New: Expiring Tax Rates to Drive Down Expected Fiscal Year 2028 Revenue

January 16, 2024 |

By Andrew Perry, Senior Policy Analyst

January 2024

Approximately $2.4 Billion of FY28 budget gap will be due to the Personal Income Tax and Corporate Franchise Tax surcharge expirations.

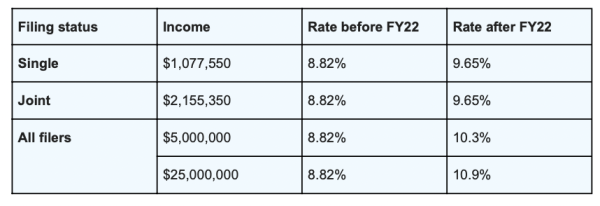

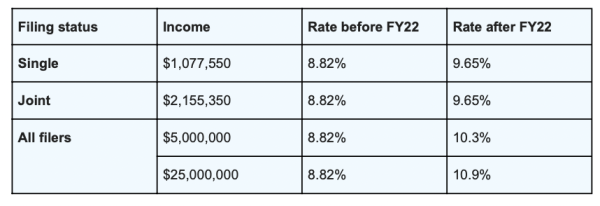

In the fiscal year 2022 budget, New York enacted temporary increases to the personal income tax (PIT) and corporate franchise tax (CFT) rates. PIT rates were raised for tax filers with more than $1 million in annual income, and new brackets were created for filers with incomes over $5 million and $25 million. The CFT rate for businesses with over $5 million in annual profits was raised from 6.5 percent to 7.25 percent.

Table 1. Fiscal year 2022 enacted changes to PIT brackets and rates

The higher PIT and CFT rates are temporary, with the higher CFT rate imposed through tax year 2026, and PIT rates imposed through tax year 2027. As such, the expiration of higher CFT rates affects the final quarter of fiscal year 2027 and takes full effect for fiscal year 2028. The expiring PIT rates will affect revenue starting in fiscal year 2028 and take full effect the following year.

The State would lose substantial revenue should temporary PIT and CFT rate increases expire:

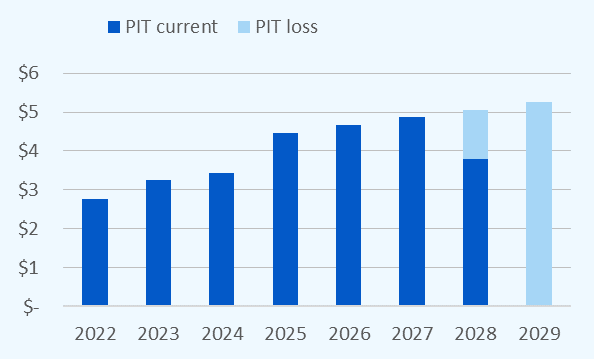

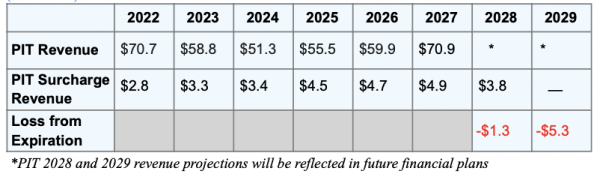

Personal Income Tax Expiration

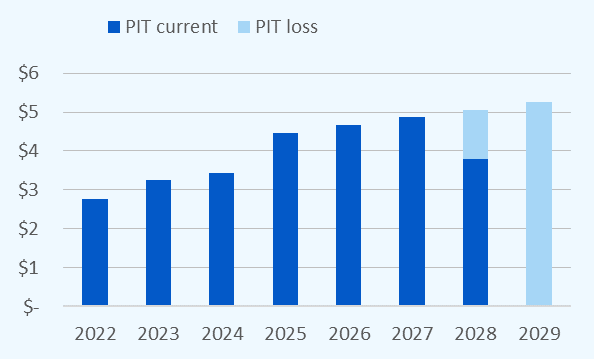

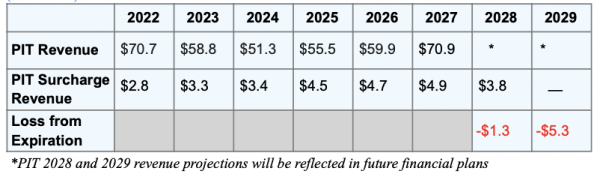

FPI estimates that by fiscal year 2028, the top PIT rates would raise about $5.1 billion. Because the rates expire at the end of tax year 2027, expiration would affect the final quarter of fiscal year 2028, losing the State $1.3 billion. The following year, fiscal year 2029 — the first full fiscal year in which the lower, pre-2022 PIT rates would be in effect — the State stands to lose about $5.3 billion in revenue.

