Fact Sheet: The 2026 Executive Budget’s Fiscal Outlook

January 29, 2025 |

Spending is set to keep pace with economic growth

The executive budget proposes a state operating budget of $143.8 billion for fiscal year 2026. This spending level would keep the budget in line with the state’s economic growth. After spending restraint consistently reduced the size of the budget relative to the economy through the 2010s, spending has kept pace with economic growth since fiscal year 2023. The executive budget would extend this trend through fiscal year 2029.

Figure 1. State operating funds spending as share of state personal income, fiscal years 2009 to 2029

Strong revenue creates surpluses

The executive budget makes significant upward revisions to its expected revenue for both the current and upcoming fiscal years (fiscal years 2025 and 2026, respectively), raising anticipated tax receipts by $4.6 billion and $4.1 billion from the levels projected in the fiscal year 2025 enacted budget financial plan. Strong personal income tax receipts drive higher-than-anticipated revenue.

Higher revenue is set to create a $3.5 billion surplus for fiscal year 2025 and $1.8 billion surplus next year. The proposed budget would roll the current year surplus into next year, financing the governor’s policy proposals. Because the governor’s costliest policy proposals, detailed in the next section, take the form of tax refunds, they would push down fiscal year 2026 revenue by $4 billion, rather than raise spending.

