The State of New York’s Fiscal Outlook

October 28, 2024 |

Expectations for the FY 2025 Mid-Year Update

Highlights

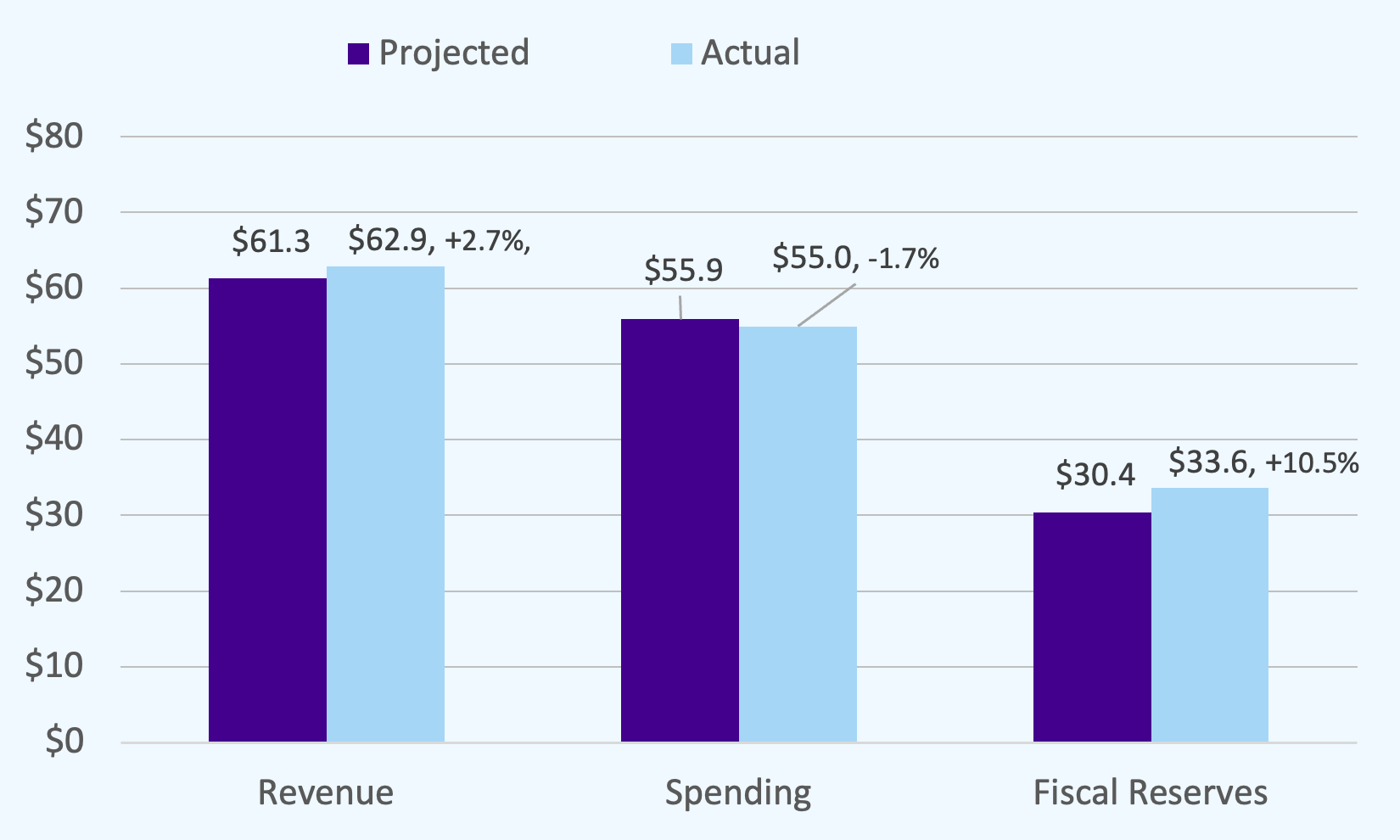

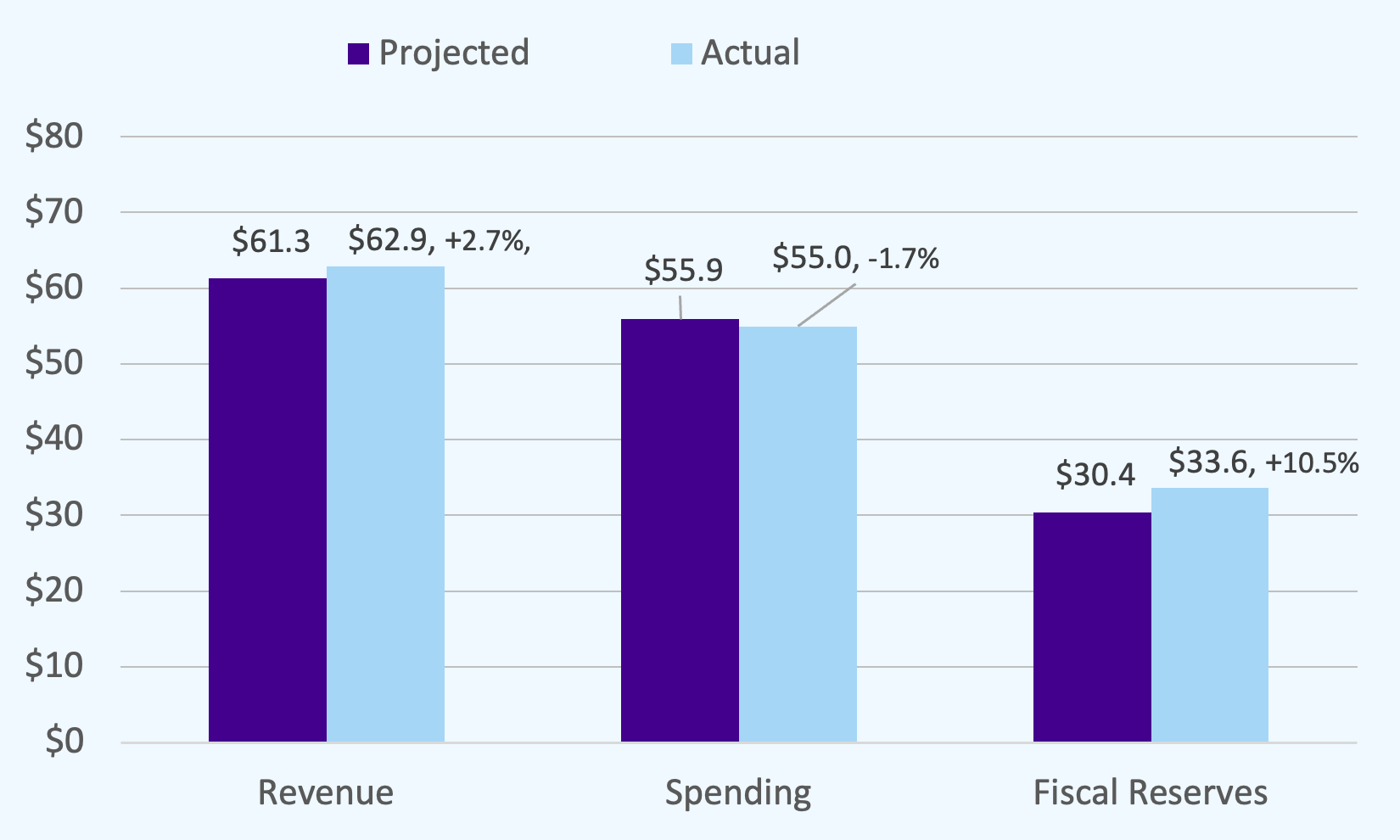

- With revenue higher than projections by 2.7 percent, and spending below projections by 1.7 percent, the State is on track to have a surplus in the current fiscal year.

- DOB currently forecasts a budget gap of $2.3 billion dollars for fiscal year 2026 (which runs April 2025 – March 2026). This gap forecast is unusually small by historical standards, just about 2 percent of planned spending.

- The fiscal year 2026 budget gap is primarily driven by a projected decline in “miscellaneous revenues” – but miscellaneous revenues are up 10 percent to date over these projections.

- FPI noted in its analysis of the enacted budget earlier this year that DOB had forecast an unexplained decline in miscellaneous revenue, projecting consecutive $3.3 billion drops in fiscal years 2025 and 2026 (11 and 13 percent drops, respectively).

- These dynamics have also increased the State’s general fund fiscal reserves, which were already at record levels, to $33.6 billion.

- Planned tax cuts in the Corporate Franchise Tax and Personal Income Tax will increase DOB’s projected budget gaps starting in fiscal year 2027.

Overview

At the end of October, the New York State Division of the Budget (DOB) is expected to release its mid-year update to the State’s financial plan. The update will detail how the revenue and spending expected in fiscal year 2025 have changed since the budget was enacted in May.[1] In examining the State Comptroller’s monthly fiscal reports, FPI notes that revenue has exceeded projections and spending has fallen below projections, leaving the State in a strong overall fiscal position.

