Mind the Gap: When are State Budget Gaps a Concern?

September 5, 2023 |

New York’s fiscal year 2024 Enacted Budget Financial Plan, released June 2023, projected budget shortfalls for fiscal years 2025 through 2027. While future budget gaps are a perennial feature of New York’s budget forecasts, the most recent projected gaps exceed those generally projected in times of greater economic stability, aligning instead with gaps projected during economic downturns. These projections must be interpreted, however, in light of an improving economic outlook as well as the inherent uncertainty of fiscal forecasting.

What is a budget gap?

Projected budget gaps reflect imbalances between revenues and spending projected in financial plan outyears — the three fiscal years following the current fiscal year. As such, projected gaps are not budget deficits. A deficit is a current-year imbalance, such as those typically incurred by the federal government, but which is unconstitutional for New York State. Rather, gaps are projections of future imbalances. These projections often reflect cautious fiscal management, which errs on the side of underestimating future revenues and overestimating future spending growth. In other words, it is preferable to have a budget surplus at the end of the year rather than to spend well in excess of revenues. Outyear budget gaps should, therefore, be understood as both cautious and uncertain; they should be used as guideposts rather than treated as matters of fact.

Budget gaps are a routine part of the State’s forecasting.

Because of conservative forecasting, outyear gaps are nearly always projected in New York State’s financial plans. In periods of economic stability, projected gaps are generally modest. For instance, during the economic recovery from the 2008-09 recession — fiscal years 2012 through 2020 — gaps during the first outyear averaged 4 percent, and generally fell between 2 and 6 percent of general fund spending. By the third and final outyear projected in each financial plan, prospective gaps were generally larger, averaging 7 percent and falling between 4 and 10 percent of the general fund budget.

Routine projected budget gaps in these ranges reflect prudent fiscal management. These gaps tend to narrow or disappear as they approach the current fiscal year, as actual spending falls below projections and revenue exceeds forecasts. Between fiscal years 2012 and 2020 — non-recessionary years characterized by lower economic uncertainty and greater fiscal stability — outyear forecasts underestimated revenue by 3 percent on average and overestimated spending by 4 percent on average. As a result, routine gaps in non-crisis years generally close without significant policy action.

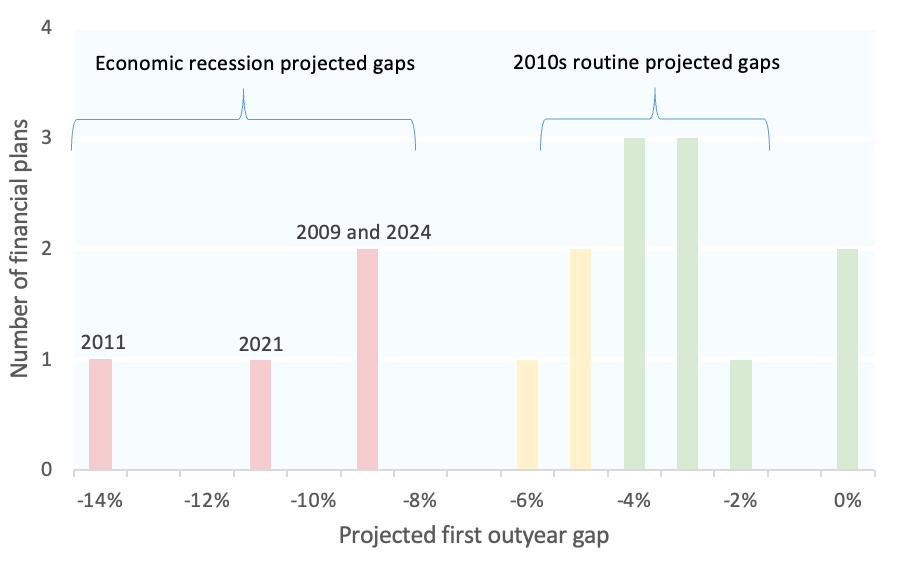

Figure 1. Frequency of budget gaps projected for the first outyear for fiscal years 2009-2024

Gaps shown as share of general fund spending

The routine nature of outyear budget gaps suggests they are best understood in the context of historical budget gaps and in relation to the size of the overall budget. Because the budget grows alongside inflation and the state’s economic growth, budget gaps are better understood as a percentage of the size of the budget, rather than as absolute numbers. In this post, budget gaps are measured as a percentage of general fund revenue.

