City of Yes and the Housing Affordability Crisis

November 15, 2024 |

Housing affordability crisis constitutes greatest threat to New York City’s economic future

By the end of 2024, the New York City Council will vote on "City of Yes for Housing Opportunity." The "City of Yes" proposal would increase the housing supply in New York City by approximately 100,000 units by 2039. Increasing housing supply is one of several necessary policy interventions needed to curtail the current crisis in housing affordability. Without increased housing supply, New York City is at risk of economic stagnation and possible decline. However, increasing housing supply should be paired with investments in deeply affordable housing and tenant protections that will more rapidly alleviate the affordability crisis and protect vulnerable New Yorkers.

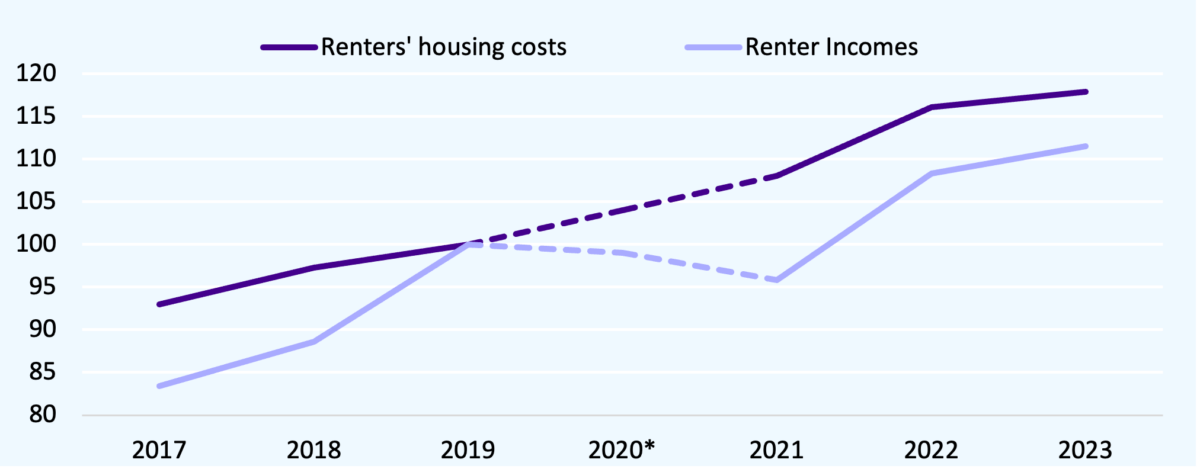

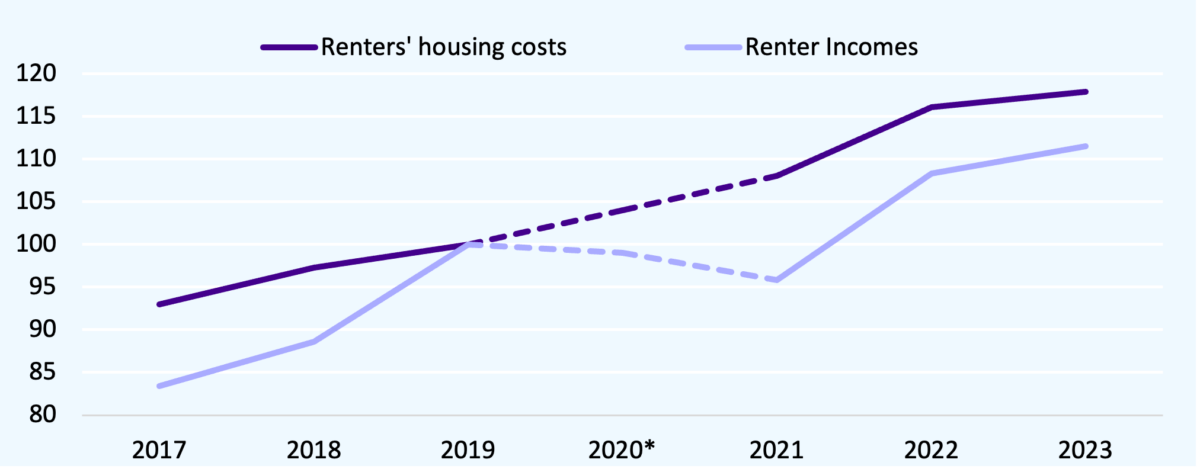

Housing costs have increased faster than incomes in New York City.

