The HEROES Act Should Include Undocumented Taxpayers

October 26, 2020 |

Across the United States, undocumented immigrants and their families are still experiencing eviction, food insecurity, hunger, and financial difficulties due to COVID-19. Federal relief has continuously excluded this population of immigrants from income replacement assistance, stimulus payments, and unemployment insurance, which has exacerbated the adverse economic effects on undocumented families.

Earlier this year, the federal government passed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) to provide financial relief to families who were impacted by COVID-19. Sadly, undocumented immigrants and their families were intentionally excluded from receiving this economic assistance. The CARES Act excluded undocumented immigrants by specifically denying the aid checks of up to $1,200 to anyone who filed taxes using an Individual Taxpayer Identification Number (ITIN) or filed with someone using an ITIN. Even in families with just one member files using an ITIN, the entire family was ineligible.[1] In all, 15.4 million people in mixed-status families in the United States were excluded from these CARES Act funds, including 1.2 million New Yorkers. Of these, nearly a third (31 percent) are U.S. citizens or have a green card.[2]

It is unfair that undocumented immigrants continue to be excluded from federal relief when they contribute their share to help fund these programs. In the United States, undocumented immigrants contribute $11.74 billion to state and local taxes a year, including $1.1 billion in state and local taxes in New York State alone.[3] Undocumented immigrants are also responsible for $140 million in contributions to New York State’s unemployment fund through taxes paid by their employer. These workers are nonetheless excluded from unemployment insurance programs, despite being affected by COVID-19 like all other New Yorkers.[4]

Although it has been stalled by the president’s on-again, off-again approach to negotiations, the federal government is still in the midst of negotiating another federal relief package, known as the Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act. Advocates across the United States are working hard to try and push legislators to include undocumented immigrants in this relief package. This $2.2 trillion proposed aid package includes unemployment assistance, stimulus payments, an expansion of the Supplemental Nutrition Assistance Program (SNAP), and more.[5]

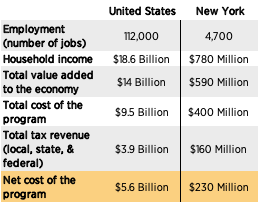

According to research from The University of California, Los Angeles (UCLA), including undocumented taxpayers in the HEROES Act, would have positive economic impacts on the country and states. Including undocumented taxpayers in the HEROES Act would help these families with financial hardships while simultaneously redistributing money to local and state economies. Aid would first and foremost provide immediate help to excluded families., Still it is important to note that it would also help boost local economies around the country through the ripple effects when the aid is spent paying for basic needs like buying food in grocery stores or covering rent. The UCLA study estimates that extending these HEROES Act benefits to excluded immigrants and their families would create 112,000 new jobs, provide $18.6 billion in household income, add $14 billion to the economy, and generate $3.9 billion in direct and indirect tax revenues (see Table 1).

If taxpayers in mixed-status households—ITIN filers and their families—were eligible for HEROS Act benefits, New York could expect 4,700 new jobs. In New York, the program would require a $400 million investment in federal funding and would provide $780 million in direct aid to immigrant families and $590 million to the state economy. The program would generate $160 million in government revenue that would bring the program’s net cost to $230 million.[6]

Table 1: Economic Benefits of Including Undocumented Immigrants in the HEROES Act

Source: Raul Hinojosa-Ojeda and Sherman Robinson, “Essential but Disposable: Undocumented workers and Their Mixed-Status Families”, UCLA Institute for Research on Labor Employment, UCLA Latino Policy and Politics Initiative, and the UCLA North American Integration and Development Center, August, 2020, https://irle.ucla.edu/2020/08/10/essentialworkers/

Note: SAM Models designed by Hinojosa et al.

Net cost of the program is not exact due to rounding.

By including undocumented immigrants in the next economic stimulus package policymakers will support livelihoods, help the economy, and accelerate job creation, helping everyone.

By: Shamier Settle and Cyierra Roldan

[1] Migration Policy Institute: https://www.migrationpolicy.org/article/covid19-immigrants-shut-out-federal-relief

[2] Migration Policy Institute (MPI) analysis of data from the 2012-16 American Community Survey (pooled) with assignments of immigration status by MPI researchers and by Jennifer Van Hook of The Pennsylvania State University and James Bachmeier of Temple University. Note that the Migration Policy Institute has somewhat higher estimates of the number of immigrants in New York State than the Center for Migration Studies or Pew Research Center.

[3] Lisa Christensen Gee, Matthew Gardner, Misha E, Hill and Meg Wiehe, “Undocumented Immigrants’ State and Local Tax Contributions,” March 2017, https://itep.sfo2.digitaloceanspaces.com/ITEP-2017-Undocumented-Immigrants-State-and-Local-Contributions.pdf

[4] David Dyssegaard Kallick, “Unemployment Insurance Taxes Paid for Undocumented Workers in New York State,” Fiscal Policy Institute, May 14, 2020, https://fiscalpolicy.org/wp-content/uploads/2020/05/UI-taxes-and-undocumented-workers.pdf

[5] House Committee on Appropriations: https://appropriations.house.gov/news/press-releases/house-democrats-release-updated-version-of-the-heroes-act

[6] These dollar amounts were calculated by UCLA using the Social Accounting Matrix Multiplier Model (SAM) which shows the flows of goods and services throughout the economy and the corresponding income and expenditures of all economic actors. To learn more about Social Accounting Matrix see UCLA’s technical report: https://irle.ucla.edu/wp-content/uploads/2020/08/Essential-Undocumented-Workers-Final-w-Cover.pdf

The HEROES Act Should Include Undocumented Taxpayers

October 26, 2020 |

Across the United States, undocumented immigrants and their families are still experiencing eviction, food insecurity, hunger, and financial difficulties due to COVID-19. Federal relief has continuously excluded this population of immigrants from income replacement assistance, stimulus payments, and unemployment insurance, which has exacerbated the adverse economic effects on undocumented families.

