How Does the Inflation Rebate Stack Up?

January 29, 2025 |

The proposed “inflation rebate” will not offset NY’s cost-of-living squeeze

Fiscal Cost: $3 billion

FPI’s Recommendation: Reject

Last month the governor released her first pro-affordability initiative: a one-time cash payment to New York households to offset the effects of inflation. Joint filers making up to $300,000 per year would receive a one-time payment of $500 and single filers making up to $150,000 per year would receive a one-time payment of $300. In total, the payments would go to about 8.6 million taxpayers and would cost the State $3 billion.

Theoretically, the goal of this program is to rebate sales tax receipts that rose quickly due to inflation over the last few years. However, a policy of this nature—sending modest checks to many people—could have the adverse impact of actually increasing price inflation. While the governor’s intent is to alleviate the negative impact of inflation on family budgets, her policy looks more like a stimulus policy than a measure to reduce cost pressures. If implemented, the policy could easily backfire, giving a small boost to prices rather than easing household finances.

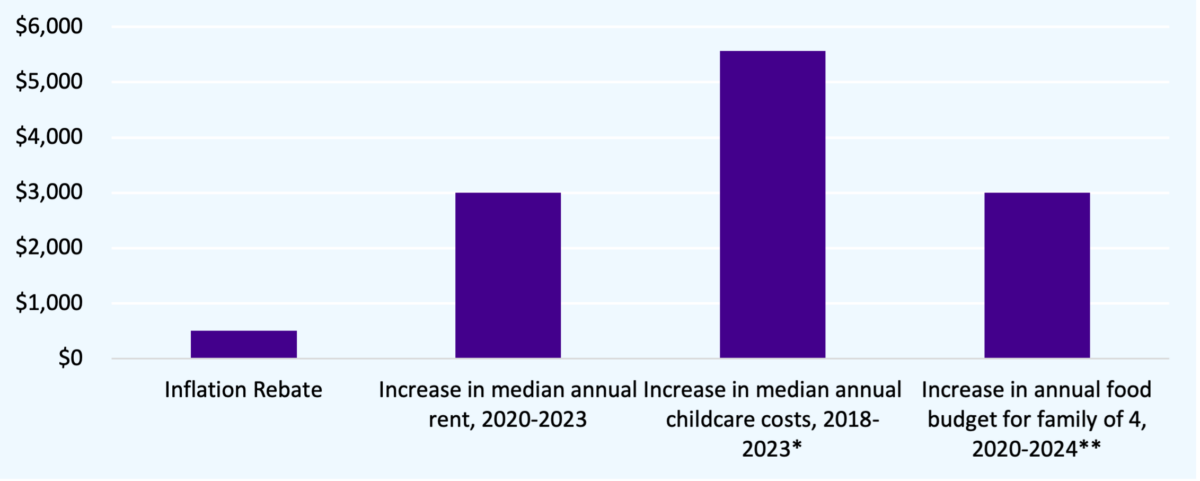

This policy will do very little to alleviate the stresses imposed by inflation and other cost-of-living increases. For example, the median renter household in New York saw an increase in rent of almost $250 per month between 2020 and 2023—meaning that the annual expense for the median renter increased by $3,000 from rent alone. A $500 check barely puts a dent in the household budgets keeping New Yorkers up at night, and it does nothing to change these cost trends.

By contrast, $3 billion could be deployed to capitalize the governor’s revolving loan proposal (which she would fund with only $50 million) to build mixed-income housing. A revolving loan fund capitalized with $3 billion could feasibly be used to produce 45,000 additional units of housing every five years, putting a significant dent into the housing supply needs of the state.

[Note: This estimation is based on Montgomery County, Maryland’s successful revolving loan fund. The estimation assumes that New York could achieve similar cost efficiencies and that these efficiencies would remain even with a much larger capitalization of the program.]

Figure 1. Comparing inflation rebate to increased annual housing costs for median renter

* Child care cost increases based on the Market Rate Surveys collected by the State in 2018 and 2023. This is the median cost increase for one child in NYC, attending a licensed group family day care home.

** Based on USDA’s estimate of a “thrifty” food budget for a family of four of $1,000 per month. Increases will be larger for families with larger food budgets.

