Fact Sheet on Fiscal Year 2025 Enacted Budget

April 23, 2024 |

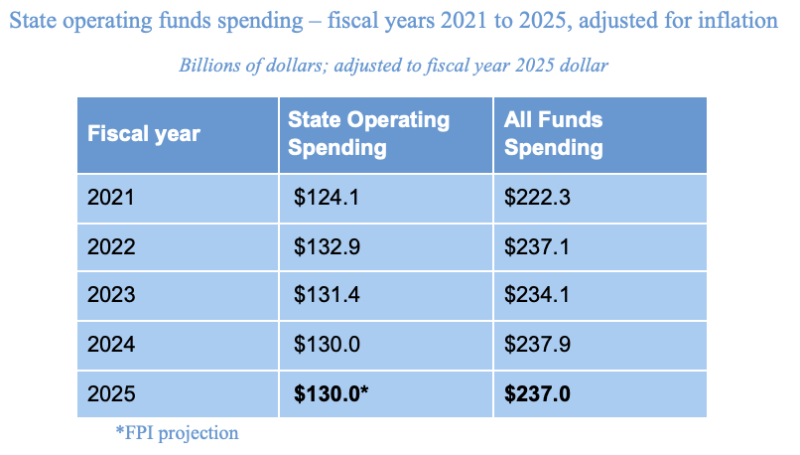

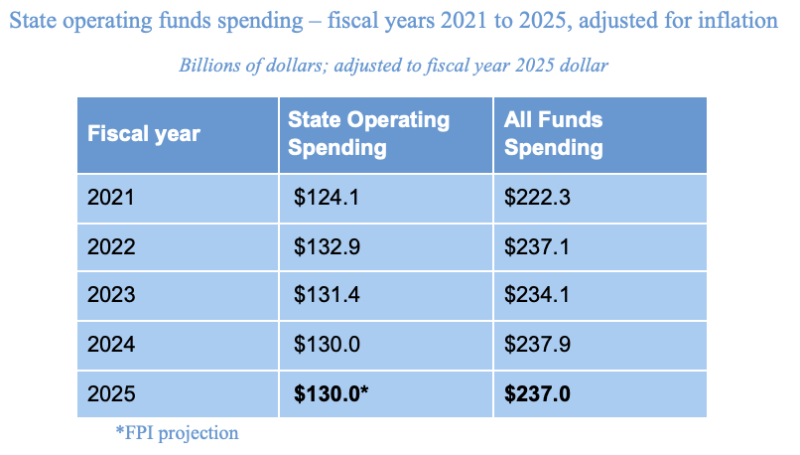

The fiscal year 2025 enacted budget totals $237 billion, an inflation-adjusted decline of 0.4 percent from fiscal year’s 2024 total budget. In non-inflation-adjusted terms (nominal dollars) this represents an increase from fiscal year 2024’s total budget of $231.6 billion.

