Understanding Foundation Aid: How Public School Funding Works in New York State

August 14, 2024 |

Introduction

Public education (K-12) is New York State’s largest public spending program, accounting for over 25 percent of all State operating spending and over 40 percent of local government spending.[1]

Public school funding is allocated to local school districts based on formulas specified in state law, primarily through a formula known as Foundation Aid. This brief explains the State’s rules that govern public school funding.

Background

New York State’s school funding formulas date back to the early 2000s, when the Campaign for Fiscal Equity (CFE) won a series of legal victories on the grounds that the structure of public school funding failed to fulfill the New York State constitution’s right to a “sound basic education.” The CFE’s legal victory resulted in the State’s adoption of a public school funding formula — known as “Foundation Aid” — that would ensure adequate funding for all school districts. This formula is progressive in character, factoring in local property values and incomes to direct the greatest funding to districts with the lowest resources.

Following the 2008 financial crisis and Covid-19 pandemic, the State delayed fully funding Foundation Aid until 2023. While the State is currently meeting its Foundation Aid funding obligations, spending growth required by the Foundation Aid formula is almost certain to be a focus of budget negotiations in the coming years. Already, in fiscal year 2025, the Governor proposed altering the Foundation Aid rules to cut $454 million from planned increases in school spending. These changes were rejected by the legislature, but the enacted budget commissioned a study of the Foundation Aid formula that will shape recommendations for next year’s budget.

Some education advocates have raised concerns that the commissioned study could endorse the Governor’s call for reductions in required Foundation Aid spending. At the same time, advocates have called for Foundation Aid modifications that will increase funding for school districts in poorer parts of the state. These competing goals position Foundation Aid to be a point of debate in fiscal year 2026’s budget process.

Overview of public school funding

Public school districts receive funding from three sources: the federal government, New York State, and local tax revenues. In typical years, local governments provide 56 percent of school funding and the State provides 40 percent of school funding. The federal government contributes just 4 percent of local district funding across the state.

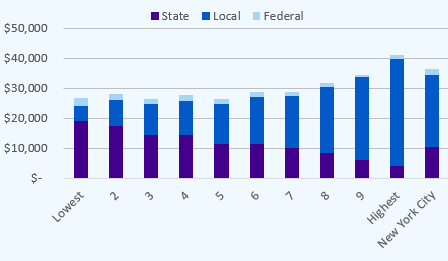

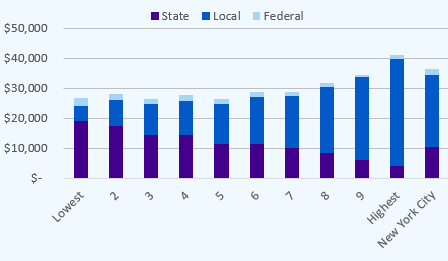

While New York school districts all spend relatively similar amounts of money educating each student – an average of $29,000 in school year 2022 – the sources of their funding differ widely. State-level school funding is sharply progressive, allocating little to the districts with the highest property values and income, and providing a majority of the funding for the lowest-resourced districts. Because local districts must allocate sufficient remaining funding to provide an adequate minimum education, local resources fill the gap between State aid and the cost of an adequate instruction.

For this reason, districts’ per-pupil spending is relatively constant across the State. The bottom 70 percent of districts by property values spend the same amount per pupil as the State average. The wealthiest 10 percent of districts, by contrast, spend 42 percent more per pupil than the State average, with the majority (87 percent) of funding coming from local sources.[2]

Figure 1. Average per pupil spending by source and school district wealth

School district wealth sorted into decile, with 1 representing districts with the lowest property values

Note: School year 2022 data. New York City is not included in the wealth calculations and reported separately.

The majority of districts across the state are funded through dedicated taxes – mainly property taxes. Importantly, a local property tax cap adopted in 2011 limits annual growth in local property tax levies to 2 percent per year, or the rate of inflation, whichever is lower. This means homeowners’ collective property tax bills cannot grow by more than 2 percent (although individual properties may appreciate more than others in a given district, raising their taxes). New York City is excluded from the property tax cap. By contrast, State law requires the five largest cities in the state – New York City, Buffalo, Yonkers, Rochester, and Syracuse – to fund their school districts from the cities’ general funds.