Perhaps the most important fiscal issue facing the State is the planned cuts to the top tax rates. A Corporate Franchise Tax rate cut is scheduled for 2026, and top Personal Income Tax rate cuts are scheduled for 2027. As DOB fiscal forecasts cover the three years following the current fiscal year, these planned tax cuts will now affect the State’s forecasting — the legislature and governor would be wise to make increases enacted in 2021 permanent.

Given the strength of the State’s fiscal footing to date, it is likely that the update will narrow future years’ projected budget gaps. The projected gaps were already narrow by historical standards. Further, strong revenue and reserve positions confirm that the State is well-positioned to invest in robust public services in the years ahead.

Figure 1. Projected and actual state operating funds revenue, spending, and reserves in the first half of fiscal year 2025

Dollars in billions

Revenue has exceeded expectations

Revenue has consistently exceeded projections through the first half of fiscal year 2025. State operating funds (which excludes federal and capital spending) through the six-month period totaled $67.6 billion, exceeding projections made in the enacted budget financial plan by $1.8 billion, or 2.7 percent. Higher-than-expected revenue was driven by “miscellaneous revenue” – a category that includes Health Care Reform Act surcharges on healthcare providers, gaming revenue, and other fees and State income. First-half miscellaneous revenue exceeded projections by $1.2 billion, or 9.3 percent.[2] FPI noted in the spring that DOB forecasts of miscellaneous revenue were unusually low, and inconsistent with expectations for all other revenue categories. Thus, the 9.3 percent rise in miscellaneous revenue over projections primarily reflects inaccurate forecasts rather than unusually high revenue in these categories.