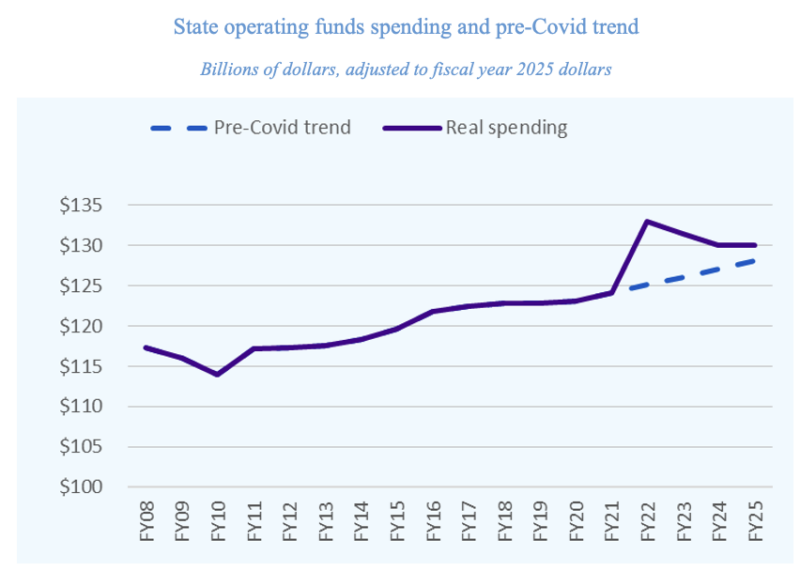

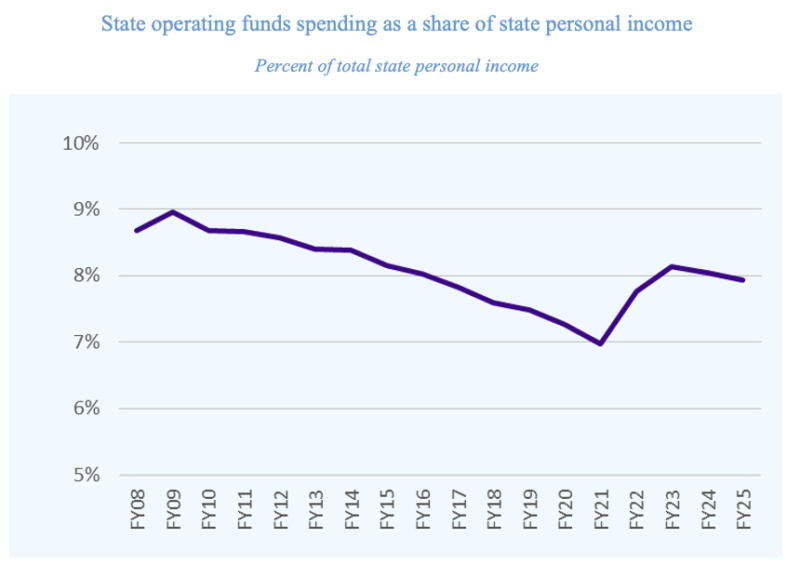

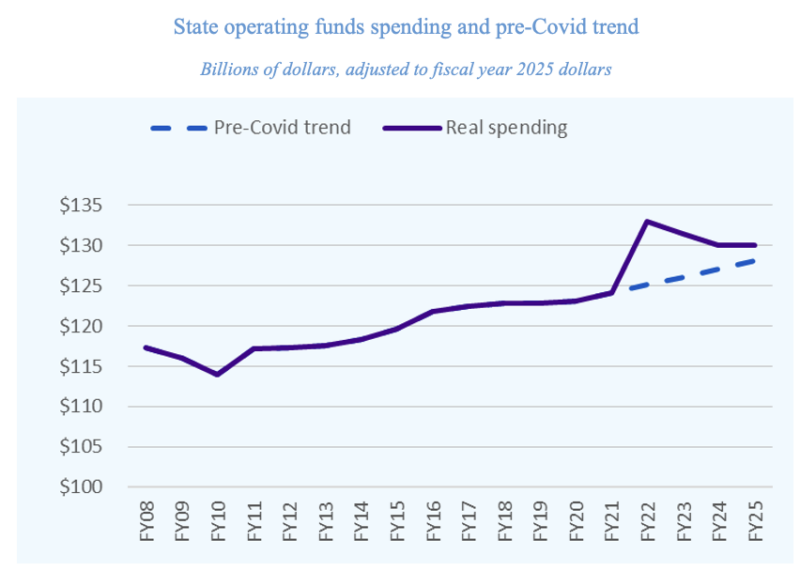

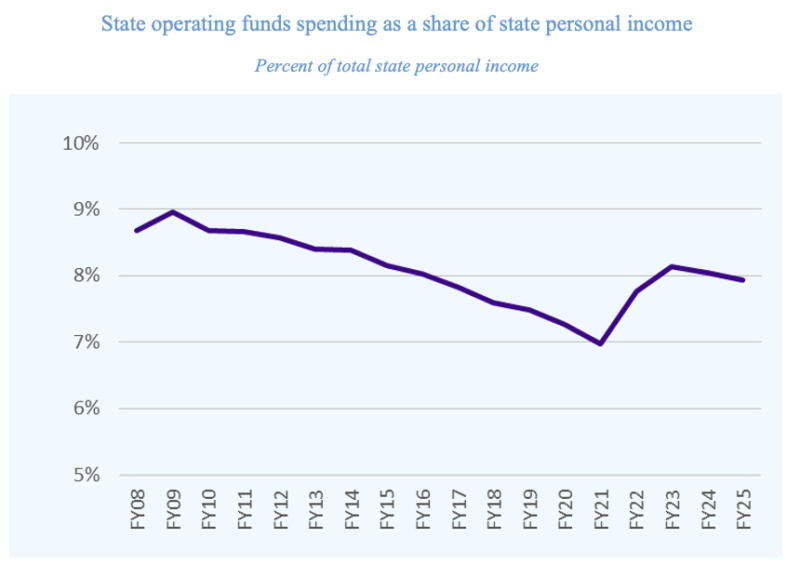

While this increase is a step up from the spending level proposed by the fiscal year 2025 executive budget, it represents continued fiscal restraint. Fiscal year 2025 spending will fall to be on par with fiscal year 2022 spending, after adjusting for inflation. Spending as a share of the state economy is also likely to fall.

While the state has not published its state operating funds spending total, FPI expects state spending in fiscal year 2025 to be $130 billion, on par with its fiscal year 2024 level, after adjusting for inflation. FPI’s estimate assumes that fiscal year 2025 federal funding will exceed executive budget projections by $3.6 billion as a result of the tax on Managed Care Organizations.

- Reserves: The State currently has $30.7 billion in reserves — more than any time in its history.[1]

- Budget gaps: The State’s forecasted budget gaps are based on extremely low revenue projections compared to both recent state trends and national economic forecasts.

- FPI estimates that if state revenue growth over the next three years is about half of its prior ten-year average, or about half of the growth rate expected for the national economy by institutional forecasters, then State spending will be generally balanced in the future years of the financial plan, and some years will have a surplus.

- Millionaire population: New York’s millionaire population grew by 27.5 percent

(15,100 millionaire households) from 2020 – 2022.