The Fight over Foundation Aid since 1993

The Campaign for Fiscal Equity (CFE) launched its constitutional challenge to New York State’s inadequate and inequitable school funding in 1993. The State’s highest court found in favor of CFE in 2003 and reaffirmed its decision in 2006, ordering the State to phase in Foundation Aid formula funding. In 2007, State lawmakers agreed to phase in Foundation Aid over the next four years.[3]

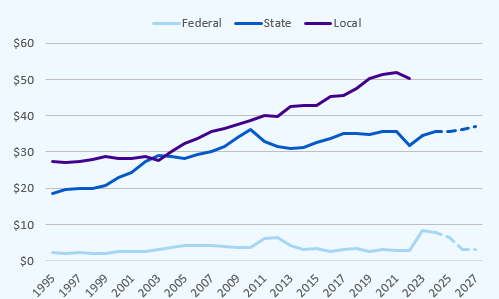

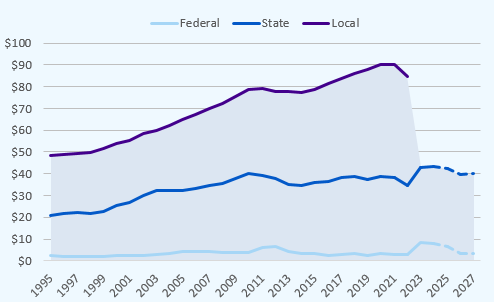

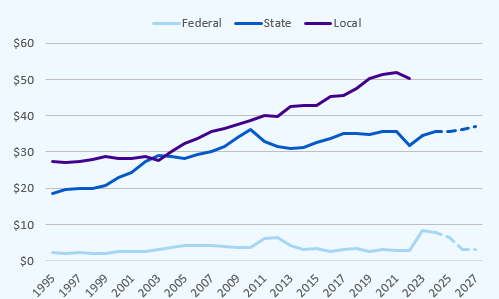

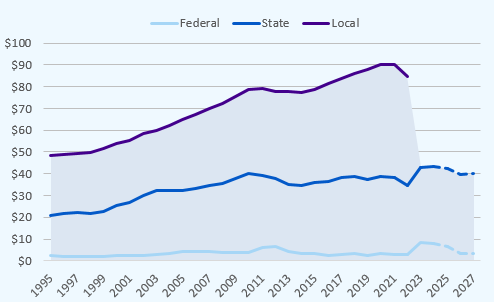

State funding for school districts grew briskly through the era of CFE’s legal challenge, averaging 5 percent annual growth, after adjusting for inflation, between school years 1995 and 2009. Local funding rose more slowly – only 2 percent annually over the same period – pushing the State’s share of school funding from 39 percent in 1995 to 45 percent in 2009.

Following the 2008 financial crisis, and given the resulting fiscal strain on the State, the State ended its commitment to phasing-in Foundation Aid by 2011. After cuts to school funding in 2010 and 2011, from 2012 through 2020 State school funding grew at just 1 percent per year. Local school districts had to pick up the slack, with local funding growing more briskly at 3 percent per year over this period (inflation-adjusted). Since the introduction of state-imposed property tax cap, local school funding growth has been driven by New York City. By school year 2020, local governments contributed 57 percent of school funding, while the State contributed 39 percent, and the federal government the remaining 4 percent.

In fiscal year 2022, State lawmakers committed to fully phasing-in Foundation Aid over the next three years, and by fiscal year 2024, the Foundation Aid formula was fully funded. Nevertheless, real State school funding is not set to return to its 2010 level until school year 2026, as inflation and lower enrollment eroded funding. With Foundation Aid fully funded and tied to inflation, the State expects relatively flat inflation-adjusted school funding in future years.

Federal school funding also rose rapidly during the Covid pandemic, reaching $7.7 billion in school year 2023. Greater State and federal support through the Covid pandemic assisted districts in moving to remote and hybrid learning, and allowed many districts to start or expand early childhood programs, including pre-kindergarten. The State expects annual federal funding to fall to $3.3 billion in fiscal year 2026 and remain at that level in the outyears. This funding level would represent a return to federal funding’s pre-Covid share of statewide school aid. Together with flat State aid, declining federal funding may place strain on many school districts.

Figure 2. School funding by source, school years 1995 to 2027

Note: local school funding data is available through school year 2022; State and federal data from school year 2025 based on State projections.