Fig 1. PIT revenue raised by surcharge and potential losses from expiration

Table 2. PIT revenue raised by surcharge and potential losses from expiration

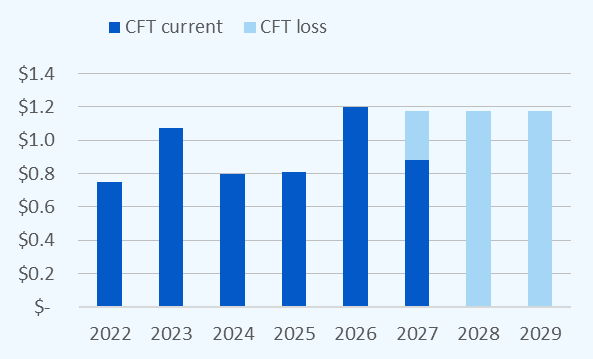

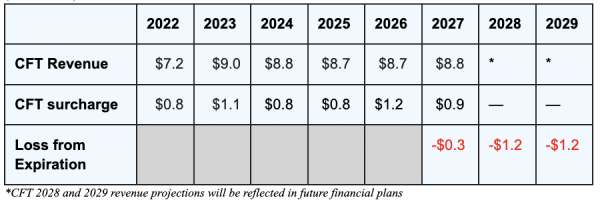

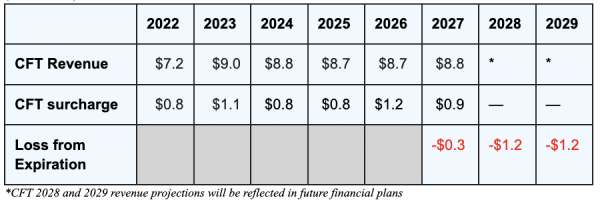

Corporate Franchise Tax Expiration

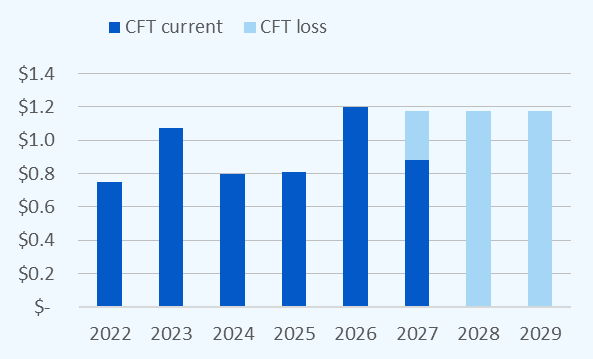

The elevated CFT rate raises about $1.2 billion in annual revenue, according to FPI analysis. This level appears relatively consistent across years. As the expiration of higher CFT rates affects the final quarter of fiscal year 2027 and takes full effect for fiscal year 2028, the State would lose about $0.3 billion in fiscal year 2027, and $1.2 billion in annual revenue beginning in fiscal year 2028.

