Tax Policy Brief: Revenue Impact of Higher State Taxes on Capital Gains

February 6, 2023 |

Estimating the Revenue Impact of Higher State Taxes on Capital Gains

The U.S. federal tax code distinguishes between two types of income: ordinary income, which we can generally think of as wage and salary income, and capital gain, which we can generally understand as income from investments (e.g., the sale of appreciated stock).[1] Where a taxpayer has capital gain that results from the sale of an asset that has been held for longer than one year, the gain is “long-term capital gain” and subject to lower, preferential tax rates. While the top U.S. federal income tax rate is 37% for a married couple filing jointly with earnings over $648,000, the top long-term capital gains rate is 20% for a married couple earning over $517,000.[2]

Since 2020, a group of New York legislators have proposed increasing the state tax rate on long-term capital gains.[3] While New York’s Personal Income Tax imposes the same tax rates on ordinary income and capital gain, these legislative proposals have explicitly identified the large federal tax benefit for investment income as the motivation for a long-term capital gains surtax. A state surtax on long-term capital gains could raise substantial revenue, and would offset some or all of the federal tax rate benefit.

In this brief we evaluate three options for increasing the New York State tax rate on long-term capital gains. The options assessed here include: (1) a low surtax rate of 1% and 2%, (2) moderate surtaxes of 2% and 4%, and (3) surtaxes of 7.5% and 15%, as proposed in bill S2162/A2576 sponsored by Senator Gustavo Rivera and Assembly Member Ron Kim.

