Regional Impacts of the July 2026 Essential Plan Cliff

February 12, 2026 |

Introduction

This July, 470,000 of the 1.7 million New Yorkers currently enrolled in the Essential Plan (EP) will lose their current health insurance.

Hundreds of thousands will become uninsured. As we wrote last week, the State can and should step in to prevent this healthcare catastrophe—but Governor Hochul’s Executive Budget proposal fails to address this. Unless the legislature takes action, New York will see the most rapid loss of healthcare coverage in its history.

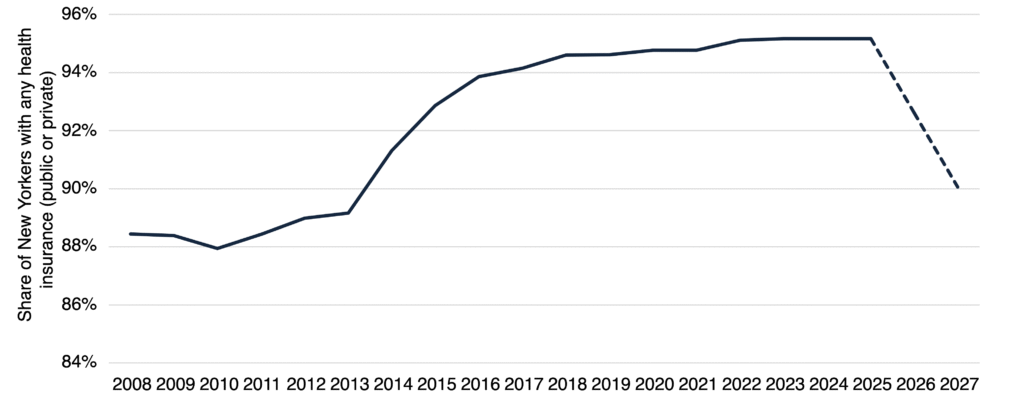

In this post we break down the potential impact by county and region. We find that, while New York City will see the largest coverage loss—with 233,000 residents impacted—every part of the state will see a dramatic loss of insurance. Long Island, for example, will see nearly 70,000 people lose coverage, including 38,000 in Suffolk County alone. Western New York will see 26,000 lose coverage. Statewide, 2.4 percent of New Yorkers will lose their health insurance coverage—likely the largest and most rapid loss of insurance in the State’s history. Medicaid work requirements beginning in January 2027 will further decimate New York insurance rolls (see figure 1).

Figure 1: Impact of Medicaid work requirements and Essential Plan cuts on New York Uninsurance Rate

Source: US Census Bureau, 2024 American Community Survey, and the author’s calculations.

Background

The Essential Plan uses federal funding to cover 1.7 million New Yorkers earning less than 250 percent of the Federal Poverty Line (FPL)—or around $40,000 for a single individual. Approximately 725,000 EP enrollees are lawfully present immigrants. (Undocumented immigrants are not eligible for the program.) Last summer, Congress passed the “One Big Beautiful Bill Act” (OBBBA), which contained dramatic cuts to healthcare nationwide. Impacts were especially intense for New York’s Essential Plan, since Republicans targeted immigrant healthcare for cuts. OBBBA eliminated federal funding for immigrant coverage, effectively cutting $7.5B from the Essential Plan’s $14B budget and rendering its current financing unsustainable. (For more background on the cuts see our piece from last May.)

In response, New York announced plans to restructure the Essential Plan, reducing eligibility from 250 percent of FPL to 200 percent. This change will allow New York to continue to serve the 1.3 million EP enrollees earning less than 200 percent of FPL—but the 470,000 enrollees earning more than that, known as the “EP 200-250 group,” will see their coverage eliminated. The State currently plans to drop coverage in July.

These plans require federal approval. Most experts believe that the State is likely to receive this approval, since it has a legal right to restructure EP in the way proposed, but so far the State has not received it. If the federal government blocks New York’s plan, Governor Hochul’s Executive Budget appears to propose eliminating the Essential Plan entirely, a catastrophic outcome. But even in the “optimistic” scenario where the plan is approved, 470,000 current EP enrollees will lose coverage.

What will become of this group? It is very unlikely that they will find coverage through an employer; the EP population is low-income, and in a state where employer-sponsored insurance costs nearly $10,000 per year for an individual plan, few employers will be prepared to provide it. Most will be eligible for federal Premium Tax Credits (PTC) to purchase coverage on the individual market—but even with PTC, coverage will cost as much as $250 per month and come with a $2,500 deductible, presenting a huge barrier for low-income New Yorkers. Hundreds of thousands are likely to be unable to afford any insurance at all.

As we wrote last week, the State can and must step in to offer alternative coverage. FPI has estimated that it would cost the state less than $1 billion in FY27 to prevent coverage loss for this population.