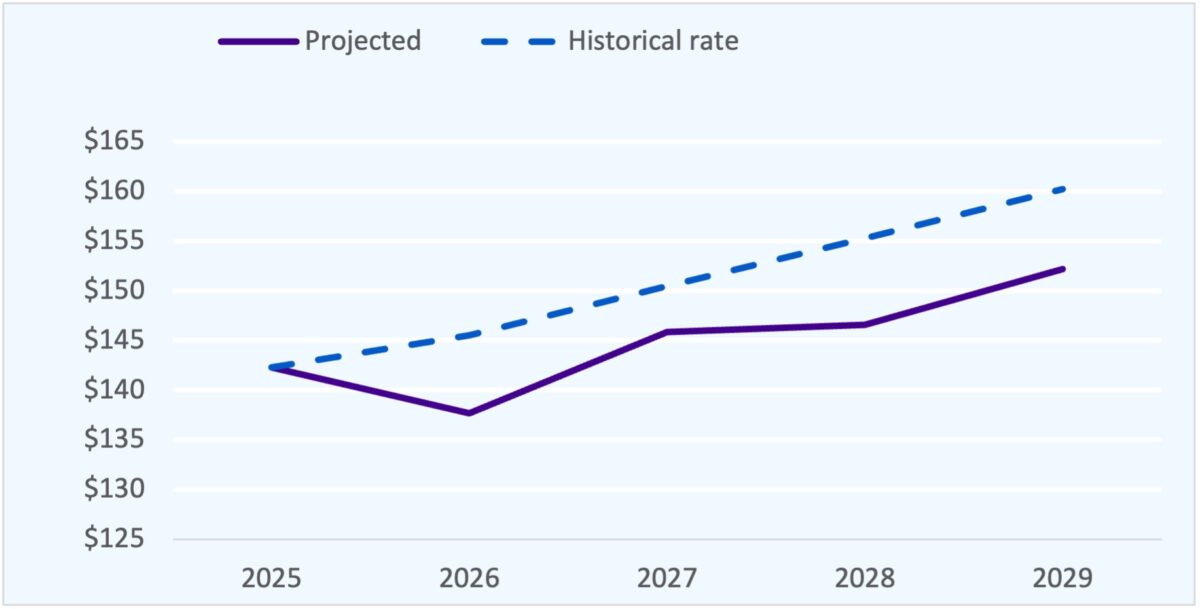

Projections of future revenue are subdued

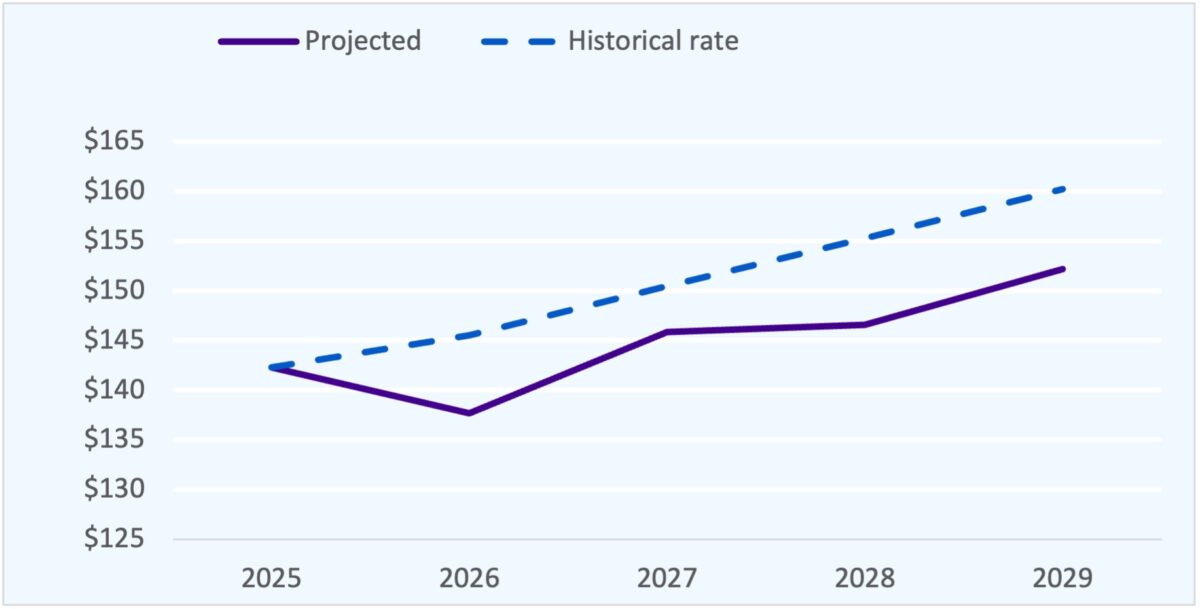

The budget projects subdued growth, averaging a 1.7 percent annual rate, in the financial plan outyears, fiscal years 2027 to 2029. This rate is about half the historical rate of growth of 3.0 percent experienced over the 2010s, adjusting for inflation. If revenue grows at this historical rate, state operating funds revenue would reach $160.2 billion by fiscal year 2029, $8 billion above the level projected in the executive budget.

Figure 2. State operating funds revenue projected by executive budget and historical trend, fiscal years 2025 to 2029 (dollars in billions)

