The Federal Housing Policy Landscape

December 9, 2024 |

How federal policy influences state-level affordable housing development

State housing policy relies heavily on two federal programs that support housing affordability: the Low-Income Housing Tax Credit and Housing Choice Vouchers (also known as “Section 8” vouchers). These two programs underpin most affordable housing construction in the US and play an important role in the provision of affordable housing in New York State.

The Low-Income Housing Tax Credit

The Low-Income Housing Tax Credit (LIHTC) was originally developed under the Reagan administration to incentivize private development of affordable housing. There are two types of LIHTC tax credits available to developers: the 4 percent “as-of-right” credit and the 9 percent “competitive” credit.

These names unfortunately tell us little about the nature of the credits. The 4 percent as-of-right credits are available to all qualifying applicants without restriction from the federal or state government (i.e., they are “as-of-right”). For affordable housing developers that qualify, these “4 percent tax credits” typically translate into a tax credit worth 30 percent of the overall development costs of buildings containing affordable housing.[i] Developers qualify by obtaining additional funding through a Housing Finance Agency or through a tax-exempt bond.

The 9 percent credits typically translate into a tax credit worth 70 percent of the total project development costs. These credits are restricted in number by federal legislation stating that each state has a right to $2.75 per capita in total tax credits of this form (with a floor of $3.185 million). For New York, this translates into about $55 million worth of 9 percent credits that the State can allocate each year through a competitive application process.