Coverage Losses by Region

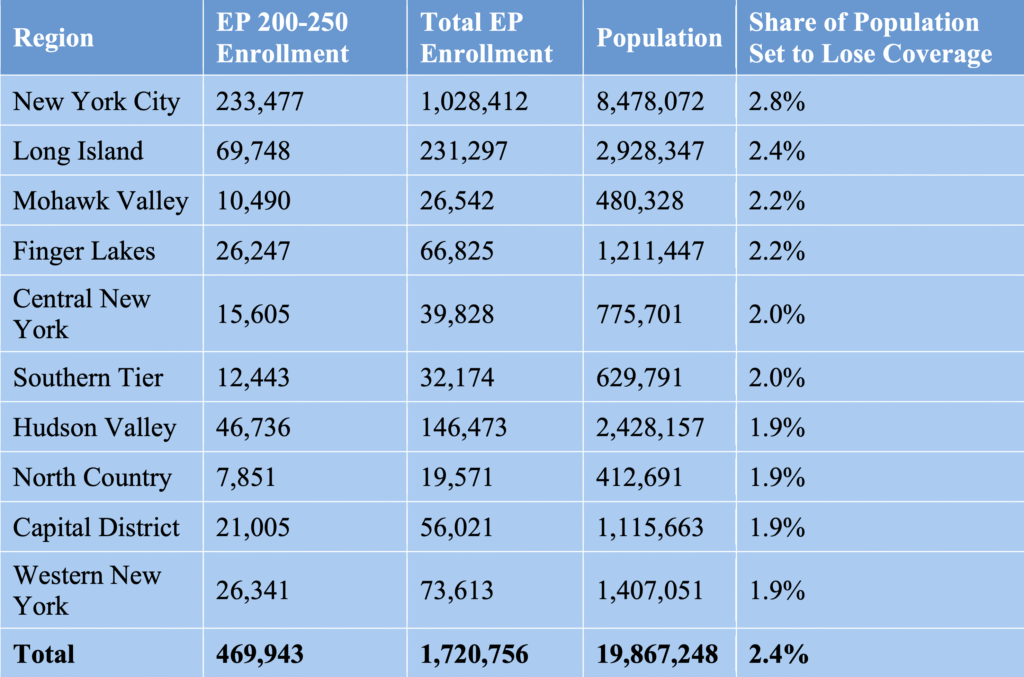

Table 1 presents EP 200-250 group enrollment, total EP enrollment and population by region and statewide. The EP 200-250 group is expected to lose coverage in July 2026.

Table 1: Essential Plan Coverage Loss by Region

Coverage loss as a share of population will be sharpest in New York City and Long Island; nearly 3 percent of NYC residents will lose coverage this July along with 2.4 percent of Long Island residents. But coverage loss is broadly distributed statewide. In the Capital District, 21,000 people will lose coverage; in Western New York, 26,000; in the Hudson Valley, nearly 47,000.

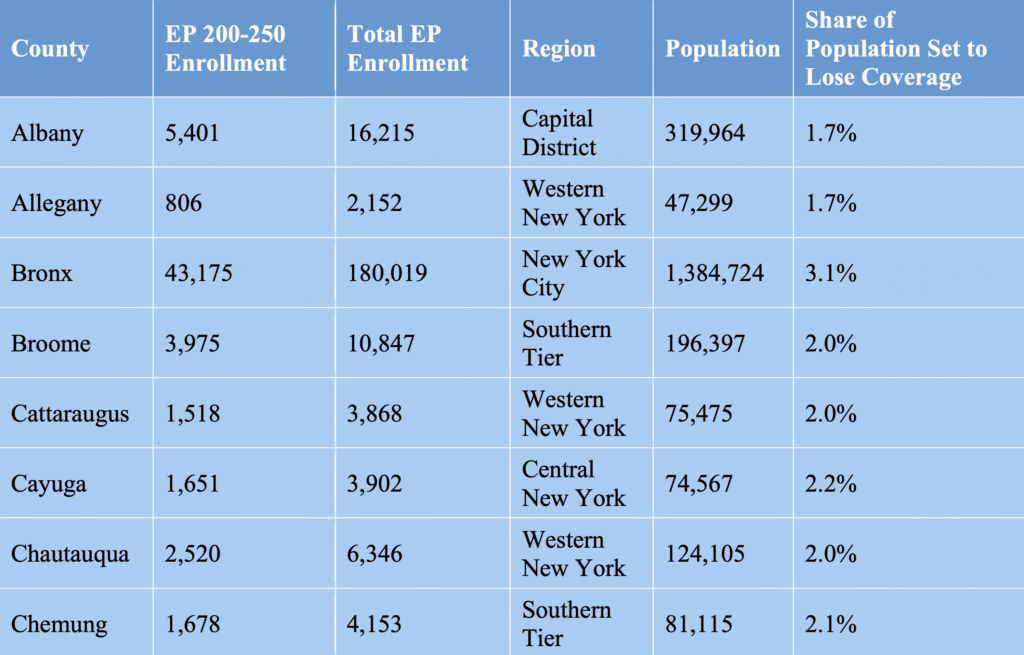

Table 2 presents EP coverage loss by county. A similar pattern emerges, with coverage losses distributed throughout the state. Notably, New York County (Manhattan) is among the least-impacted counties in the State, while Fulton and Suffolk are among the most impacted; in Suffolk County alone, 38,000 people are set to lose insurance this July.

