New York’s Millionaires Will Get a $12 Billion Federal Tax Cut Next Year

November 20, 2025 |

On July 4, 2025, President Donald Trump signed into law the federal reconciliation legislation known as the “One Big Beautiful Bill Act” (OBBBA), which enacted $4.5 trillion of tax cuts and reduced federal outlays for Medicaid and SNAP by $1.2 trillion. Democrats have decried the bill as tax cuts for billionaires while Republicans have defended it as middle-class tax relief. The Fiscal Policy Institute has previously analyzed the national distribution of the OBBBA’s benefits, finding that the act broadly benefits the well-off, with 70 percent of the benefits going to the top 20 percent of households (nationally, those earning over $120,000), and that the advantages are even more skewed toward the richest households, with the top 1 percent of earners receiving, on average, an annual tax cut of $100,000.

These multitrillion dollar cost estimates are issued by the Congressional Budget Office, and they reflect cumulative ten-year forecasts at the national level. But for state fiscal policy purposes, we need to know how much the richest New York taxpayers are saving on their taxes each year. After all, these tax cuts come at the cost of as many as one million New Yorkers losing their health insurance and hundreds of thousands of state residents facing a hunger crisis. Because the State will be forced to manage these crises, it ought to understand how much tax revenue could simply be recaptured from the OBBBA tax cuts.

FPI estimates that the OBBBA will save New York taxpayers who earn $1 million in annual income a collective $12 billion in federal taxes each year. This is equivalent to an annual average tax cut of $129,600 per millionaire taxpayer, 2.7 percent of their total income.

OBBBA Tax Cuts that Benefit New York’s Top 1 Percent

The tax cuts under the OBBBA consist primarily of extensions to earlier cuts enacted by the 2017 “Tax Cuts and Jobs Act” (TCJA), passed during the first Trump administration. The TCJA reduced the corporate tax rate, individual income tax rates, and provided a wide range of additional tax benefits to wealthy individuals and profitable corporations. This analysis looks at the three highest-value tax benefits that are now permanent:

1) Individual Income Tax Rate Reductions

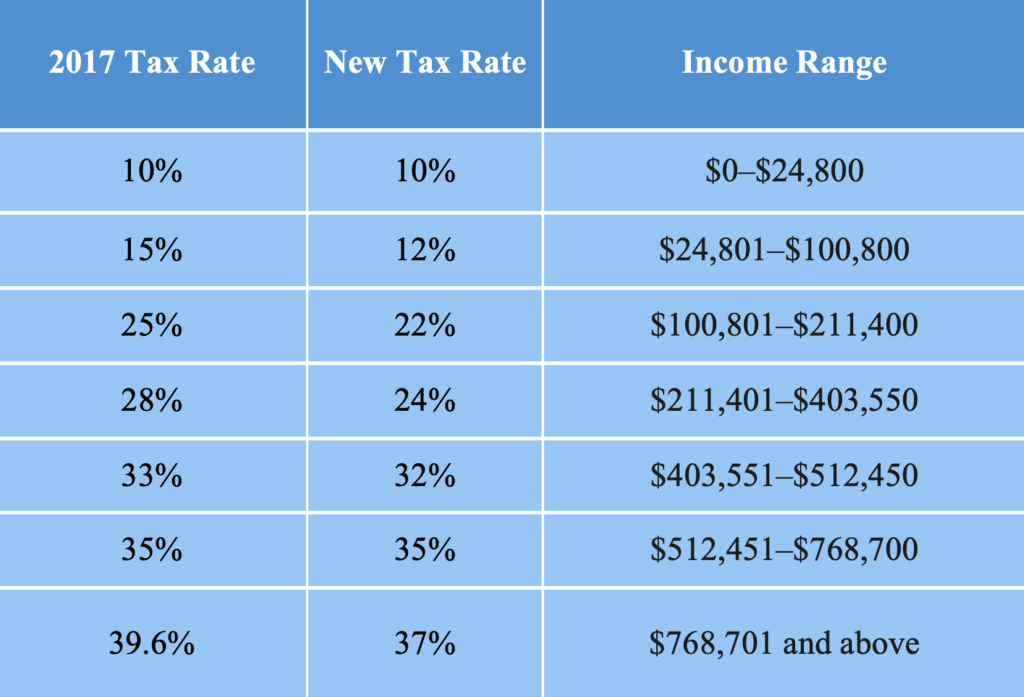

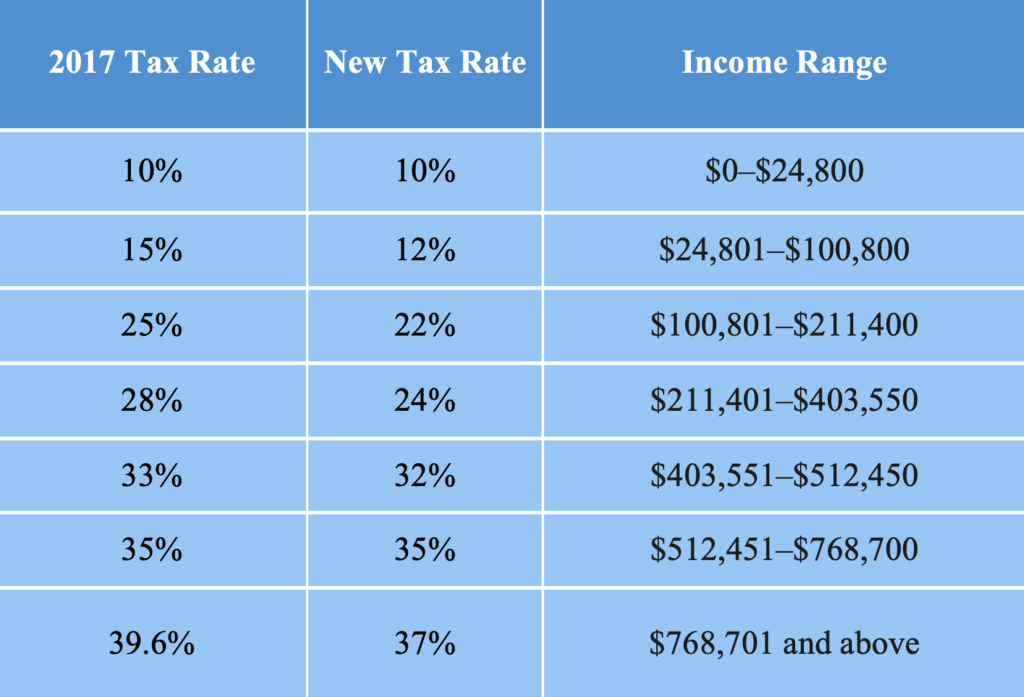

The TCJA temporarily reduced the rate on most income tax brackets, but these tax cuts were set to expire at the end of 2025. The OBBBA made the below rate reductions permanent—FPI estimates they will save New York taxpayers earning over $1 million per year $6.5 billion in 2027.

Table 1. U.S. federal income tax rates before 2017 and after the OBBBA (for married filers in 2026)

2) Pass-through Deduction

Among the TCJA’s most significant tax benefits for the well-off is a 20 percent federal income tax deduction for owners of eligible pass-through businesses under section 199A of the Internal Revenue Code. Most businesses today are organized as some form of pass-through entity—an S corporation, LLC, or partnership—to avoid corporate tax liability; now, under the permanent provisions of the OBBBA, some of the wealthiest pass-through business owners will get an extra 20 percent tax break.

Owners of pass-through businesses are taxed on their business income as individuals and pay no corporate tax. Before the TCJA, an individual earning a salary and an individual earning income from business ownership were generally subject to the same tax treatment. But the 199A deduction creates a disparity between individuals who earn salary income and those who earn income as business profits. Prior to 2017, an individual taxpayer who earned $500,000 as a high-salaried employee of a real estate developer and one who earned $500,000 as the owner of a real estate development company would have been subject to the same income tax liability. Now, under the OBBBA, the company’s owner will receive a 20 percent income tax deduction (assuming they are otherwise eligible) while the salaried employee will receive no equivalent deduction.

3) Corporate Tax Cut

Prior to the TCJA, the U.S. federal corporate income tax rate was 35 percent. The TCJA reduced that rate to 21 percent—its lowest level since before World War II.