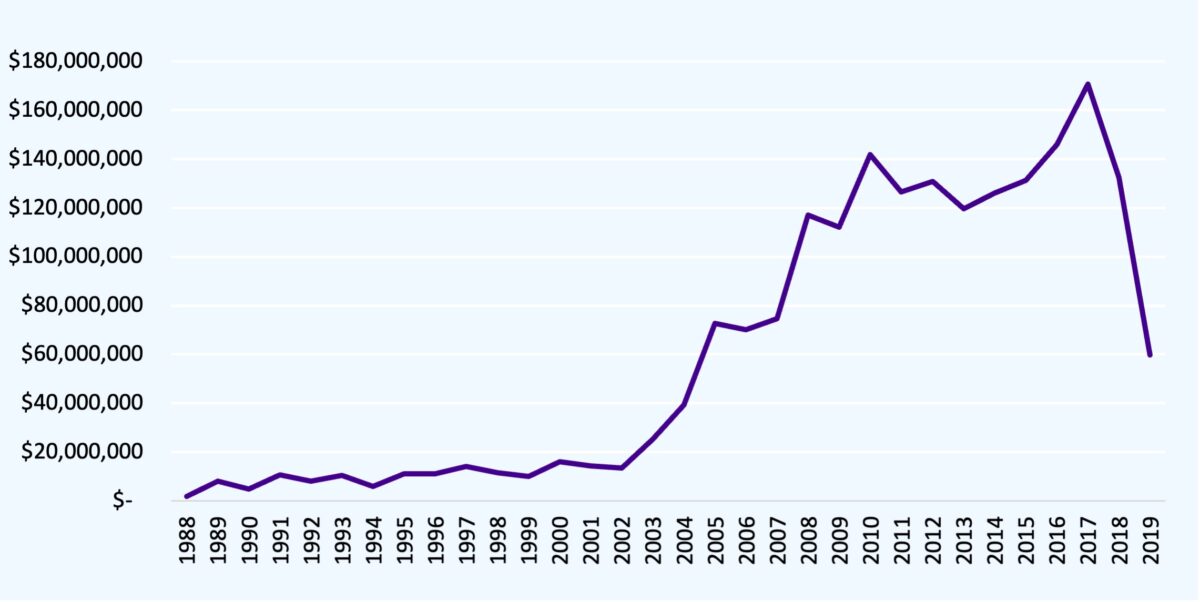

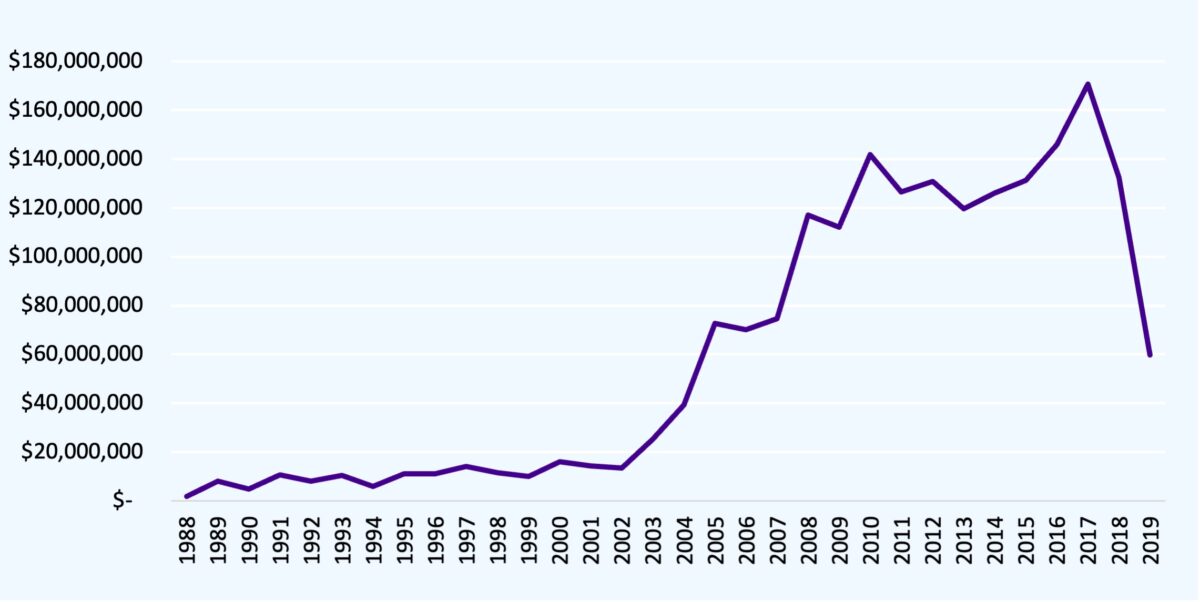

In New York, the Department of Housing and Community Renewal (HCR) allocates 9 percent credits, with some delegated to the Department of Housing Preservation and Development (HPD) in New York City. The 4 percent credits are vetted by the State’s Housing Finance Agency (HFA), which exists under HCR. Figure 1 shows the total annual allocation of LIHTC tax credits in New York between 1988 and 2019. Allocated credits rose sharply in the early 2000s, peaked in 2017, and dropped sharply starting in 2018. The sharp decline in 2018 is likely due to changes in the tax code enacted by the 2017 Tax Cuts and Jobs Act which altered the value of the tax credits to developers (explained in greater detail below).

Figure 1. Total annual allocation of LIHTC credits in New York.

Source: LIHTC Property Database published by the Department of Housing and Urban Development.