Excerpt from Table 2: Essential Plan Coverage Loss by County (download report to see all regions)

Conclusion

New Yorkers do not need to accept this massive loss of insurance. Analysis, including that released by FPI, has demonstrated that the state has the fiscal capacity to offer alternative coverage, either by subsidizing purchase of insurance on the individual market, as we have proposed, or through an alternative mechanism. Doing so must be a top priority in the Fiscal Year 2027 budget.

Regional Impacts of the July 2026 Essential Plan Cliff

February 12, 2026 |

Introduction

This July, 470,000 of the 1.7 million New Yorkers currently enrolled in the Essential Plan (EP) will lose their current health insurance.

Hundreds of thousands will become uninsured. As we wrote last week, the State can and should step in to prevent this healthcare catastrophe—but Governor Hochul’s Executive Budget proposal fails to address this. Unless the legislature takes action, New York will see the most rapid loss of healthcare coverage in its history.

In this post we break down the potential impact by county and region. We find that, while New York City will see the largest coverage loss—with 233,000 residents impacted—every part of the state will see a dramatic loss of insurance. Long Island, for example, will see nearly 70,000 people lose coverage, including 38,000 in Suffolk County alone. Western New York will see 26,000 lose coverage. Statewide, 2.4 percent of New Yorkers will lose their health insurance coverage—likely the largest and most rapid loss of insurance in the State’s history. Medicaid work requirements beginning in January 2027 will further decimate New York insurance rolls (see figure 1).

Figure 1: Impact of Medicaid work requirements and Essential Plan cuts on New York Uninsurance Rate

Source: US Census Bureau, 2024 American Community Survey, and the author’s calculations.

Background

The Essential Plan uses federal funding to cover 1.7 million New Yorkers earning less than 250 percent of the Federal Poverty Line (FPL)—or around $40,000 for a single individual. Approximately 725,000 EP enrollees are lawfully present immigrants. (Undocumented immigrants are not eligible for the program.) Last summer, Congress passed the “One Big Beautiful Bill Act” (OBBBA), which contained dramatic cuts to healthcare nationwide. Impacts were especially intense for New York’s Essential Plan, since Republicans targeted immigrant healthcare for cuts. OBBBA eliminated federal funding for immigrant coverage, effectively cutting $7.5B from the Essential Plan’s $14B budget and rendering its current financing unsustainable. (For more background on the cuts see our piece from last May.)

In response, New York announced plans to restructure the Essential Plan, reducing eligibility from 250 percent of FPL to 200 percent. This change will allow New York to continue to serve the 1.3 million EP enrollees earning less than 200 percent of FPL—but the 470,000 enrollees earning more than that, known as the “EP 200-250 group,” will see their coverage eliminated. The State currently plans to drop coverage in July.

These plans require federal approval. Most experts believe that the State is likely to receive this approval, since it has a legal right to restructure EP in the way proposed, but so far the State has not received it. If the federal government blocks New York’s plan, Governor Hochul’s Executive Budget appears to propose eliminating the Essential Plan entirely, a catastrophic outcome. But even in the “optimistic” scenario where the plan is approved, 470,000 current EP enrollees will lose coverage.

What will become of this group? It is very unlikely that they will find coverage through an employer; the EP population is low-income, and in a state where employer-sponsored insurance costs nearly $10,000 per year for an individual plan, few employers will be prepared to provide it. Most will be eligible for federal Premium Tax Credits (PTC) to purchase coverage on the individual market—but even with PTC, coverage will cost as much as $250 per month and come with a $2,500 deductible, presenting a huge barrier for low-income New Yorkers. Hundreds of thousands are likely to be unable to afford any insurance at all.

As we wrote last week, the State can and must step in to offer alternative coverage. FPI has estimated that it would cost the state less than $1 billion in FY27 to prevent coverage loss for this population.

Coverage Losses by Region

Table 1 presents EP 200-250 group enrollment, total EP enrollment and population by region and statewide. The EP 200-250 group is expected to lose coverage in July 2026.

Table 1: Essential Plan Coverage Loss by Region

Coverage loss as a share of population will be sharpest in New York City and Long Island; nearly 3 percent of NYC residents will lose coverage this July along with 2.4 percent of Long Island residents. But coverage loss is broadly distributed statewide. In the Capital District, 21,000 people will lose coverage; in Western New York, 26,000; in the Hudson Valley, nearly 47,000.

Table 2 presents EP coverage loss by county. A similar pattern emerges, with coverage losses distributed throughout the state. Notably, New York County (Manhattan) is among the least-impacted counties in the State, while Fulton and Suffolk are among the most impacted; in Suffolk County alone, 38,000 people are set to lose insurance this July.

Excerpt from Table 2: Essential Plan Coverage Loss by County (download report to see all regions)

Conclusion

New Yorkers do not need to accept this massive loss of insurance. Analysis, including that released by FPI, has demonstrated that the state has the fiscal capacity to offer alternative coverage, either by subsidizing purchase of insurance on the individual market, as we have proposed, or through an alternative mechanism. Doing so must be a top priority in the Fiscal Year 2027 budget.