Fiscal Analysis: 2025 Revenue To Exceed Projections by At Least $4 Billion

March 15, 2024 |

Reasonable assumptions about state revenue growth show additional spending power and quell concerns about future budget gaps

Emily Eisner, Ph.D., Economist; Andrew Perry, Senior Policy Analyst

March 15, 2024

Key Findings:

- FPI’s model of State revenue growth projects FY25 revenue will likely exceed current forecasts by at least $4 billion.

- The DOB’s assumed growth rates for State revenue are very low by historical standards and are out of sync with most forecasts of U.S. economic growth over coming years.

- Based on FPI’s model, currently forecasted budget gaps will almost entirely close and some years will contain significant surplus

New York State’s Division of the Budget (DOB) forecasts a State budget for fiscal year 2025 of $129.5 billion, following fiscal year 2024’s budget of $129.9 billion. DOB’s forecasts assume declining revenue – and thus a shrinking budget – over the next fiscal year. These forecasts are out of step with both recent state economic trends and national economic expectations.

- FPI models of State revenue growth demonstrate that fiscal year 2025 revenue will likely exceed current forecasts by at least $4 billion. This does not include the additional $1.35 added by the recent Economic and Revenue Consensus Report.

- If State revenue grows at an average rate over the next year (based on the last decade of state data), revenue will exceed current State projections for fiscal year 2025 by $5.2 billion, or 4.0 percent.

Assuming low but positive real growth rates, future out-year budget gaps would disappear or be negligible, indicating that the State would remain on a stable spending trajectory as long as real growth remains non-negative.

In their one-house budget proposals for fiscal year 2025, the State Senate and Assembly project spending (based on higher revenue expectations) of $137.9 billion and $140.0 billion, respectively. Compared to the executive budget, both spending proposals require additional revenue to meet funding needs. To fund these spending proposals, both houses add new revenue measures in addition to re-estimating next-year revenue more optimistically. Both legislative houses would raise personal income and corporate taxes, generating an expected $2.3 billion, and impose a new tax on Medicaid providers that would generate $4 billion in matching federal Medicaid funding.

DOB revenue projections reflect overly pessimistic assumptions about state economic growth — out of step with recent economic trends

Revenue projections play a key role in determining the path of budget negotiations. DOB releases updated revenue projections throughout the year, forecasting the State’s revenue and spending for three years beyond the current fiscal year. As the State’s ability to spend is limited by expected revenue, these forecasts determine the size of the budget enacted each April.