Figure 2. Actual state operating funds revenue relative to projections by month, fiscal year 2025 to date

Positive values indicate actual revenue exceeds projections

Spending is below projections

The State spent less than projected in the first half of the fiscal year. In the first six months of fiscal year 2025, State operating funds spending was $60.5 billion, $1.0 billion, or 1.7 percent, below its projected level.

The bulk of this apparent underspending is concentrated in the State’s Medicaid budget. In its July 2024 first quarter update to the financial plan, DOB reported that lower-than-anticipated Medicaid spending was the result of a federal reimbursement that offset State costs. (The first quarter update did not revise the enacted budget’s fiscal projections).[3]

The State had expected fiscal year 2025 state operating spending to be flat from fiscal year 2024, after adjusting for inflation. If the first half of the fiscal year’s underspending persists through the year, actual inflation-adjusted spending will fall 1.6 percent in fiscal year 2025, from $131.9 billion to $129.8 billion.

This spending level would continue the budget’s convergence with its pre-Covid trend. After rising amid emergency relief spending in fiscal year 2022, inflation-adjusted state spending has since steadily fallen, closing in on average real spending growth over the prior decade. If year-to-date spending trends persist, state spending at the end of fiscal year 2025 would be just 2.6 percent above its pre-Covid trend.

Figure 3. Actual state operating funds spending and pre-Covid trend, fiscal years 2010 to 2025