- For renters, incomes grew by 11.5 percent from 2019 to 2023, whereas housing costs grew by nearly 18 percent.

- That is, for renters, housing costs grew 57 percent faster than wages between 2019 and 2023.

Figure 1. Median incomes and housing costs for New York City renters

Note. Data from the American Community Survey 1-yr files. Data for 2020 is not considered high quality.

- For homeowners, incomes grew by 9.8 percent from 2019 whereas housing costs grew by 11.6 percent.

- That is, for homeowners, housing costs grew 18 percent faster than wages between 2019 and 2023.

Figure 2. Median incomes and housing costs for New York City homeowners

Housing affordability has become the leading reason that families are leaving New York State.

- Recent population loss—546,000 people over the past four years[1]—threatens the economic and fiscal stability of New York City by hindering job growth and undermining the tax base.

- 36 percent of out-migrants cite housing as their primary reason for moving out of New York. Before the Covid-19 pandemic, this number was only 16 percent.

Figure 3. New York domestic migrants’ reasons for moving, pre- and post-Covid

Note. Data from the Current Population Survey.

The City can afford to invest in affordability measures — for example, expanding housing vouchers, producing more units that are offered at permanently affordable rates, and continuing to stabilize and improve the NYCHA housing developments — that will complement City of Yes.

- Recent City revenue forecasts have underestimated revenue and overstated impending deficits.

- For instance, while the fiscal year 2023 adopted budget projected a $4.2 billion gap in fiscal year 2024, the year ended with a $4.4 billion surplus.

- The Independent Budget Office expects outyear revenue to exceed projections by an average of $1.7 billion each year.

- New York City includes $1.5 billion in in-year reserves in each fiscal year.

[1] NYC Department of City Planning Population Division, New York City’s Current Population Estimates and Trends, June 2024.

City of Yes and the Housing Affordability Crisis

November 15, 2024 |

Housing affordability crisis constitutes greatest threat to New York City’s economic future

By the end of 2024, the New York City Council will vote on "City of Yes for Housing Opportunity." The "City of Yes" proposal would increase the housing supply in New York City by approximately 100,000 units by 2039. Increasing housing supply is one of several necessary policy interventions needed to curtail the current crisis in housing affordability. Without increased housing supply, New York City is at risk of economic stagnation and possible decline. However, increasing housing supply should be paired with investments in deeply affordable housing and tenant protections that will more rapidly alleviate the affordability crisis and protect vulnerable New Yorkers.

Housing costs have increased faster than incomes in New York City.

- For renters, incomes grew by 11.5 percent from 2019 to 2023, whereas housing costs grew by nearly 18 percent.

- That is, for renters, housing costs grew 57 percent faster than wages between 2019 and 2023.

Figure 1. Median incomes and housing costs for New York City renters

Note. Data from the American Community Survey 1-yr files. Data for 2020 is not considered high quality.

- For homeowners, incomes grew by 9.8 percent from 2019 whereas housing costs grew by 11.6 percent.

- That is, for homeowners, housing costs grew 18 percent faster than wages between 2019 and 2023.

Figure 2. Median incomes and housing costs for New York City homeowners

Housing affordability has become the leading reason that families are leaving New York State.

- Recent population loss—546,000 people over the past four years[1]—threatens the economic and fiscal stability of New York City by hindering job growth and undermining the tax base.

- 36 percent of out-migrants cite housing as their primary reason for moving out of New York. Before the Covid-19 pandemic, this number was only 16 percent.

Figure 3. New York domestic migrants’ reasons for moving, pre- and post-Covid

Note. Data from the Current Population Survey.

The City can afford to invest in affordability measures — for example, expanding housing vouchers, producing more units that are offered at permanently affordable rates, and continuing to stabilize and improve the NYCHA housing developments — that will complement City of Yes.

- Recent City revenue forecasts have underestimated revenue and overstated impending deficits.

- For instance, while the fiscal year 2023 adopted budget projected a $4.2 billion gap in fiscal year 2024, the year ended with a $4.4 billion surplus.

- The Independent Budget Office expects outyear revenue to exceed projections by an average of $1.7 billion each year.

- New York City includes $1.5 billion in in-year reserves in each fiscal year.

[1] NYC Department of City Planning Population Division, New York City’s Current Population Estimates and Trends, June 2024.