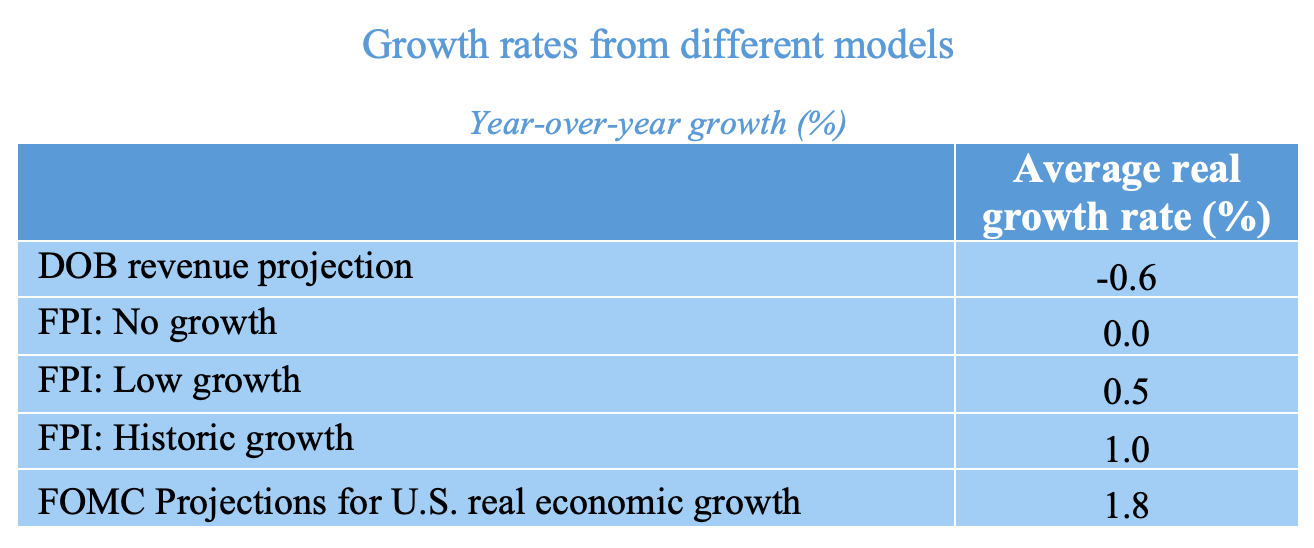

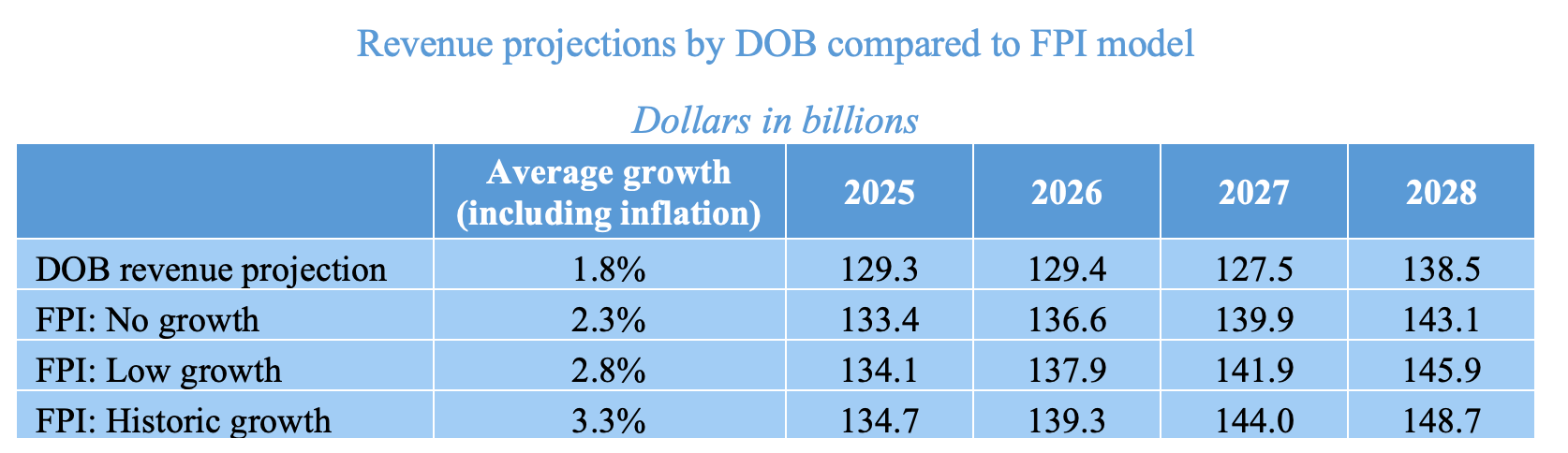

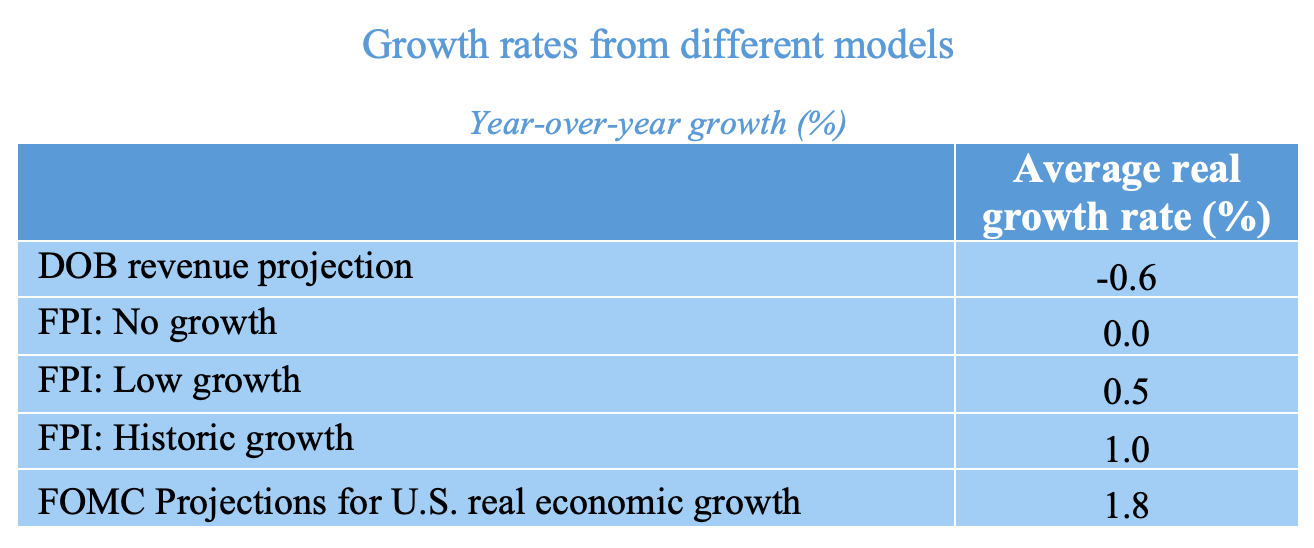

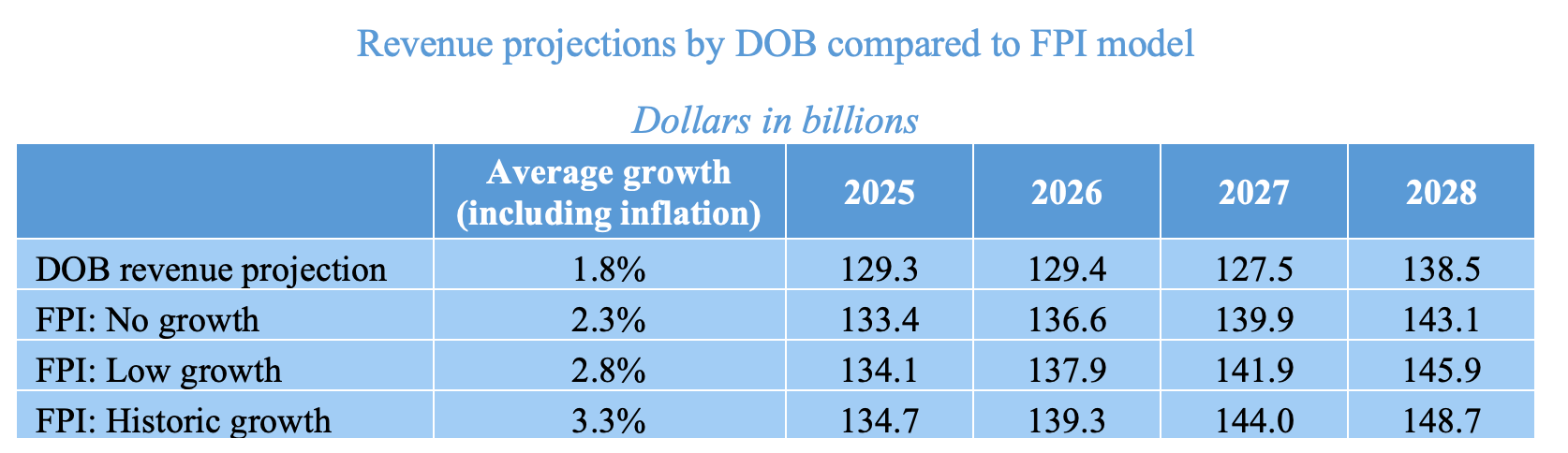

In this year’s executive budget, DOB released revenue and spending forecasts for fiscal years 2025 through 2028. These revenue forecasts assume an average growth rate for fiscal years 2025 through 2028 of -0.6 percent (negative growth) after adjusting for inflation, or 1.8 percent in non-inflation-adjusted dollars. These assumed growth rates for State revenue are very low by historical standards and are out of sync with most forecasts of U.S. economic growth over coming years.

DOB’s expectation of -0.6 percent real economic growth is additionally out of step with the last decade of state economic trends. Between fiscal years 2011 and 2021 the real revenue growth rate averaged 1.0 percent, and would have been higher if not for tax cuts and the expansion of corporate tax credits.

Further, current U.S. economic projections by the members of the Federal Reserve’s Federal Open Market Committee (FOMC) predict real economic growth of 1.4-1.9 percent (inflation-adjusted) over calendar years 2024 through 2026 with long run real growth estimated to be around 1.8 percent. New York’s growth typically trends alongside the U.S. economy and as of July 2023, the U.S. and New York both had annual growth in personal income of 4.9 percent. However, New York’s economy, as measured by total personal income, has been growing at about half the rate of the U.S. economy since 2018, so it is reasonable to expect that New York growth will be lower than overall U.S. economic growth for the foreseeable future. Nonetheless, optimistic forecasts of economic growth in the U.S. cast doubt on the pessimistic forecasts made by DOB.

Based on FPI’s model, currently forecasted budget gaps will almost entirely close and some years will contain significant surplus