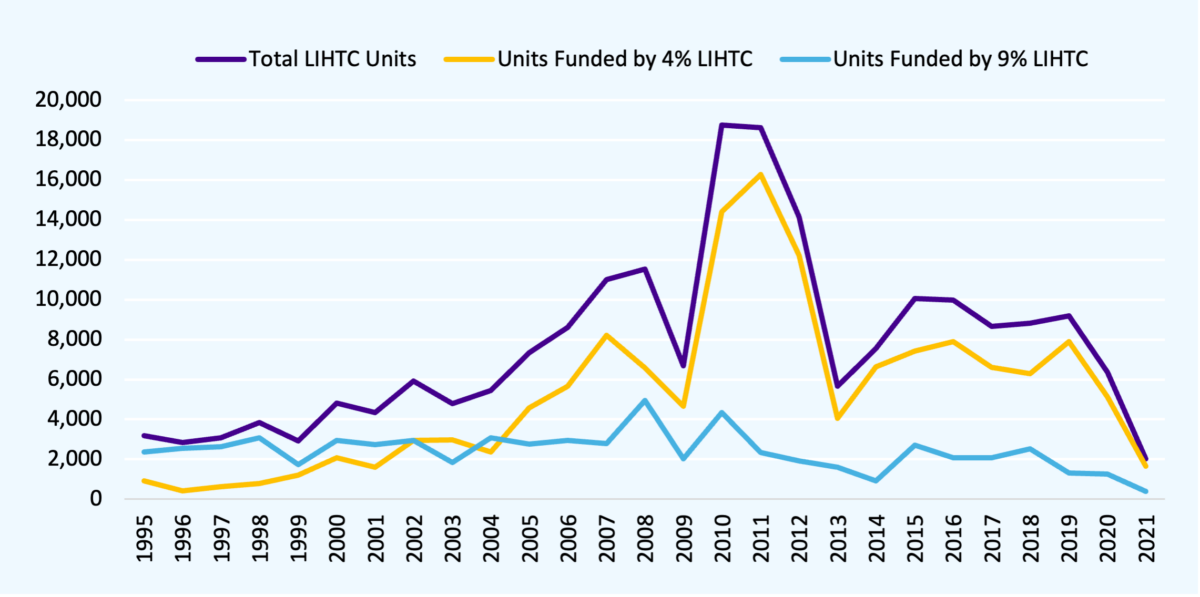

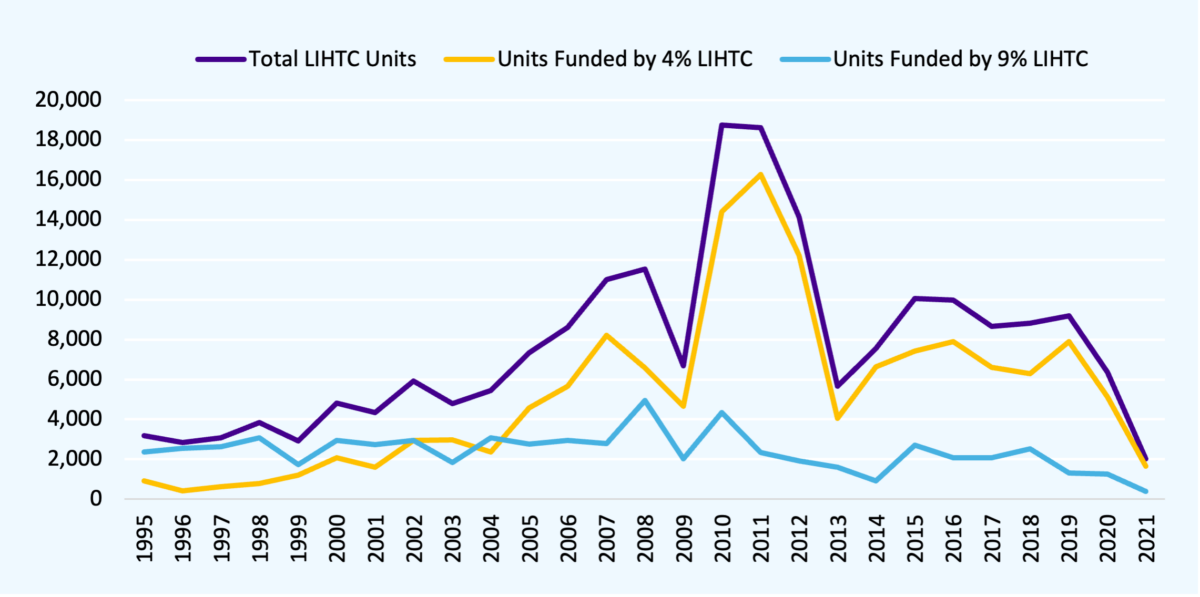

Figure 2. Total new LIHTC units in New York each year, by type of LIHTC credit.

Source: The National Housing Preservation Database, created by Public and Affordable Housing Research Corporation (PAHRC) and National Low Income Housing Coalition (NLIHC).

Figure 2 shows the number of affordable residential units funded by LIHTC tax credits by year that the unit became available to the residential housing market. We can see that the 4 percent tax credit has been used to create many more affordable units in New York than the 9 percent credit. Overall, the number of affordable units built using LIHTC funds has dropped since the early 2010s. Over the years 1988 to 2022, the total number of affordable units in New York created with the help of LIHTC is between 200,000 and 250,000 — about 6,500 per year. In 2021, the number of affordable units developed was just over 2,000. According to data from the Department of Housing and Urban Development, in the years 2012-2021, New York State allocated about $15,000 in federal tax credits for each affordable unit produced under the LIHTC program.