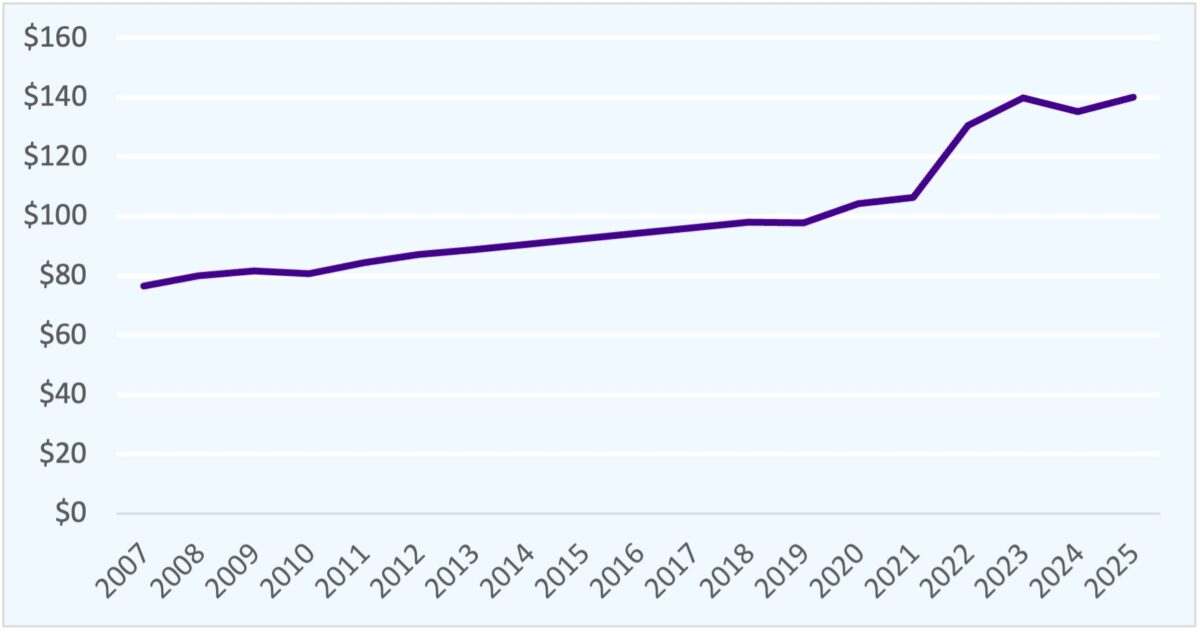

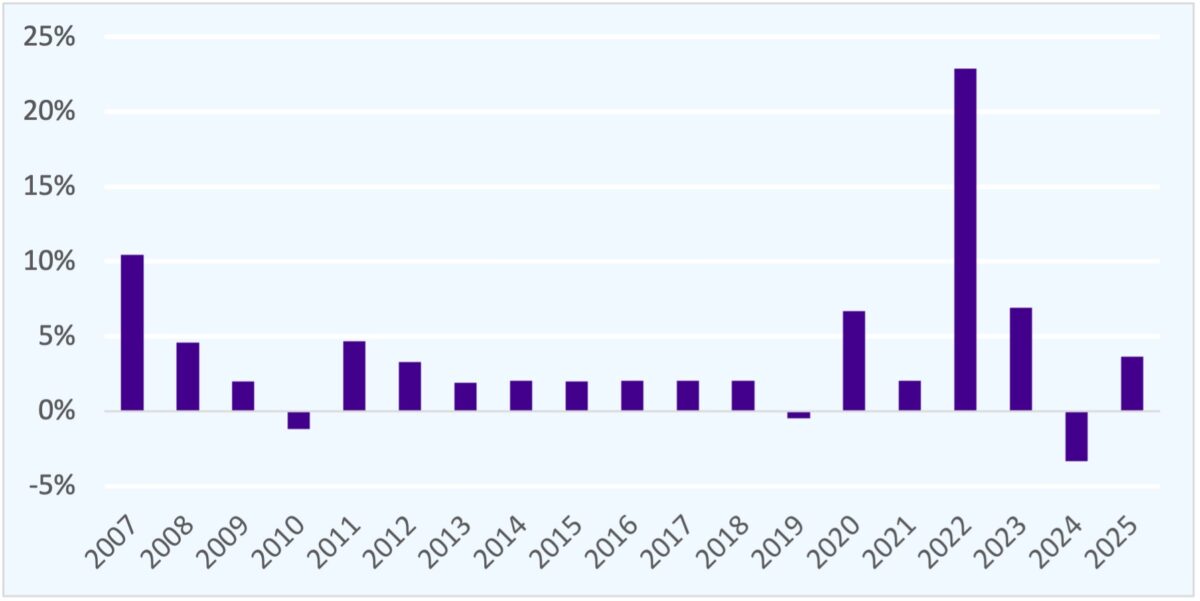

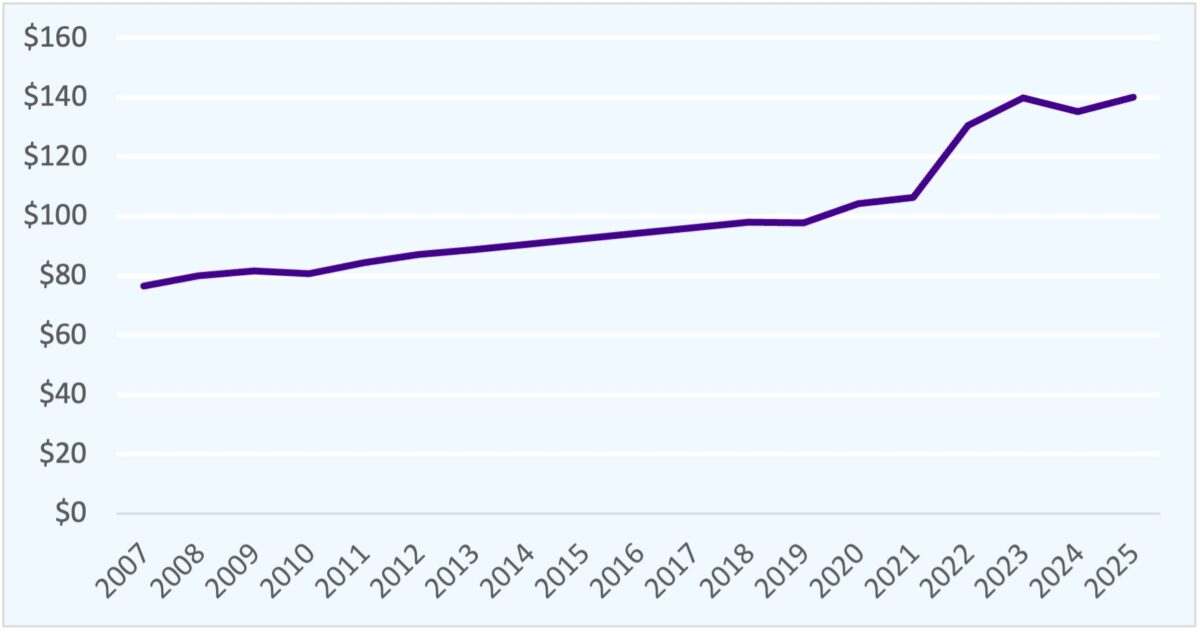

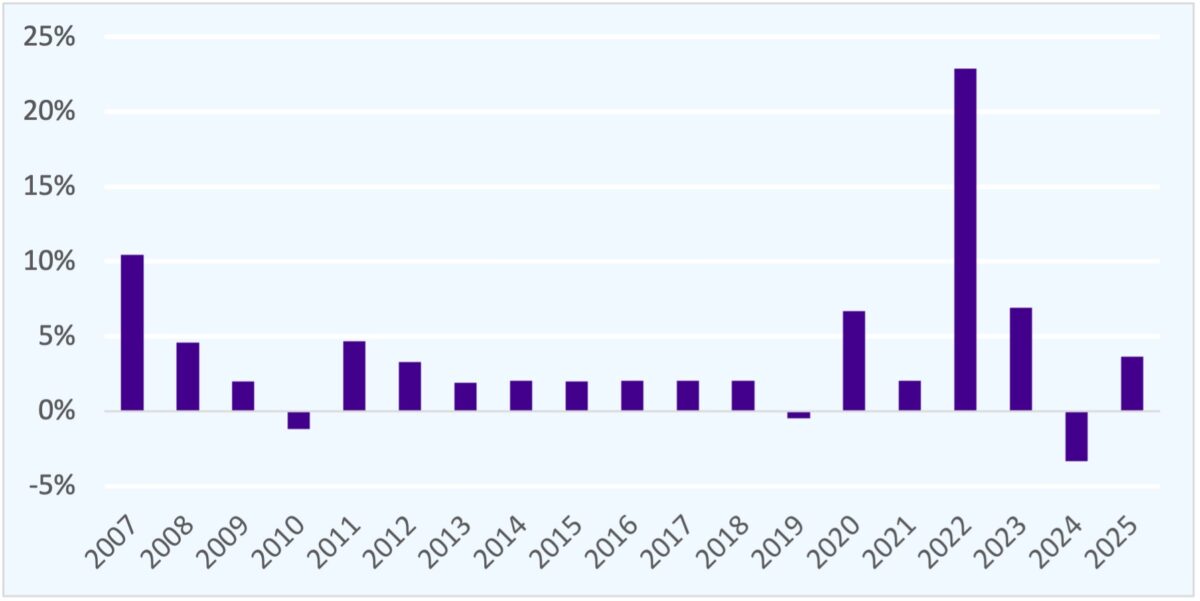

The State’s revenue projections have been increasingly conservative in recent years. While revenue grew briskly in the immediate aftermath of the Covid pandemic and has remained high (see figure 3), annual growth has been variable (see figure 4). This fiscal uncertainty prompted the State to take a very conservative approach to its fiscal projections. As a result, consistent annual surpluses have been accompanied by pessimistic forecasts.

Figure 3. State operating funds revenue, fiscal years 2007 to 2025 (dollars in billions)

Figure 4. Annual change in state operating funds revenue, fiscal years 2007 to 2025

An increasing preference for one-off policies

The State’s annual surpluses in recent years, alongside cautious fiscal forecasts, have resulted in a strong preference for one-off and temporary policies, rather than commitments to permanent programs. Since fiscal year 2023, these have included a gas tax holiday and homeowner tax rebate; a series of bonus payments to healthcare and childcare workers; and a series of debt prepayment. The proposed $3 billion inflation would follow this pattern, as would a temporary, three-year enhancement to the child tax credit.

Historically strong reserves

The State also used its high, consistent surpluses to bolster its fiscal reserves in recent years. Prior to the pandemic, the State’s meager fiscal reserves lagged other states and would have been inadequate to maintain spending during a downturn. Between fiscal years 2021 and 2023, the State increased its formal reserves from less than $4 billion to nearly $20 billion. Further, the State maintains other funds not designated as reserves but nevertheless uncommitted to other uses and available to support the budget. Taken together, the State’s fiscal resources will reach $34 billion in fiscal year 2025, a record high.

Figure 5. State fiscal resources, fiscal year 2015 to 2025 (billions of dollars)

