November State Receipts Exceed Projections for Sixth Month Straight

December 19, 2023 |

November receipts 10.7% above latest projections and 9% above November 2022 receipts

ALBANY, NY | The State Comptroller released its November Cash Report Friday, showing that November receipts came in over projections and over November 2022 receipts:

-

November 2023 receipts:

$7.59 billion

- November 2023 projections:

Enacted (June): $7.06 billion

Mid-Year Update (October): $6.86 billion

- November 2022 receipts: $6.97 billion

Following the cash report release, Fiscal Policy Institute Executive Director Nathan Gusdorf released the following statements:

What the cash report says:

“The New York State Comptroller’s November cash basis report shows that tax receipts have come in stable for the seventh month in a row. The November receipts confirm that New York’s tax base and economy remain strong, and that shortfalls in April reflected weaker-than-expected capital gains in tax year 2022 rather than a deterioration in current economic conditions.

“Total State funds receipts for the month of November were $732 million above projections made in the mid-year update to the financial plan and $628 million above November 2022 levels. Personal income tax receipts were $448 million above projections made in the updated financial plan. Consumption taxes came in about $2 million below projections. Total year-to-date receipts remain below the same months in 2022 due entirely to decreased April 2023 receipts. The month of April 2023 remains an outlier due to weak capital gains and volatility from the state’s Pass-Through Entity Tax (PTET).

What the data indicate:

“Seven months of strong tax receipts confirm that the state economy remains robust, and align with improving economic forecasts and the State’s recent downward revision to the projected budget gap for the next fiscal year. While predictions of a recession have been revised to show less risk on the horizon, there is always the possibility of unforeseen events that change the forecasted path of the economy. However, with cash reserves of $19.5 billion, the State is in a strong position to manage any future revenue shortfalls through a combination of drawing on reserves and revenue increases. Conversely, reducing or freezing State spending would undermine the State’s ongoing economic recovery.”

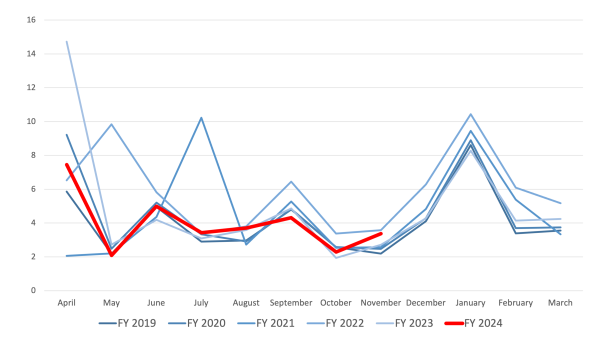

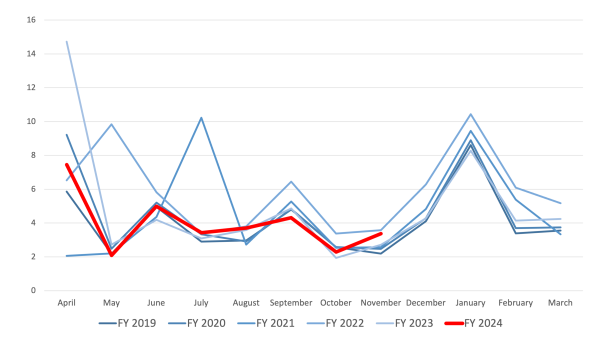

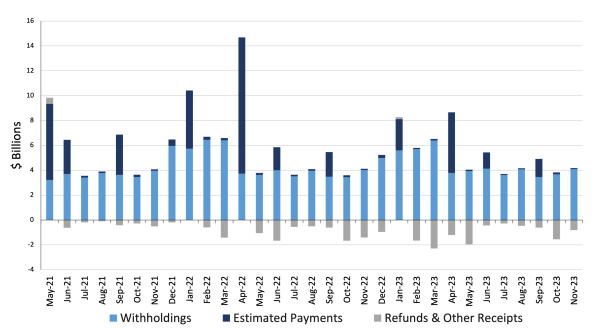

Personal income tax receipts by month and fiscal year (billions $)