Earlier this year, the federal government passed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) to provide financial relief to families who were impacted by COVID-19. Sadly, undocumented immigrants and their families were intentionally excluded from receiving this economic assistance. The CARES Act excluded undocumented immigrants by specifically denying the aid checks of up to $1,200 to anyone who filed taxes using an Individual Taxpayer Identification Number (ITIN) or filed with someone using an ITIN. Even in families with just one member files using an ITIN, the entire family was ineligible.[1] In all, 15.4 million people in mixed-status families in the United States were excluded from these CARES Act funds, including 1.2 million New Yorkers. Of these, nearly a third (31 percent) are U.S. citizens or have a green card.[2]

It is unfair that undocumented immigrants continue to be excluded from federal relief when they contribute their share to help fund these programs. In the United States, undocumented immigrants contribute $11.74 billion to state and local taxes a year, including $1.1 billion in state and local taxes in New York State alone.[3] Undocumented immigrants are also responsible for $140 million in contributions to New York State’s unemployment fund through taxes paid by their employer. These workers are nonetheless excluded from unemployment insurance programs, despite being affected by COVID-19 like all other New Yorkers.[4]

Although it has been stalled by the president’s on-again, off-again approach to negotiations, the federal government is still in the midst of negotiating another federal relief package, known as the Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act. Advocates across the United States are working hard to try and push legislators to include undocumented immigrants in this relief package. This $2.2 trillion proposed aid package includes unemployment assistance, stimulus payments, an expansion of the Supplemental Nutrition Assistance Program (SNAP), and more.[5]

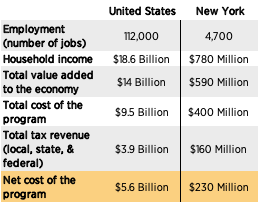

According to research from The University of California, Los Angeles (UCLA), including undocumented taxpayers in the HEROES Act, would have positive economic impacts on the country and states. Including undocumented taxpayers in the HEROES Act would help these families with financial hardships while simultaneously redistributing money to local and state economies. Aid would first and foremost provide immediate help to excluded families., Still it is important to note that it would also help boost local economies around the country through the ripple effects when the aid is spent paying for basic needs like buying food in grocery stores or covering rent. The UCLA study estimates that extending these HEROES Act benefits to excluded immigrants and their families would create 112,000 new jobs, provide $18.6 billion in household income, add $14 billion to the economy, and generate $3.9 billion in direct and indirect tax revenues (see Table 1).

If taxpayers in mixed-status households—ITIN filers and their families—were eligible for HEROS Act benefits, New York could expect 4,700 new jobs. In New York, the program would require a $400 million investment in federal funding and would provide $780 million in direct aid to immigrant families and $590 million to the state economy. The program would generate $160 million in government revenue that would bring the program’s net cost to $230 million.[6]

Table 1: Economic Benefits of Including Undocumented Immigrants in the HEROES Act

Source: Raul Hinojosa-Ojeda and Sherman Robinson, “Essential but Disposable: Undocumented workers and Their Mixed-Status Families”, UCLA Institute for Research on Labor Employment, UCLA Latino Policy and Politics Initiative, and the UCLA North American Integration and Development Center, August, 2020, https://irle.ucla.edu/2020/08/10/essentialworkers/

Note: SAM Models designed by Hinojosa et al.

Net cost of the program is not exact due to rounding.

By including undocumented immigrants in the next economic stimulus package policymakers will support livelihoods, help the economy, and accelerate job creation, helping everyone.

By: Shamier Settle and Cyierra Roldan

[1] Migration Policy Institute: https://www.migrationpolicy.org/article/covid19-immigrants-shut-out-federal-relief

[2] Migration Policy Institute (MPI) analysis of data from the 2012-16 American Community Survey (pooled) with assignments of immigration status by MPI researchers and by Jennifer Van Hook of The Pennsylvania State University and James Bachmeier of Temple University. Note that the Migration Policy Institute has somewhat higher estimates of the number of immigrants in New York State than the Center for Migration Studies or Pew Research Center.

[3] Lisa Christensen Gee, Matthew Gardner, Misha E, Hill and Meg Wiehe, “Undocumented Immigrants’ State and Local Tax Contributions,” March 2017, https://itep.sfo2.digitaloceanspaces.com/ITEP-2017-Undocumented-Immigrants-State-and-Local-Contributions.pdf

[4] David Dyssegaard Kallick, “Unemployment Insurance Taxes Paid for Undocumented Workers in New York State,” Fiscal Policy Institute, May 14, 2020, https://fiscalpolicy.org/wp-content/uploads/2020/05/UI-taxes-and-undocumented-workers.pdf

[5] House Committee on Appropriations: https://appropriations.house.gov/news/press-releases/house-democrats-release-updated-version-of-the-heroes-act

[6] These dollar amounts were calculated by UCLA using the Social Accounting Matrix Multiplier Model (SAM) which shows the flows of goods and services throughout the economy and the corresponding income and expenditures of all economic actors. To learn more about Social Accounting Matrix see UCLA’s technical report: https://irle.ucla.edu/wp-content/uploads/2020/08/Essential-Undocumented-Workers-Final-w-Cover.pdf