Methods

1) Individual Rate Reductions

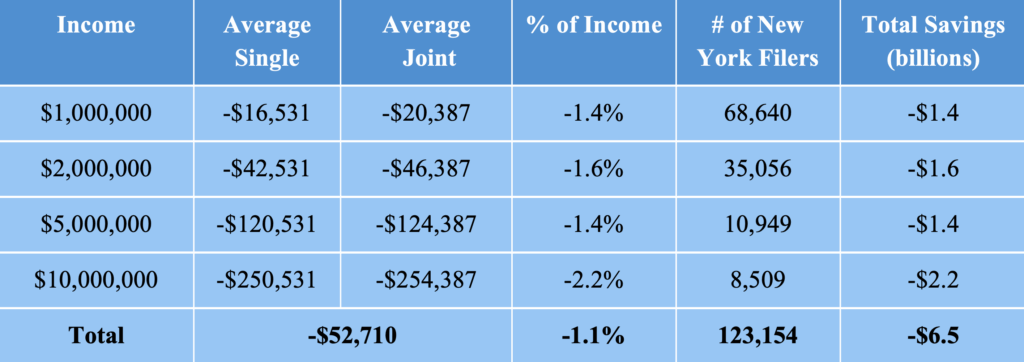

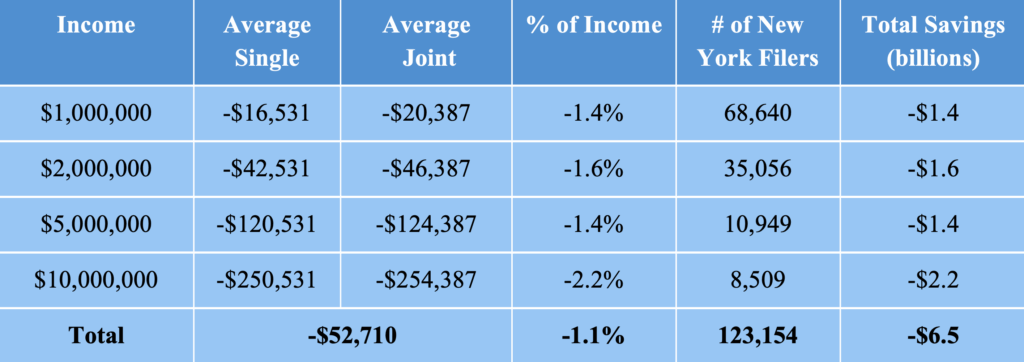

FPI analyzed OBBBA tax savings from individual income tax rate cuts by comparing top earners’ federal tax liability under baseline and newly enacted tax rates. Without the OBBBA, the top federal tax rate, which kicks in at $768,700 for joint filers and $640,600 for single filers, was set to be 39.6 percent in tax year 2026. The OBBBA lowered this rate to 37 percent.

With this rate reduction, joint filers earning $1 million will save $20,387, 1.4% of their income. For those earning $10 million, savings per filer will reach $254,387, 2.2% of their income. Collective savings for New York taxpayers earning more than $1 million will total $6.5 billion annually.

Table 2. Average OBBBA tax advantages for top earners

2) Pass-through Deduction (Section 199A)

According to IRS Statistics of Income data, New York taxpayers claimed $11.4 billion in qualified pass-through income. Of this, $5.4 billion was claimed by taxpayers with at least $1 million in income. This is consistent with estimates from the Joint Committee on Taxation that millionaire income earners account for nearly half of 199A benefits. We estimate that the effective rate of federal tax savings under 199A is 30 percent. Therefore, New York taxpayers earning at least $1 million accrue total savings of $1.6 billion under 199A. This is equivalent to $23,050 per millionaire taxpayer, 0.5 percent of their income.

3) Corporate Tax Rate Reduction

The Yale Budget Lab estimates that corporate tax rate cuts provide an average savings of $33,095 to the top 1 percent of income earners. Based on the national income distribution, we estimate that this yields an average savings of $53,869 for $1 million earners, 1.1 percent of their income. This indicates an aggregate tax benefit of $3.8 billion for New York’s resident $1 million income earners.

New York’s Millionaires Will Get a $12 Billion Federal Tax Cut Next Year

November 20, 2025 |

On July 4, 2025, President Donald Trump signed into law the federal reconciliation legislation known as the “One Big Beautiful Bill Act” (OBBBA), which enacted $4.5 trillion of tax cuts and reduced federal outlays for Medicaid and SNAP by $1.2 trillion. Democrats have decried the bill as tax cuts for billionaires while Republicans have defended it as middle-class tax relief. The Fiscal Policy Institute has previously analyzed the national distribution of the OBBBA’s benefits, finding that the act broadly benefits the well-off, with 70 percent of the benefits going to the top 20 percent of households (nationally, those earning over $120,000), and that the advantages are even more skewed toward the richest households, with the top 1 percent of earners receiving, on average, an annual tax cut of $100,000.