Billions of fiscal year 2025 dollars

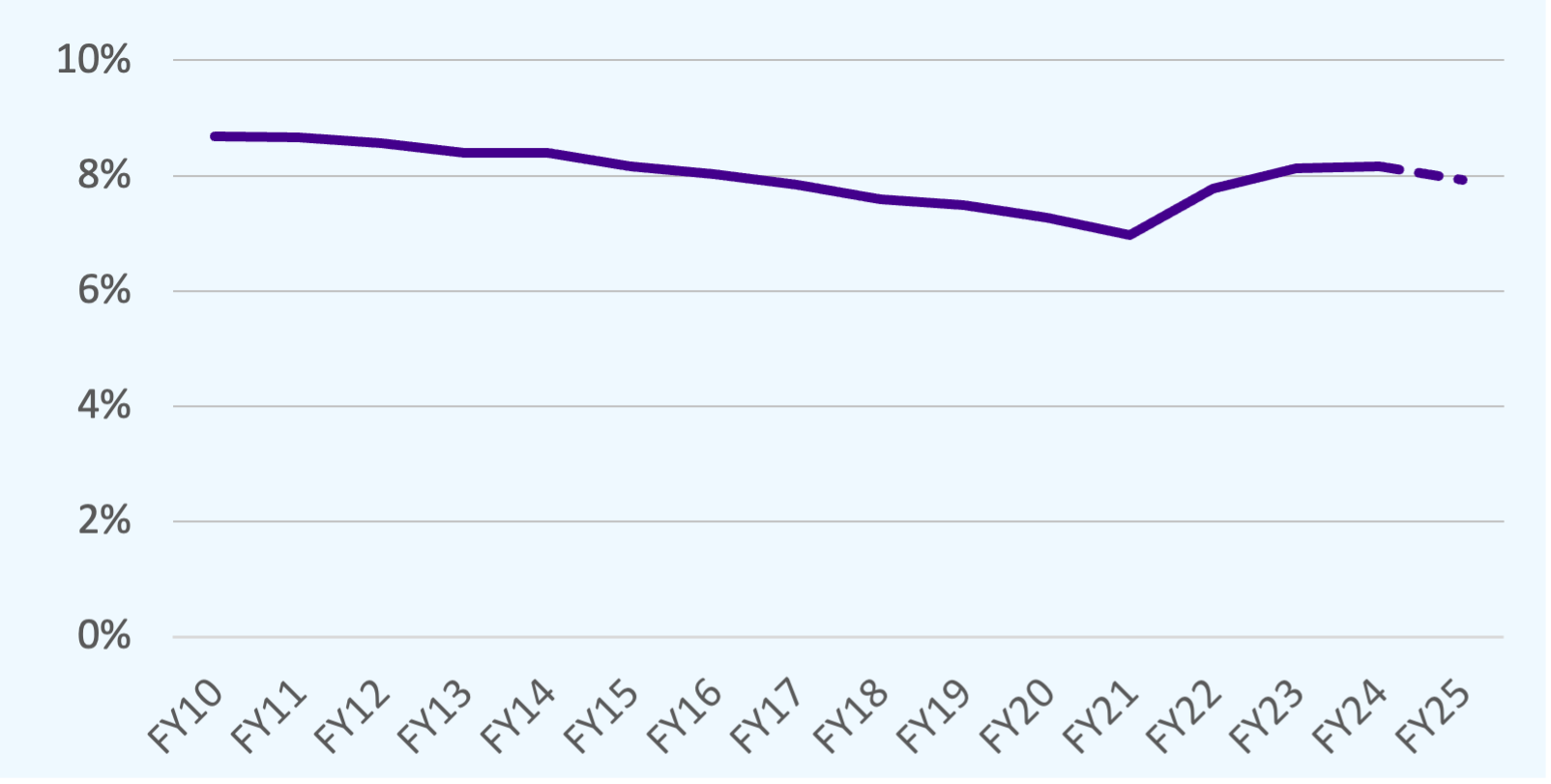

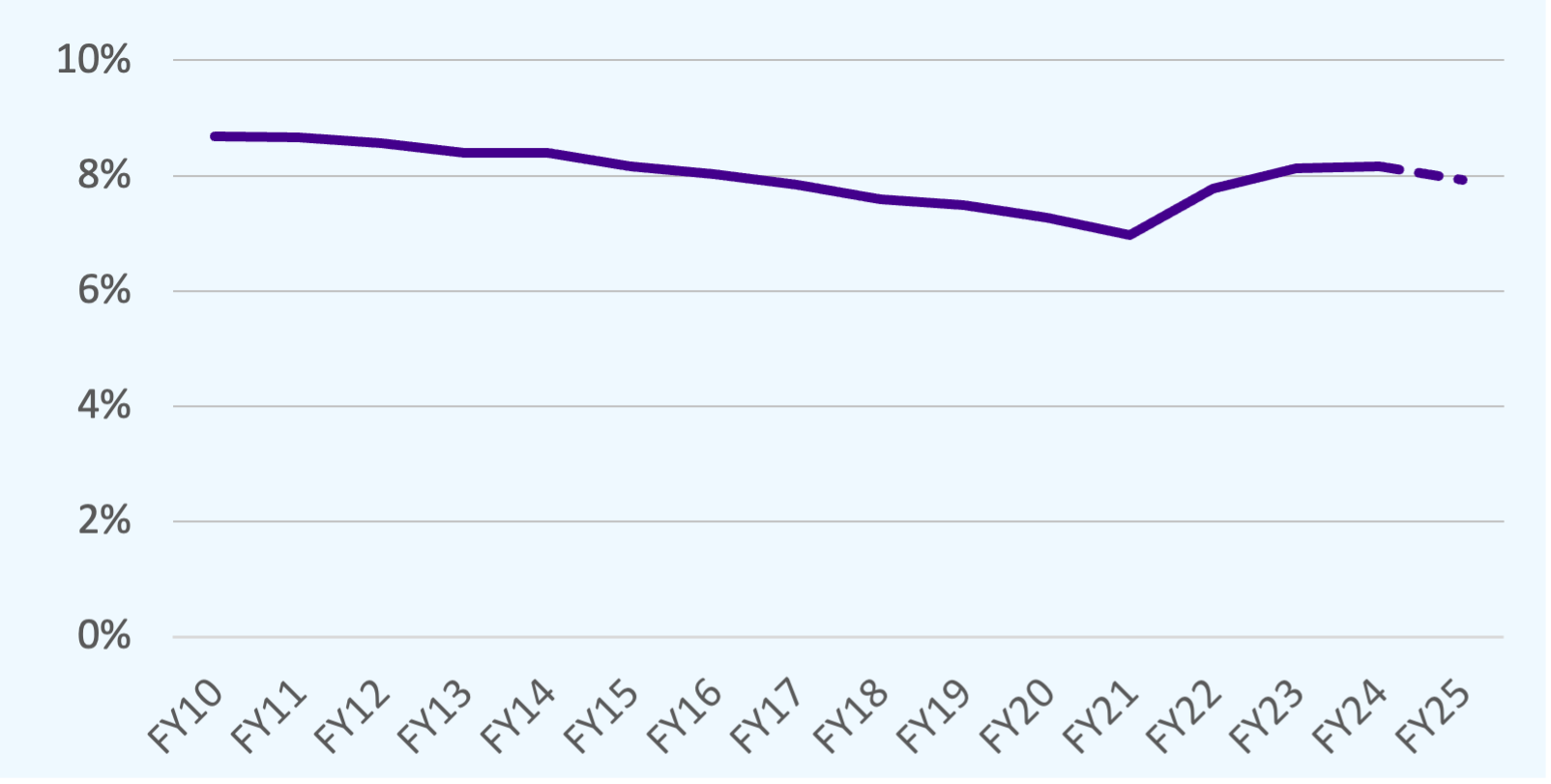

New York’s annual spending level can also be measured as a share of the state’s total personal income. Because State spending largely funds public workers’ wages, spending that falls relative to state personal income reflects that public services’ footprint in the state’s economy is shrinking, with public wages and/or employment not keeping pace with private sector growth.

Through the 2010s, state spending fell consistently as a share of state personal income, from 9.0 percent in fiscal year 2009 to 7.0 percent in fiscal year 2021. This reflected a period of deliberately restrained spending growth and low relative investment in public services. While this trend partly reversed amid the Covid pandemic, it is set to fall from 8.2 percent to 7.9 percent in fiscal year 2025. This level would be on par with fiscal year 2017.

Figure 4. State operating funds spending as a share of personal income, fiscal years 2010 to 2025

Reserve balances remain at record highs

Higher-than-expected revenue and lower-than-expected spending in the first half of fiscal year 2025 pushed the State’s fiscal reserves to new highs. Since fiscal year 2022, the State has consistently pushed greater-than-expected fiscal surpluses into its reserves. While some of these reserves (23 percent) are held in statutory reserves, the use of which is regulated by State law, most reserves are in unrestricted funds designated as fiscal reserves (41 percent), or held as undesignated balances in the State’s general fund (36 percent).[4] These unrestricted funds – both those designated as fiscal reserves and not – are not committed to any spending program or restricted by law, and therefore available to support the State’s general fiscal needs.

