New York Hospitals will Close under the “One Big Beautiful Bill Act”

June 27, 2025 |

70 hospitals at risk of closure from federal Medicaid cuts

Key Findings

- 70 of New York’s 156 hospitals get over 25 percent of their net patient revenue from Medicaid or government appropriations.

- 94 of New York’s 156 hospitals would see profits eroded entirely with just a 10 percent cut to Medicaid revenue (and assuming no change to services rendered).

- 8 hospitals at risk of closure — the most of any district in the state — are in New York’s 23rd district, represented by Republican Representative Nicholas Langworthy. Another 7 at-risk hospitals are in Republican Representative Elise Stefanik’s district, both of whom voted in favor of the cuts to Medicaid in the One Big Beautiful Bill Act.

- 22 hospitals at risk of closure are in Republican-represented congressional districts.

Introduction

The One Big Beautiful Bill Act (OBBBA) passed by the U.S. House of Representatives last month will have major implications for New York’s budget and for the provision of healthcare in New York. Federal cuts to Medicaid and to the tax credits that fund the Essential Plan shift the cost of care from the federal government to the State. Given the magnitude of the projected impact of the OBBBA in New York — an estimated $13.5 billion in lost federal revenue and added costs each year — many health care providers, including hospitals, will experience budget shortfalls. This brief analyzes the risk of hospital closures statewide if the cuts to Medicaid in the OBBBA are enacted.

45% of New York hospitals face significant financial shocks

Based on 2023 data from the National Academy of State Health Policymakers, almost 45% of hospitals in New York – 70 out of 156 – receive at least a quarter of their net patient revenue (revenue received from providing health services) from a combination of Medicaid and other government appropriations.