These multitrillion dollar cost estimates are issued by the Congressional Budget Office, and they reflect cumulative ten-year forecasts at the national level. But for state fiscal policy purposes, we need to know how much the richest New York taxpayers are saving on their taxes each year. After all, these tax cuts come at the cost of as many as one million New Yorkers losing their health insurance and hundreds of thousands of state residents facing a hunger crisis. Because the State will be forced to manage these crises, it ought to understand how much tax revenue could simply be recaptured from the OBBBA tax cuts.

FPI estimates that the OBBBA will save New York taxpayers who earn $1 million in annual income a collective $12 billion in federal taxes each year. This is equivalent to an annual average tax cut of $129,600 per millionaire taxpayer, 2.7 percent of their total income.

OBBBA Tax Cuts that Benefit New York’s Top 1 Percent

The tax cuts under the OBBBA consist primarily of extensions to earlier cuts enacted by the 2017 “Tax Cuts and Jobs Act” (TCJA), passed during the first Trump administration. The TCJA reduced the corporate tax rate, individual income tax rates, and provided a wide range of additional tax benefits to wealthy individuals and profitable corporations. This analysis looks at the three highest-value tax benefits that are now permanent:

1) Individual Income Tax Rate Reductions

The TCJA temporarily reduced the rate on most income tax brackets, but these tax cuts were set to expire at the end of 2025. The OBBBA made the below rate reductions permanent—FPI estimates they will save New York taxpayers earning over $1 million per year $6.5 billion in 2027.

Table 1. U.S. federal income tax rates before 2017 and after the OBBBA (for married filers in 2026)

2) Pass-through Deduction

Among the TCJA’s most significant tax benefits for the well-off is a 20 percent federal income tax deduction for owners of eligible pass-through businesses under section 199A of the Internal Revenue Code. Most businesses today are organized as some form of pass-through entity—an S corporation, LLC, or partnership—to avoid corporate tax liability; now, under the permanent provisions of the OBBBA, some of the wealthiest pass-through business owners will get an extra 20 percent tax break.

Owners of pass-through businesses are taxed on their business income as individuals and pay no corporate tax. Before the TCJA, an individual earning a salary and an individual earning income from business ownership were generally subject to the same tax treatment. But the 199A deduction creates a disparity between individuals who earn salary income and those who earn income as business profits. Prior to 2017, an individual taxpayer who earned $500,000 as a high-salaried employee of a real estate developer and one who earned $500,000 as the owner of a real estate development company would have been subject to the same income tax liability. Now, under the OBBBA, the company’s owner will receive a 20 percent income tax deduction (assuming they are otherwise eligible) while the salaried employee will receive no equivalent deduction.

3) Corporate Tax Cut

Prior to the TCJA, the U.S. federal corporate income tax rate was 35 percent. The TCJA reduced that rate to 21 percent—its lowest level since before World War II.

Methods

1) Individual Rate Reductions

FPI analyzed OBBBA tax savings from individual income tax rate cuts by comparing top earners’ federal tax liability under baseline and newly enacted tax rates. Without the OBBBA, the top federal tax rate, which kicks in at $768,700 for joint filers and $640,600 for single filers, was set to be 39.6 percent in tax year 2026. The OBBBA lowered this rate to 37 percent.

With this rate reduction, joint filers earning $1 million will save $20,387, 1.4% of their income. For those earning $10 million, savings per filer will reach $254,387, 2.2% of their income. Collective savings for New York taxpayers earning more than $1 million will total $6.5 billion annually.

Table 2. Average OBBBA tax advantages for top earners

2) Pass-through Deduction (Section 199A)

According to IRS Statistics of Income data, New York taxpayers claimed $11.4 billion in qualified pass-through income. Of this, $5.4 billion was claimed by taxpayers with at least $1 million in income. This is consistent with estimates from the Joint Committee on Taxation that millionaire income earners account for nearly half of 199A benefits. We estimate that the effective rate of federal tax savings under 199A is 30 percent. Therefore, New York taxpayers earning at least $1 million accrue total savings of $1.6 billion under 199A. This is equivalent to $23,050 per millionaire taxpayer, 0.5 percent of their income.

3) Corporate Tax Rate Reduction

The Yale Budget Lab estimates that corporate tax rate cuts provide an average savings of $33,095 to the top 1 percent of income earners. Based on the national income distribution, we estimate that this yields an average savings of $53,869 for $1 million earners, 1.1 percent of their income. This indicates an aggregate tax benefit of $3.8 billion for New York’s resident $1 million income earners.