While the State’s enacted budget financial plan expected reserve levels to be flat between fiscal years 2024 and 2025, higher revenue and lower spending channeled an additional $3.2 billion into the State’s unrestricted general fund. These additional funds push the State’s available fiscal resources to $33.6 billion – higher than fiscal year’s $30.4 billion, itself a record balance, and far above pre-Covid levels, which never exceeded $10 billion. These reserves will allow the State to maintain public services through revenue volatility in future years.

Figure 5. State fiscal reserves, fiscal years 2015 to 2025

Dollars in billions

Projected budget gaps likely to narrow

The fiscal year 2025 enacted budget financial plan included projections of fiscal shortfalls in the financial plan’s outyears – fiscal years 2026 through 2028. Projected budget gaps are a routine feature of the State’s financial management and the product of conservative budgeting – projecting lower-than-likely future revenue minimizes the risk of a fiscal shock in the case of an economic downturn. The gaps typically disappear without policy intervention as actual revenue exceeds projections.

The fiscal year 2025 enacted budget financial plan’s projected budget gaps were small relative to routine pre-Covid gaps. For each outyear, projected gaps measured as a share of general fund spending were smaller than their historical average projected in for typical years (excluding years of fiscal crises, when projected budget gaps generally swell). For fiscal year 2028, the last financial plan outyear, past financial plans have projected 6.4 percent budget gaps, on average, while the enacted plan projected a 5.8 percent gap.

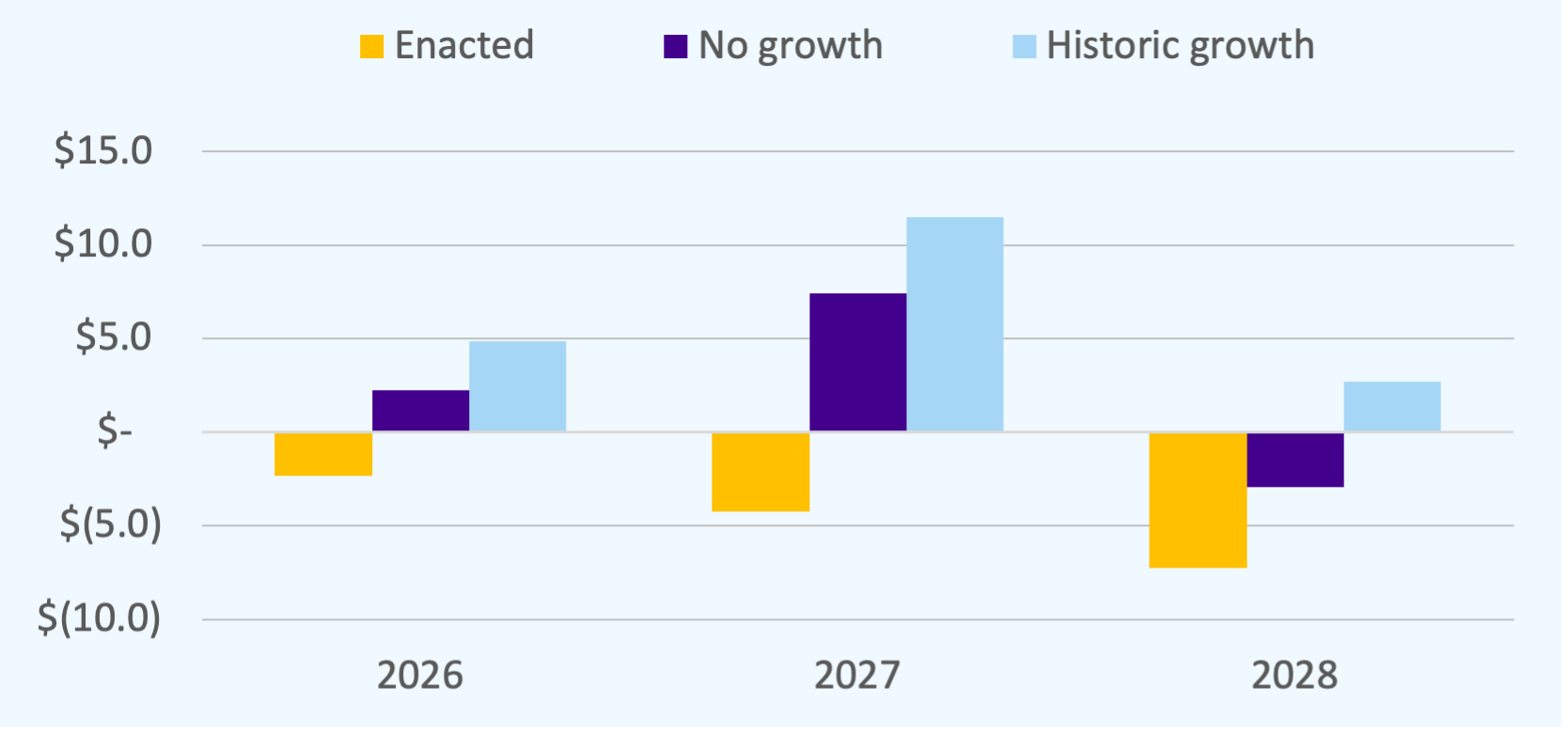

In 2021, the State enacted temporary increases to taxes on high earners and corporations. If allowed to expire, the State will begin to lose corporate tax revenue in fiscal year 2027 and high earner tax revenue in fiscal year 2028, with full effects of lost revenue taking effect the following fiscal years. Revenue loss in fiscal year 2027 would total $290 million, rising to $2.4 billion the following year. Making these temporary tax increases permanent would narrow projected outyear budget gaps to 3.3 percent in fiscal year 2027 and 3.9 percent the following year.

