October Cash Basis Report shows higher than expected Personal Income Tax receipts

November 22, 2022 |

Last three financial plan revenue estimates dramatically underestimated PIT revenue

Press Contact: Monica Klein, 917-565-0715

NEW YORK, NY | November 21, 2022 — The New York State Comptroller this week released its October 2022 cash basis report, which documents recent trends in state spending and revenue.

Key Points:

- In fiscal year 2023, New York’s personal income tax (PIT) has raised $35.1 billion year to date.

- Since Covid, the last three financial plans have all dramatically underestimated revenue from PIT — underestimating by about 18 percent on average.

- If current PIT revenue trends continue for the remainder of the fiscal year, the end of year surplus will likely exceed state projections.

In fiscal year 2023 to date, New York’s personal income tax (PIT) has raised $35.1 billion — $7.0 billion, or 25.0 percent, more than the level projected in the enacted financial plan. The mid-year financial plan update, released on Friday, raised PIT revenue projections for the current fiscal year by nearly $2 billion, or 4.2 percent, to a total of 48.95 billion. October PIT collections came in $83.8 million, or 4.5 percent, above the most recently updated cash flow projections.

A temporary surcharge on high-income earners enacted in fiscal year 2022 was expected to raise $3.3 billion in gross revenue in fiscal year 2023.* This year’s PIT overperformance suggests that this surcharge is likely raising more revenue than initially projected.