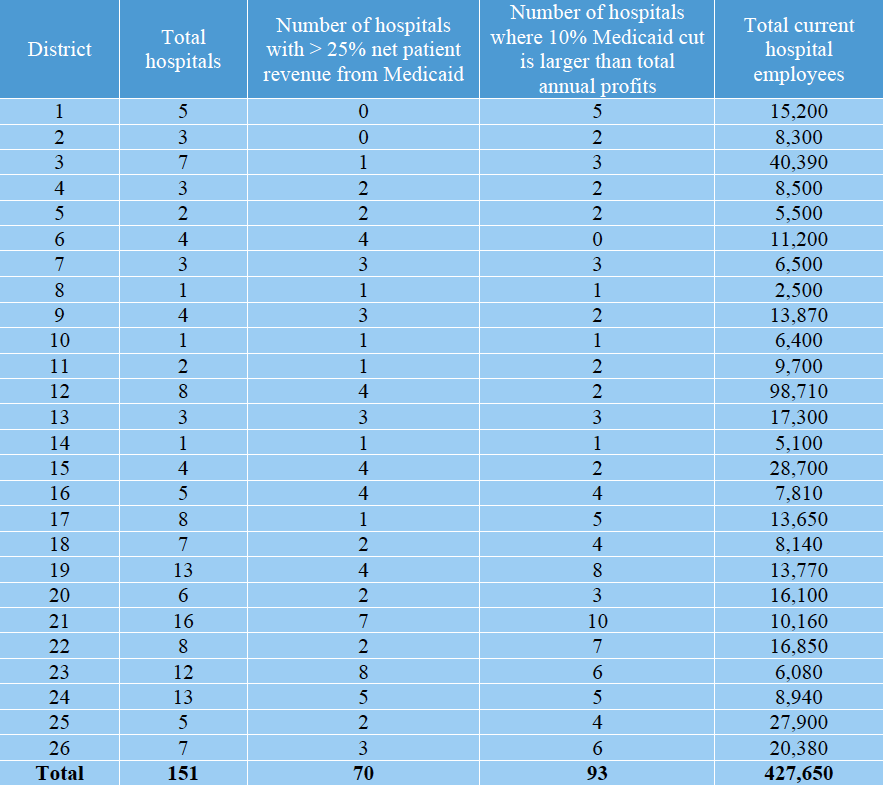

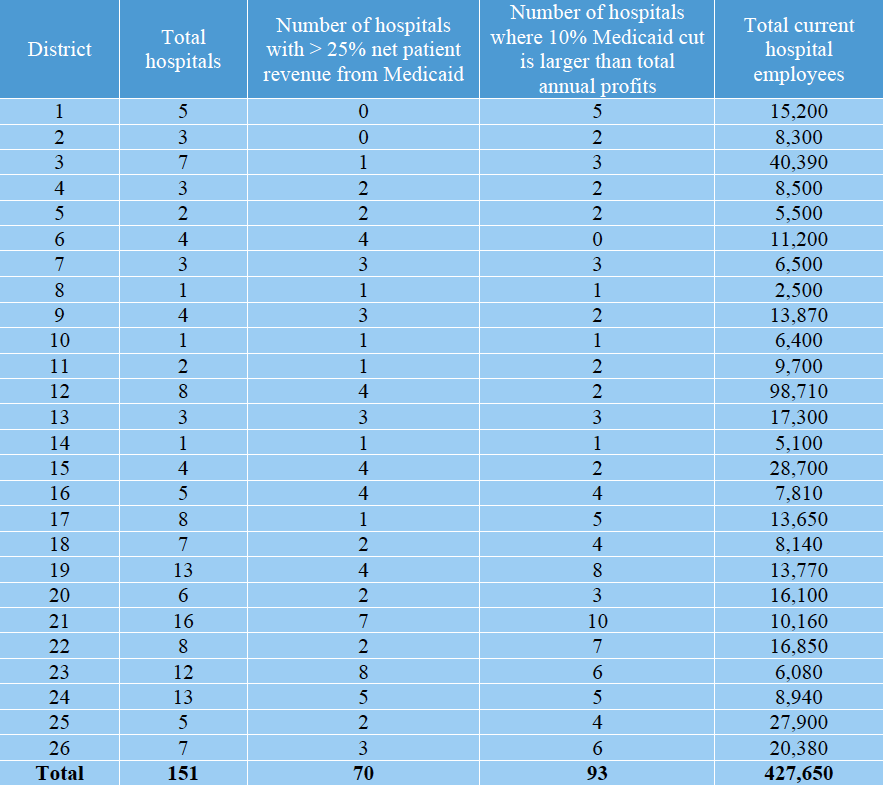

If this funding source shrinks — as it will under the OBBBA Medicaid cuts — these hospitals will face significant financial challenges, reduce services, and may be forced to shutter entirely. Further, many hospitals already have relatively narrow profit margins. According to the 2023 hospital financing data, 93 hospitals in New York have profit margins smaller than 10 percent of their overall Medicaid revenue. That is, if Medicaid were cut by 10%, 93 hospitals would either find themselves either newly in the red or more deeply in the red than they had been previously. These hospitals will need to adjust their services in order to stay in business. Of the congressional districts with the highest numbers of at-risk hospitals, two are represented by Republicans who voted for the OBBBA. In District 23 (Rep. Nick Langworthy), 8 out of 12 hospitals rely on Medicaid funding, while 8 out of 16 hospitals in District 21 (Rep. Elise Stefanik) depend on Medicaid for over 25 percent of their revenue. In fact, 22 of the 70 at-risk hospitals are in districts represented by Republicans who voted in favor of the OBBBA (with the exception of District 2, represented by Andrew Garbarino, who did not vote on the bill).

Mechanisms through which the OBBBA limits hospital funding

The OBBBA exposes hospitals to financial risks in several distinct ways:

-

Uncompensated care for the newly uninsured

The New York State Department of Health has estimated that the reconciliation bill will leave an additional 1.5 million New Yorkers uninsured, more than doubling the uninsurance rate in the state. Any increase to the uninsured rate creates a financial burden on hospitals, because hospitals will continue to have a legal and moral obligation to treat uninsured patients in emergency situations, but will no longer be compensated for that care. Loss of insurance will not only mean hospitals are no longer compensated for medical emergencies, it will also mean that hospitals see more emergency patients; newly uninsured patients will lose access to primary and preventive care, meaning that they will be more likely to face medical emergencies and will seek care in hospital emergency departments.

-

Elimination of Recent Medicaid Rate Increases and Future Downward Pressure on Medicaid Rates

The OBBBA would eliminate the state’s recently enacted MCO tax. This tax was used to fund, among other things, approximately $700 million in state- and federal-share hospital rate increases in fiscal year 2026 and subsequent years. However, these rate increases were made contingent on availability of the MCO tax revenue – and with that revenue gone, the increases will not happen. Further, fiscal pressures on the larger state budget will likely restrain Medicaid rate increases for the foreseeable future. Medicaid already pays less than half of what commercial insurance pays for the same services, which is why hospitals with a high Medicaid patient share are often financially burdened; the OBBBA would reverse recent progress on this issue.

-

Restrictions on Safety Net Hospital Funding

New York and other states offer significant direct funding, beyond Medicaid reimbursement, to help hospitals stay afloat. In the past several years this funding has amounted to about $3.5 billion annually through a variety of programs, including the Vital Access Provider Assistance Program, the Global Budget initiative financed by New York’s 1115 waiver, the Directed Payment Template state-directed payment program, and the Safety Net Transformation Fund. All of these sources of revenue are under acute pressure. All these programs serve hospitals that are already financially distressed and rely on ongoing state support to remain open. The programs collectively serve over 70 New York State hospitals, and it is almost inevitable that cuts to these programs will force some of these hospitals to close. The Senate version of the OBBBA, if passed, may have an even bigger impact on providers than the House bill by further restricting the ways in which states can reimburse hospitals for care.

Table 1. Hospitals most likely to be impacted by Medicaid cuts, by NY Congressional District

Note: The originally uploaded report contained errors in Table 2. Specifically, some of the listed congressional districts were incorrect. It has since been corrected.

New York Hospitals will Close under the “One Big Beautiful Bill Act”

June 27, 2025 |

70 hospitals at risk of closure from federal Medicaid cuts

Key Findings

- 70 of New York’s 156 hospitals get over 25 percent of their net patient revenue from Medicaid or government appropriations.