Figure 1. Revenue Estimates for Different Rates

Figure 2. Average Tax Increase by Income Quantile

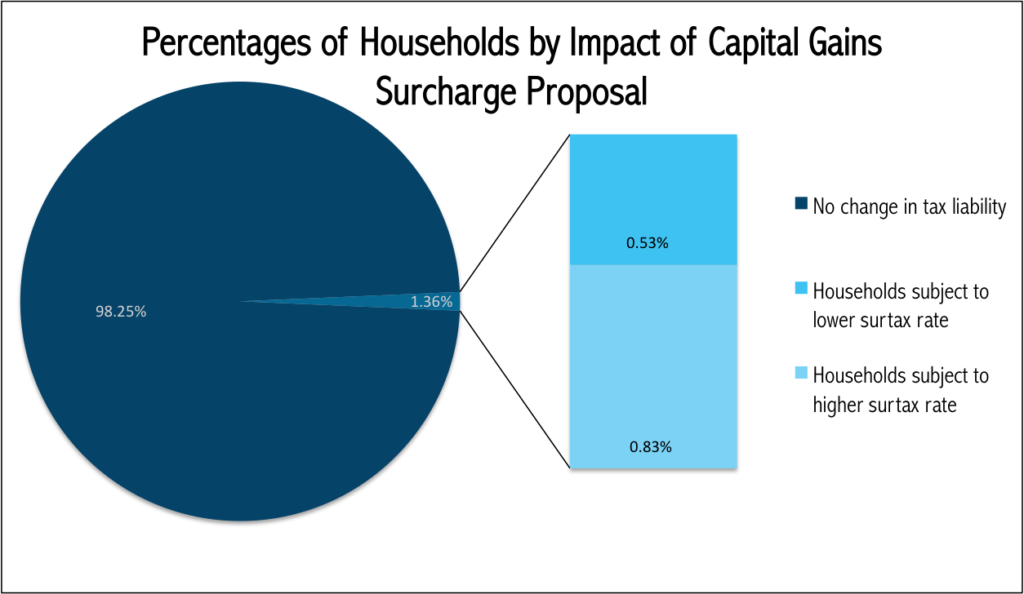

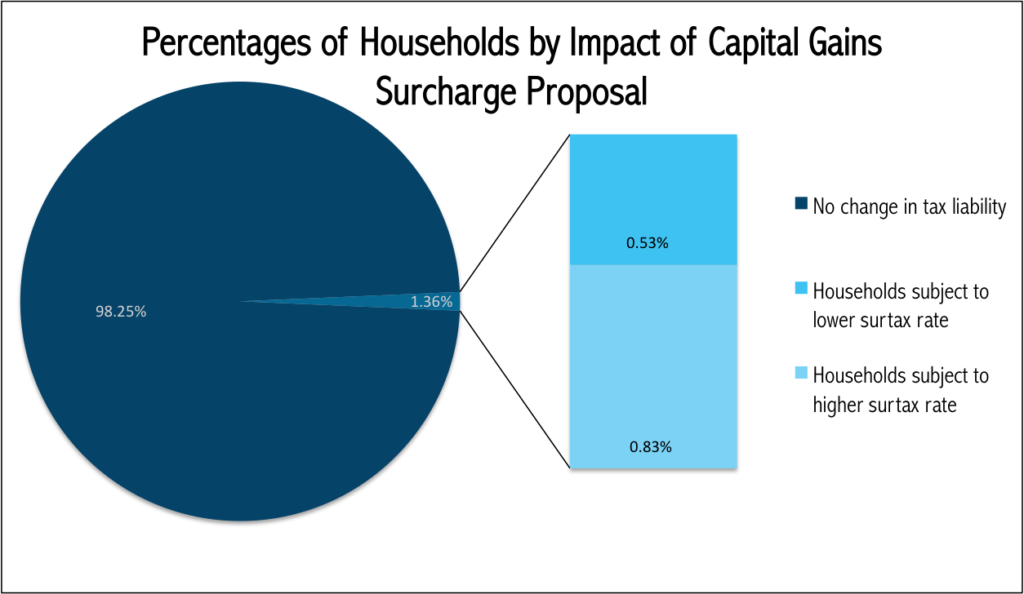

Figure 3. Capital Gains Surtax Would Only Effect Top 1.3%

Only 1.3% of tax filers in New York would be affected by these proposals, and only 0.83% of tax filers would be subject to the highest surtax rate under these proposals (the $1M bracket). This incidence breakdown applies to all three proposals since they have the same income brackets guiding the rate increases. Under any of these three proposals, about 99% of tax filers in New York would see zero change in their tax rates.

The capital gains tax break has a long history – but it’s bad policy.

One important historical argument for giving long-term capital gains preferential tax treatment is that in some theoretical models, taxing capital income can disincentivize investment, leading to lower growth rates and less innovation. However, recent research in capital taxation shows that any of the potentially negative impacts of capital taxation on the economy are likely negligible and might even be positive due to the redistributive impacts of the taxation.[4] Moreover, federal policymakers and economic experts have long criticized the preferential treatment given to long-term capital gains, noting that in practice, giving preference to capital gains incentivizes taxpayers to manipulate their income by treating labor income as capital income – a phenomenon described as “income shifting” – thus creating a regressive tax system that favors the wealthy and burdens working and middle income families.[5] Despite frequent calls from policymakers to end this tax preference, the federal government has failed to equalize the treatment of ordinary income and capital gain, and there is no indication that it will do so anytime in the future.

[1] More precisely, ordinary income includes wages and salary income as well as bonuses, ordinary business profits, self-employment income, and rents, among others. Capital gain is gain from the sale of a capital asset, which includes stocks, bonds, real property, patents and trademarks, artworks, and other assets.

[2] Long-term capital gains are additionally subject to the Net Investment Income Tax (“NIIT”) of 3.8% for married couples with modified adjusted gross income in excess of $250,000. The NIIT applies to capital gains, interest, dividends, rents and royalties, as well as other types of investment income, and was enacted as part of the 2012 Patient Protection and Affordable Care Act.

[3] Note the many co-sponsors of the legislation: S2162/A2576.

[4] Emmanuel Saez and Gabriel Zucman, “Progressive Wealth Taxation”, Brookings Papers on Economic Activity, Fall 2019. https://eml.berkeley.edu/~saez/saez-zucmanBPEAoct19.pdf.

[5] Roger H. Gordon and Jeffrey K. MacKie-Mason, “The Importance of Income Shifting to the Design and Analysis of Tax Policy” in Martin Feldstein et al., Taxing Multinational Corporations (U. Chicago Press, January 1995). https://www.nber.org/system/files/chapters/c7725/c7725.pdf.