Figure 3. Total school funding by source, school years 1995 to 2027

How Foundation Aid Works

The school disburses two types of school aid to localities: Foundation Aid and expense-based aid. Foundation Aid, which will total $35.9 billion in fiscal year 2025, accounts for 71 percent of State school aid, while expense-based aid comprises the remaining 29 percent. Both Foundation Aid and expense-based aid factor in districts’ economic resources in allocating State aid.

Foundation Aid

Foundation Aid is allocated to districts based on a complex funding formula. This section provides a high level overview of formula’s major components.

At the highest level, the Foundation Aid formula simply multiplies the number of pupils in a given district by the level of funding necessary to achieve funding adequacy in that district. The formula calculates the number of pupils by estimating total current-year enrollment and giving higher weights to (i) students with disabilities (weighted at 141 percent higher than other students) and (ii) students formerly enrolled in special education programs (weighted at 50 percent higher than other students). Summer enrollment is weighted at 12 percent of regular school year enrollment.

Two formulas calculate each district’s per-pupil Foundation Aid amount. Districts are allocated the greatest of either of these two formulas or $500. In this way, a districts’ funding cannot fall below $500 per pupil.

- The first formula adjusts a statewide per-pupil Foundation Aid amount by district-specific factors, including students’ need, then subtracts the district’s expected local contribution, resulting in the State’s district-specific per-pupil contribution.

- The statewide Foundation Aid amount is based on the State Education Department’s (NYSED) estimate of the minimum cost of educating a student. In school year 2024, this amount was $7,242. The Foundation Aid amount is then adjusted, being multiplied by:

- the most recent year’s rate of inflation (gauged by the U.S. consumer price index, or CPI);

- a regional cost index (RCI), which increases aid levels for areas with higher average professional services wages;

- and a pupil need index (PNI).

- PNI is a formula that increases aid for districts with higher rates of pupils who either live in poverty, are eligible for reduced price lunch (a higher income standard than the official poverty measure), and who are English language learners. The PNI also raises aid for districts with lower population density.

- The formula then calculates the expected local contribution for each district, which is subtracted from the Foundation Aid amount. The expected local contribution can be derived from two formulas, each of which factor in a district’s collective property value and earned income per pupil. Districts with high per-pupil property values and income are expected to contribute more local resources, and consequently receive lower Foundation Aid allocations.

- The statewide Foundation Aid amount is based on the State Education Department’s (NYSED) estimate of the minimum cost of educating a student. In school year 2024, this amount was $7,242. The Foundation Aid amount is then adjusted, being multiplied by:

- The second Foundation Aid formula is more condensed, but retains the same elements. The large majority (91 percent) of districts receive funding through this alternate formula. The districts receiving funding through the first formula have slightly lower incomes and property values.

- Under this formula, district’s allocations are the products of:

- the statewide Foundation Aid amount,

- the RCI;

- The CPI;

- The PNI; and

- a state sharing ratio (SSR). The SSR factors in districts’ property values and aggregate incomes, assigning lower ratios – and therefore less state aid – to districts with high incomes and wealth.

- Under this formula, district’s allocations are the products of:

In summary, districts with higher enrollment, higher regional wages, or more pupils in poverty would see higher Foundation Aid allocations. By contrast, higher per-pupil property values and aggregate income would push down a district’s Foundation Aid, but not below $500 per pupil unit. 45 of the state’s wealthiest districts (7 percent of all school districts) receive the minimum $500 per pupil funding level.

Foundation Aid’s “hold harmless” provision

Finally, Foundation Aid includes a “hold harmless” provision that does not allow a district’s allocation to fall from year to year, even if changes in the formula factors would entail a reduction in funding. The hold harmless provision has been of special significance in recent years as districts across the state face declining enrollment. In fiscal year 2025, half of districts (334 districts, 50 percent of all districts) would have seen a Foundation Aid decrease between school years 2024 and 2025. In her fiscal year 2025 executive budget, the governor proposed replacing hold harmless with a transitional aid formula that would replace nearly all (91 percent) of any annual Foundation Aid decrease in a given year for the lowest-resource districts. For the wealthiest districts, half of any years’ decrease would be replaced. This change was rejected by the legislature and not enacted.