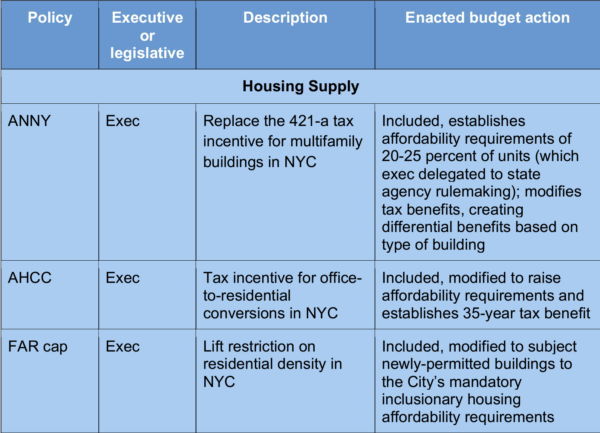

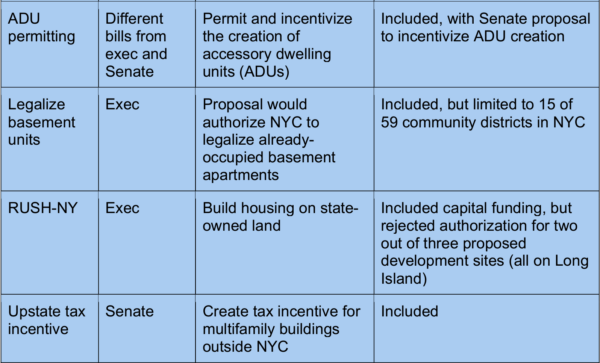

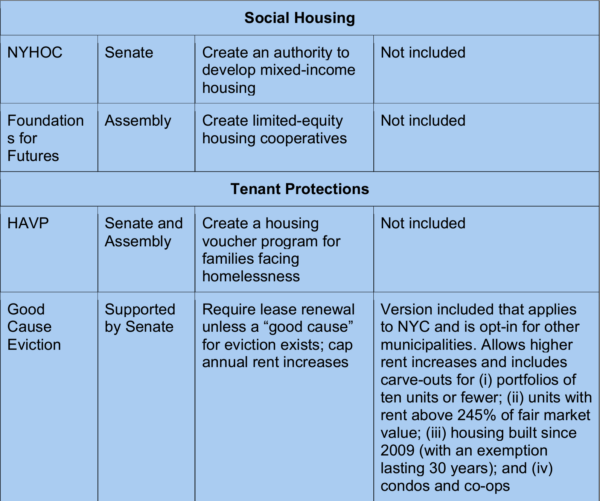

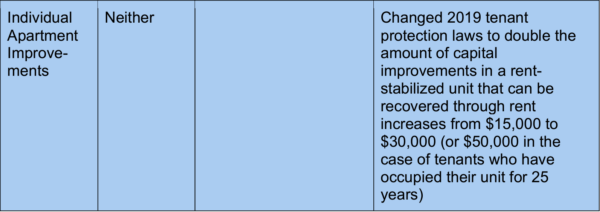

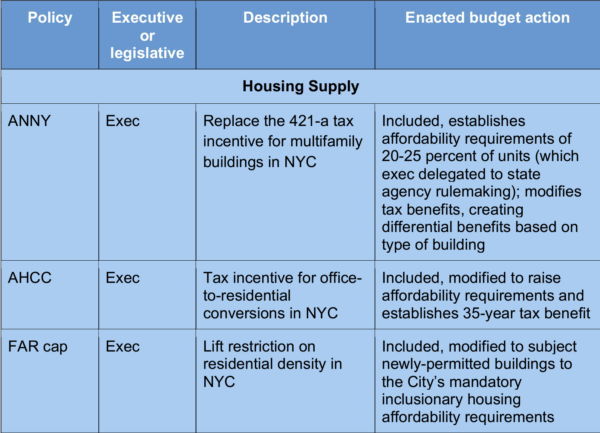

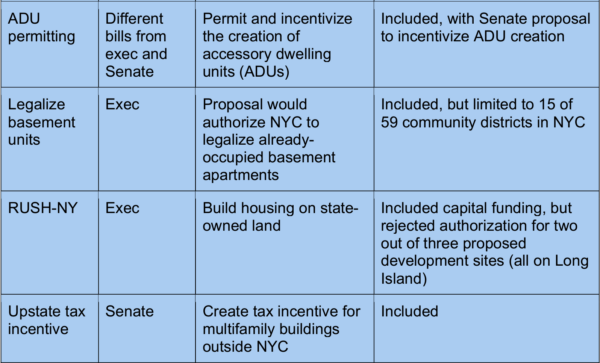

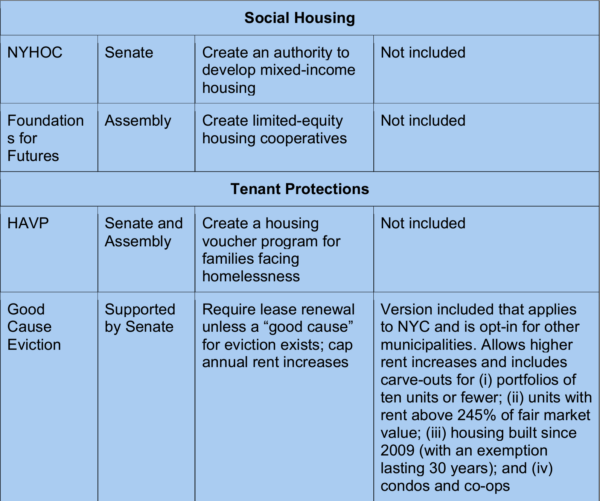

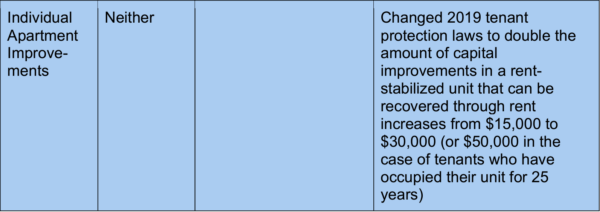

Major Housing Policy Proposals

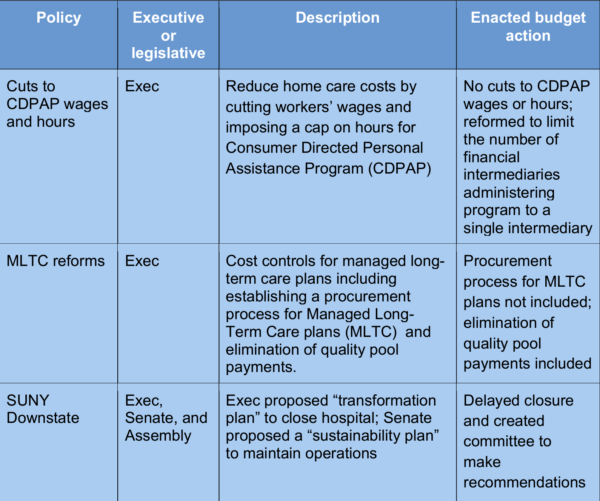

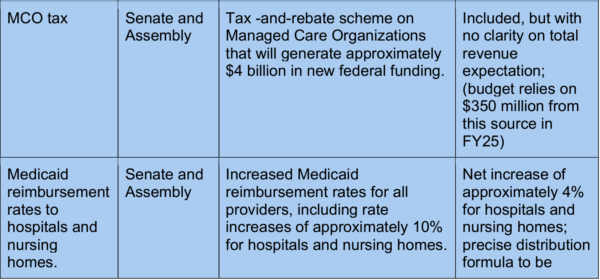

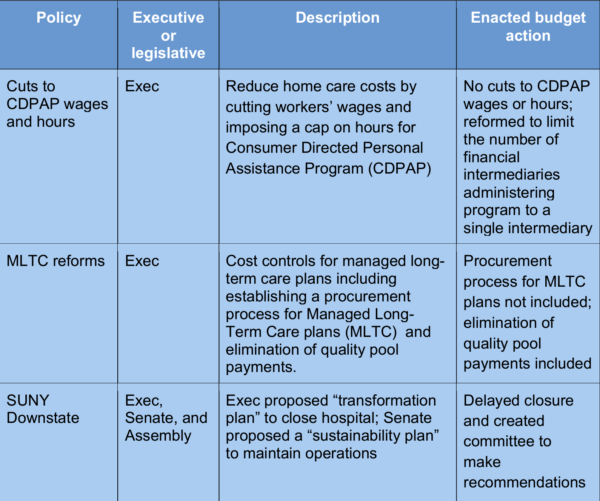

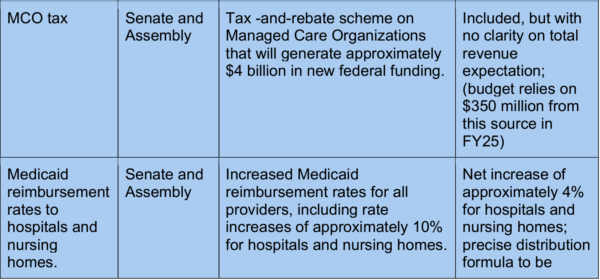

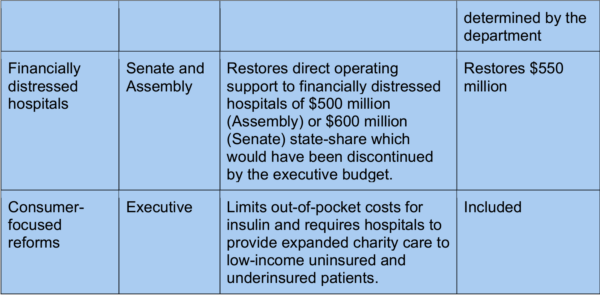

Major Healthcare Proposals

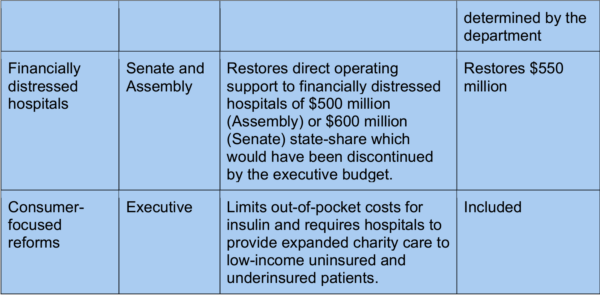

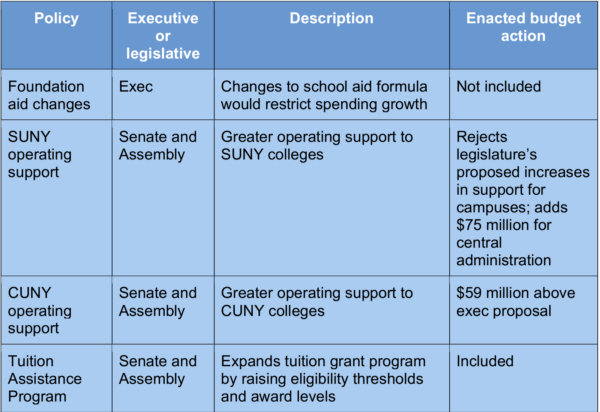

Major Education Proposals

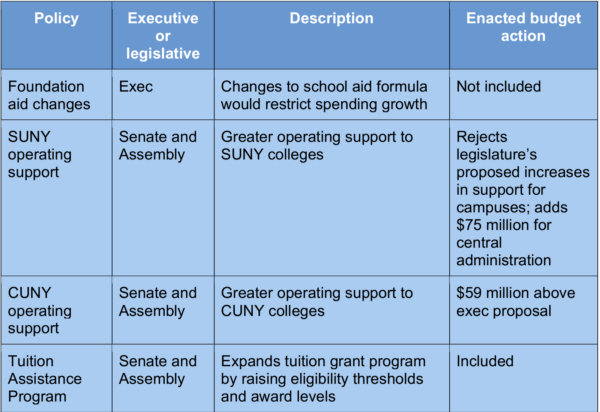

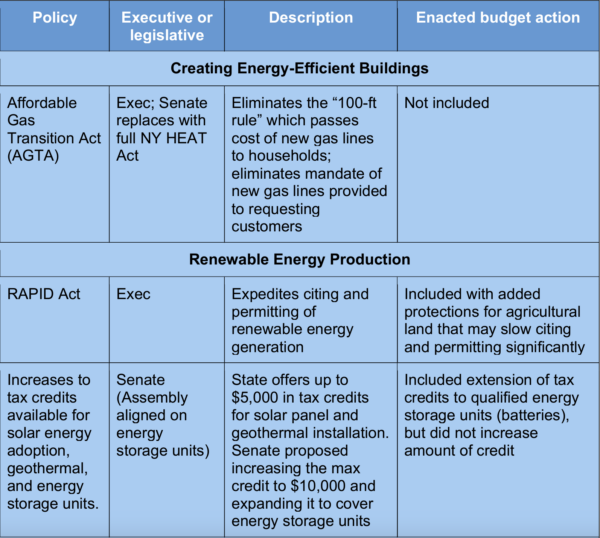

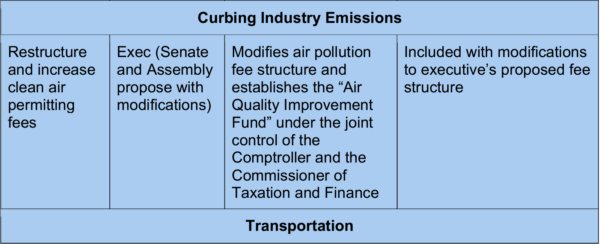