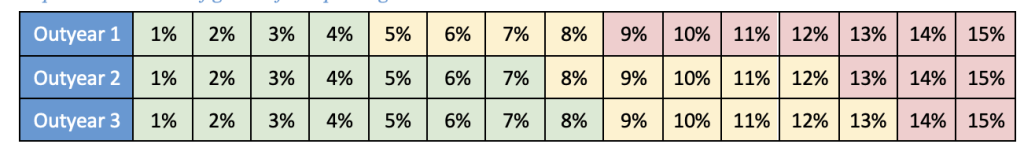

To provide historical context for the relative size of outyear budget gaps, FPI analyzed the budget gaps projected by enacted budget financials plans for fiscal years 2009 through 2024. Half of the financial plans analyzed projected first outyear gaps of 4 percent or less. These median shortfalls, which reflect routine gaps, rose to 7 percent in the second outyear and 8 percent in the final outyear. Gaps exceeding this level are potentially concerning and merit greater monitoring over the course of the budget cycle. A third category, the highest 20 percent of budget gaps, represent significant budget gaps generally associated with economic crises. In the first outyear, significant gaps have been 9 percent of the budget or higher. For outyears two and three, this threshold rises to 13 and 14 percent, respectively.

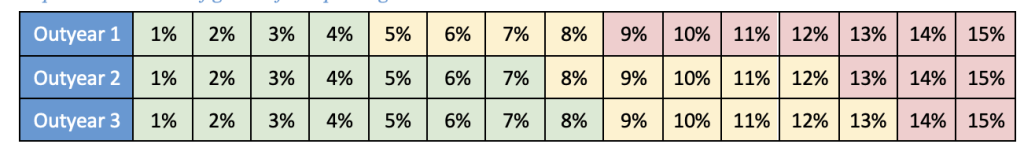

Figure 2. Rubric to assess projected budget gap severity by outyear

Gaps shown as share of general fund spending

- Green: Routine budget gaps — those at or below the median historical gaps, highlighted in green — are generally an artifact of conservative fiscal forecasts and tend to narrow and close with minimal policy intervention, as a revenue exceeds initial expectations and spending comes in below initial estimates. In non-crisis years, outyear forecasts underestimated revenue by an average of 3 percent and overestimated spending by average of 4 percent. Spending was significantly overestimated in the wake of the 2008 financial crisis because of dramatic cuts in fiscal years 2011 and 2012.

- Yellow: Slightly higher, concerning gaps — these generally aligned with years of economic recovery in which budgets were balanced without revenue action or substantial cuts,

- Red: Significant budget gaps — those in the top quintile of historical gaps, highlighted in red — align with years of economic crisis. Policy interventions were necessary to balance budget gaps in the wake of these crises. The State undertook across-the-board spending cuts and enacted higher personal income tax (PIT) rates on high-income earners in the wake of the financial crisis. In fiscal year 2022, the State again raised top PIT rates to balance budgets. Federal emergency relief and a brisk economic recovery averted spending cuts.

Current budget gaps reflect uncertainty, but not crisis.