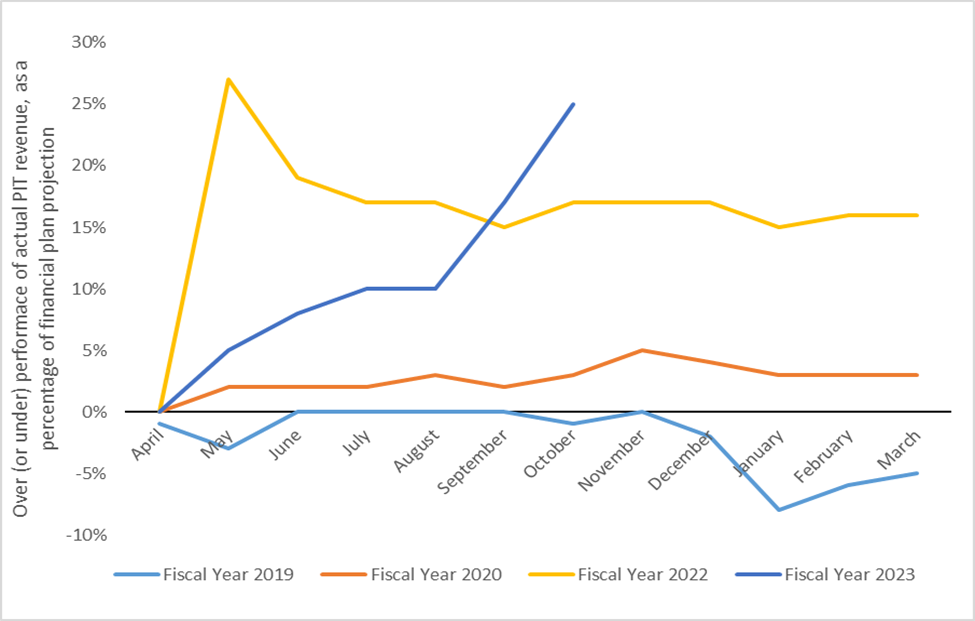

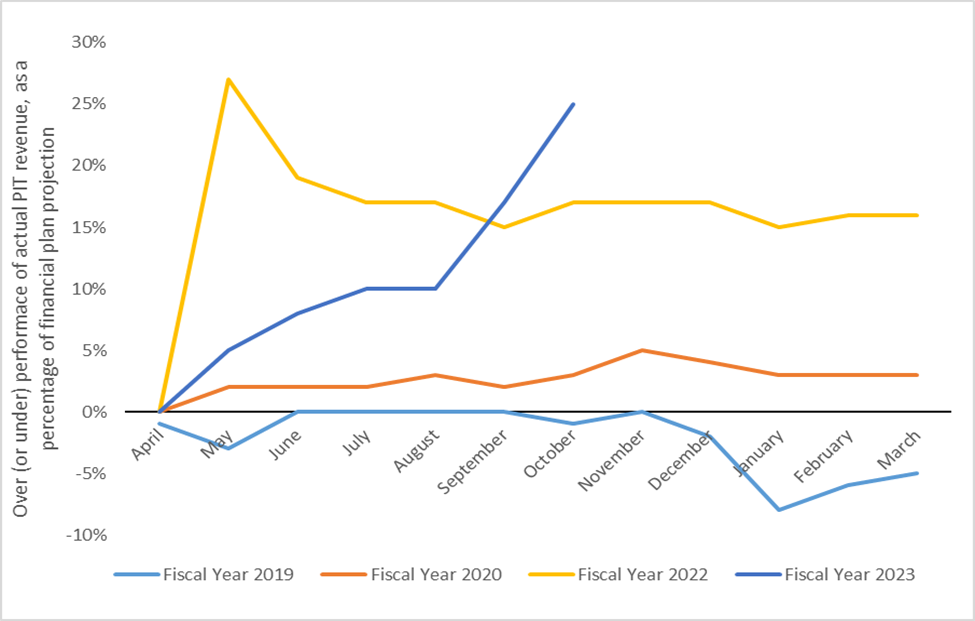

Financial plan revenue estimates have consistently underestimated the strength of New York’s recovery from the Covid recession. Prior to the pandemic, enacted financial plan revenue projections were generally more accurate: in fiscal years 2019 and 2020, the difference between actual revenue and enacted plan projections never exceeded 8 percent. In the two most recent financial plans, however, projections have dramatically underestimated revenue. By the end of fiscal year 2022, actual PIT receipts exceeded state projections by 16 percent — similar to PIT’s overperformance of estimates this year. PIT revenues have consistently been buoyed by strong wage growth and better-than-expected employment growth. Despite concerns of an impending recession, PIT’s performance indicates that economic activity remains above expectations and that New York remains on solid fiscal footing heading into fiscal year 2024.

|

Monthly actual PIT revenue relative to enacted financial plan projections

| *PIT revenues for fiscal year 2023 are substantially affected by pass-through entity tax (PTET) credits. The PTET allows the owners of pass-through entities (e.g., partnerships, LLCs) to elect to pay an entity-level tax in order to benefit from the federal deduction for state and local taxes. Taxpayers who pay the PTET can then receive a credit against their Personal Income Tax liability for the amount of PTET paid. While PTET credits are expected to be revenue neutral over the life of the program, they shift revenue from PIT to business taxes. Further, the credits’ timing shifts total revenue between certain years. For fiscal year 2023, PTET credits are expected to reduce PIT revenue by $25.1 billion. This is offset by higher business tax receipts in fiscal year 2022 and subsequent years. For the purpose of assessing the fiscal impact of high income tax surcharges, gross revenue is a more appropriate base of comparison. In fiscal year 2023, gross PIT revenue is projected to reach $75.5 billion. |

October Cash Basis Report shows higher than expected Personal Income Tax receipts

November 22, 2022 |

Last three financial plan revenue estimates dramatically underestimated PIT revenue

Press Contact: Monica Klein, 917-565-0715

NEW YORK, NY | November 21, 2022 — The New York State Comptroller this week released its October 2022 cash basis report, which documents recent trends in state spending and revenue.

Key Points:

- In fiscal year 2023, New York’s personal income tax (PIT) has raised $35.1 billion year to date.

- Since Covid, the last three financial plans have all dramatically underestimated revenue from PIT — underestimating by about 18 percent on average.

- If current PIT revenue trends continue for the remainder of the fiscal year, the end of year surplus will likely exceed state projections.

In fiscal year 2023 to date, New York’s personal income tax (PIT) has raised $35.1 billion — $7.0 billion, or 25.0 percent, more than the level projected in the enacted financial plan. The mid-year financial plan update, released on Friday, raised PIT revenue projections for the current fiscal year by nearly $2 billion, or 4.2 percent, to a total of 48.95 billion. October PIT collections came in $83.8 million, or 4.5 percent, above the most recently updated cash flow projections.

A temporary surcharge on high-income earners enacted in fiscal year 2022 was expected to raise $3.3 billion in gross revenue in fiscal year 2023.* This year’s PIT overperformance suggests that this surcharge is likely raising more revenue than initially projected.

Financial plan revenue estimates have consistently underestimated the strength of New York’s recovery from the Covid recession. Prior to the pandemic, enacted financial plan revenue projections were generally more accurate: in fiscal years 2019 and 2020, the difference between actual revenue and enacted plan projections never exceeded 8 percent. In the two most recent financial plans, however, projections have dramatically underestimated revenue. By the end of fiscal year 2022, actual PIT receipts exceeded state projections by 16 percent — similar to PIT’s overperformance of estimates this year. PIT revenues have consistently been buoyed by strong wage growth and better-than-expected employment growth. Despite concerns of an impending recession, PIT’s performance indicates that economic activity remains above expectations and that New York remains on solid fiscal footing heading into fiscal year 2024.

|

Monthly actual PIT revenue relative to enacted financial plan projections

| *PIT revenues for fiscal year 2023 are substantially affected by pass-through entity tax (PTET) credits. The PTET allows the owners of pass-through entities (e.g., partnerships, LLCs) to elect to pay an entity-level tax in order to benefit from the federal deduction for state and local taxes. Taxpayers who pay the PTET can then receive a credit against their Personal Income Tax liability for the amount of PTET paid. While PTET credits are expected to be revenue neutral over the life of the program, they shift revenue from PIT to business taxes. Further, the credits’ timing shifts total revenue between certain years. For fiscal year 2023, PTET credits are expected to reduce PIT revenue by $25.1 billion. This is offset by higher business tax receipts in fiscal year 2022 and subsequent years. For the purpose of assessing the fiscal impact of high income tax surcharges, gross revenue is a more appropriate base of comparison. In fiscal year 2023, gross PIT revenue is projected to reach $75.5 billion. |