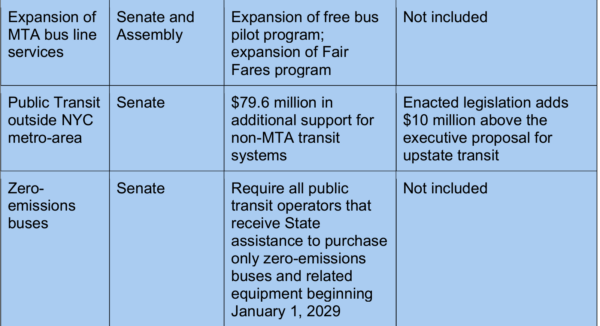

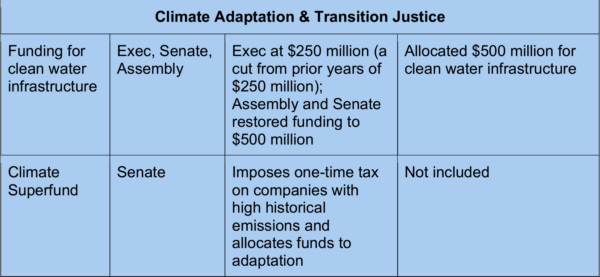

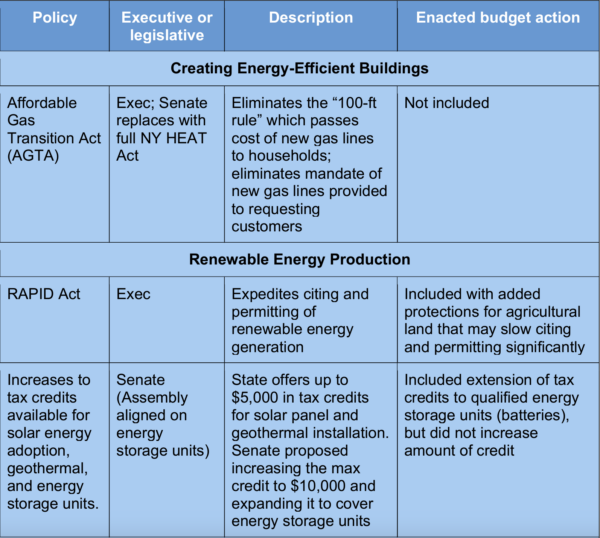

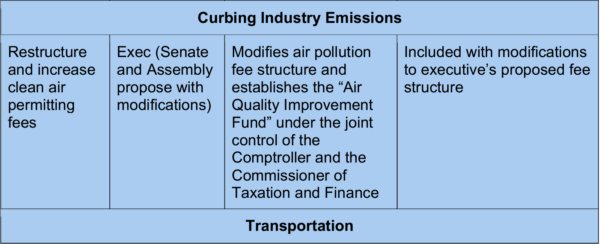

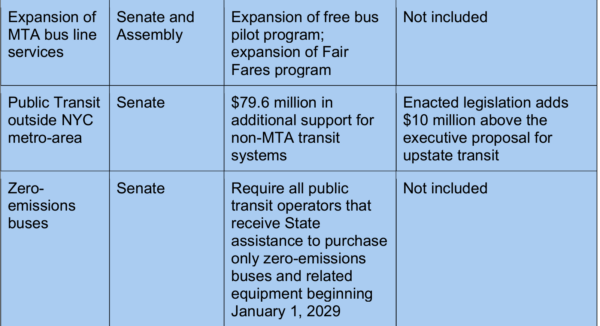

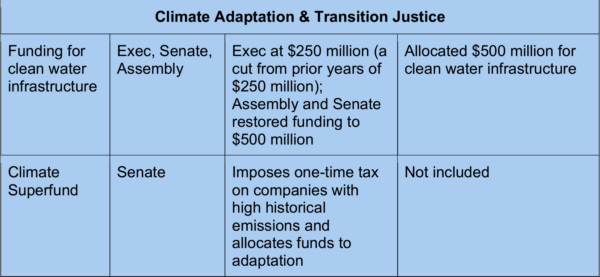

Major Climate Proposals

[1] This includes unrestricted general fund balances, but excludes PTET and labor agreement reserves. Fiscal year 2025 executive budget financial plan and March 2024 State Comptroller monthly cash basis report.

Fact Sheet on Fiscal Year 2025 Enacted Budget

April 23, 2024 |

The fiscal year 2025 enacted budget totals $237 billion, an inflation-adjusted decline of 0.4 percent from fiscal year’s 2024 total budget. In non-inflation-adjusted terms (nominal dollars) this represents an increase from fiscal year 2024’s total budget of $231.6 billion.