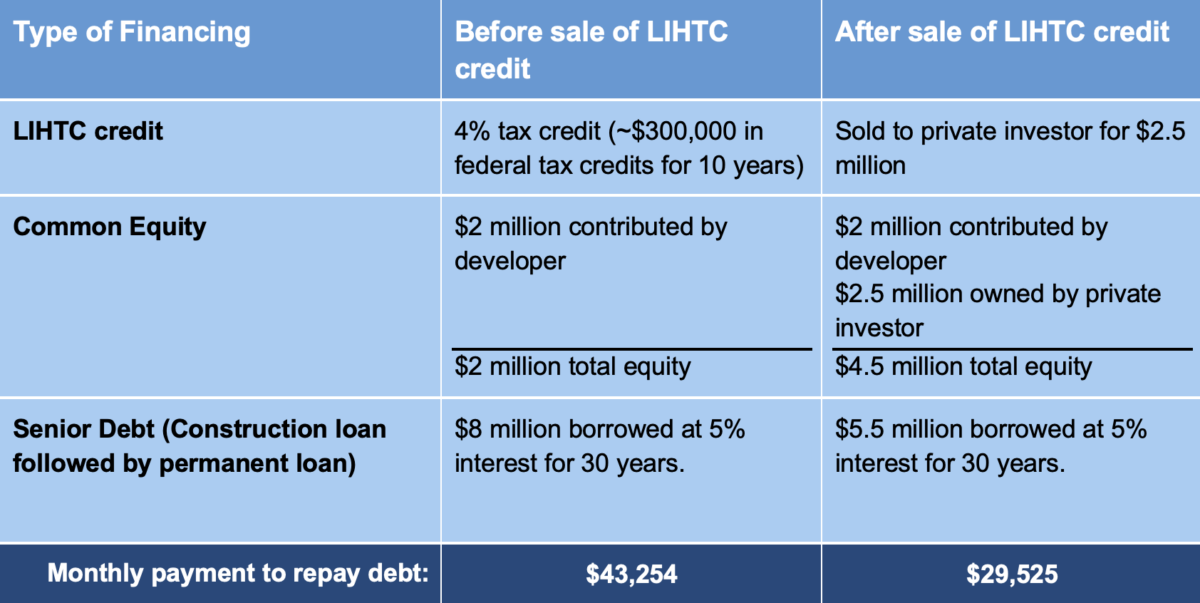

But how exactly do these tax credits work to build new affordable housing? The idea is that the private housing developer needs some reduction in their total development costs to make it possible to build housing with affordable units. To lower costs, the developer is awarded a large tax credit that they can use against their tax liabilities for the next 10 years. As described above, LIHTC tax credits are worth either 30 percent or 70 percent of the overall development cost of the project. However, housing developers do not always have large tax liabilities, making the tax credit less valuable to them directly. Instead of using the tax credit themselves, affordable housing developers sell the tax credit to a private investor in exchange for an equity investment in the project. That is, the private investor receives the full value of the tax credits to claim on their own taxes, plus partial ownership of the development, in return for providing up-front cash to the developer. By selling the tax credit to a private investor and increasing their cash on hand, the housing developer can take a smaller loan from the bank and thus has a smaller monthly payment to make to the bank over the life of the loan. With a reduced bank loan, the housing developer has lower monthly payments to the bank and thus can afford to charge sub-market rental rates to lower-income tenants.

Unfortunately, developers do not always receive the full value of the tax credit from the private investor. For example, a tax credit worth $1 million may be sold to a private developer for less than $750,000.[ii] Depending on how much demand there is from private investors for tax credits, the value of LIHTC credits to housing developers may be far below their statutory value. In this way, LIHTC ultimately subsidizes private financial actors more directly than it benefits the housing sector. The Tax Cuts and Jobs Act of 2017 decreased the federal corporate tax rate from 35 percent to 21 percent, making tax credits less valuable for the private investors who buy LIHTC credits from affordable housing developers (as the value of a tax credit depends on a business’s tax liability). With less demand for tax credits, the value of LIHTC credits has declined significantly, as depicted in Figure 1.