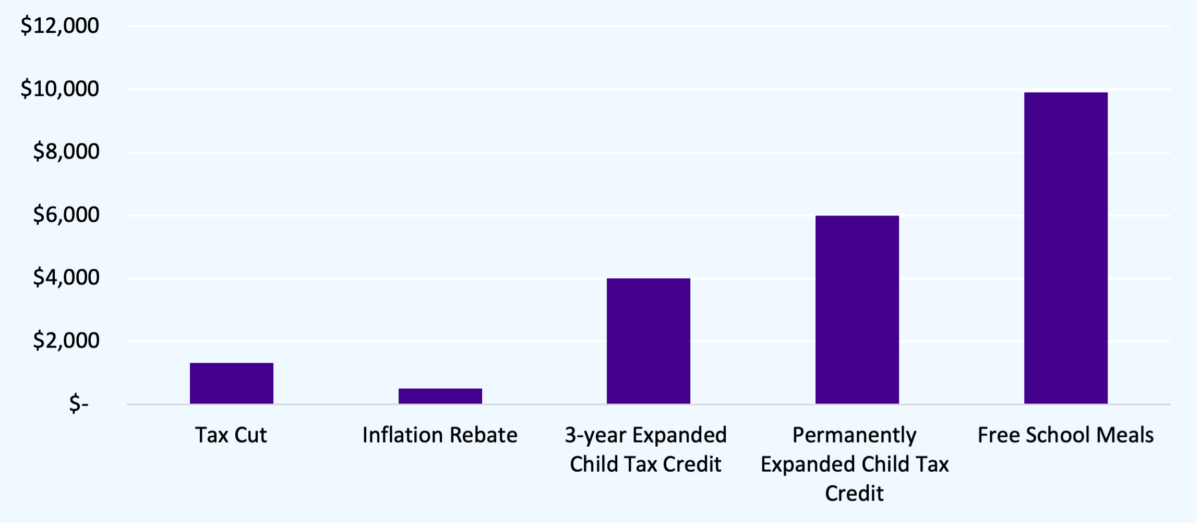

Governor Hochul’s State of the State address made clear that “affordability” is her top priority this session. As part of her agenda, Governor Hochul and her team have put forward a set of policies intended to “put money back in New Yorkers’ pockets.” The four major proposals include a tax cut for households making up to $323,000 per year, the “inflation rebate payment” discussed in this brief, a temporary expansion of the child tax credit for three years, and fully funding free school meals for all public-school students in the State. Of these four proposals, only the child tax credit and free school meals will significantly impact New Yorkers’ household budgets. The tax cut and inflation rebate payments create significant costs for the State, undermining the state’s ability to invest in meaningful affordability policy, without producing significant financial support for New York families.

Figure 2. Accumulated 5-year benefit to married couple with two children.

Note: These estimates assume that the family earns $100,000 per year and that the children are ages 2 and 6 at the start of the 5-year period. Varying these specifications does not dramatically change the results.

How Does the Inflation Rebate Stack Up?

January 29, 2025 |

The proposed “inflation rebate” will not offset NY’s cost-of-living squeeze

Fiscal Cost: $3 billion

FPI’s Recommendation: Reject

Last month the governor released her first pro-affordability initiative: a one-time cash payment to New York households to offset the effects of inflation. Joint filers making up to $300,000 per year would receive a one-time payment of $500 and single filers making up to $150,000 per year would receive a one-time payment of $300. In total, the payments would go to about 8.6 million taxpayers and would cost the State $3 billion.

Theoretically, the goal of this program is to rebate sales tax receipts that rose quickly due to inflation over the last few years. However, a policy of this nature—sending modest checks to many people—could have the adverse impact of actually increasing price inflation. While the governor’s intent is to alleviate the negative impact of inflation on family budgets, her policy looks more like a stimulus policy than a measure to reduce cost pressures. If implemented, the policy could easily backfire, giving a small boost to prices rather than easing household finances.