While this increase is a step up from the spending level proposed by the fiscal year 2025 executive budget, it represents continued fiscal restraint. Fiscal year 2025 spending will fall to be on par with fiscal year 2022 spending, after adjusting for inflation. Spending as a share of the state economy is also likely to fall.

While the state has not published its state operating funds spending total, FPI expects state spending in fiscal year 2025 to be $130 billion, on par with its fiscal year 2024 level, after adjusting for inflation. FPI’s estimate assumes that fiscal year 2025 federal funding will exceed executive budget projections by $3.6 billion as a result of the tax on Managed Care Organizations.

- Reserves: The State currently has $30.7 billion in reserves — more than any time in its history.[1]

- Budget gaps: The State’s forecasted budget gaps are based on extremely low revenue projections compared to both recent state trends and national economic forecasts.

- FPI estimates that if state revenue growth over the next three years is about half of its prior ten-year average, or about half of the growth rate expected for the national economy by institutional forecasters, then State spending will be generally balanced in the future years of the financial plan, and some years will have a surplus.

- Millionaire population: New York’s millionaire population grew by 27.5 percent

(15,100 millionaire households) from 2020 – 2022.

Major Housing Policy Proposals

Major Healthcare Proposals

Major Education Proposals

Major Climate Proposals

[1] This includes unrestricted general fund balances, but excludes PTET and labor agreement reserves. Fiscal year 2025 executive budget financial plan and March 2024 State Comptroller monthly cash basis report.