How New Mexico Will Pay for Universal Childcare

October 29, 2025 |

New Mexico will allow residents of all income levels receive childcare subsidies—what lessons can New York learn?

Starting November 1, 2025, New Mexico will remove all income limits for its childcare assistance program, allowing New Mexico residents of all income levels to receive childcare subsidies. Currently, income limits are set at 400 percent of the federal poverty level (FPL), meaning only those who earn less than $128,600 per year are eligible. About 30,000 families currently receive childcare subsidies, and the state estimates the expansion will serve an additional 12,000 children.

While New Mexico is opening subsidies to all income levels, it leaves the childcare program’s existing structure in place: it allocates subsidies for families to enroll their children in licensed childcare services—about $12,000 for infants; it retains existing work requirements and restrictions to US citizens and legally authorized immigrants; and copayments will remain at zero for new families.

New Mexico’s Sovereign Wealth Fund Pays for Universal Childcare

New Mexico maintains substantial permanent funds capitalized by taxes and royalties on oil and gas production. Permanent funds are endowments that invest in financial assets and make pay-outs of investment earnings without drawing down the principal deposits. As such, the fund balances will grow over time even without continued inflows. As long as distributions out of the funds remain less than inflows and capital gains, the funds will continue to grow over time.

Between 2020 and 2024, New Mexico’s oil and gas production doubled while oil prices rose by 70 percent, creating a significant windfall for the funds. This has allowed the State to increase annual disbursements from the funds over recent years.

The State’s primary fund is the Land Grant Permanent Fund, a $33 billion fund created by taxes on oil and gas extraction from public lands, which are substantial in New Mexico. This fund pays 0.75 percent of its total value—about $248 million—to the state’s childcare programs each year. This fund is in fact larger than New Mexico’s total budget, which in fiscal year 2025 was $29 billion. A fund of comparable size in New York would need to be worth about $275 billion.

In 2020, New Mexico also created a permanent endowment dedicated to childcare. The endowment was capitalized with both surplus federal Covid funds and oil profits and invested in securities. It currently holds $10 billion. State law requires that 5 percent of the fund’s total value—$500 million—is disbursed to childcare assistance each year.

Both funds’ disbursements are governed by state law and based on moving averages of recent years’ valuations (such that disbursements will tend to lag their given percentage of current year valuations). For fiscal year 2026, New Mexico expects to receive $700 million in dedicated disbursements from these funds.

The state also receives about $90 million in federal funding dedicated to childcare assistance for children age three and younger. Additional general fund spending brings total early childhood funding to nearly $1.0 billion in fiscal year 2026. Of this, about half—$474 million—is for childcare ($284 million is for pre-kindergarten, with the remainder for other child services).

New Mexico Early Childhood Spending, Fiscal Year 2026 ($ in millions)

| Childcare | $474 |

|---|---|

| Pre-Kindergarten | $284 |

| Other | $233 |

| Total | $991 |

How does this relate to me, a New Yorker?

Prominent New York lawmakers, from Governor Kathy Hochul to New York City mayoral candidate Zohran Mamdani, have made achieving universal childcare central to their policy agendas. The project enjoys broad political support in New York: In recent years, the New York State legislature has enacted significant expansions to its childcare assistance program, doubling the number of eligible children and sharply increasing funding. For this reason, New Mexico’s efforts could provide insight on the scale of investment needed to reach universality.

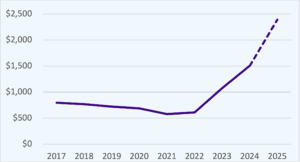

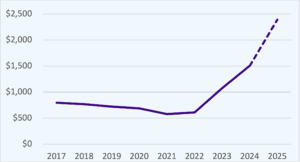

New York State Childcare Subsidy Spending, Fiscal Years 2017 to 2025 ($ in millions)

Source: New York State Office of Children and Family Services. Dashed line represents projected spending in federal fiscal year 2025.

First, it is worth noting that New Mexico is already closer to universality than New York. New Mexico’s income limits (400 percent of FPL) are slightly higher than New York’s (which are set at 85 percent the State median income): A family of four can earn up to $128,000 in New Mexico while in New York the threshold is $113,600. Meanwhile, New Mexico has among the lowest incomes in the country, with a median income of $63,300 compared to $82,100 in New York. As a result, about two-thirds of children under 6 in New Mexico are currently eligible for subsidies. In New York, it’s about half.

Second, New Mexico already spends far more on childcare than New York. To reach the same per child spending as New Mexico, New York would need to spend a total of $4.6 billion on childcare annually, an increase of $2.5 billion from the current level of $2.1 billion. However, New Mexico’s costs of living and doing business are substantially lower than New York’s. New Mexico reports that the average cost of childcare per enrolled child is about $12,000. New York’s average market rate for 0-to-5-year-olds is $20,100. Adjusting for this cost differential, New York would need to spend about $7.1 billion on childcare subsidies, $5.0 billion above current spending. This level of spending in New York would approximate New Mexico’s fiscal effort in the first stage of its push toward universal childcare.