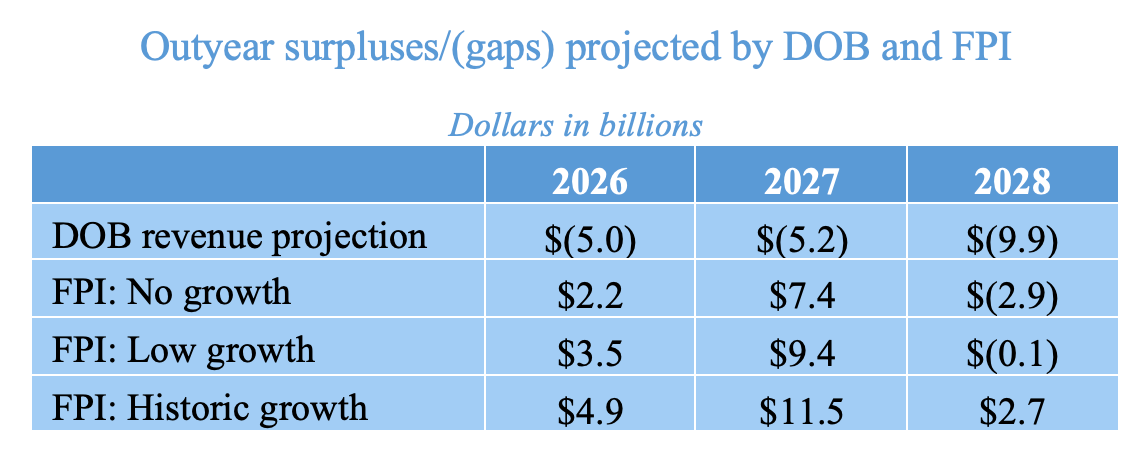

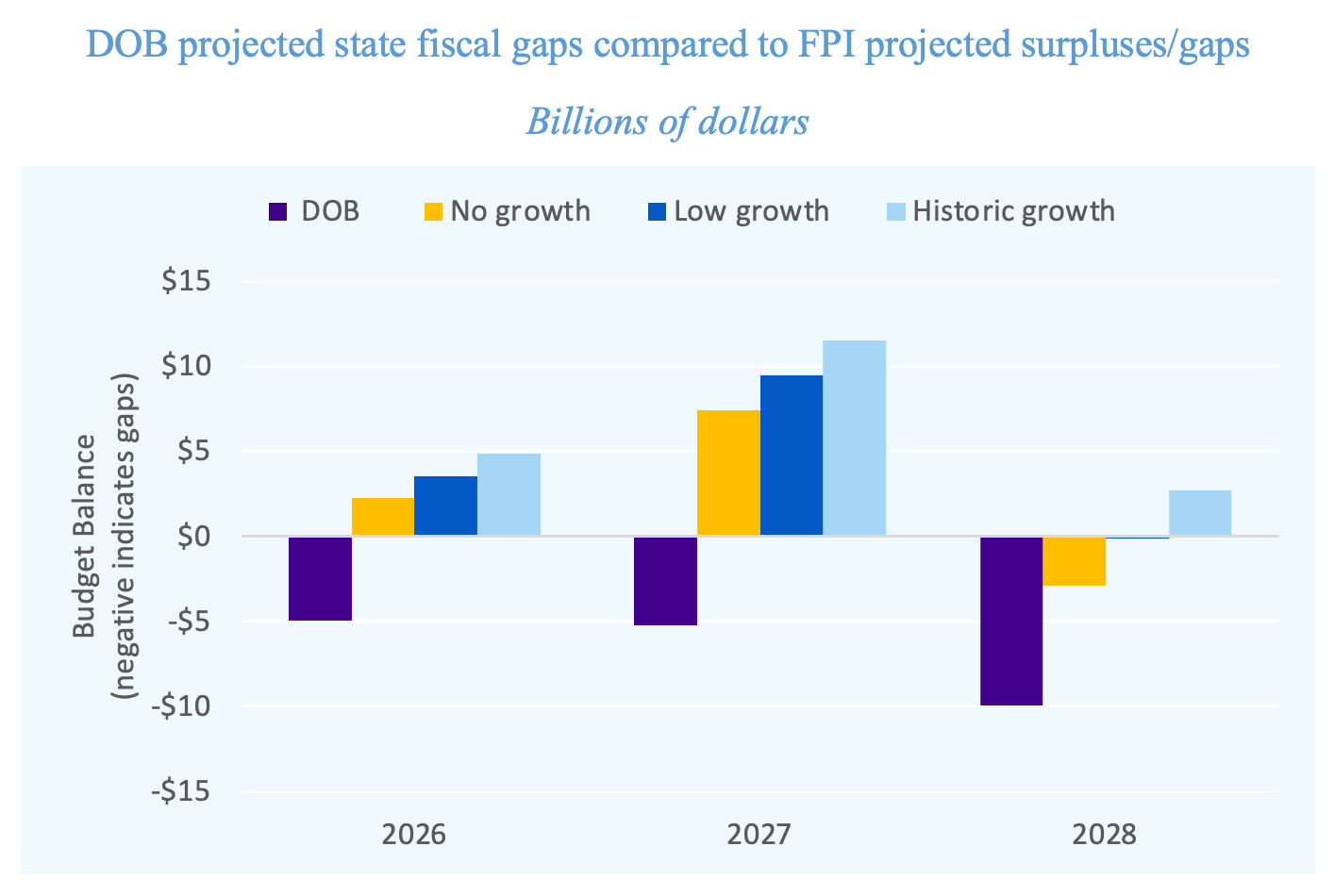

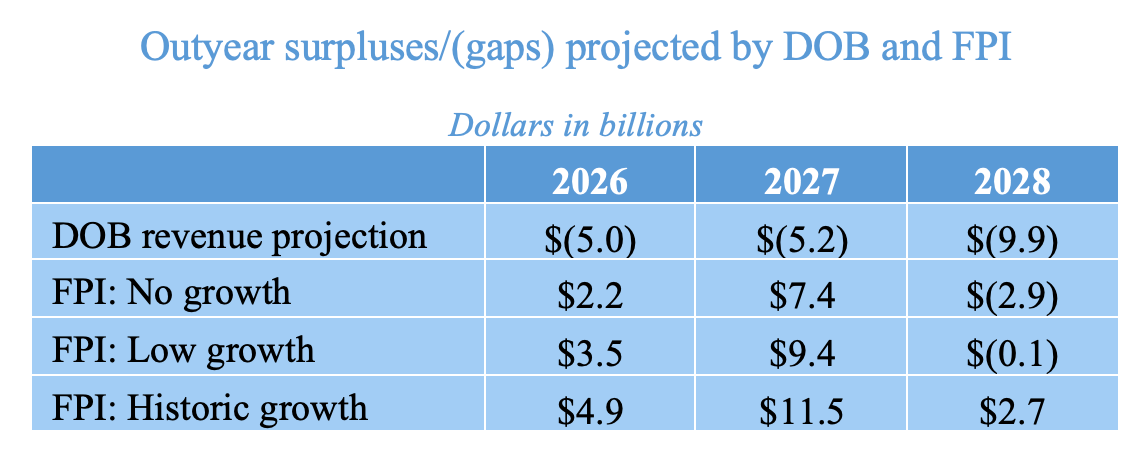

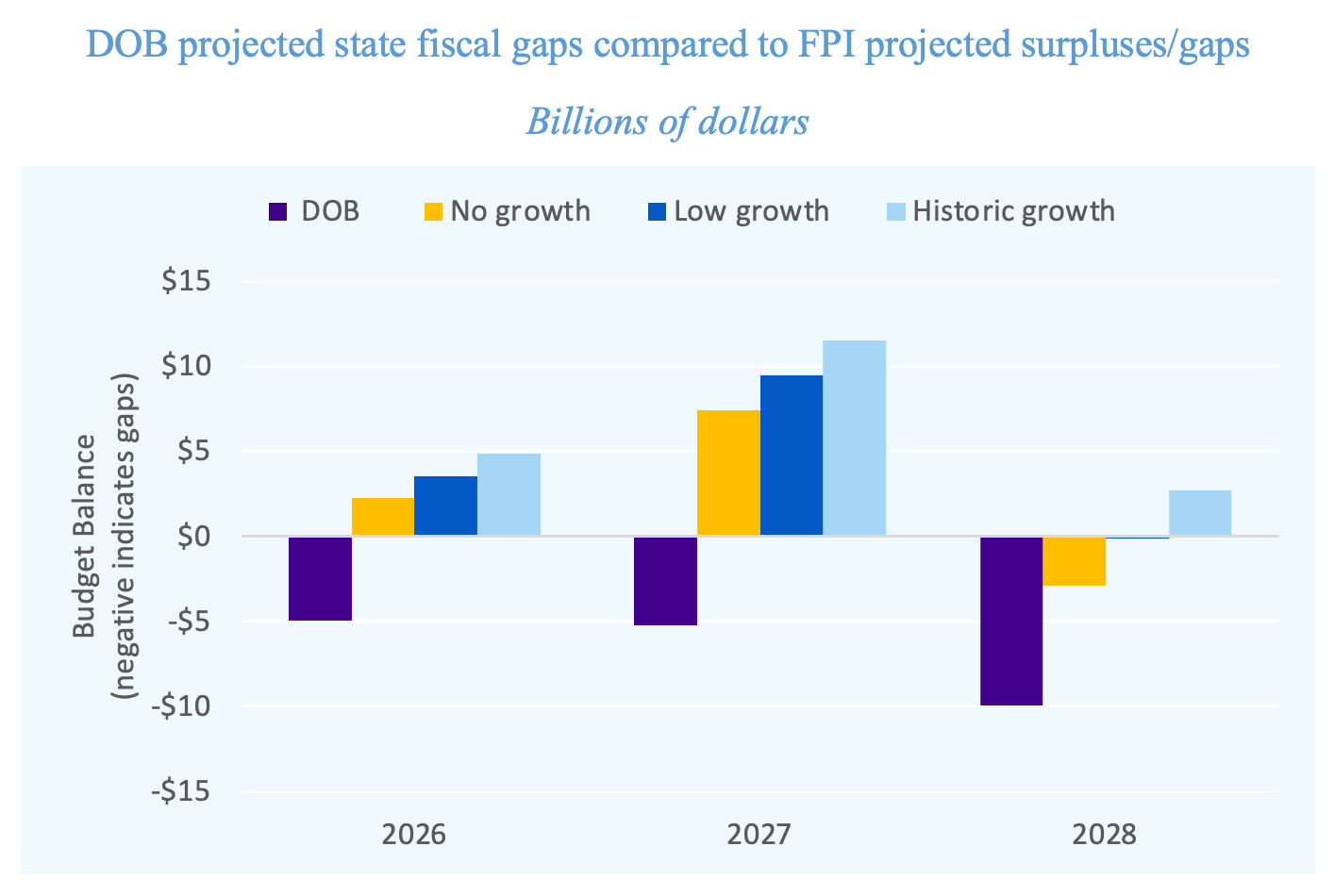

Beyond fiscal year 2025, FPI analyzes projected state budget gaps under these three different growth rate scenarios. In even the most conservative of scenarios — in which real revenue growth is 0.0 percent — currently forecasted budget gaps are almost entirely closed, and some years contain significant surplus. Using the 2010s historical average growth rate, all future budget gaps are converted into significant surpluses, demonstrating the sensitivity of state budget gap projections to the assumed growth in revenue.

