy, health policy, childcare and higher education. Without deeper intervention in the provision of these basic needs, the residents of New York will continue to face untenable costs.

[1] This estimation is based on Montgomery County, Maryland’s successful revolving loan fund. The estimation assumes that New York could achieve similar cost efficiencies and that these efficiencies would remain even with a much larger capitalization of the program.

[i] https://www.cbpp.org/press/statements/record-rise-in-poverty-highlights-importance-of-child-tax-credit-health-coverage

[ii] https://www.osc.ny.gov/files/reports/pdf/nys-children-in-need.pdf

[iii] https://otda.ny.gov/news/meetings/CPRAC/2024-12-18/attachments/2024-12-18-CPRAC-2024-Recommendations-and-Progress-Report.pdf

[iv] https://nyhealthfoundation.org/wp-content/uploads/2020/09/bringing-free-lunch-to-all-NYC-school-children-september-2020.pdf

[v] https://www.sciencedirect.com/science/article/abs/pii/S0306919224000174?via%3Dihub; https://www.maxwell.syr.edu/docs/default-source/research/cpr/working-papers/wp-203-let-them-eat-lunch.pdf?sfvrsn=efae783d_8

[vi] https://frac.org/research/resource-library/reach-report-2024

Governor Hochul’s Affordability Policy Report Card

January 18, 2025 |

The governor wants to address affordability – but will cash handouts do it?

Governor Hochul’s State of the State address made clear that “affordability” is her top priority this session. As part of her agenda, Governor Hochul and her team have put forward a set of policies intended to “put money back in New Yorkers’ pockets.” The four major proposals include a tax cut, an “inflation rebate payment,” an expansion of the child tax credit, and fully funding free school lunches for all public-school students in the State.

Of these four proposals, only the child tax credit and free school lunches will significantly impact New Yorkers’ household budgets. The tax cut and inflation rebate payments create significant costs for the State, undermining the state’s ability to invest in meaningful affordability policy, without producing significant financial support for New York families.

Affordability is the right goal, and one that the governor is correct to prioritize. However, achieving affordability requires structural reforms that target root causes, not one-off spending and small tax cuts that chip away at the government’s ability to provide strong public services.

Figure 1. Accumulated 5-year benefit to married couple with two children.

Note: These estimates assume that the family earns $100,000 per year and that the children are ages 2 and 6 at the start of the 5-year period. Varying these specifications does not dramatically change the results.

Middle Class Tax Cut

Fiscal Cost: $1 billion

FPI’s Recommendation: Reject

The governor has proposed a “middle class” income tax cut for households making up to $323,200 per year (for joint filers), at an estimated cost to the State of $1 billion. This tax cut follows a substantially larger “middle class” tax cut that was enacted in the fiscal year 2017 budget and fully phased in by fiscal year 2024. The executive branch estimated that these prior tax cuts would cost $4.2 billion by 2025; now the governor plans to increase the cumulative revenue loss from a decade of “middle class” tax cuts to over $5 billion annually. As a point of reference, the MTA is currently estimated to need about $2 billion annually in new revenue to support $33 billion of debt issuance for its capital plan. Or, $5 billion of annual revenue could cover about 1/3 of the cost of a statewide universal childcare program. Investing in transit or childcare—among other options—would be more valuable to middle class families than a few hundred dollars per year in tax cuts.

The governor’s office estimates that this tax cut will impact 8.3 million taxpayers, with a maximum tax liability decrease of 5 percent. Without more detail on the proposal, it is difficult to say exactly how much this will amount to in savings for each household. Crudely speaking, $1 billion spread across 8.3 million taxpayers implies an average tax saving of $120 per taxpayer, hardly an amount that constitutes significant savings in the face of real household budgeting concerns.

If applied progressively, the policy may deliver more savings to those with lower incomes, but even then, the tax cut isn’t poised to deliver more than a few hundred dollars of relief to families—anything more would necessarily cost the state more than $1 billion. If a tax liability decrease of 5 percent is applied to all taxpayers up to the income eligibility threshold, the total cost to the state would be about $1.2 billion. The average tax liability decrease by income group is shown in the chart below. As you can see, the maximum tax cut would be $633 for those earning up to $300,000. For those earning less, the tax cut is far less significant; for those earning less than $100,000 per year, a 5 percent tax decrease would be less than $200.

Figure 2. Estimated tax liability decrease for 5 percent tax cut.

Table 1. Estimated tax liability decrease for 5 percent tax cut.

This tax cut will not provide meaningful relief to working New Yorkers, and will only further undermine the State’s ability to invest in public services and infrastructure that ease cost of living pressures. Moreover, revenue losses are particularly unwise at a time of uncertainty around federal funding. NYCHA alone could lose up to $1.3 billion from federal funding cuts under the new Trump administration, and the State must be prepared to backfill such losses.

Inflation Rebate Payments

Fiscal Cost: $3 billion

FPI’s Recommendation: Reject

Last month the governor released her first pro-affordability initiative: a one-time cash payment to New York households to offset the effects of inflation. Joint filers making up to $300,000 per year would receive a one-time payment of $500 and single filers making up to $150,000 per year would receive a one-time payment of $300. In total, the payments would go to about 8.6 million taxpayers and would cost the State $3 billion.