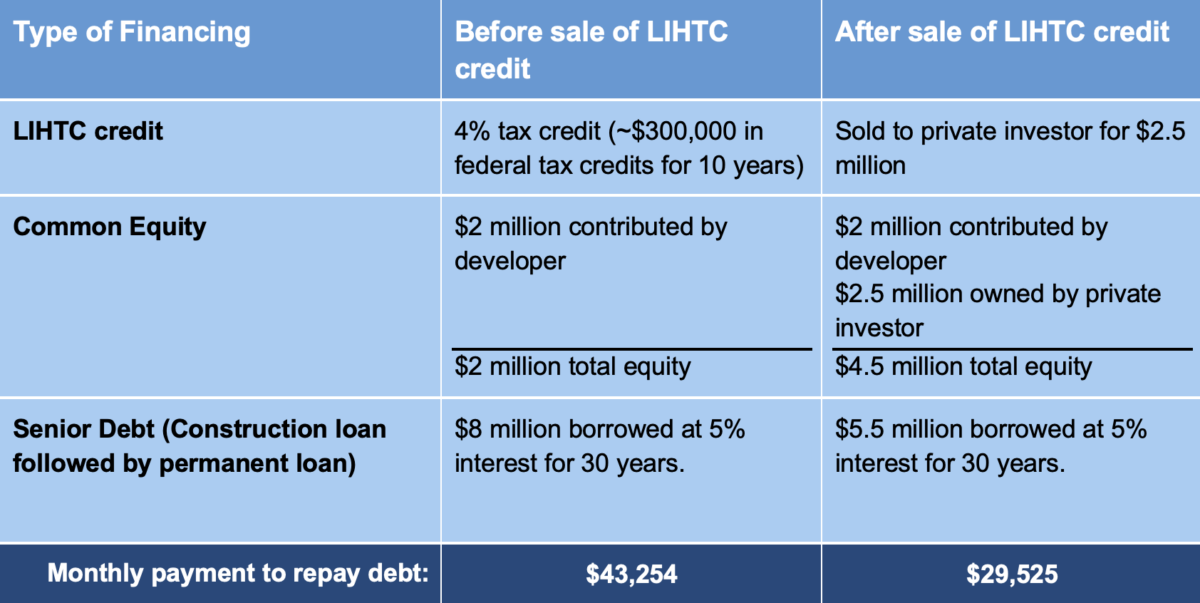

Table 1. Example use of LIHTC 4% credit in project with $10 million in construction costs.

Housing choice vouchers and project-based vouchers

The other major federal policy contributing to affordable housing around the country is the Housing Choice Voucher program, otherwise known as the Section 8 voucher program (in reference to Section 8 of the US Housing Act of 1937). This program provides about $30 billion annually to low-income individuals and families to support their housing expenses.[iii] Low-income households who benefit from these vouchers are required to pay no more than 30 percent of their income in rent and use their voucher to subsidize the remaining rental payment.

There are two types of vouchers: “tenant-based,” and “project-based vouchers.” Whereas tenant-based vouchers are awarded to a tenant household to support rent payment on the private housing market, project-based vouchers allocate vouchers to a specific unit of affordable housing. The project-based voucher thereby ensures that the respective unit will receive guaranteed rental income from the federal government while still being home to a low-income resident.

Tenant-based housing choice voucher programs are administered through public housing authorities (PHAs) around the country. For example, in New York City, the Section 8 program is administered through the New York City Housing Authority (NYCHA). In 2023, NYCHA provided vouchers to about 100,000 families (over 214,000 authorized residents) that had annual incomes of $19,569, on average. The average total monthly rent charged by landlords of Section 8 tenants in New York City is $1,695/month. However, tenants only pay an average of $387/month, with NYCHA covering the remaining $1,308 using federal funding from the housing choice voucher program.[iv]

A public housing authority can also allocate up to 20 percent of its housing choice vouchers to a specific housing project that will accept low-income tenants and an additional 10 percent if the housing is designated for people who are veterans, or are experiencing homeless, or if the respective housing project is supporting older adults or those with disabilities.[v] The vouchers that get used for this purpose are called “project-based vouchers” because they provide secure funding to an affordable housing development. Project-based vouchers increase the anticipated revenue of an affordable housing project by ensuring that a set of Section 8 housing vouchers will all get used at that housing development. By securing an income source that buffers the rental payment made by low-income tenants, the project-based vouchers increase the financial viability of an affordable housing development.

One other version of project-based vouchers that do not count towards the 20 percent cap are those that are part of the Rental Assistance Demonstration. The Rental Assistance Demonstration (RAD) is a program through which the federal government transfers its funding for public housing developments (Section 9) into project-based vouchers (Section 8). This program has been implemented in collaboration with NYCHA under the name “Permanent Affordability Commitment Together” (PACT). This program has provided project-based vouchers to NYCHA developments in exchange for their Section 9 designation and funding. The transition is designed to provide more stable funding so that these affordable housing developments can improve the quality and safety of their buildings.