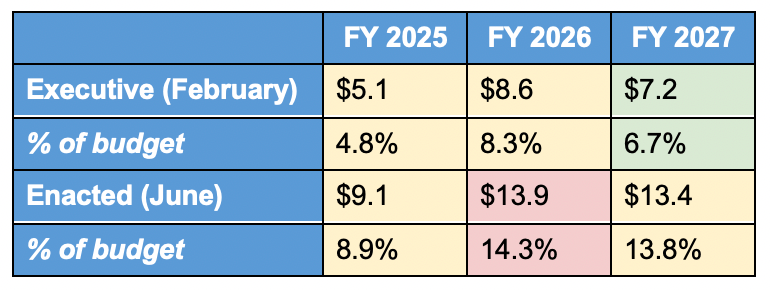

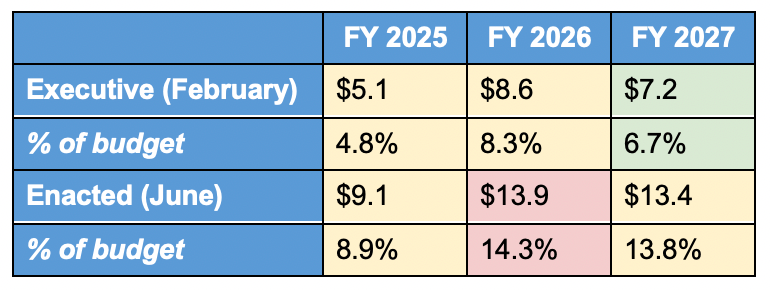

The fiscal year 2024 enacted budget financial plan made significant downward revisions to revenue, resulting in larger projected gaps. While gaps projected in the February 2023 executive budget financial plan were either routine or slightly concerning, the revised gaps align with crisis-era shortfalls.

Figure 3. Budget gaps projected in the fiscal year 2024 executive and enacted budget financial plans

While past crisis-era budget gaps were projected after an economic shock, the currently-projected gaps appear to reflect an expected downturn in the national economy as the Federal Reserve’s campaign of interest rate hikes dampens economic activity. If and when a recession might materialize, however, is far from clear, as FPI documented in a recent blog post.

Economic pessimism, however, is not entirely responsible for the projected budget gaps. Recently-projected budget gaps are attributable to downward revisions to revenue expectations. However, the State’s economic outlook does not appear to have been significantly downgraded in recent months. Further, the most recent economic data have exceeded the State’s forecasts. Rather, recently projected budget gaps appear largely based on weak April 2023 tax revenue. As FPI noted in its analysis of the fiscal year 2024 enacted budget financial plan, April’s low tax receipts were largely backward-looking, reflecting financial market conditions in 2022. Fiscal data from May through July have exceeded projections.

Because of the high uncertainty around the fiscal imbalance projected in this plan, New York lawmakers should avoid reactive policy responses and monitor fiscal and economic data as it arrives. Should a recession occur, the State should leverage the substantial fiscal reserves and avoid recession-exacerbating service cuts.

Mind the Gap: When are State Budget Gaps a Concern?

September 5, 2023 |

New York’s fiscal year 2024 Enacted Budget Financial Plan, released June 2023, projected budget shortfalls for fiscal years 2025 through 2027. While future budget gaps are a perennial feature of New York’s budget forecasts, the most recent projected gaps exceed those generally projected in times of greater economic stability, aligning instead with gaps projected during economic downturns. These projections must be interpreted, however, in light of an improving economic outlook as well as the inherent uncertainty of fiscal forecasting.

What is a budget gap?

Projected budget gaps reflect imbalances between revenues and spending projected in financial plan outyears — the three fiscal years following the current fiscal year. As such, projected gaps are not budget deficits. A deficit is a current-year imbalance, such as those typically incurred by the federal government, but which is unconstitutional for New York State. Rather, gaps are projections of future imbalances. These projections often reflect cautious fiscal management, which errs on the side of underestimating future revenues and overestimating future spending growth. In other words, it is preferable to have a budget surplus at the end of the year rather than to spend well in excess of revenues. Outyear budget gaps should, therefore, be understood as both cautious and uncertain; they should be used as guideposts rather than treated as matters of fact.

Budget gaps are a routine part of the State’s forecasting.

Because of conservative forecasting, outyear gaps are nearly always projected in New York State’s financial plans. In periods of economic stability, projected gaps are generally modest. For instance, during the economic recovery from the 2008-09 recession — fiscal years 2012 through 2020 — gaps during the first outyear averaged 4 percent, and generally fell between 2 and 6 percent of general fund spending. By the third and final outyear projected in each financial plan, prospective gaps were generally larger, averaging 7 percent and falling between 4 and 10 percent of the general fund budget.