Theoretically, the goal of this program is to rebate sales tax receipts that rose quickly due to inflation over the last few years. However, a policy of this nature—sending modest checks to many people—could have the adverse impact of actually increasing price inflation. While the governor’s intent is to alleviate the negative impact of inflation on family budgets, her policy looks more like a stimulus policy than a measure to reduce cost pressures. If implemented, the policy could easily backfire, giving a small boost to prices rather than easing household finances.

This policy will do very little to alleviate the stresses imposed by inflation and other cost-of-living increases. For example, the median renter household in New York saw an increase in rent of almost $250 per month between 2020 and 2023—meaning that the annual expense for the median renter increased by $3,000 from rent alone. A $500 check barely puts a dent in the household budgets keeping New Yorkers up at night, and it does nothing to change these cost trends.

By contrast, $3 billion could be deployed to capitalize the governor’s revolving loan proposal (which she would fund with only $100 million) to build mixed-income housing. A revolving loan fund capitalized with $3 billion could feasibly be used to produce 45,000 additional units of housing every five years, putting a significant dent into the housing supply needs of the state.[1]

Figure 3. Comparing inflation rebate to increased annual housing costs for median renter

Child Tax Credit Expansion

Fiscal Cost: $1 billion

FPI’s Recommendation: Adopt

The governor proposes expanding the Empire State Child Credit (ESCC) so that income-eligible families will receive $1,000 per child ages 0-3 and $500 for children ages 4-16. Households that include married adults filing jointly receive the full benefit if their incomes are less than $110,000 per year. Single filers receive the full benefit if annual income is less than $75,000. A generous phase-out is applied so that households earning up to $200,00 still receive a partial benefit.

The ESCC expansion puts dollars where they are most effective and constitutes a recurring investment in New York families. The federal child tax credit expansion during the Covid-19 pandemic contributed to a dramatic reduction in child poverty.[i] New York has a high rate of child poverty relative to peer and neighboring states. As of 2022, the child poverty rate in New York was 18.8 percent—meaning nearly 1 in 5 children in New York live below the federal poverty line.[ii] Further, because the New York cost of living is so high relative to the federal poverty line, the poverty statistics necessarily undercount the population of children living below their needs. A report released this past December by the Child Poverty Reduction Advisory Council recommended expanding the ESCC as a primary tool for addressing child poverty in the State (notably along with a series of other policies including a statewide housing voucher program).[iii] The governor’s team estimates that her proposed expansion to the ESCC would reduce child poverty in the State by 8.2 percent. The policy would impact an estimated 1.7 million households and 3 million children.

Universal Free School Meals

Fiscal Cost: $340 million

FPI’s Recommendation: Adopt

Universal school meals have become an increasingly common tool for states to improve educational services and support the finances of low- and middle-income families. By eliminating the income test, universal school meal programs dramatically cut down on administrative burden and stigma faced by low-income families. For example, the New York Health Foundation found that before implementing universal free school lunch in the New York City public schools, only one third of eligible students participated in the means-tested program. By making the program universal, participation increases dramatically, as the stigma of receiving the benefit is removed.[iv] Universal school meal programs have also been shown to significantly cut down on the rate of child food hardship, and to boost test scores in both reading and math.[v]

In the 2022-2023 school year, New York reportedly had 1.26 million students receiving free school lunches and 708,000 receiving free school breakfasts.[vi] Based on student participation in free school meals during the Covid-19 pandemic, when the program was temporarily made universal, there are approximately 500,000 students who would be impacted by making free school lunch universal again and 200,000 students who would be impacted by making free school breakfast universal again. The governor’s office estimates that providing free school meals saves a family $165 per month per child. That saves families well over $1,500 per year in grocery costs per child—50 percent more than the value of the largest ESCC in the governor’s proposal.

Conclusion

Governor Hochul’s proposals to address affordability in New York fall short of addressing the magnitude of the cost-of-living strain faced by New Yorkers. Two of the governor’s top line proposals—the middle class tax cut and the inflation rebate—do relatively little to ease the budget crunch faced by families, while making a significant impact on the State’s resources. These proposals will cost $4 billion in the next fiscal year without meaningfully lowering the cost of living for working New Yorkers. On the other hand, two of the governor’s proposals—the expanded child tax credit and universal free school meals—will make significant progress towards supporting families with children. To fully address the affordability concerns that plague the State, the governor and legislators will need to implement structural reforms to housing policy, health policy, childcare and higher education. Without deeper intervention in the provision of these basic needs, the residents of New York will continue to face untenable costs.

[1] This estimation is based on Montgomery County, Maryland’s successful revolving loan fund. The estimation assumes that New York could achieve similar cost efficiencies and that these efficiencies would remain even with a much larger capitalization of the program.

[i] https://www.cbpp.org/press/statements/record-rise-in-poverty-highlights-importance-of-child-tax-credit-health-coverage

[ii] https://www.osc.ny.gov/files/reports/pdf/nys-children-in-need.pdf

[iii] https://otda.ny.gov/news/meetings/CPRAC/2024-12-18/attachments/2024-12-18-CPRAC-2024-Recommendations-and-Progress-Report.pdf

[iv] https://nyhealthfoundation.org/wp-content/uploads/2020/09/bringing-free-lunch-to-all-NYC-school-children-september-2020.pdf

[v] https://www.sciencedirect.com/science/article/abs/pii/S0306919224000174?via%3Dihub; https://www.maxwell.syr.edu/docs/default-source/research/cpr/working-papers/wp-203-let-them-eat-lunch.pdf?sfvrsn=efae783d_8

[vi] https://frac.org/research/resource-library/reach-report-2024