Unfortunately, the total annual budget for all housing choice vouchers in the US of $30 billion is not nearly enough to meet the needs of all the individuals and families across the country who are in need of housing assistance. In fact, only one of every four qualified households in the US receives a voucher.[vi] Further, in 2023 the New York State Comptroller released a report finding that many New York regions are under-utilizing federal housing vouchers, making use of less than 85 percent of available voucher funding.[vii] The report found that in some cases the under-utilization is due to lack of affordable housing that will take the vouchers, pointing to the supply of housing as a key issue for both tenants and policymakers.

Conclusion

Myriad other federal housing-related programs exist – the HOME Investment Partnership Program, Community Development Block Grants, Emergency Solutions Grants, the Affordable Housing Trust Fund, and others. However, these programs pale in comparison to the Low-Income Housing Tax Credit and the Housing Choice Voucher program in terms of their size and impact. Though LIHTC has had less impact in recent years, it remains important to affordably housing development. Likewise, the Housing Choice Voucher program has gained increasing importance in New York, as it funds tenant-based voucher programs and project-based vouchers that support building more affordable housing.

Sources

[i] Tax Policy Center. The Tax Policy Briefing Book, “What is the Low-Income Housing Tax Credit and how does it work?” https://www.taxpolicycenter.org/briefing-book/what-low-income-housing-tax-credit-and-how-does-it-work

[ii] Eriksen, M. D. (2009). The market price of low-income housing tax credits. Journal of Urban Economics, 66(2), 141-149. https://ideas.repec.org/a/eee/juecon/v66y2009i2p141-149.html

[iii] U.S. Department of Housing and Urban Development, “HUD ANNOUNCES THE AVAILABILITY OF $30.3 BILLION FOR HOUSING AUTHORITIES TO PROVIDE AFFORDABLE HOUSING,” HUD No. 23-076. April 13, 2023. https://www.hud.gov/press/press_releases_media_advisories/hud_no_23_076.

[iv] New York City Housing Authority. Adopted Budget Financial Plan FY2024-FY2028. https://www.nyc.gov/assets/nycha/downloads/pdf/2024-2028-NYCHA-Budget-Book.pdf

[v] Center on Budget and Policy Priorities. “Policy Basics: Project-Based Vouchers,” September 30, 2024. https://www.cbpp.org/research/housing/project-based-vouchers

[vi] Center on Budget and Policy Priorities. “Introduction to the Housing Voucher Program,” May 15, 2009. https://www.cbpp.org/research/introduction-to-the-housing-voucher-program

[vii] Office of the New York State Comptroller. “DiNapoli: Federal Housing Aid Going Unused Despite New York’s Affordable Housing Crisis.” March 15, 2023. https://www.osc.ny.gov/press/releases/2023/03/dinapoli-federal-housing-aid-going-unused-despite-new-yorks-affordable-housing-crisis

The Federal Housing Policy Landscape

December 9, 2024 |

How federal policy influences state-level affordable housing development

State housing policy relies heavily on two federal programs that support housing affordability: the Low-Income Housing Tax Credit and Housing Choice Vouchers (also known as “Section 8” vouchers). These two programs underpin most affordable housing construction in the US and play an important role in the provision of affordable housing in New York State.

The Low-Income Housing Tax Credit

The Low-Income Housing Tax Credit (LIHTC) was originally developed under the Reagan administration to incentivize private development of affordable housing. There are two types of LIHTC tax credits available to developers: the 4 percent “as-of-right” credit and the 9 percent “competitive” credit.

These names unfortunately tell us little about the nature of the credits. The 4 percent as-of-right credits are available to all qualifying applicants without restriction from the federal or state government (i.e., they are “as-of-right”). For affordable housing developers that qualify, these “4 percent tax credits” typically translate into a tax credit worth 30 percent of the overall development costs of buildings containing affordable housing.[i] Developers qualify by obtaining additional funding through a Housing Finance Agency or through a tax-exempt bond.

The 9 percent credits typically translate into a tax credit worth 70 percent of the total project development costs. These credits are restricted in number by federal legislation stating that each state has a right to $2.75 per capita in total tax credits of this form (with a floor of $3.185 million). For New York, this translates into about $55 million worth of 9 percent credits that the State can allocate each year through a competitive application process.