FPI projects a minimum of $4 billion in additional FY 2025 revenue

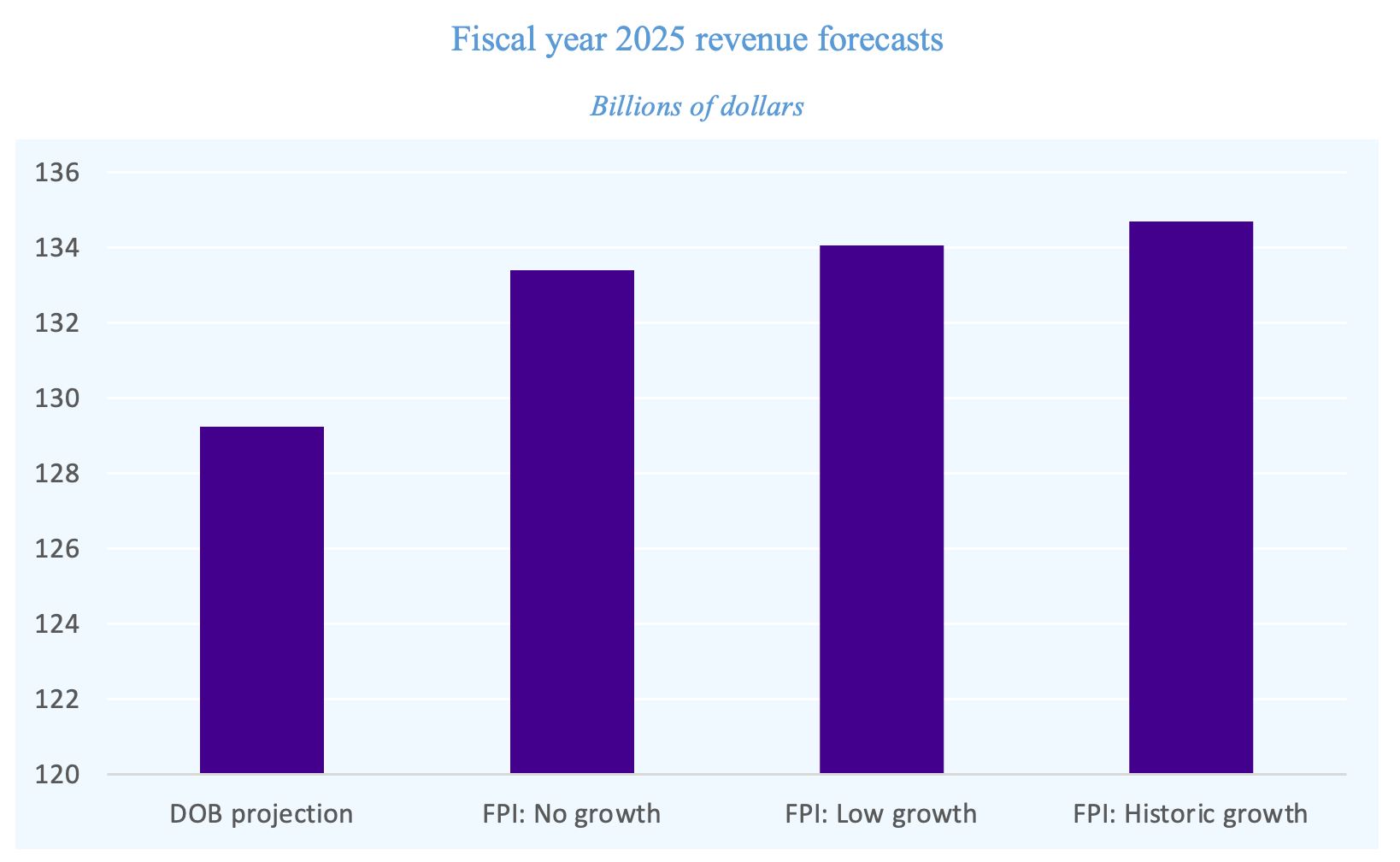

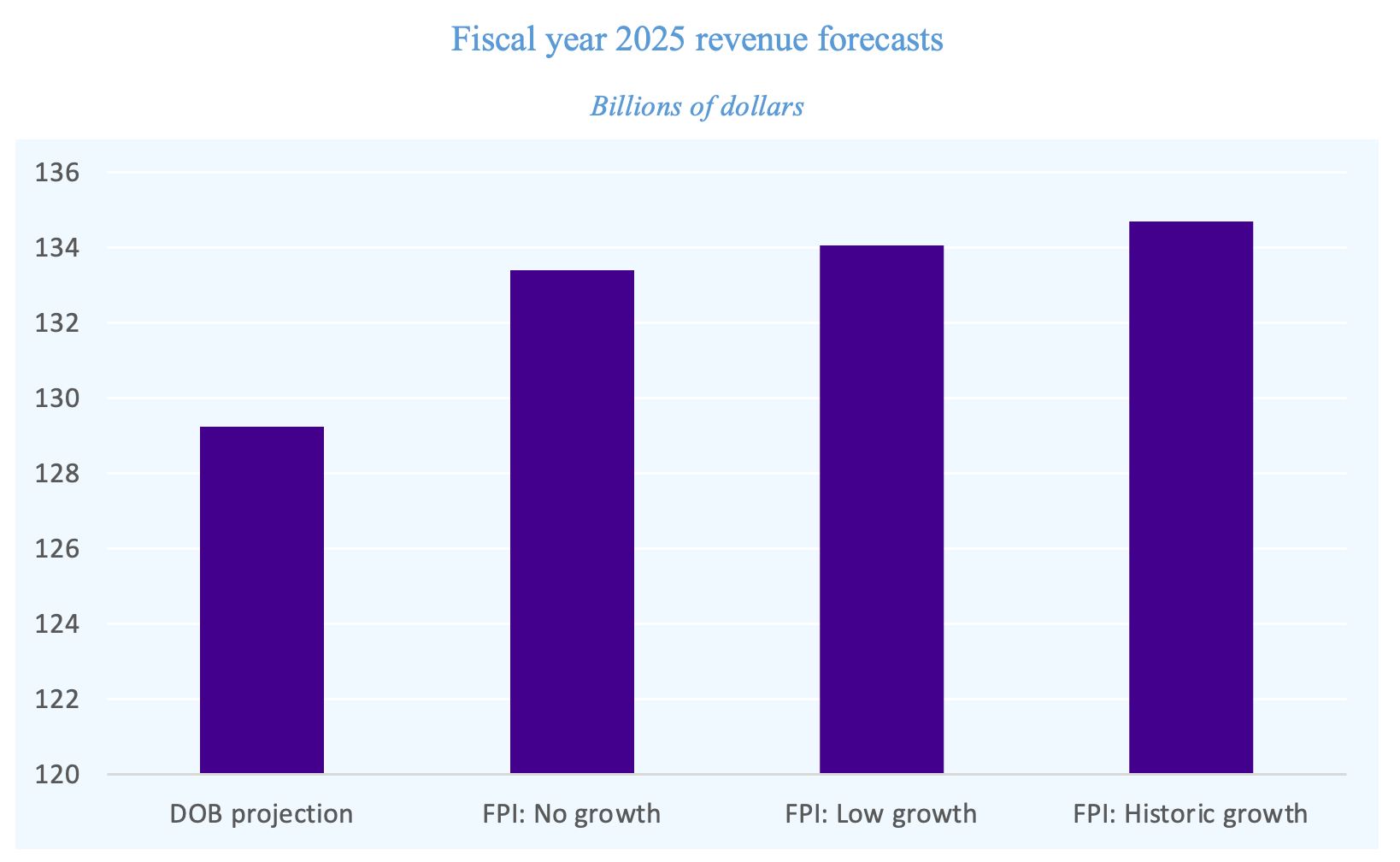

FPI considers three alternative scenarios based on the historical growth in New York state revenue, as well as the current economic forecasts at the national level. The most conservative FPI scenario projects no real revenue growth over the next few years. The most optimistic scenario uses 1.0 percent revenue growth — the average historical rate of revenue growth between fiscal years 2011 and 2021. A “low growth” scenario is also included that limits revenue growth to 0.5 percent on average, splitting the difference between the most conservative and most optimistic approaches.