Figure 6. Budget gaps projected in the fiscal year 2025 enacted budget financial plan and historical average for each financial plan outyear

Projected gaps as a share of general fund spending

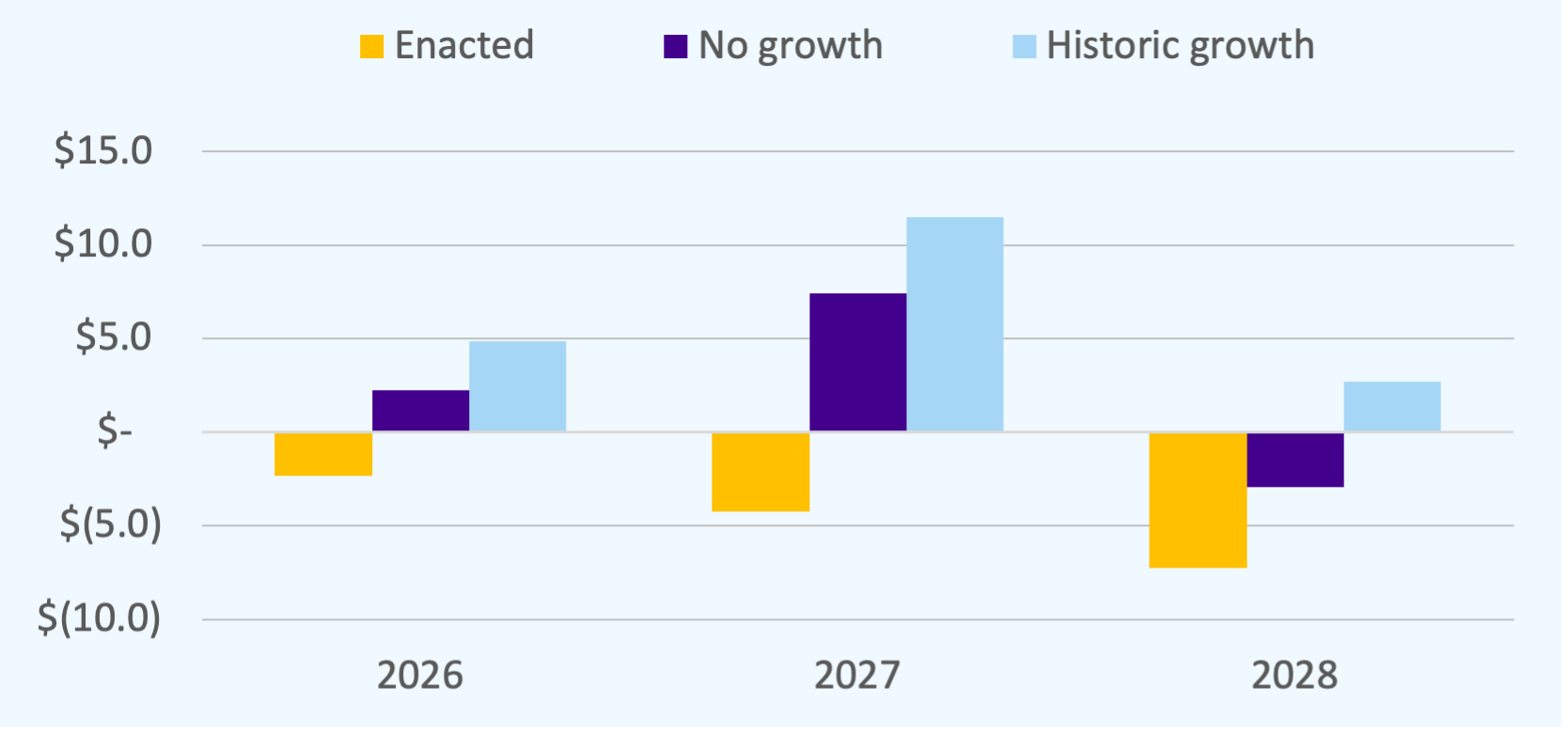

The modest budget gaps projected by the enacted plan rest on an assumption of falling real revenue over the outyears. This is atypical outside of severe recessions. If revenue simply keeps pace with inflation, that is, is flat in real terms, fiscal years 2026 and 2027 will end in surpluses with a small third year shortfall. If real revenue growth matches its historical average in the decade prior to Covid, each year would end with a fiscal surplus.

While the first quarter update did not revise its estimates of projected budget gaps, the State’s strong fiscal footing in the first half of fiscal year 2025 is likely to further narrow already small and manageable projected shortfalls, confirming the State’s fiscal strength and capacity to deliver robust public services.