In New York, the Department of Housing and Community Renewal (HCR) allocates 9 percent credits, with some delegated to the Department of Housing Preservation and Development (HPD) in New York City. The 4 percent credits are vetted by the State’s Housing Finance Agency (HFA), which exists under HCR. Figure 1 shows the total annual allocation of LIHTC tax credits in New York between 1988 and 2019. Allocated credits rose sharply in the early 2000s, peaked in 2017, and dropped sharply starting in 2018. The sharp decline in 2018 is likely due to changes in the tax code enacted by the 2017 Tax Cuts and Jobs Act which altered the value of the tax credits to developers (explained in greater detail below).

Figure 1. Total annual allocation of LIHTC credits in New York.

Source: LIHTC Property Database published by the Department of Housing and Urban Development.

Figure 2. Total new LIHTC units in New York each year, by type of LIHTC credit.

Source: The National Housing Preservation Database, created by Public and Affordable Housing Research Corporation (PAHRC) and National Low Income Housing Coalition (NLIHC).

Figure 2 shows the number of affordable residential units funded by LIHTC tax credits by year that the unit became available to the residential housing market. We can see that the 4 percent tax credit has been used to create many more affordable units in New York than the 9 percent credit. Overall, the number of affordable units built using LIHTC funds has dropped since the early 2010s. Over the years 1988 to 2022, the total number of affordable units in New York created with the help of LIHTC is between 200,000 and 250,000 — about 6,500 per year. In 2021, the number of affordable units developed was just over 2,000. According to data from the Department of Housing and Urban Development, in the years 2012-2021, New York State allocated about $15,000 in federal tax credits for each affordable unit produced under the LIHTC program.

But how exactly do these tax credits work to build new affordable housing? The idea is that the private housing developer needs some reduction in their total development costs to make it possible to build housing with affordable units. To lower costs, the developer is awarded a large tax credit that they can use against their tax liabilities for the next 10 years. As described above, LIHTC tax credits are worth either 30 percent or 70 percent of the overall development cost of the project. However, housing developers do not always have large tax liabilities, making the tax credit less valuable to them directly. Instead of using the tax credit themselves, affordable housing developers sell the tax credit to a private investor in exchange for an equity investment in the project. That is, the private investor receives the full value of the tax credits to claim on their own taxes, plus partial ownership of the development, in return for providing up-front cash to the developer. By selling the tax credit to a private investor and increasing their cash on hand, the housing developer can take a smaller loan from the bank and thus has a smaller monthly payment to make to the bank over the life of the loan. With a reduced bank loan, the housing developer has lower monthly payments to the bank and thus can afford to charge sub-market rental rates to lower-income tenants.

Unfortunately, developers do not always receive the full value of the tax credit from the private investor. For example, a tax credit worth $1 million may be sold to a private developer for less than $750,000.[ii] Depending on how much demand there is from private investors for tax credits, the value of LIHTC credits to housing developers may be far below their statutory value. In this way, LIHTC ultimately subsidizes private financial actors more directly than it benefits the housing sector. The Tax Cuts and Jobs Act of 2017 decreased the federal corporate tax rate from 35 percent to 21 percent, making tax credits less valuable for the private investors who buy LIHTC credits from affordable housing developers (as the value of a tax credit depends on a business’s tax liability). With less demand for tax credits, the value of LIHTC credits has declined significantly, as depicted in Figure 1.

Table 1. Example use of LIHTC 4% credit in project with $10 million in construction costs.

Housing choice vouchers and project-based vouchers

The other major federal policy contributing to affordable housing around the country is the Housing Choice Voucher program, otherwise known as the Section 8 voucher program (in reference to Section 8 of the US Housing Act of 1937). This program provides about $30 billion annually to low-income individuals and families to support their housing expenses.[iii] Low-income households who benefit from these vouchers are required to pay no more than 30 percent of their income in rent and use their voucher to subsidize the remaining rental payment.

There are two types of vouchers: “tenant-based,” and “project-based vouchers.” Whereas tenant-based vouchers are awarded to a tenant household to support rent payment on the private housing market, project-based vouchers allocate vouchers to a specific unit of affordable housing. The project-based voucher thereby ensures that the respective unit will receive guaranteed rental income from the federal government while still being home to a low-income resident.