Manageable projected gaps

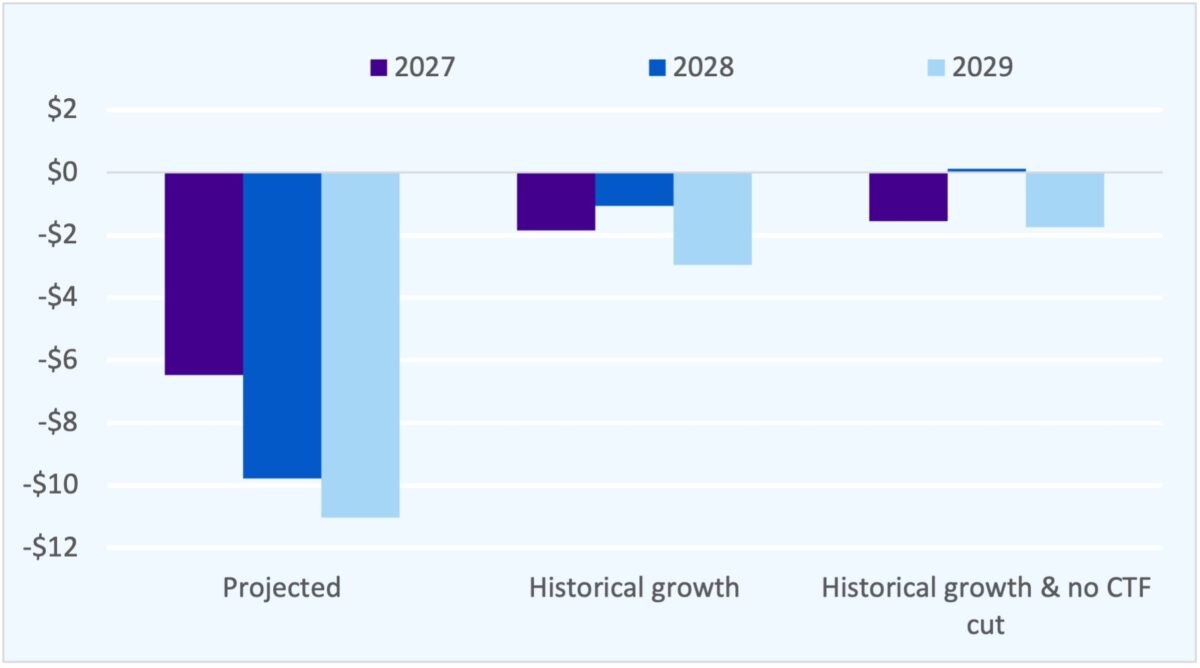

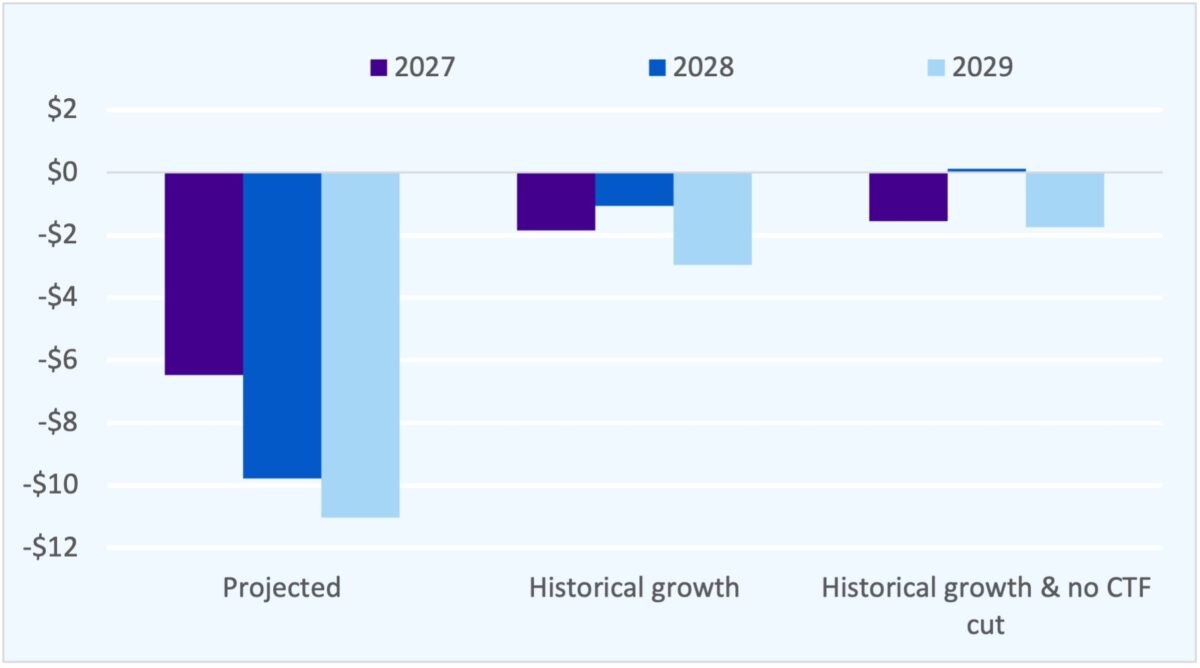

The executive budget projects a $6.5 billion budget gap in fiscal year 2027, rising to $11 billion in fiscal year 2029. In presenting the budget, the State budget director called these gaps “manageable.” The State’s budget gaps typically narrow as revenue exceeds conservative estimates. If the State’s revenue grows at an average historical rate through fiscal year 2029, the gaps would narrow from an average $9 billion per year to $2 billion. Further, the current gaps assume that temporary increases to the corporate tax rate passed in 2021 will expire in 2027. If these rates are made permanent, the remaining gaps will average just $1 billion each year.