Expense-based aid

While Foundation Aid comprises a majority of State aid to public schools, nearly 30 percent is comprised of expense-based aid, which reimburses certain costs incurred by school districts. These “aidable expense” categories are set by law and allowable costs are regulated by NYSED. Building aid, which reimburses districts for hard and soft costs and debt service of building projects, is the largest expense-based aid allocation. Its $3.4 billion outlay in fiscal year 2025 makes up 10 percent of State school aid. Reimbursement for transportation expenses and districts’ purchase of BOCES services, which provide vocational training, comprises the next-largest expense based aids, totaling $2.6 billion and $1.3 billion, respectively, making up 7 and 4 percent of State school aid. Like Foundation Aid, districts with high property values and income receive reduced reimbursements for aidable expenses. By contrast, nearly all aidable expenses incurred the lowest-income districts may be reimbursed by the State.

Universal pre-kindergarten

A final major source of school aid from New York State supports the expansion of statewide universal pre-kindergarten (UPK). State UPK grants are allocated to districts based on the number of eligible 3 and 4 year-olds served by the programs. Per-pupil awards are adjusted based on districts’ wealth. Further, a subset of state UPK funding that supports the creation of full-day UPK programs are allocated on a competitive basis. While total State UPK funding does factor in local resources, per-pupil UPK grants are far flatter across districts than other Foundation Aid.

While State pre-kindergarten grants began in 1997, significant investments have been made since fiscal year 2022, with expansions of UPK programs funded by federal Covid relief funded and subsequently by State takeovers of federal costs. In fiscal year 2025, the state plans to allocate $1.2 billion to statewide UPK. The State estimates that this funding represents 95 percent of the funding necessary to achieve fully universal coverage.[4]

STAR

Finally, the State funds schools through one channel outside of its school aid formulas: the school tax relief (STAR) program. The STAR program is a benefit to New York homeowners, relieving a portion of their property taxes, including those dedicated to schools. Because the STAR program lowers school tax revenue, the State reimburses districts’ forgone revenue. In fiscal year 2025, the State expects to spend $1.6 billion on STAR benefits.[5]

Other factors affecting State school aid

State law limits annual growth in school aid funding provided by the State to no greater than the annual growth in statewide personal income. The State legislature, however, overrode this cap in recent years to phase-in the Foundation Aid formula.

Finally, it is worth noting that while 85 percent of State school aid funding is general fund spending – supported by the State’s broad tax base – 15 percent is supported by dedicated gambling revenues. While gambling revenues can be a volatile revenue source, this has not imposed volatility on school aid, as general fund spending can rise or fall to fill fully fund school aid commitments.

The future of Foundation Aid

School year 2025 represents a new status quo for school funding in New York State. Having withstood the Governor’s attempt to restrain school aid growth, the Foundation Aid remains formula fully funded. With inflation falling and enrollment growth low or negative in most districts, State school funding is set to grow slowly in the years ahead. However, the future of Foundation Aid is poised to remain a topic of contention.

The fiscal year 2025 enacted budget included $2 million for the University of Albany’s Rockefeller Institute to study the formula and submit a report by December 1, 2024. The study is directed to examine each component of the formula as well as funding adequacy and districts’ fiscal conditions and make

recommendations for revisions that are “fiscally sustainable for the state, local taxpayers, and school.”[6] While the report’s findings and recommendations are non-binding, it is likely to kick start a debate over changes to the formula in the fiscal year 2026 budget, and may provide support for another initiative by the governor to reduce required spending under the Foundation Aid rules.

Reviewing the Foundation Aid formula has been a priority for many of the state’s education advocates. The Alliance for Quality Education has called for revising the Foundation Aid formula by updating NYSED’s method for determining the base cost of a sound basic education and using alternative measures of student need, including updating its use of outdated poverty data from the 2000 Census.[7] Changes along these lines may shift additional resources to the highest-need districts.

The relationship between a district’s resources and student need and the level of State funding it is allocated is likely to be a central debate. While the current formula is sharply progressive, allocating greater per-pupil funding to the highest-need districts, many argue it should go further. The Education Trust finds that while total school funding (including State and local) is relatively equal across districts, it fails to channel greater resources to students who need it most.[8] Similarly, the School Finance Indicators Database found that by failing to channel greater resources to the highest need schools, New York’s flat school funding structure creates a higher “opportunity gap” than every other state in the country except Connecticut.[9] New York’s extreme school segregation bolsters the case for greater progressivity. Stanford University’s Educational Opportunity Project found that New York has the highest rate of school segregation in the country.[10] Studies have repeatedly found that school segregation is a central driver of socioeconomic outcome disparities.[11]

Any change to the Foundation Aid formula will affect both the distribution of funding across districts and the overall level of State school aid. Increasing school aid’s progressivity while holding the total funding level constant would entail redistributing funds from wealthy to high-need districts. Given that the State’s property tax cap remains in place, districts losing funding would have limited ability to fill any gap with local resources. Balancing these tradeoffs will be the central challenge to reforming Foundation Aid.