Tenant-based housing choice voucher programs are administered through public housing authorities (PHAs) around the country. For example, in New York City, the Section 8 program is administered through the New York City Housing Authority (NYCHA). In 2023, NYCHA provided vouchers to about 100,000 families (over 214,000 authorized residents) that had annual incomes of $19,569, on average. The average total monthly rent charged by landlords of Section 8 tenants in New York City is $1,695/month. However, tenants only pay an average of $387/month, with NYCHA covering the remaining $1,308 using federal funding from the housing choice voucher program.[iv]

A public housing authority can also allocate up to 20 percent of its housing choice vouchers to a specific housing project that will accept low-income tenants and an additional 10 percent if the housing is designated for people who are veterans, or are experiencing homeless, or if the respective housing project is supporting older adults or those with disabilities.[v] The vouchers that get used for this purpose are called “project-based vouchers” because they provide secure funding to an affordable housing development. Project-based vouchers increase the anticipated revenue of an affordable housing project by ensuring that a set of Section 8 housing vouchers will all get used at that housing development. By securing an income source that buffers the rental payment made by low-income tenants, the project-based vouchers increase the financial viability of an affordable housing development.

One other version of project-based vouchers that do not count towards the 20 percent cap are those that are part of the Rental Assistance Demonstration. The Rental Assistance Demonstration (RAD) is a program through which the federal government transfers its funding for public housing developments (Section 9) into project-based vouchers (Section 8). This program has been implemented in collaboration with NYCHA under the name “Permanent Affordability Commitment Together” (PACT). This program has provided project-based vouchers to NYCHA developments in exchange for their Section 9 designation and funding. The transition is designed to provide more stable funding so that these affordable housing developments can improve the quality and safety of their buildings.

Unfortunately, the total annual budget for all housing choice vouchers in the US of $30 billion is not nearly enough to meet the needs of all the individuals and families across the country who are in need of housing assistance. In fact, only one of every four qualified households in the US receives a voucher.[vi] Further, in 2023 the New York State Comptroller released a report finding that many New York regions are under-utilizing federal housing vouchers, making use of less than 85 percent of available voucher funding.[vii] The report found that in some cases the under-utilization is due to lack of affordable housing that will take the vouchers, pointing to the supply of housing as a key issue for both tenants and policymakers.

Conclusion

Myriad other federal housing-related programs exist – the HOME Investment Partnership Program, Community Development Block Grants, Emergency Solutions Grants, the Affordable Housing Trust Fund, and others. However, these programs pale in comparison to the Low-Income Housing Tax Credit and the Housing Choice Voucher program in terms of their size and impact. Though LIHTC has had less impact in recent years, it remains important to affordably housing development. Likewise, the Housing Choice Voucher program has gained increasing importance in New York, as it funds tenant-based voucher programs and project-based vouchers that support building more affordable housing.

Sources

[i] Tax Policy Center. The Tax Policy Briefing Book, “What is the Low-Income Housing Tax Credit and how does it work?” https://www.taxpolicycenter.org/briefing-book/what-low-income-housing-tax-credit-and-how-does-it-work

[ii] Eriksen, M. D. (2009). The market price of low-income housing tax credits. Journal of Urban Economics, 66(2), 141-149. https://ideas.repec.org/a/eee/juecon/v66y2009i2p141-149.html

[iii] U.S. Department of Housing and Urban Development, “HUD ANNOUNCES THE AVAILABILITY OF $30.3 BILLION FOR HOUSING AUTHORITIES TO PROVIDE AFFORDABLE HOUSING,” HUD No. 23-076. April 13, 2023. https://www.hud.gov/press/press_releases_media_advisories/hud_no_23_076.

[iv] New York City Housing Authority. Adopted Budget Financial Plan FY2024-FY2028. https://www.nyc.gov/assets/nycha/downloads/pdf/2024-2028-NYCHA-Budget-Book.pdf

[v] Center on Budget and Policy Priorities. “Policy Basics: Project-Based Vouchers,” September 30, 2024. https://www.cbpp.org/research/housing/project-based-vouchers

[vi] Center on Budget and Policy Priorities. “Introduction to the Housing Voucher Program,” May 15, 2009. https://www.cbpp.org/research/introduction-to-the-housing-voucher-program

[vii] Office of the New York State Comptroller. “DiNapoli: Federal Housing Aid Going Unused Despite New York’s Affordable Housing Crisis.” March 15, 2023. https://www.osc.ny.gov/press/releases/2023/03/dinapoli-federal-housing-aid-going-unused-despite-new-yorks-affordable-housing-crisis