- 94 of New York’s 156 hospitals would see profits eroded entirely with just a 10 percent cut to Medicaid revenue (and assuming no change to services rendered).

- 8 hospitals at risk of closure — the most of any district in the state — are in New York’s 23rd district, represented by Republican Representative Nicholas Langworthy. Another 7 at-risk hospitals are in Republican Representative Elise Stefanik’s district, both of whom voted in favor of the cuts to Medicaid in the One Big Beautiful Bill Act.

- 22 hospitals at risk of closure are in Republican-represented congressional districts.

Introduction

The One Big Beautiful Bill Act (OBBBA) passed by the U.S. House of Representatives last month will have major implications for New York’s budget and for the provision of healthcare in New York. Federal cuts to Medicaid and to the tax credits that fund the Essential Plan shift the cost of care from the federal government to the State. Given the magnitude of the projected impact of the OBBBA in New York — an estimated $13.5 billion in lost federal revenue and added costs each year — many health care providers, including hospitals, will experience budget shortfalls. This brief analyzes the risk of hospital closures statewide if the cuts to Medicaid in the OBBBA are enacted.

45% of New York hospitals face significant financial shocks

Based on 2023 data from the National Academy of State Health Policymakers, almost 45% of hospitals in New York – 70 out of 156 – receive at least a quarter of their net patient revenue (revenue received from providing health services) from a combination of Medicaid and other government appropriations.

If this funding source shrinks — as it will under the OBBBA Medicaid cuts — these hospitals will face significant financial challenges, reduce services, and may be forced to shutter entirely. Further, many hospitals already have relatively narrow profit margins. According to the 2023 hospital financing data, 93 hospitals in New York have profit margins smaller than 10 percent of their overall Medicaid revenue. That is, if Medicaid were cut by 10%, 93 hospitals would either find themselves either newly in the red or more deeply in the red than they had been previously. These hospitals will need to adjust their services in order to stay in business. Of the congressional districts with the highest numbers of at-risk hospitals, two are represented by Republicans who voted for the OBBBA. In District 23 (Rep. Nick Langworthy), 8 out of 12 hospitals rely on Medicaid funding, while 8 out of 16 hospitals in District 21 (Rep. Elise Stefanik) depend on Medicaid for over 25 percent of their revenue. In fact, 22 of the 70 at-risk hospitals are in districts represented by Republicans who voted in favor of the OBBBA (with the exception of District 2, represented by Andrew Garbarino, who did not vote on the bill).

Mechanisms through which the OBBBA limits hospital funding

The OBBBA exposes hospitals to financial risks in several distinct ways:

-

Uncompensated care for the newly uninsured

The New York State Department of Health has estimated that the reconciliation bill will leave an additional 1.5 million New Yorkers uninsured, more than doubling the uninsurance rate in the state. Any increase to the uninsured rate creates a financial burden on hospitals, because hospitals will continue to have a legal and moral obligation to treat uninsured patients in emergency situations, but will no longer be compensated for that care. Loss of insurance will not only mean hospitals are no longer compensated for medical emergencies, it will also mean that hospitals see more emergency patients; newly uninsured patients will lose access to primary and preventive care, meaning that they will be more likely to face medical emergencies and will seek care in hospital emergency departments.

-

Elimination of Recent Medicaid Rate Increases and Future Downward Pressure on Medicaid Rates

The OBBBA would eliminate the state’s recently enacted MCO tax. This tax was used to fund, among other things, approximately $700 million in state- and federal-share hospital rate increases in fiscal year 2026 and subsequent years. However, these rate increases were made contingent on availability of the MCO tax revenue – and with that revenue gone, the increases will not happen. Further, fiscal pressures on the larger state budget will likely restrain Medicaid rate increases for the foreseeable future. Medicaid already pays less than half of what commercial insurance pays for the same services, which is why hospitals with a high Medicaid patient share are often financially burdened; the OBBBA would reverse recent progress on this issue.

-

Restrictions on Safety Net Hospital Funding

New York and other states offer significant direct funding, beyond Medicaid reimbursement, to help hospitals stay afloat. In the past several years this funding has amounted to about $3.5 billion annually through a variety of programs, including the Vital Access Provider Assistance Program, the Global Budget initiative financed by New York’s 1115 waiver, the Directed Payment Template state-directed payment program, and the Safety Net Transformation Fund. All of these sources of revenue are under acute pressure. All these programs serve hospitals that are already financially distressed and rely on ongoing state support to remain open. The programs collectively serve over 70 New York State hospitals, and it is almost inevitable that cuts to these programs will force some of these hospitals to close. The Senate version of the OBBBA, if passed, may have an even bigger impact on providers than the House bill by further restricting the ways in which states can reimburse hospitals for care.

Table 1. Hospitals most likely to be impacted by Medicaid cuts, by NY Congressional District

Note: The originally uploaded report contained errors in Table 2. Specifically, some of the listed congressional districts were incorrect. It has since been corrected.