[1] https://state-local-finance-data.taxpolicycenter.org/pages.cfm; https://www.budget.ny.gov/pubs/archive/fy25/en/fy25fp-en.pdf

[2] Typical years refers to pre-Covid funding patterns. Recent trends in school funding will be discussed below.

[3] https://www.aqeny.org/equity/

[4] https://www.budget.ny.gov/pubs/archive/fy24/ex/book/education.pdf

[5] The total includes a portion of STAR benefits disbursed to homeowners as a personal income tax (PIT) credit, not a property tax benefit. PIT credit costs are not borne by school districts and therefore not reimbursed.

[6] S8306-C

[7] https://www.aqeny.org/wp-content/uploads/2023/05/AQE-ELC-Foundation-Aid-white-paper-5-19-23.pdf

[8] https://newyork.edtrust.org/online-data-tool-allows-users-to-explore-how-new-york-school-districts-are-investing-resources/

[9] https://www.schoolfinancedata.org/the-adequacy-and-fairness-of-state-school-finance-systems-2024/

[10] https://edopportunity.org/segregation/about/

[11] https://cepa.stanford.edu/sites/default/files/wp19-06-v082022.pdf

Understanding Foundation Aid: How Public School Funding Works in New York State

August 14, 2024 |

Introduction

Public education (K-12) is New York State’s largest public spending program, accounting for over 25 percent of all State operating spending and over 40 percent of local government spending.[1]

Public school funding is allocated to local school districts based on formulas specified in state law, primarily through a formula known as Foundation Aid. This brief explains the State’s rules that govern public school funding.

Background

New York State’s school funding formulas date back to the early 2000s, when the Campaign for Fiscal Equity (CFE) won a series of legal victories on the grounds that the structure of public school funding failed to fulfill the New York State constitution’s right to a “sound basic education.” The CFE’s legal victory resulted in the State’s adoption of a public school funding formula — known as “Foundation Aid” — that would ensure adequate funding for all school districts. This formula is progressive in character, factoring in local property values and incomes to direct the greatest funding to districts with the lowest resources.

Following the 2008 financial crisis and Covid-19 pandemic, the State delayed fully funding Foundation Aid until 2023. While the State is currently meeting its Foundation Aid funding obligations, spending growth required by the Foundation Aid formula is almost certain to be a focus of budget negotiations in the coming years. Already, in fiscal year 2025, the Governor proposed altering the Foundation Aid rules to cut $454 million from planned increases in school spending. These changes were rejected by the legislature, but the enacted budget commissioned a study of the Foundation Aid formula that will shape recommendations for next year’s budget.

Some education advocates have raised concerns that the commissioned study could endorse the Governor’s call for reductions in required Foundation Aid spending. At the same time, advocates have called for Foundation Aid modifications that will increase funding for school districts in poorer parts of the state. These competing goals position Foundation Aid to be a point of debate in fiscal year 2026’s budget process.

Overview of public school funding

Public school districts receive funding from three sources: the federal government, New York State, and local tax revenues. In typical years, local governments provide 56 percent of school funding and the State provides 40 percent of school funding. The federal government contributes just 4 percent of local district funding across the state.

While New York school districts all spend relatively similar amounts of money educating each student – an average of $29,000 in school year 2022 – the sources of their funding differ widely. State-level school funding is sharply progressive, allocating little to the districts with the highest property values and income, and providing a majority of the funding for the lowest-resourced districts. Because local districts must allocate sufficient remaining funding to provide an adequate minimum education, local resources fill the gap between State aid and the cost of an adequate instruction.

For this reason, districts’ per-pupil spending is relatively constant across the State. The bottom 70 percent of districts by property values spend the same amount per pupil as the State average. The wealthiest 10 percent of districts, by contrast, spend 42 percent more per pupil than the State average, with the majority (87 percent) of funding coming from local sources.[2]

Figure 1. Average per pupil spending by source and school district wealth

School district wealth sorted into decile, with 1 representing districts with the lowest property values

Note: School year 2022 data. New York City is not included in the wealth calculations and reported separately.