In all scenarios, FPI finds that fiscal year 2025 revenue will exceed $133 billion. The large difference between current DOB projections and FPI projections stems from the fact that DOB expects New York revenue to contract by 3.0 percent net of inflation between fiscal years 2024 and fiscal years 2025. FPI expects positive real growth between fiscal year 2024 and fiscal year 2025, creating a large difference in forecasted revenue for fiscal year 2025. In the most conservative model with no real growth in revenue, FPI estimates fiscal year 2025 revenue to be $133.4 billion, $4.1 billion higher than current DOB projections, even after accounting for the recent additions made by the Economic and Revenue Consensus Report. If growth were to match its average over the 2010s, the State’s fiscal year 2025 revenue could be as high as $134.7 billion.

Conclusion

New York State’s revenue is likely to exceed the State’s pessimistic forecast in fiscal year 2025 and subsequent fiscal years. At minimum, FPI expects fiscal year revenue to exceed the currently estimated $129.9 billion by an additional $4 billion. A historically average rate of revenue growth would generate over $5 billion in fiscal year 2025 and substantial fiscal surpluses in further outyears. This would allow the State to support a higher base of recurring spending in the years ahead.

Methodology

To construct revenue projections, FPI uses fiscal year 2024 as a base year and applies annual growth rates that vary according to the assumed model. In all instances, FPI uses state operating funds revenue for fiscal year 2024, adjusted to remove volatility associated with the timing of PTET payments. Further, the fiscal year 2024 revenue that FPI uses as the base incorporates the Fiscal Year 2025 revenue consensus, apportioning half of the total $1.35 billion consensus to fiscal year 2024.

In all models, FPI analyzes real growth rates and uses the DOB projected inflation rate to convert to nominal values. To compute real growth rates, FPI applies the Northeast CPI for past years of revenue and uses DOB’s CPI New York forecasts as published in the Economic and Revenue Outlook for outyears.

The growth rate used in the “historical growth” model uses the average real revenue growth rate from fiscal years 2011 through 2021. This period was chosen to reflect a period of economic stability after the 2008 recessions and prior to Covid-era boom and 2021 tax increases. It is worth noting that tax receipts in the fiscal year 2011 to 2021 period were dampened by tax cuts and rising use of corporate tax breaks.

For gap projections, FPI incorporates the effect of making 2021 tax increases permanent, adding $293 million in fiscal year 2027 and $2.4 billion in fiscal year 2028. To highlight the effect of growth rates on revenue, table 1 does not include this additional revenue.

References

Fiscal Year 2025 Consensus Economic and Revenue Forecast Report (March 2024), budget.ny.gov/pubs/supporting/forecast/fy25/fy25-consensus-report-memo.pdf

Fiscal Year 2025 Economic and Revenue Outlook (January 2024), budget.ny.gov/pubs/archive/fy25/ex/ero/fy25ero.pdf

New York State Division of the Budget, Fiscal Year 2025 Executive Budget Financial Plan (January 2024), and prior editions, budget.ny.gov/pubs/financial-plans/index.html

U.S. Bureau of Labor Statistics, Consumer Price Index—Northeast, bls.gov/cpi/data.htm.

Fiscal Analysis: 2025 Revenue To Exceed Projections by At Least $4 Billion

March 15, 2024 |

Reasonable assumptions about state revenue growth show additional spending power and quell concerns about future budget gaps

Emily Eisner, Ph.D., Economist; Andrew Perry, Senior Policy Analyst

March 15, 2024

Key Findings:

- FPI’s model of State revenue growth projects FY25 revenue will likely exceed current forecasts by at least $4 billion.

- The DOB’s assumed growth rates for State revenue are very low by historical standards and are out of sync with most forecasts of U.S. economic growth over coming years.

- Based on FPI’s model, currently forecasted budget gaps will almost entirely close and some years will contain significant surplus

New York State’s Division of the Budget (DOB) forecasts a State budget for fiscal year 2025 of $129.5 billion, following fiscal year 2024’s budget of $129.9 billion. DOB’s forecasts assume declining revenue – and thus a shrinking budget – over the next fiscal year. These forecasts are out of step with both recent state economic trends and national economic expectations.

- FPI models of State revenue growth demonstrate that fiscal year 2025 revenue will likely exceed current forecasts by at least $4 billion. This does not include the additional $1.35 added by the recent Economic and Revenue Consensus Report.

- If State revenue grows at an average rate over the next year (based on the last decade of state data), revenue will exceed current State projections for fiscal year 2025 by $5.2 billion, or 4.0 percent.

Assuming low but positive real growth rates, future out-year budget gaps would disappear or be negligible, indicating that the State would remain on a stable spending trajectory as long as real growth remains non-negative.

In their one-house budget proposals for fiscal year 2025, the State Senate and Assembly project spending (based on higher revenue expectations) of $137.9 billion and $140.0 billion, respectively. Compared to the executive budget, both spending proposals require additional revenue to meet funding needs. To fund these spending proposals, both houses add new revenue measures in addition to re-estimating next-year revenue more optimistically. Both legislative houses would raise personal income and corporate taxes, generating an expected $2.3 billion, and impose a new tax on Medicaid providers that would generate $4 billion in matching federal Medicaid funding.

DOB revenue projections reflect overly pessimistic assumptions about state economic growth — out of step with recent economic trends

Revenue projections play a key role in determining the path of budget negotiations. DOB releases updated revenue projections throughout the year, forecasting the State’s revenue and spending for three years beyond the current fiscal year. As the State’s ability to spend is limited by expected revenue, these forecasts determine the size of the budget enacted each April.