Fig 2. CFT revenue raised by surcharge and potential losses from expiration

Table 3. CFT revenue raised by surcharge and potential losses from expiration

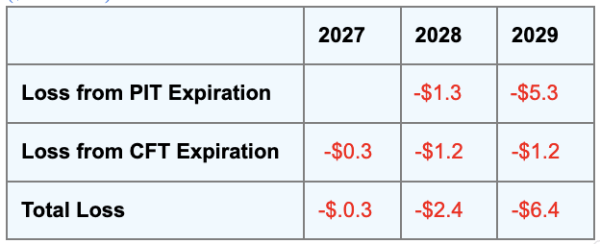

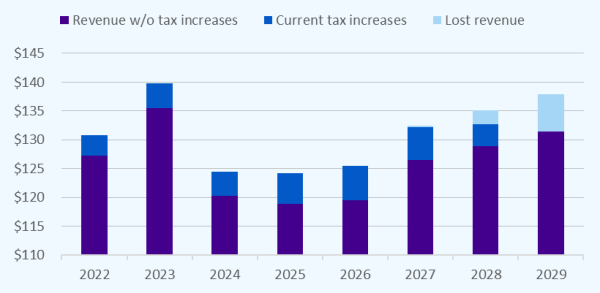

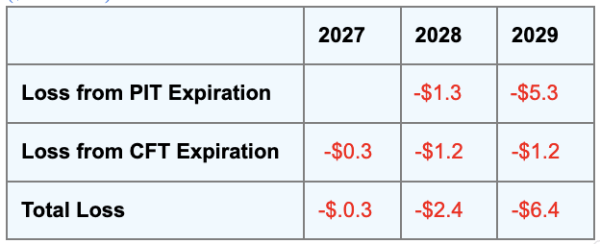

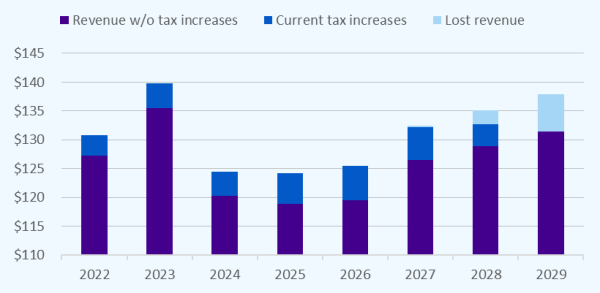

Personal Income Tax & Corporate Franchise Tax Expirations Combined

Should both the fiscal year 2022 PIT and CFT rates expire, New York State would lose about $2.4 billion in fiscal year 2028, which is partially affected by expiring PIT rates and about $6.4 billion in annual revenue in fiscal year 2029 and thereafter — about 5 percent of state funds revenue.

Figure 3. Total (PIT+CFT) surcharge revenue and potential losses as part of state operating funds revenue

Table 4. Total (PIT+CFT) potential losses as part of state operating funds revenue

New: Expiring Tax Rates to Drive Down Expected Fiscal Year 2028 Revenue

January 16, 2024 |

By Andrew Perry, Senior Policy Analyst

January 2024

Approximately $2.4 Billion of FY28 budget gap will be due to the Personal Income Tax and Corporate Franchise Tax surcharge expirations.

In the fiscal year 2022 budget, New York enacted temporary increases to the personal income tax (PIT) and corporate franchise tax (CFT) rates. PIT rates were raised for tax filers with more than $1 million in annual income, and new brackets were created for filers with incomes over $5 million and $25 million. The CFT rate for businesses with over $5 million in annual profits was raised from 6.5 percent to 7.25 percent.

Table 1. Fiscal year 2022 enacted changes to PIT brackets and rates

The higher PIT and CFT rates are temporary, with the higher CFT rate imposed through tax year 2026, and PIT rates imposed through tax year 2027. As such, the expiration of higher CFT rates affects the final quarter of fiscal year 2027 and takes full effect for fiscal year 2028. The expiring PIT rates will affect revenue starting in fiscal year 2028 and take full effect the following year.

The State would lose substantial revenue should temporary PIT and CFT rate increases expire:

Personal Income Tax Expiration

FPI estimates that by fiscal year 2028, the top PIT rates would raise about $5.1 billion. Because the rates expire at the end of tax year 2027, expiration would affect the final quarter of fiscal year 2028, losing the State $1.3 billion. The following year, fiscal year 2029 — the first full fiscal year in which the lower, pre-2022 PIT rates would be in effect — the State stands to lose about $5.3 billion in revenue.

Fig 1. PIT revenue raised by surcharge and potential losses from expiration

Table 2. PIT revenue raised by surcharge and potential losses from expiration

Corporate Franchise Tax Expiration

The elevated CFT rate raises about $1.2 billion in annual revenue, according to FPI analysis. This level appears relatively consistent across years. As the expiration of higher CFT rates affects the final quarter of fiscal year 2027 and takes full effect for fiscal year 2028, the State would lose about $0.3 billion in fiscal year 2027, and $1.2 billion in annual revenue beginning in fiscal year 2028.

Fig 2. CFT revenue raised by surcharge and potential losses from expiration

Table 3. CFT revenue raised by surcharge and potential losses from expiration

Personal Income Tax & Corporate Franchise Tax Expirations Combined

Should both the fiscal year 2022 PIT and CFT rates expire, New York State would lose about $2.4 billion in fiscal year 2028, which is partially affected by expiring PIT rates and about $6.4 billion in annual revenue in fiscal year 2029 and thereafter — about 5 percent of state funds revenue.

Figure 3. Total (PIT+CFT) surcharge revenue and potential losses as part of state operating funds revenue

Table 4. Total (PIT+CFT) potential losses as part of state operating funds revenue