The majority of districts across the state are funded through dedicated taxes – mainly property taxes. Importantly, a local property tax cap adopted in 2011 limits annual growth in local property tax levies to 2 percent per year, or the rate of inflation, whichever is lower. This means homeowners’ collective property tax bills cannot grow by more than 2 percent (although individual properties may appreciate more than others in a given district, raising their taxes). New York City is excluded from the property tax cap. By contrast, State law requires the five largest cities in the state – New York City, Buffalo, Yonkers, Rochester, and Syracuse – to fund their school districts from the cities’ general funds.

The Fight over Foundation Aid since 1993

The Campaign for Fiscal Equity (CFE) launched its constitutional challenge to New York State’s inadequate and inequitable school funding in 1993. The State’s highest court found in favor of CFE in 2003 and reaffirmed its decision in 2006, ordering the State to phase in Foundation Aid formula funding. In 2007, State lawmakers agreed to phase in Foundation Aid over the next four years.[3]

State funding for school districts grew briskly through the era of CFE’s legal challenge, averaging 5 percent annual growth, after adjusting for inflation, between school years 1995 and 2009. Local funding rose more slowly – only 2 percent annually over the same period – pushing the State’s share of school funding from 39 percent in 1995 to 45 percent in 2009.

Following the 2008 financial crisis, and given the resulting fiscal strain on the State, the State ended its commitment to phasing-in Foundation Aid by 2011. After cuts to school funding in 2010 and 2011, from 2012 through 2020 State school funding grew at just 1 percent per year. Local school districts had to pick up the slack, with local funding growing more briskly at 3 percent per year over this period (inflation-adjusted). Since the introduction of state-imposed property tax cap, local school funding growth has been driven by New York City. By school year 2020, local governments contributed 57 percent of school funding, while the State contributed 39 percent, and the federal government the remaining 4 percent.

In fiscal year 2022, State lawmakers committed to fully phasing-in Foundation Aid over the next three years, and by fiscal year 2024, the Foundation Aid formula was fully funded. Nevertheless, real State school funding is not set to return to its 2010 level until school year 2026, as inflation and lower enrollment eroded funding. With Foundation Aid fully funded and tied to inflation, the State expects relatively flat inflation-adjusted school funding in future years.

Federal school funding also rose rapidly during the Covid pandemic, reaching $7.7 billion in school year 2023. Greater State and federal support through the Covid pandemic assisted districts in moving to remote and hybrid learning, and allowed many districts to start or expand early childhood programs, including pre-kindergarten. The State expects annual federal funding to fall to $3.3 billion in fiscal year 2026 and remain at that level in the outyears. This funding level would represent a return to federal funding’s pre-Covid share of statewide school aid. Together with flat State aid, declining federal funding may place strain on many school districts.

Figure 2. School funding by source, school years 1995 to 2027

Note: local school funding data is available through school year 2022; State and federal data from school year 2025 based on State projections.

Figure 3. Total school funding by source, school years 1995 to 2027

How Foundation Aid Works

The school disburses two types of school aid to localities: Foundation Aid and expense-based aid. Foundation Aid, which will total $35.9 billion in fiscal year 2025, accounts for 71 percent of State school aid, while expense-based aid comprises the remaining 29 percent. Both Foundation Aid and expense-based aid factor in districts’ economic resources in allocating State aid.

Foundation Aid

Foundation Aid is allocated to districts based on a complex funding formula. This section provides a high level overview of formula’s major components.

At the highest level, the Foundation Aid formula simply multiplies the number of pupils in a given district by the level of funding necessary to achieve funding adequacy in that district. The formula calculates the number of pupils by estimating total current-year enrollment and giving higher weights to (i) students with disabilities (weighted at 141 percent higher than other students) and (ii) students formerly enrolled in special education programs (weighted at 50 percent higher than other students). Summer enrollment is weighted at 12 percent of regular school year enrollment.

Two formulas calculate each district’s per-pupil Foundation Aid amount. Districts are allocated the greatest of either of these two formulas or $500. In this way, a districts’ funding cannot fall below $500 per pupil.

- The first formula adjusts a statewide per-pupil Foundation Aid amount by district-specific factors, including students’ need, then subtracts the district’s expected local contribution, resulting in the State’s district-specific per-pupil contribution.

- The statewide Foundation Aid amount is based on the State Education Department’s (NYSED) estimate of the minimum cost of educating a student. In school year 2024, this amount was $7,242. The Foundation Aid amount is then adjusted, being multiplied by:

- the most recent year’s rate of inflation (gauged by the U.S. consumer price index, or CPI);

- a regional cost index (RCI), which increases aid levels for areas with higher average professional services wages;

- and a pupil need index (PNI).