Routine projected budget gaps in these ranges reflect prudent fiscal management. These gaps tend to narrow or disappear as they approach the current fiscal year, as actual spending falls below projections and revenue exceeds forecasts. Between fiscal years 2012 and 2020 — non-recessionary years characterized by lower economic uncertainty and greater fiscal stability — outyear forecasts underestimated revenue by 3 percent on average and overestimated spending by 4 percent on average. As a result, routine gaps in non-crisis years generally close without significant policy action.

Figure 1. Frequency of budget gaps projected for the first outyear for fiscal years 2009-2024

Gaps shown as share of general fund spending

The routine nature of outyear budget gaps suggests they are best understood in the context of historical budget gaps and in relation to the size of the overall budget. Because the budget grows alongside inflation and the state’s economic growth, budget gaps are better understood as a percentage of the size of the budget, rather than as absolute numbers. In this post, budget gaps are measured as a percentage of general fund revenue.

To provide historical context for the relative size of outyear budget gaps, FPI analyzed the budget gaps projected by enacted budget financials plans for fiscal years 2009 through 2024. Half of the financial plans analyzed projected first outyear gaps of 4 percent or less. These median shortfalls, which reflect routine gaps, rose to 7 percent in the second outyear and 8 percent in the final outyear. Gaps exceeding this level are potentially concerning and merit greater monitoring over the course of the budget cycle. A third category, the highest 20 percent of budget gaps, represent significant budget gaps generally associated with economic crises. In the first outyear, significant gaps have been 9 percent of the budget or higher. For outyears two and three, this threshold rises to 13 and 14 percent, respectively.

Figure 2. Rubric to assess projected budget gap severity by outyear

Gaps shown as share of general fund spending

- Green: Routine budget gaps — those at or below the median historical gaps, highlighted in green — are generally an artifact of conservative fiscal forecasts and tend to narrow and close with minimal policy intervention, as a revenue exceeds initial expectations and spending comes in below initial estimates. In non-crisis years, outyear forecasts underestimated revenue by an average of 3 percent and overestimated spending by average of 4 percent. Spending was significantly overestimated in the wake of the 2008 financial crisis because of dramatic cuts in fiscal years 2011 and 2012.

- Yellow: Slightly higher, concerning gaps — these generally aligned with years of economic recovery in which budgets were balanced without revenue action or substantial cuts,

- Red: Significant budget gaps — those in the top quintile of historical gaps, highlighted in red — align with years of economic crisis. Policy interventions were necessary to balance budget gaps in the wake of these crises. The State undertook across-the-board spending cuts and enacted higher personal income tax (PIT) rates on high-income earners in the wake of the financial crisis. In fiscal year 2022, the State again raised top PIT rates to balance budgets. Federal emergency relief and a brisk economic recovery averted spending cuts.

Current budget gaps reflect uncertainty, but not crisis.

The fiscal year 2024 enacted budget financial plan made significant downward revisions to revenue, resulting in larger projected gaps. While gaps projected in the February 2023 executive budget financial plan were either routine or slightly concerning, the revised gaps align with crisis-era shortfalls.

Figure 3. Budget gaps projected in the fiscal year 2024 executive and enacted budget financial plans

While past crisis-era budget gaps were projected after an economic shock, the currently-projected gaps appear to reflect an expected downturn in the national economy as the Federal Reserve’s campaign of interest rate hikes dampens economic activity. If and when a recession might materialize, however, is far from clear, as FPI documented in a recent blog post.

Economic pessimism, however, is not entirely responsible for the projected budget gaps. Recently-projected budget gaps are attributable to downward revisions to revenue expectations. However, the State’s economic outlook does not appear to have been significantly downgraded in recent months. Further, the most recent economic data have exceeded the State’s forecasts. Rather, recently projected budget gaps appear largely based on weak April 2023 tax revenue. As FPI noted in its analysis of the fiscal year 2024 enacted budget financial plan, April’s low tax receipts were largely backward-looking, reflecting financial market conditions in 2022. Fiscal data from May through July have exceeded projections.

Because of the high uncertainty around the fiscal imbalance projected in this plan, New York lawmakers should avoid reactive policy responses and monitor fiscal and economic data as it arrives. Should a recession occur, the State should leverage the substantial fiscal reserves and avoid recession-exacerbating service cuts.