Tax Policy Brief: Revenue Impact of Higher State Taxes on Capital Gains

February 6, 2023 |

Estimating the Revenue Impact of Higher State Taxes on Capital Gains

The U.S. federal tax code distinguishes between two types of income: ordinary income, which we can generally think of as wage and salary income, and capital gain, which we can generally understand as income from investments (e.g., the sale of appreciated stock).[1] Where a taxpayer has capital gain that results from the sale of an asset that has been held for longer than one year, the gain is “long-term capital gain” and subject to lower, preferential tax rates. While the top U.S. federal income tax rate is 37% for a married couple filing jointly with earnings over $648,000, the top long-term capital gains rate is 20% for a married couple earning over $517,000.[2]

Since 2020, a group of New York legislators have proposed increasing the state tax rate on long-term capital gains.[3] While New York’s Personal Income Tax imposes the same tax rates on ordinary income and capital gain, these legislative proposals have explicitly identified the large federal tax benefit for investment income as the motivation for a long-term capital gains surtax. A state surtax on long-term capital gains could raise substantial revenue, and would offset some or all of the federal tax rate benefit.

In this brief we evaluate three options for increasing the New York State tax rate on long-term capital gains. The options assessed here include: (1) a low surtax rate of 1% and 2%, (2) moderate surtaxes of 2% and 4%, and (3) surtaxes of 7.5% and 15%, as proposed in bill S2162/A2576 sponsored by Senator Gustavo Rivera and Assembly Member Ron Kim.

Figure 1. Revenue Estimates for Different Rates

Figure 2. Average Tax Increase by Income Quantile

Figure 3. Capital Gains Surtax Would Only Effect Top 1.3%

Only 1.3% of tax filers in New York would be affected by these proposals, and only 0.83% of tax filers would be subject to the highest surtax rate under these proposals (the $1M bracket). This incidence breakdown applies to all three proposals since they have the same income brackets guiding the rate increases. Under any of these three proposals, about 99% of tax filers in New York would see zero change in their tax rates.

The capital gains tax break has a long history – but it’s bad policy.

One important historical argument for giving long-term capital gains preferential tax treatment is that in some theoretical models, taxing capital income can disincentivize investment, leading to lower growth rates and less innovation. However, recent research in capital taxation shows that any of the potentially negative impacts of capital taxation on the economy are likely negligible and might even be positive due to the redistributive impacts of the taxation.[4] Moreover, federal policymakers and economic experts have long criticized the preferential treatment given to long-term capital gains, noting that in practice, giving preference to capital gains incentivizes taxpayers to manipulate their income by treating labor income as capital income – a phenomenon described as “income shifting” – thus creating a regressive tax system that favors the wealthy and burdens working and middle income families.[5] Despite frequent calls from policymakers to end this tax preference, the federal government has failed to equalize the treatment of ordinary income and capital gain, and there is no indication that it will do so anytime in the future.

[1] More precisely, ordinary income includes wages and salary income as well as bonuses, ordinary business profits, self-employment income, and rents, among others. Capital gain is gain from the sale of a capital asset, which includes stocks, bonds, real property, patents and trademarks, artworks, and other assets.

[2] Long-term capital gains are additionally subject to the Net Investment Income Tax (“NIIT”) of 3.8% for married couples with modified adjusted gross income in excess of $250,000. The NIIT applies to capital gains, interest, dividends, rents and royalties, as well as other types of investment income, and was enacted as part of the 2012 Patient Protection and Affordable Care Act.

[3] Note the many co-sponsors of the legislation: S2162/A2576.

[4] Emmanuel Saez and Gabriel Zucman, “Progressive Wealth Taxation”, Brookings Papers on Economic Activity, Fall 2019. https://eml.berkeley.edu/~saez/saez-zucmanBPEAoct19.pdf.

[5] Roger H. Gordon and Jeffrey K. MacKie-Mason, “The Importance of Income Shifting to the Design and Analysis of Tax Policy” in Martin Feldstein et al., Taxing Multinational Corporations (U. Chicago Press, January 1995). https://www.nber.org/system/files/chapters/c7725/c7725.pdf.