- PNI is a formula that increases aid for districts with higher rates of pupils who either live in poverty, are eligible for reduced price lunch (a higher income standard than the official poverty measure), and who are English language learners. The PNI also raises aid for districts with lower population density.

- The formula then calculates the expected local contribution for each district, which is subtracted from the Foundation Aid amount. The expected local contribution can be derived from two formulas, each of which factor in a district’s collective property value and earned income per pupil. Districts with high per-pupil property values and income are expected to contribute more local resources, and consequently receive lower Foundation Aid allocations.

- The statewide Foundation Aid amount is based on the State Education Department’s (NYSED) estimate of the minimum cost of educating a student. In school year 2024, this amount was $7,242. The Foundation Aid amount is then adjusted, being multiplied by:

- The second Foundation Aid formula is more condensed, but retains the same elements. The large majority (91 percent) of districts receive funding through this alternate formula. The districts receiving funding through the first formula have slightly lower incomes and property values.

- Under this formula, district’s allocations are the products of:

- the statewide Foundation Aid amount,

- the RCI;

- The CPI;

- The PNI; and

- a state sharing ratio (SSR). The SSR factors in districts’ property values and aggregate incomes, assigning lower ratios – and therefore less state aid – to districts with high incomes and wealth.

- Under this formula, district’s allocations are the products of:

In summary, districts with higher enrollment, higher regional wages, or more pupils in poverty would see higher Foundation Aid allocations. By contrast, higher per-pupil property values and aggregate income would push down a district’s Foundation Aid, but not below $500 per pupil unit. 45 of the state’s wealthiest districts (7 percent of all school districts) receive the minimum $500 per pupil funding level.

Foundation Aid’s “hold harmless” provision

Finally, Foundation Aid includes a “hold harmless” provision that does not allow a district’s allocation to fall from year to year, even if changes in the formula factors would entail a reduction in funding. The hold harmless provision has been of special significance in recent years as districts across the state face declining enrollment. In fiscal year 2025, half of districts (334 districts, 50 percent of all districts) would have seen a Foundation Aid decrease between school years 2024 and 2025. In her fiscal year 2025 executive budget, the governor proposed replacing hold harmless with a transitional aid formula that would replace nearly all (91 percent) of any annual Foundation Aid decrease in a given year for the lowest-resource districts. For the wealthiest districts, half of any years’ decrease would be replaced. This change was rejected by the legislature and not enacted.

Expense-based aid

While Foundation Aid comprises a majority of State aid to public schools, nearly 30 percent is comprised of expense-based aid, which reimburses certain costs incurred by school districts. These “aidable expense” categories are set by law and allowable costs are regulated by NYSED. Building aid, which reimburses districts for hard and soft costs and debt service of building projects, is the largest expense-based aid allocation. Its $3.4 billion outlay in fiscal year 2025 makes up 10 percent of State school aid. Reimbursement for transportation expenses and districts’ purchase of BOCES services, which provide vocational training, comprises the next-largest expense based aids, totaling $2.6 billion and $1.3 billion, respectively, making up 7 and 4 percent of State school aid. Like Foundation Aid, districts with high property values and income receive reduced reimbursements for aidable expenses. By contrast, nearly all aidable expenses incurred the lowest-income districts may be reimbursed by the State.

Universal pre-kindergarten

A final major source of school aid from New York State supports the expansion of statewide universal pre-kindergarten (UPK). State UPK grants are allocated to districts based on the number of eligible 3 and 4 year-olds served by the programs. Per-pupil awards are adjusted based on districts’ wealth. Further, a subset of state UPK funding that supports the creation of full-day UPK programs are allocated on a competitive basis. While total State UPK funding does factor in local resources, per-pupil UPK grants are far flatter across districts than other Foundation Aid.