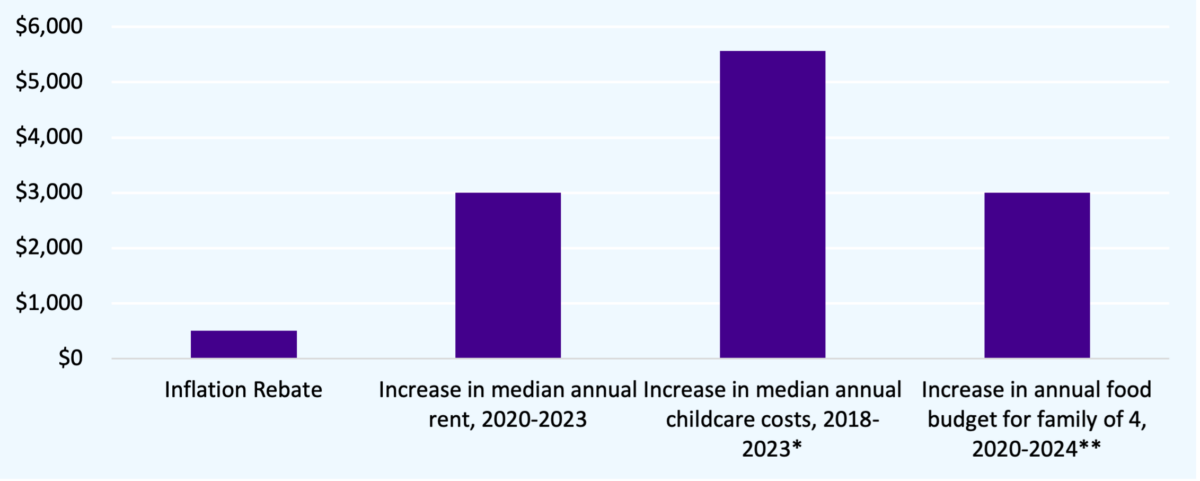

This policy will do very little to alleviate the stresses imposed by inflation and other cost-of-living increases. For example, the median renter household in New York saw an increase in rent of almost $250 per month between 2020 and 2023—meaning that the annual expense for the median renter increased by $3,000 from rent alone. A $500 check barely puts a dent in the household budgets keeping New Yorkers up at night, and it does nothing to change these cost trends.

By contrast, $3 billion could be deployed to capitalize the governor’s revolving loan proposal (which she would fund with only $50 million) to build mixed-income housing. A revolving loan fund capitalized with $3 billion could feasibly be used to produce 45,000 additional units of housing every five years, putting a significant dent into the housing supply needs of the state.

[Note: This estimation is based on Montgomery County, Maryland’s successful revolving loan fund. The estimation assumes that New York could achieve similar cost efficiencies and that these efficiencies would remain even with a much larger capitalization of the program.]

Figure 1. Comparing inflation rebate to increased annual housing costs for median renter

* Child care cost increases based on the Market Rate Surveys collected by the State in 2018 and 2023. This is the median cost increase for one child in NYC, attending a licensed group family day care home.

** Based on USDA’s estimate of a “thrifty” food budget for a family of four of $1,000 per month. Increases will be larger for families with larger food budgets.

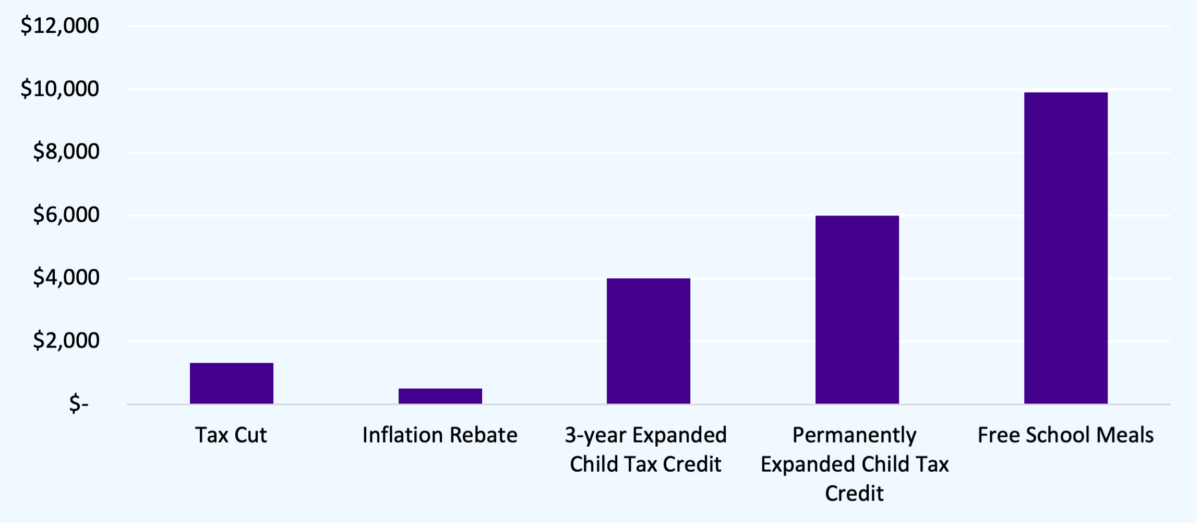

Governor Hochul’s State of the State address made clear that “affordability” is her top priority this session. As part of her agenda, Governor Hochul and her team have put forward a set of policies intended to “put money back in New Yorkers’ pockets.” The four major proposals include a tax cut for households making up to $323,000 per year, the “inflation rebate payment” discussed in this brief, a temporary expansion of the child tax credit for three years, and fully funding free school meals for all public-school students in the State. Of these four proposals, only the child tax credit and free school meals will significantly impact New Yorkers’ household budgets. The tax cut and inflation rebate payments create significant costs for the State, undermining the state’s ability to invest in meaningful affordability policy, without producing significant financial support for New York families.

Figure 2. Accumulated 5-year benefit to married couple with two children.

Note: These estimates assume that the family earns $100,000 per year and that the children are ages 2 and 6 at the start of the 5-year period. Varying these specifications does not dramatically change the results.