Figure 7. Projected budget gaps under alternative revenue growth scenarios

Billions of dollars; positive figures indicate surpluses; negative, gaps

Table 1. Projected surpluses/(gaps) under different revenue growth assumptions

[1] This will be the first update to the enacted budget projections, as the first quarter update released in July did not include new projections.

[2] Actual fiscal data in this brief is from Office of the State Comptroller, September 2024 cash basis report (October 2024), https://www.osc.ny.gov/reports/finance. Projections are from New York State Division of the Budget, Fiscal year 2025 enacted budget financial plan (June 2024), https://www.budget.ny.gov/pubs/archive/fy25/en/fy25fp-en.pdf.

[3] New York State Division of the Budget, Fiscal year 2025 first quarterly update to the financial plan (July 2024), https://www.budget.ny.gov/pubs/archive/fy25/en/fy25en-fp-q1.pdf.

[14] General fund balances counted as other fiscal reserves exclude PTET and Labor Management reserves, which are earmarked for specific future expenditures.

The State of New York’s Fiscal Outlook

October 28, 2024 |

Expectations for the FY 2025 Mid-Year Update

Highlights

- With revenue higher than projections by 2.7 percent, and spending below projections by 1.7 percent, the State is on track to have a surplus in the current fiscal year.

- DOB currently forecasts a budget gap of $2.3 billion dollars for fiscal year 2026 (which runs April 2025 – March 2026). This gap forecast is unusually small by historical standards, just about 2 percent of planned spending.

- The fiscal year 2026 budget gap is primarily driven by a projected decline in “miscellaneous revenues” – but miscellaneous revenues are up 10 percent to date over these projections.

- FPI noted in its analysis of the enacted budget earlier this year that DOB had forecast an unexplained decline in miscellaneous revenue, projecting consecutive $3.3 billion drops in fiscal years 2025 and 2026 (11 and 13 percent drops, respectively).

- These dynamics have also increased the State’s general fund fiscal reserves, which were already at record levels, to $33.6 billion.

- Planned tax cuts in the Corporate Franchise Tax and Personal Income Tax will increase DOB’s projected budget gaps starting in fiscal year 2027.

Overview

At the end of October, the New York State Division of the Budget (DOB) is expected to release its mid-year update to the State’s financial plan. The update will detail how the revenue and spending expected in fiscal year 2025 have changed since the budget was enacted in May.[1] In examining the State Comptroller’s monthly fiscal reports, FPI notes that revenue has exceeded projections and spending has fallen below projections, leaving the State in a strong overall fiscal position.

Perhaps the most important fiscal issue facing the State is the planned cuts to the top tax rates. A Corporate Franchise Tax rate cut is scheduled for 2026, and top Personal Income Tax rate cuts are scheduled for 2027. As DOB fiscal forecasts cover the three years following the current fiscal year, these planned tax cuts will now affect the State’s forecasting — the legislature and governor would be wise to make increases enacted in 2021 permanent.

Given the strength of the State’s fiscal footing to date, it is likely that the update will narrow future years’ projected budget gaps. The projected gaps were already narrow by historical standards. Further, strong revenue and reserve positions confirm that the State is well-positioned to invest in robust public services in the years ahead.

Figure 1. Projected and actual state operating funds revenue, spending, and reserves in the first half of fiscal year 2025

Dollars in billions

Revenue has exceeded expectations

Revenue has consistently exceeded projections through the first half of fiscal year 2025. State operating funds (which excludes federal and capital spending) through the six-month period totaled $67.6 billion, exceeding projections made in the enacted budget financial plan by $1.8 billion, or 2.7 percent. Higher-than-expected revenue was driven by “miscellaneous revenue” – a category that includes Health Care Reform Act surcharges on healthcare providers, gaming revenue, and other fees and State income. First-half miscellaneous revenue exceeded projections by $1.2 billion, or 9.3 percent.[2] FPI noted in the spring that DOB forecasts of miscellaneous revenue were unusually low, and inconsistent with expectations for all other revenue categories. Thus, the 9.3 percent rise in miscellaneous revenue over projections primarily reflects inaccurate forecasts rather than unusually high revenue in these categories.

Figure 2. Actual state operating funds revenue relative to projections by month, fiscal year 2025 to date

Positive values indicate actual revenue exceeds projections

Spending is below projections

The State spent less than projected in the first half of the fiscal year. In the first six months of fiscal year 2025, State operating funds spending was $60.5 billion, $1.0 billion, or 1.7 percent, below its projected level.

The bulk of this apparent underspending is concentrated in the State’s Medicaid budget. In its July 2024 first quarter update to the financial plan, DOB reported that lower-than-anticipated Medicaid spending was the result of a federal reimbursement that offset State costs. (The first quarter update did not revise the enacted budget’s fiscal projections).[3]

The State had expected fiscal year 2025 state operating spending to be flat from fiscal year 2024, after adjusting for inflation. If the first half of the fiscal year’s underspending persists through the year, actual inflation-adjusted spending will fall 1.6 percent in fiscal year 2025, from $131.9 billion to $129.8 billion.

This spending level would continue the budget’s convergence with its pre-Covid trend. After rising amid emergency relief spending in fiscal year 2022, inflation-adjusted state spending has since steadily fallen, closing in on average real spending growth over the prior decade. If year-to-date spending trends persist, state spending at the end of fiscal year 2025 would be just 2.6 percent above its pre-Covid trend.