Figure 6. Projected budget gaps and gaps under potential scenarios, fiscal year 2027 to 2029 (dollars in billions)

Fact Sheet: The 2026 Executive Budget’s Fiscal Outlook

January 29, 2025 |

Spending is set to keep pace with economic growth

The executive budget proposes a state operating budget of $143.8 billion for fiscal year 2026. This spending level would keep the budget in line with the state’s economic growth. After spending restraint consistently reduced the size of the budget relative to the economy through the 2010s, spending has kept pace with economic growth since fiscal year 2023. The executive budget would extend this trend through fiscal year 2029.

Figure 1. State operating funds spending as share of state personal income, fiscal years 2009 to 2029

Strong revenue creates surpluses

The executive budget makes significant upward revisions to its expected revenue for both the current and upcoming fiscal years (fiscal years 2025 and 2026, respectively), raising anticipated tax receipts by $4.6 billion and $4.1 billion from the levels projected in the fiscal year 2025 enacted budget financial plan. Strong personal income tax receipts drive higher-than-anticipated revenue.

Higher revenue is set to create a $3.5 billion surplus for fiscal year 2025 and $1.8 billion surplus next year. The proposed budget would roll the current year surplus into next year, financing the governor’s policy proposals. Because the governor’s costliest policy proposals, detailed in the next section, take the form of tax refunds, they would push down fiscal year 2026 revenue by $4 billion, rather than raise spending.

Projections of future revenue are subdued

The budget projects subdued growth, averaging a 1.7 percent annual rate, in the financial plan outyears, fiscal years 2027 to 2029. This rate is about half the historical rate of growth of 3.0 percent experienced over the 2010s, adjusting for inflation. If revenue grows at this historical rate, state operating funds revenue would reach $160.2 billion by fiscal year 2029, $8 billion above the level projected in the executive budget.

Figure 2. State operating funds revenue projected by executive budget and historical trend, fiscal years 2025 to 2029 (dollars in billions)

The State’s revenue projections have been increasingly conservative in recent years. While revenue grew briskly in the immediate aftermath of the Covid pandemic and has remained high (see figure 3), annual growth has been variable (see figure 4). This fiscal uncertainty prompted the State to take a very conservative approach to its fiscal projections. As a result, consistent annual surpluses have been accompanied by pessimistic forecasts.

Figure 3. State operating funds revenue, fiscal years 2007 to 2025 (dollars in billions)

Figure 4. Annual change in state operating funds revenue, fiscal years 2007 to 2025

An increasing preference for one-off policies

The State’s annual surpluses in recent years, alongside cautious fiscal forecasts, have resulted in a strong preference for one-off and temporary policies, rather than commitments to permanent programs. Since fiscal year 2023, these have included a gas tax holiday and homeowner tax rebate; a series of bonus payments to healthcare and childcare workers; and a series of debt prepayment. The proposed $3 billion inflation would follow this pattern, as would a temporary, three-year enhancement to the child tax credit.

Historically strong reserves

The State also used its high, consistent surpluses to bolster its fiscal reserves in recent years. Prior to the pandemic, the State’s meager fiscal reserves lagged other states and would have been inadequate to maintain spending during a downturn. Between fiscal years 2021 and 2023, the State increased its formal reserves from less than $4 billion to nearly $20 billion. Further, the State maintains other funds not designated as reserves but nevertheless uncommitted to other uses and available to support the budget. Taken together, the State’s fiscal resources will reach $34 billion in fiscal year 2025, a record high.

Figure 5. State fiscal resources, fiscal year 2015 to 2025 (billions of dollars)

Manageable projected gaps

The executive budget projects a $6.5 billion budget gap in fiscal year 2027, rising to $11 billion in fiscal year 2029. In presenting the budget, the State budget director called these gaps “manageable.” The State’s budget gaps typically narrow as revenue exceeds conservative estimates. If the State’s revenue grows at an average historical rate through fiscal year 2029, the gaps would narrow from an average $9 billion per year to $2 billion. Further, the current gaps assume that temporary increases to the corporate tax rate passed in 2021 will expire in 2027. If these rates are made permanent, the remaining gaps will average just $1 billion each year.

Figure 6. Projected budget gaps and gaps under potential scenarios, fiscal year 2027 to 2029 (dollars in billions)