While State pre-kindergarten grants began in 1997, significant investments have been made since fiscal year 2022, with expansions of UPK programs funded by federal Covid relief funded and subsequently by State takeovers of federal costs. In fiscal year 2025, the state plans to allocate $1.2 billion to statewide UPK. The State estimates that this funding represents 95 percent of the funding necessary to achieve fully universal coverage.[4]

STAR

Finally, the State funds schools through one channel outside of its school aid formulas: the school tax relief (STAR) program. The STAR program is a benefit to New York homeowners, relieving a portion of their property taxes, including those dedicated to schools. Because the STAR program lowers school tax revenue, the State reimburses districts’ forgone revenue. In fiscal year 2025, the State expects to spend $1.6 billion on STAR benefits.[5]

Other factors affecting State school aid

State law limits annual growth in school aid funding provided by the State to no greater than the annual growth in statewide personal income. The State legislature, however, overrode this cap in recent years to phase-in the Foundation Aid formula.

Finally, it is worth noting that while 85 percent of State school aid funding is general fund spending – supported by the State’s broad tax base – 15 percent is supported by dedicated gambling revenues. While gambling revenues can be a volatile revenue source, this has not imposed volatility on school aid, as general fund spending can rise or fall to fill fully fund school aid commitments.

The future of Foundation Aid

School year 2025 represents a new status quo for school funding in New York State. Having withstood the Governor’s attempt to restrain school aid growth, the Foundation Aid remains formula fully funded. With inflation falling and enrollment growth low or negative in most districts, State school funding is set to grow slowly in the years ahead. However, the future of Foundation Aid is poised to remain a topic of contention.

The fiscal year 2025 enacted budget included $2 million for the University of Albany’s Rockefeller Institute to study the formula and submit a report by December 1, 2024. The study is directed to examine each component of the formula as well as funding adequacy and districts’ fiscal conditions and make

recommendations for revisions that are “fiscally sustainable for the state, local taxpayers, and school.”[6] While the report’s findings and recommendations are non-binding, it is likely to kick start a debate over changes to the formula in the fiscal year 2026 budget, and may provide support for another initiative by the governor to reduce required spending under the Foundation Aid rules.

Reviewing the Foundation Aid formula has been a priority for many of the state’s education advocates. The Alliance for Quality Education has called for revising the Foundation Aid formula by updating NYSED’s method for determining the base cost of a sound basic education and using alternative measures of student need, including updating its use of outdated poverty data from the 2000 Census.[7] Changes along these lines may shift additional resources to the highest-need districts.

The relationship between a district’s resources and student need and the level of State funding it is allocated is likely to be a central debate. While the current formula is sharply progressive, allocating greater per-pupil funding to the highest-need districts, many argue it should go further. The Education Trust finds that while total school funding (including State and local) is relatively equal across districts, it fails to channel greater resources to students who need it most.[8] Similarly, the School Finance Indicators Database found that by failing to channel greater resources to the highest need schools, New York’s flat school funding structure creates a higher “opportunity gap” than every other state in the country except Connecticut.[9] New York’s extreme school segregation bolsters the case for greater progressivity. Stanford University’s Educational Opportunity Project found that New York has the highest rate of school segregation in the country.[10] Studies have repeatedly found that school segregation is a central driver of socioeconomic outcome disparities.[11]

Any change to the Foundation Aid formula will affect both the distribution of funding across districts and the overall level of State school aid. Increasing school aid’s progressivity while holding the total funding level constant would entail redistributing funds from wealthy to high-need districts. Given that the State’s property tax cap remains in place, districts losing funding would have limited ability to fill any gap with local resources. Balancing these tradeoffs will be the central challenge to reforming Foundation Aid.

[1] https://state-local-finance-data.taxpolicycenter.org/pages.cfm; https://www.budget.ny.gov/pubs/archive/fy25/en/fy25fp-en.pdf

[2] Typical years refers to pre-Covid funding patterns. Recent trends in school funding will be discussed below.

[3] https://www.aqeny.org/equity/

[4] https://www.budget.ny.gov/pubs/archive/fy24/ex/book/education.pdf

[5] The total includes a portion of STAR benefits disbursed to homeowners as a personal income tax (PIT) credit, not a property tax benefit. PIT credit costs are not borne by school districts and therefore not reimbursed.

[6] S8306-C

[7] https://www.aqeny.org/wp-content/uploads/2023/05/AQE-ELC-Foundation-Aid-white-paper-5-19-23.pdf

[8] https://newyork.edtrust.org/online-data-tool-allows-users-to-explore-how-new-york-school-districts-are-investing-resources/

[9] https://www.schoolfinancedata.org/the-adequacy-and-fairness-of-state-school-finance-systems-2024/

[10] https://edopportunity.org/segregation/about/

[11] https://cepa.stanford.edu/sites/default/files/wp19-06-v082022.pdf