Figure 3. Actual state operating funds spending and pre-Covid trend, fiscal years 2010 to 2025

Billions of fiscal year 2025 dollars

New York’s annual spending level can also be measured as a share of the state’s total personal income. Because State spending largely funds public workers’ wages, spending that falls relative to state personal income reflects that public services’ footprint in the state’s economy is shrinking, with public wages and/or employment not keeping pace with private sector growth.

Through the 2010s, state spending fell consistently as a share of state personal income, from 9.0 percent in fiscal year 2009 to 7.0 percent in fiscal year 2021. This reflected a period of deliberately restrained spending growth and low relative investment in public services. While this trend partly reversed amid the Covid pandemic, it is set to fall from 8.2 percent to 7.9 percent in fiscal year 2025. This level would be on par with fiscal year 2017.

Figure 4. State operating funds spending as a share of personal income, fiscal years 2010 to 2025

Reserve balances remain at record highs

Higher-than-expected revenue and lower-than-expected spending in the first half of fiscal year 2025 pushed the State’s fiscal reserves to new highs. Since fiscal year 2022, the State has consistently pushed greater-than-expected fiscal surpluses into its reserves. While some of these reserves (23 percent) are held in statutory reserves, the use of which is regulated by State law, most reserves are in unrestricted funds designated as fiscal reserves (41 percent), or held as undesignated balances in the State’s general fund (36 percent).[4] These unrestricted funds – both those designated as fiscal reserves and not – are not committed to any spending program or restricted by law, and therefore available to support the State’s general fiscal needs.

While the State’s enacted budget financial plan expected reserve levels to be flat between fiscal years 2024 and 2025, higher revenue and lower spending channeled an additional $3.2 billion into the State’s unrestricted general fund. These additional funds push the State’s available fiscal resources to $33.6 billion – higher than fiscal year’s $30.4 billion, itself a record balance, and far above pre-Covid levels, which never exceeded $10 billion. These reserves will allow the State to maintain public services through revenue volatility in future years.

Figure 5. State fiscal reserves, fiscal years 2015 to 2025

Dollars in billions

Projected budget gaps likely to narrow

The fiscal year 2025 enacted budget financial plan included projections of fiscal shortfalls in the financial plan’s outyears – fiscal years 2026 through 2028. Projected budget gaps are a routine feature of the State’s financial management and the product of conservative budgeting – projecting lower-than-likely future revenue minimizes the risk of a fiscal shock in the case of an economic downturn. The gaps typically disappear without policy intervention as actual revenue exceeds projections.

The fiscal year 2025 enacted budget financial plan’s projected budget gaps were small relative to routine pre-Covid gaps. For each outyear, projected gaps measured as a share of general fund spending were smaller than their historical average projected in for typical years (excluding years of fiscal crises, when projected budget gaps generally swell). For fiscal year 2028, the last financial plan outyear, past financial plans have projected 6.4 percent budget gaps, on average, while the enacted plan projected a 5.8 percent gap.

In 2021, the State enacted temporary increases to taxes on high earners and corporations. If allowed to expire, the State will begin to lose corporate tax revenue in fiscal year 2027 and high earner tax revenue in fiscal year 2028, with full effects of lost revenue taking effect the following fiscal years. Revenue loss in fiscal year 2027 would total $290 million, rising to $2.4 billion the following year. Making these temporary tax increases permanent would narrow projected outyear budget gaps to 3.3 percent in fiscal year 2027 and 3.9 percent the following year.

Figure 6. Budget gaps projected in the fiscal year 2025 enacted budget financial plan and historical average for each financial plan outyear

Projected gaps as a share of general fund spending

The modest budget gaps projected by the enacted plan rest on an assumption of falling real revenue over the outyears. This is atypical outside of severe recessions. If revenue simply keeps pace with inflation, that is, is flat in real terms, fiscal years 2026 and 2027 will end in surpluses with a small third year shortfall. If real revenue growth matches its historical average in the decade prior to Covid, each year would end with a fiscal surplus.

While the first quarter update did not revise its estimates of projected budget gaps, the State’s strong fiscal footing in the first half of fiscal year 2025 is likely to further narrow already small and manageable projected shortfalls, confirming the State’s fiscal strength and capacity to deliver robust public services.

Figure 7. Projected budget gaps under alternative revenue growth scenarios

Billions of dollars; positive figures indicate surpluses; negative, gaps

Table 1. Projected surpluses/(gaps) under different revenue growth assumptions

[1] This will be the first update to the enacted budget projections, as the first quarter update released in July did not include new projections.

[2] Actual fiscal data in this brief is from Office of the State Comptroller, September 2024 cash basis report (October 2024), https://www.osc.ny.gov/reports/finance. Projections are from New York State Division of the Budget, Fiscal year 2025 enacted budget financial plan (June 2024), https://www.budget.ny.gov/pubs/archive/fy25/en/fy25fp-en.pdf.

[3] New York State Division of the Budget, Fiscal year 2025 first quarterly update to the financial plan (July 2024), https://www.budget.ny.gov/pubs/archive/fy25/en/fy25en-fp-q1.pdf.

[14] General fund balances counted as other fiscal reserves exclude PTET and Labor Management reserves, which are earmarked for specific future expenditures.