If New York were to expand childcare subsidies in a manner analogous to New Mexico, the new services would primarily support infants and toddlers (up to age three), as both New Mexico and New York separately fund care for 3- and 4-year-olds through universal pre-kindergarten programs.

While New Mexico’s total spending per child may serve as an approximate benchmark for the level of investment need in New York State, its financing structure is not replicable here. New Mexico uses permanent funds capitalized by fossil fuel extraction on public lands; New York does not own vast tracts of public lands or permit natural gas extraction. The size of New Mexico’s permanent funds exceeds its annual budget. While New York maintains reserve funds, they are equal to about one-tenth of the state’s total budget and are reserved for use in economic downturns, not dedicated to fund ongoing program expenses.

Nevertheless, New Yorkers do not need to envy New Mexico’s fiscal capacity. New Mexico is among the poorest US states—46th in GDP per capita—while New York is among the richest—5th in GDP per capita. As such, New York has far greater capacity to raise revenue through broad-based taxation. Modest increases in New York’s personal income tax and corporate tax would generate billions of dollars in new, recurring revenue. These tax measures would be sufficient to fund universal childcare.

Sources:

Andrew L. Breidenbach, Hailey Heinz, Dana Bell, and David Purcell, “Trends After Policy Change in New Mexico’s Child Care Assistance Program” University of New Mexico Cradle to Career Policy Institute, March 2025, https://ccpi.unm.edu/sites/default/files/publications/Trends%20After%20Policy%20Change%20in%20NM%27s%20Child%20Care%20Assistance%20Program.pdf.

Gov. Michele Lujan Grisham, Jon Clark, and Robert Smith, “FY 2026 Annual Investment Plan,” State of New Mexico State Investment Counsil, August 2025, https://www.sic.state.nm.us/wp-content/uploads/2025/09/FY26-Annual-Investment-Plan-final.pdf.

Elizabeth Groginsky, “FY26 Budget Request,” New Mexico Early Childhood Education and Care Department House Appropriations and Finance Committee, February 12, 2025, https://www.nmececd.org/wp-content/uploads/2025/02/FY26-Budget-Deck_Final-Version_2.11.25.pdf.

New Mexico Early Childhood and Care Department, “Universal Access to Child Care,” September 8, 2025, https://www.nmececd.org/wp-content/uploads/2025/09/Universal-Child-Care-Fact-Sheet_FinaL.pdf.

New Mexico Legislative and Finance Committee, “2025 Accountability Report: Early Childhood,” August 2023, https://www.nmlegis.gov/handouts/LHHS%20091025%20Item%2010%20Accountability%20Report.pdf.

How New Mexico Will Pay for Universal Childcare

October 29, 2025 |

New Mexico will allow residents of all income levels receive childcare subsidies—what lessons can New York learn?

Starting November 1, 2025, New Mexico will remove all income limits for its childcare assistance program, allowing New Mexico residents of all income levels to receive childcare subsidies. Currently, income limits are set at 400 percent of the federal poverty level (FPL), meaning only those who earn less than $128,600 per year are eligible. About 30,000 families currently receive childcare subsidies, and the state estimates the expansion will serve an additional 12,000 children.

While New Mexico is opening subsidies to all income levels, it leaves the childcare program’s existing structure in place: it allocates subsidies for families to enroll their children in licensed childcare services—about $12,000 for infants; it retains existing work requirements and restrictions to US citizens and legally authorized immigrants; and copayments will remain at zero for new families.

New Mexico’s Sovereign Wealth Fund Pays for Universal Childcare

New Mexico maintains substantial permanent funds capitalized by taxes and royalties on oil and gas production. Permanent funds are endowments that invest in financial assets and make pay-outs of investment earnings without drawing down the principal deposits. As such, the fund balances will grow over time even without continued inflows. As long as distributions out of the funds remain less than inflows and capital gains, the funds will continue to grow over time.

Between 2020 and 2024, New Mexico’s oil and gas production doubled while oil prices rose by 70 percent, creating a significant windfall for the funds. This has allowed the State to increase annual disbursements from the funds over recent years.

The State’s primary fund is the Land Grant Permanent Fund, a $33 billion fund created by taxes on oil and gas extraction from public lands, which are substantial in New Mexico. This fund pays 0.75 percent of its total value—about $248 million—to the state’s childcare programs each year. This fund is in fact larger than New Mexico’s total budget, which in fiscal year 2025 was $29 billion. A fund of comparable size in New York would need to be worth about $275 billion.

In 2020, New Mexico also created a permanent endowment dedicated to childcare. The endowment was capitalized with both surplus federal Covid funds and oil profits and invested in securities. It currently holds $10 billion. State law requires that 5 percent of the fund’s total value—$500 million—is disbursed to childcare assistance each year.

Both funds’ disbursements are governed by state law and based on moving averages of recent years’ valuations (such that disbursements will tend to lag their given percentage of current year valuations). For fiscal year 2026, New Mexico expects to receive $700 million in dedicated disbursements from these funds.