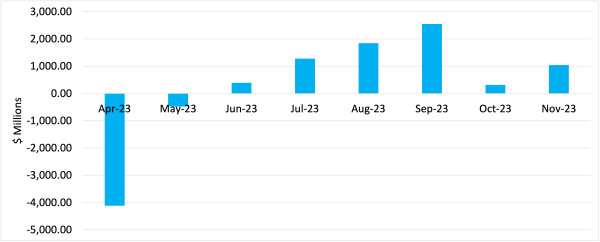

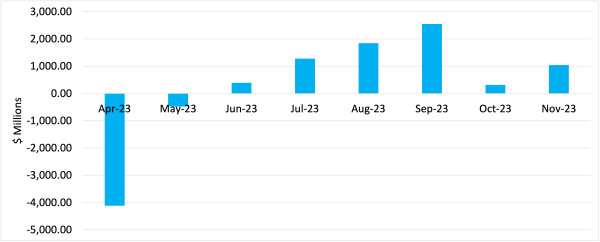

Monthly revenue has exceeded projections for past six months

Difference between actual and projected revenue

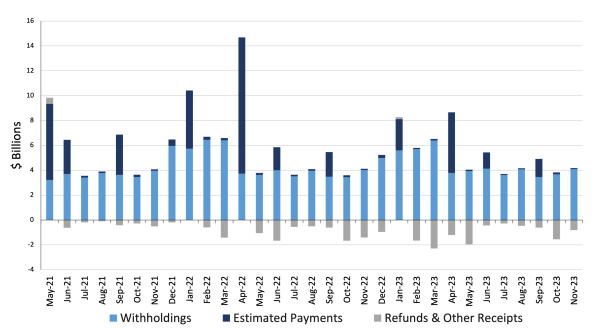

Personal income tax receipts broken down by type

The Fiscal Policy Institute is a nonpartisan, nonprofit research and education organization committed to improving public policies and private practices to better the economic and social conditions of all.

###

November State Receipts Exceed Projections for Sixth Month Straight

December 19, 2023 |

November receipts 10.7% above latest projections and 9% above November 2022 receipts

ALBANY, NY | The State Comptroller released its November Cash Report Friday, showing that November receipts came in over projections and over November 2022 receipts:

-

November 2023 receipts:

$7.59 billion

- November 2023 projections:

Enacted (June): $7.06 billion

Mid-Year Update (October): $6.86 billion

- November 2022 receipts: $6.97 billion

Following the cash report release, Fiscal Policy Institute Executive Director Nathan Gusdorf released the following statements:

What the cash report says:

“The New York State Comptroller’s November cash basis report shows that tax receipts have come in stable for the seventh month in a row. The November receipts confirm that New York’s tax base and economy remain strong, and that shortfalls in April reflected weaker-than-expected capital gains in tax year 2022 rather than a deterioration in current economic conditions.

“Total State funds receipts for the month of November were $732 million above projections made in the mid-year update to the financial plan and $628 million above November 2022 levels. Personal income tax receipts were $448 million above projections made in the updated financial plan. Consumption taxes came in about $2 million below projections. Total year-to-date receipts remain below the same months in 2022 due entirely to decreased April 2023 receipts. The month of April 2023 remains an outlier due to weak capital gains and volatility from the state’s Pass-Through Entity Tax (PTET).

What the data indicate:

“Seven months of strong tax receipts confirm that the state economy remains robust, and align with improving economic forecasts and the State’s recent downward revision to the projected budget gap for the next fiscal year. While predictions of a recession have been revised to show less risk on the horizon, there is always the possibility of unforeseen events that change the forecasted path of the economy. However, with cash reserves of $19.5 billion, the State is in a strong position to manage any future revenue shortfalls through a combination of drawing on reserves and revenue increases. Conversely, reducing or freezing State spending would undermine the State’s ongoing economic recovery.”

Personal income tax receipts by month and fiscal year (billions $)

Monthly revenue has exceeded projections for past six months

Difference between actual and projected revenue

Personal income tax receipts broken down by type

The Fiscal Policy Institute is a nonpartisan, nonprofit research and education organization committed to improving public policies and private practices to better the economic and social conditions of all.

###