In this year’s executive budget, DOB released revenue and spending forecasts for fiscal years 2025 through 2028. These revenue forecasts assume an average growth rate for fiscal years 2025 through 2028 of -0.6 percent (negative growth) after adjusting for inflation, or 1.8 percent in non-inflation-adjusted dollars. These assumed growth rates for State revenue are very low by historical standards and are out of sync with most forecasts of U.S. economic growth over coming years.

DOB’s expectation of -0.6 percent real economic growth is additionally out of step with the last decade of state economic trends. Between fiscal years 2011 and 2021 the real revenue growth rate averaged 1.0 percent, and would have been higher if not for tax cuts and the expansion of corporate tax credits.

Further, current U.S. economic projections by the members of the Federal Reserve’s Federal Open Market Committee (FOMC) predict real economic growth of 1.4-1.9 percent (inflation-adjusted) over calendar years 2024 through 2026 with long run real growth estimated to be around 1.8 percent. New York’s growth typically trends alongside the U.S. economy and as of July 2023, the U.S. and New York both had annual growth in personal income of 4.9 percent. However, New York’s economy, as measured by total personal income, has been growing at about half the rate of the U.S. economy since 2018, so it is reasonable to expect that New York growth will be lower than overall U.S. economic growth for the foreseeable future. Nonetheless, optimistic forecasts of economic growth in the U.S. cast doubt on the pessimistic forecasts made by DOB.

Based on FPI’s model, currently forecasted budget gaps will almost entirely close and some years will contain significant surplus

Beyond fiscal year 2025, FPI analyzes projected state budget gaps under these three different growth rate scenarios. In even the most conservative of scenarios — in which real revenue growth is 0.0 percent — currently forecasted budget gaps are almost entirely closed, and some years contain significant surplus. Using the 2010s historical average growth rate, all future budget gaps are converted into significant surpluses, demonstrating the sensitivity of state budget gap projections to the assumed growth in revenue.

FPI projects a minimum of $4 billion in additional FY 2025 revenue

FPI considers three alternative scenarios based on the historical growth in New York state revenue, as well as the current economic forecasts at the national level. The most conservative FPI scenario projects no real revenue growth over the next few years. The most optimistic scenario uses 1.0 percent revenue growth — the average historical rate of revenue growth between fiscal years 2011 and 2021. A “low growth” scenario is also included that limits revenue growth to 0.5 percent on average, splitting the difference between the most conservative and most optimistic approaches.

In all scenarios, FPI finds that fiscal year 2025 revenue will exceed $133 billion. The large difference between current DOB projections and FPI projections stems from the fact that DOB expects New York revenue to contract by 3.0 percent net of inflation between fiscal years 2024 and fiscal years 2025. FPI expects positive real growth between fiscal year 2024 and fiscal year 2025, creating a large difference in forecasted revenue for fiscal year 2025. In the most conservative model with no real growth in revenue, FPI estimates fiscal year 2025 revenue to be $133.4 billion, $4.1 billion higher than current DOB projections, even after accounting for the recent additions made by the Economic and Revenue Consensus Report. If growth were to match its average over the 2010s, the State’s fiscal year 2025 revenue could be as high as $134.7 billion.

Conclusion

New York State’s revenue is likely to exceed the State’s pessimistic forecast in fiscal year 2025 and subsequent fiscal years. At minimum, FPI expects fiscal year revenue to exceed the currently estimated $129.9 billion by an additional $4 billion. A historically average rate of revenue growth would generate over $5 billion in fiscal year 2025 and substantial fiscal surpluses in further outyears. This would allow the State to support a higher base of recurring spending in the years ahead.

Methodology

To construct revenue projections, FPI uses fiscal year 2024 as a base year and applies annual growth rates that vary according to the assumed model. In all instances, FPI uses state operating funds revenue for fiscal year 2024, adjusted to remove volatility associated with the timing of PTET payments. Further, the fiscal year 2024 revenue that FPI uses as the base incorporates the Fiscal Year 2025 revenue consensus, apportioning half of the total $1.35 billion consensus to fiscal year 2024.

In all models, FPI analyzes real growth rates and uses the DOB projected inflation rate to convert to nominal values. To compute real growth rates, FPI applies the Northeast CPI for past years of revenue and uses DOB’s CPI New York forecasts as published in the Economic and Revenue Outlook for outyears.

The growth rate used in the “historical growth” model uses the average real revenue growth rate from fiscal years 2011 through 2021. This period was chosen to reflect a period of economic stability after the 2008 recessions and prior to Covid-era boom and 2021 tax increases. It is worth noting that tax receipts in the fiscal year 2011 to 2021 period were dampened by tax cuts and rising use of corporate tax breaks.

For gap projections, FPI incorporates the effect of making 2021 tax increases permanent, adding $293 million in fiscal year 2027 and $2.4 billion in fiscal year 2028. To highlight the effect of growth rates on revenue, table 1 does not include this additional revenue.

References

Fiscal Year 2025 Consensus Economic and Revenue Forecast Report (March 2024), budget.ny.gov/pubs/supporting/forecast/fy25/fy25-consensus-report-memo.pdf

Fiscal Year 2025 Economic and Revenue Outlook (January 2024), budget.ny.gov/pubs/archive/fy25/ex/ero/fy25ero.pdf

New York State Division of the Budget, Fiscal Year 2025 Executive Budget Financial Plan (January 2024), and prior editions, budget.ny.gov/pubs/financial-plans/index.html

U.S. Bureau of Labor Statistics, Consumer Price Index—Northeast, bls.gov/cpi/data.htm.