The state also receives about $90 million in federal funding dedicated to childcare assistance for children age three and younger. Additional general fund spending brings total early childhood funding to nearly $1.0 billion in fiscal year 2026. Of this, about half—$474 million—is for childcare ($284 million is for pre-kindergarten, with the remainder for other child services).

New Mexico Early Childhood Spending, Fiscal Year 2026 ($ in millions)

| Childcare | $474 |

|---|---|

| Pre-Kindergarten | $284 |

| Other | $233 |

| Total | $991 |

How does this relate to me, a New Yorker?

Prominent New York lawmakers, from Governor Kathy Hochul to New York City mayoral candidate Zohran Mamdani, have made achieving universal childcare central to their policy agendas. The project enjoys broad political support in New York: In recent years, the New York State legislature has enacted significant expansions to its childcare assistance program, doubling the number of eligible children and sharply increasing funding. For this reason, New Mexico’s efforts could provide insight on the scale of investment needed to reach universality.

New York State Childcare Subsidy Spending, Fiscal Years 2017 to 2025 ($ in millions)

Source: New York State Office of Children and Family Services. Dashed line represents projected spending in federal fiscal year 2025.

First, it is worth noting that New Mexico is already closer to universality than New York. New Mexico’s income limits (400 percent of FPL) are slightly higher than New York’s (which are set at 85 percent the State median income): A family of four can earn up to $128,000 in New Mexico while in New York the threshold is $113,600. Meanwhile, New Mexico has among the lowest incomes in the country, with a median income of $63,300 compared to $82,100 in New York. As a result, about two-thirds of children under 6 in New Mexico are currently eligible for subsidies. In New York, it’s about half.

Second, New Mexico already spends far more on childcare than New York. To reach the same per child spending as New Mexico, New York would need to spend a total of $4.6 billion on childcare annually, an increase of $2.5 billion from the current level of $2.1 billion. However, New Mexico’s costs of living and doing business are substantially lower than New York’s. New Mexico reports that the average cost of childcare per enrolled child is about $12,000. New York’s average market rate for 0-to-5-year-olds is $20,100. Adjusting for this cost differential, New York would need to spend about $7.1 billion on childcare subsidies, $5.0 billion above current spending. This level of spending in New York would approximate New Mexico’s fiscal effort in the first stage of its push toward universal childcare.

If New York were to expand childcare subsidies in a manner analogous to New Mexico, the new services would primarily support infants and toddlers (up to age three), as both New Mexico and New York separately fund care for 3- and 4-year-olds through universal pre-kindergarten programs.

While New Mexico’s total spending per child may serve as an approximate benchmark for the level of investment need in New York State, its financing structure is not replicable here. New Mexico uses permanent funds capitalized by fossil fuel extraction on public lands; New York does not own vast tracts of public lands or permit natural gas extraction. The size of New Mexico’s permanent funds exceeds its annual budget. While New York maintains reserve funds, they are equal to about one-tenth of the state’s total budget and are reserved for use in economic downturns, not dedicated to fund ongoing program expenses.

Nevertheless, New Yorkers do not need to envy New Mexico’s fiscal capacity. New Mexico is among the poorest US states—46th in GDP per capita—while New York is among the richest—5th in GDP per capita. As such, New York has far greater capacity to raise revenue through broad-based taxation. Modest increases in New York’s personal income tax and corporate tax would generate billions of dollars in new, recurring revenue. These tax measures would be sufficient to fund universal childcare.

Sources:

Andrew L. Breidenbach, Hailey Heinz, Dana Bell, and David Purcell, “Trends After Policy Change in New Mexico’s Child Care Assistance Program” University of New Mexico Cradle to Career Policy Institute, March 2025, https://ccpi.unm.edu/sites/default/files/publications/Trends%20After%20Policy%20Change%20in%20NM%27s%20Child%20Care%20Assistance%20Program.pdf.

Gov. Michele Lujan Grisham, Jon Clark, and Robert Smith, “FY 2026 Annual Investment Plan,” State of New Mexico State Investment Counsil, August 2025, https://www.sic.state.nm.us/wp-content/uploads/2025/09/FY26-Annual-Investment-Plan-final.pdf.

Elizabeth Groginsky, “FY26 Budget Request,” New Mexico Early Childhood Education and Care Department House Appropriations and Finance Committee, February 12, 2025, https://www.nmececd.org/wp-content/uploads/2025/02/FY26-Budget-Deck_Final-Version_2.11.25.pdf.

New Mexico Early Childhood and Care Department, “Universal Access to Child Care,” September 8, 2025, https://www.nmececd.org/wp-content/uploads/2025/09/Universal-Child-Care-Fact-Sheet_FinaL.pdf.

New Mexico Legislative and Finance Committee, “2025 Accountability Report: Early Childhood,” August 2023, https://www.nmlegis.gov/handouts/LHHS%20091025%20Item%2010%20Accountability%20Report.pdf.